Zooming Out

June 3, 2024

I am a self-described market junkie.

When I wake up, I check the futures. Before I go to sleep, I check the futures.

I just started using a Bloomberg terminal again for the first time in a long time and I am quickly relearning all the opportunities it gives me to see all sorts of market information. I am in my glory.

Admittedly, functioning this way makes it easy to lose the forest for the trees; to get so in the weeds that I can lose sight of big picture. Sometimes I can get a little too cute, especially if I am itching to take a bearish view.

So, at the end of every month (especially when it falls on a weekend), I am given a chance to zoom out to see the bigger picture.

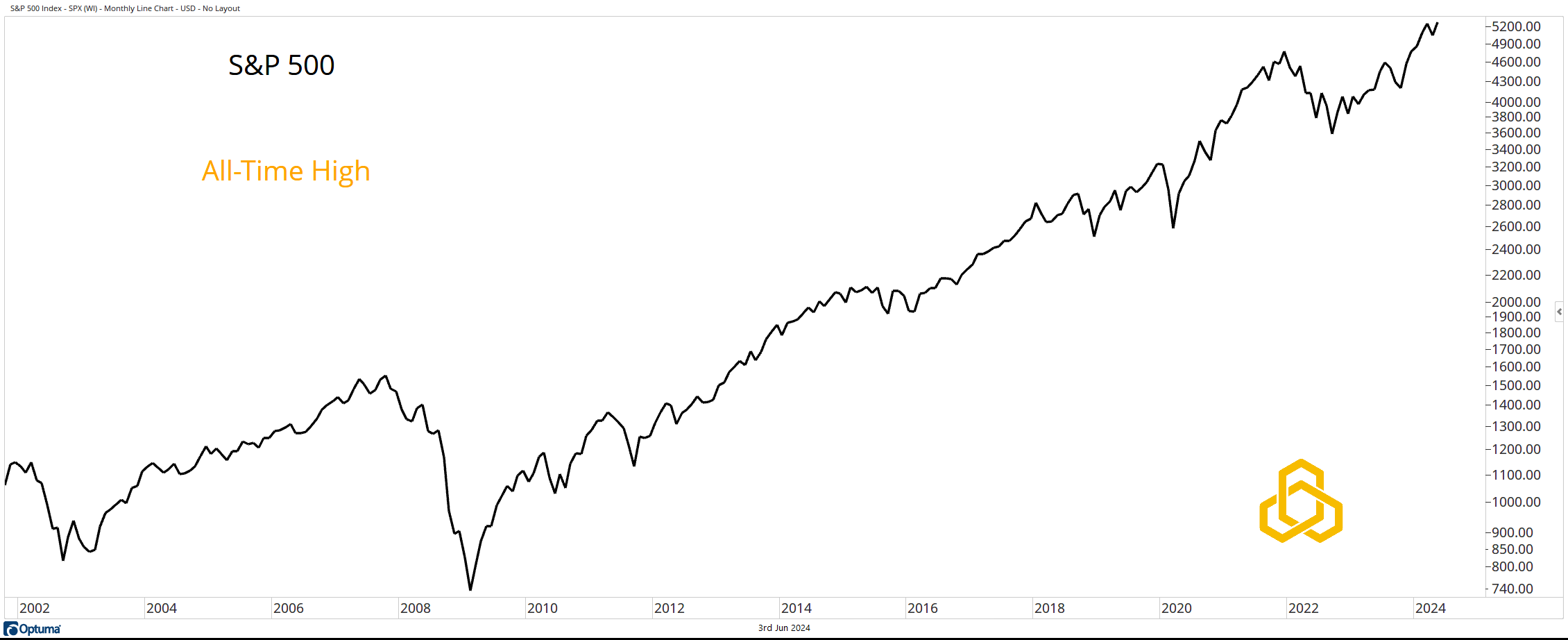

S&P 500

Starting where we usually do, with the S&P 500, we can see that the most widely followed index in the world closed the month of May at an all-time high.

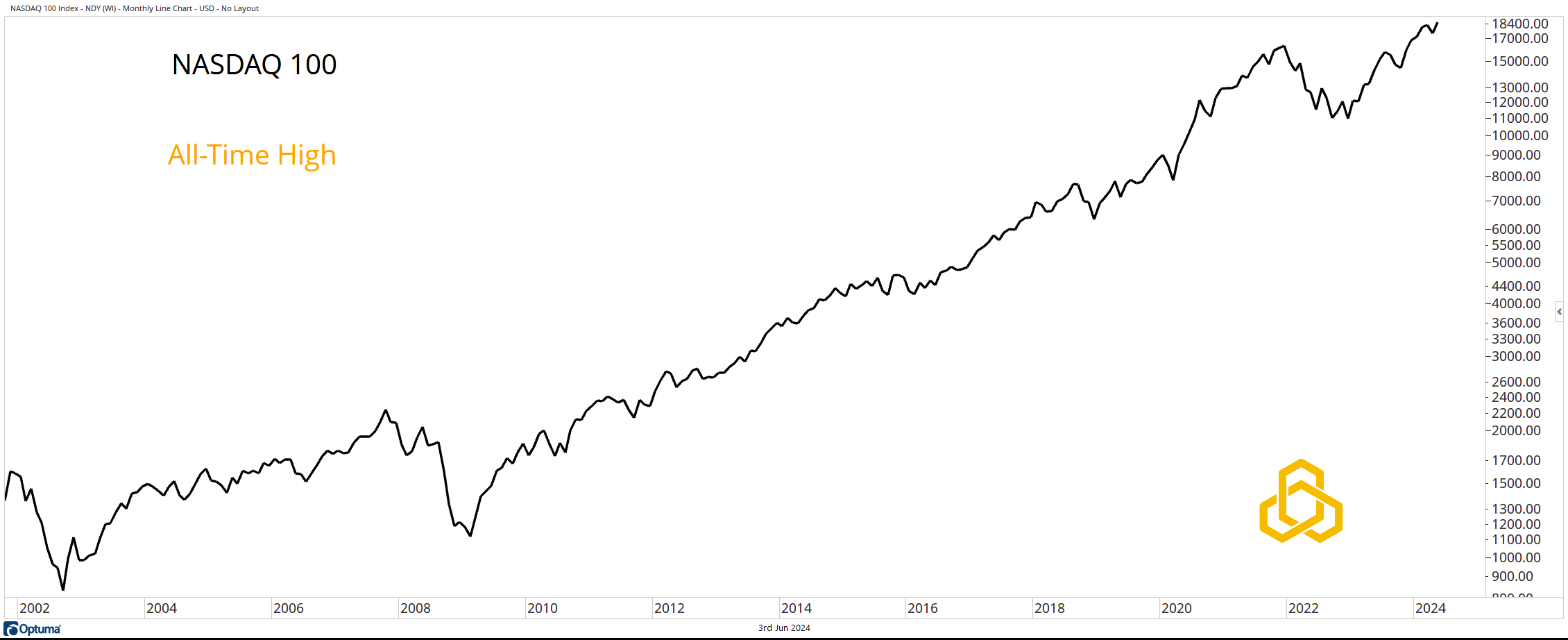

NASDAQ 100

The NASDAQ 100, home to the biggest growth stocks on the planet, closed the month of May at an all-time high.

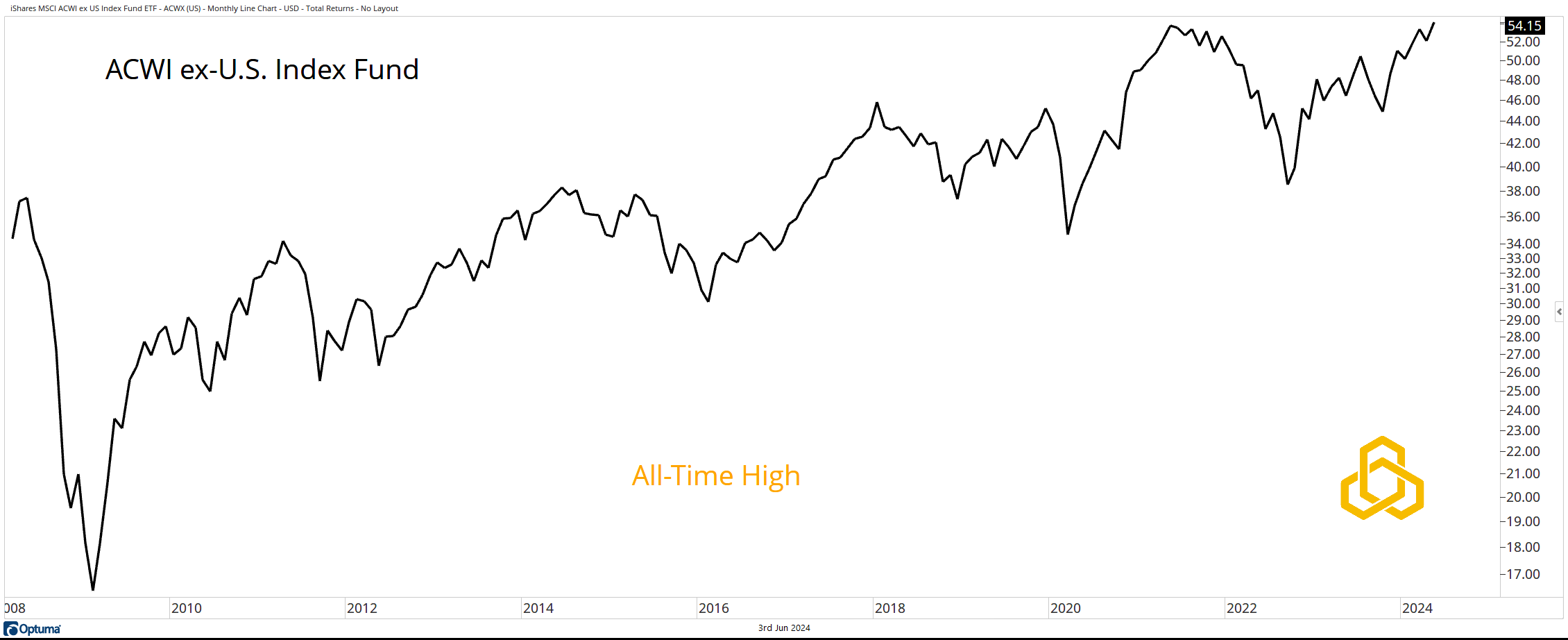

ACWI ex-U.S. Index Fund

We have been told over and over that international diversification is a loser’s game, largely because on a relative basis it has been true. But that is only if you are a U.S. domiciled investor. All the talk of how bad international has been would mighty lead you to believe that the chart below would be heading from the upper left to the lower right.

However, the ACWI ex-U.S. Index Fund close the month of May at an all-time high.

S&P 600

Small Caps have been a sloppy mess for two and a half years. The S&P 600 is not trading at an all-time high as June begins, but it has not exactly fallen off a cliff either.

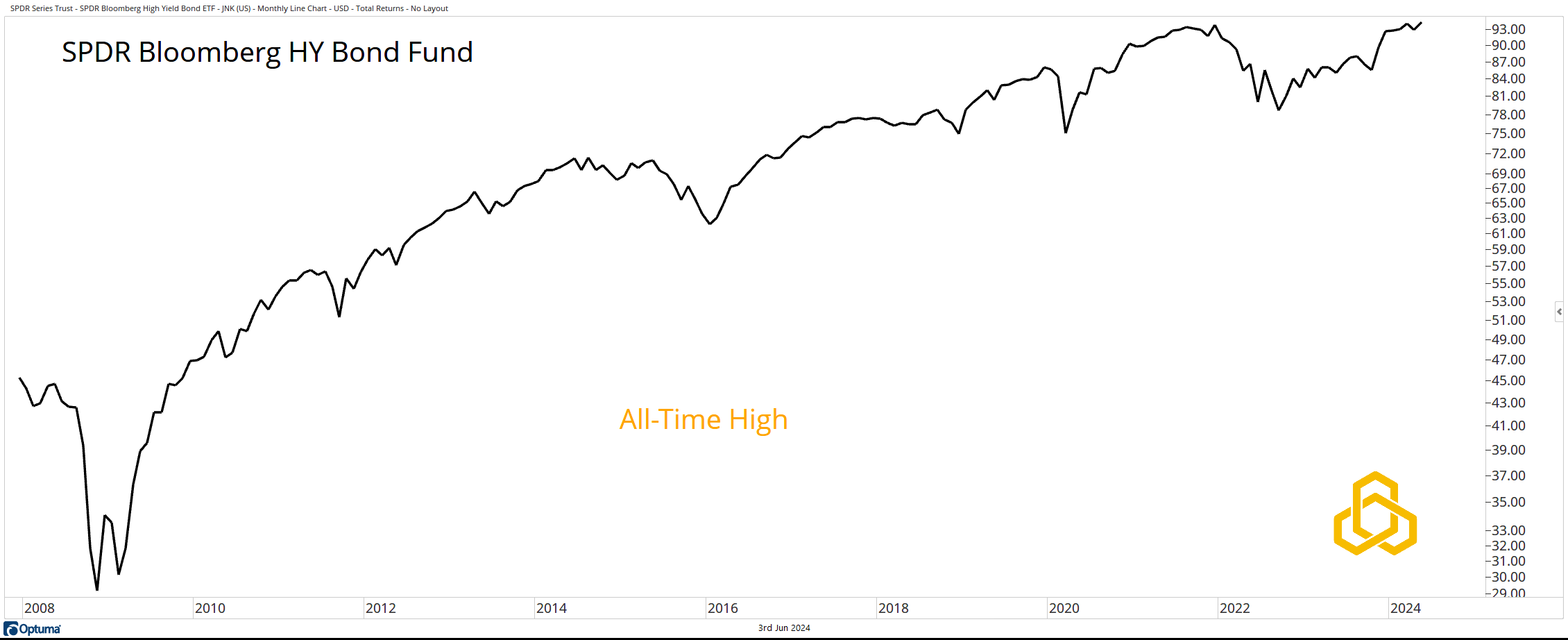

Junk Bonds

The SPDR Bloomberg HY Bond Fund closed the month of May at an all-time high. These are arguably the riskiest credits in the market and, on a total return basis, have never been higher at the end of a month.

This is by no means an exhaustive list, but I think that it does a good job of painting a picture of a generally healthy environment.

At least it does from a “big picture perspective.”

*All charts from Optuma as of the close of trading on May 31, 2024. Past performance does not guarantee future results.

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-331-20240603