You Were Always on My Mind!

March 18, 2024

I have an eclectic music taste; I can move from 90’s Hip Hop (Biggie and Dre) to Grunge (think Nirvana) to Country (think about the title of today’s note). It comes from the great American poet, Willie Nelson. Fine, I am taking some liberties here as it relates to poets, but the title came to my mind as I think about the fact that the market is still thinking about inflation.

The prevailing narrative is that the Fed has managed to beat inflation without harming the economy, the so-called soft landing, or no landing. However, the market’s message to inflation seems to be “You were always on my mind.”

As we work through today’s note, please keep in mind our views on the existing positive correlation between stocks and bonds.

Bonds

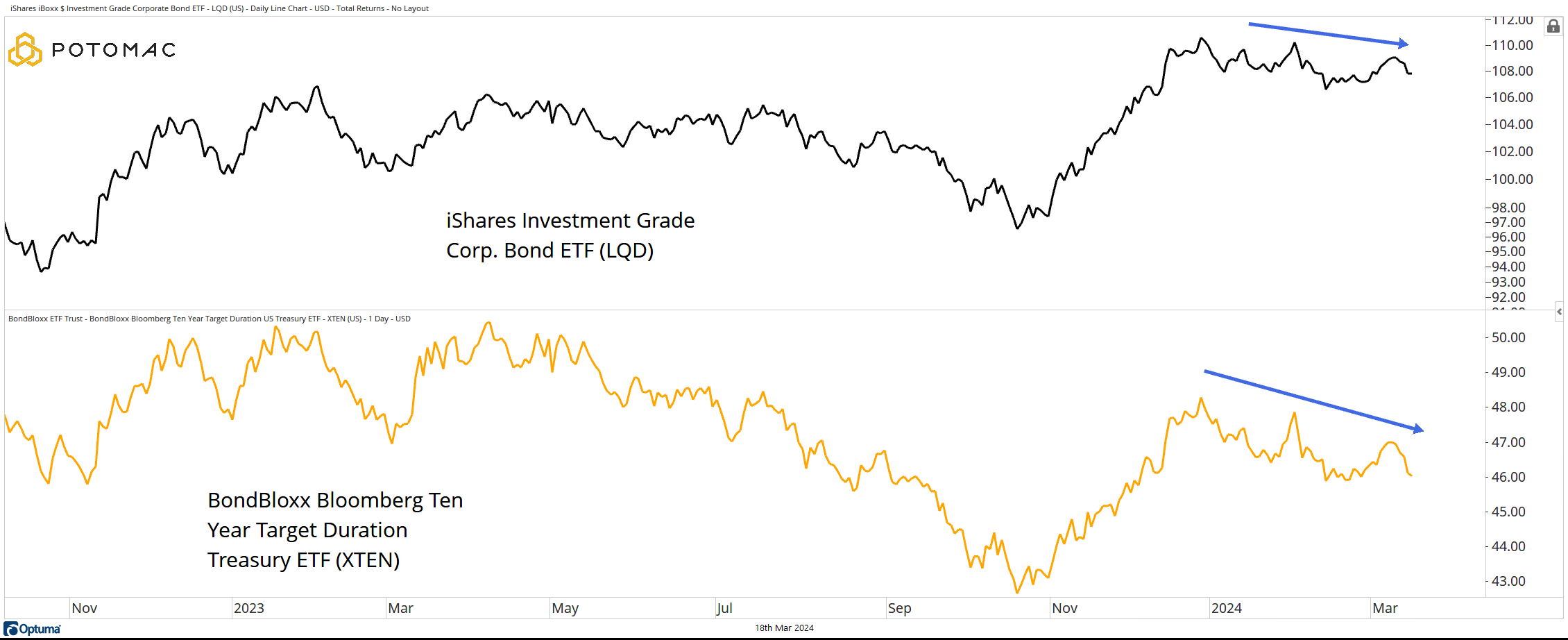

Both Corporate bonds and Treasuries, as represented by the BondBloxx 10-Year Target Duration ETF (XTEN), turned lower last week, continuing a trend that has been in place for much of 2024.

This weakness is in contrast to the strength that we have seen in the equity market during the opening quarter of the year. The stocks still think that there will be multiple rate cuts this year, but the bonds appear to disagree.

Short-Term TIPS vs Bonds

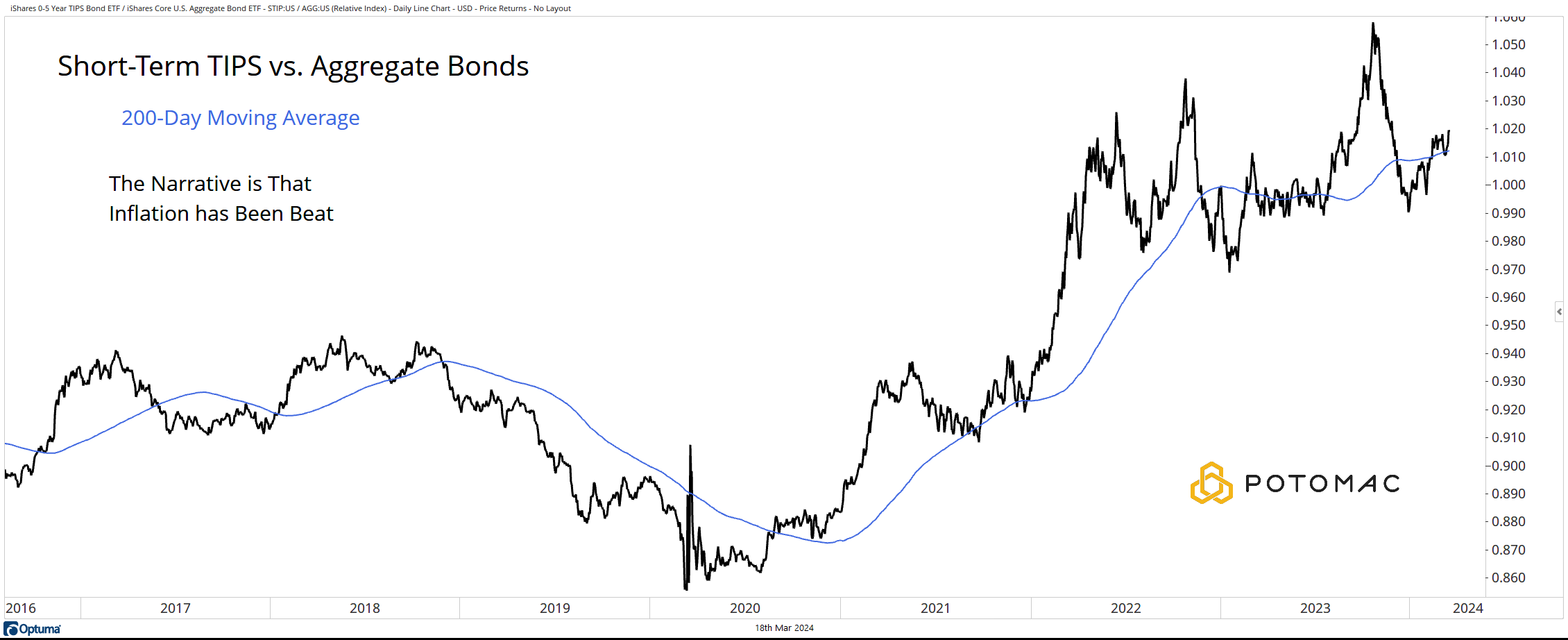

The ratio of the iShares 0-5 Year Tips Bond ETF (STIP) to the iShares Core U.S. Aggregate Bond ETF (AGG) has recently regained the rising 200-day moving average after making a higher low in December 2023 relative to January 2023.

The narrative is that inflation has been beaten, but it appears that no one has delivered that message to the bond market.

Short-Term Sector Performance

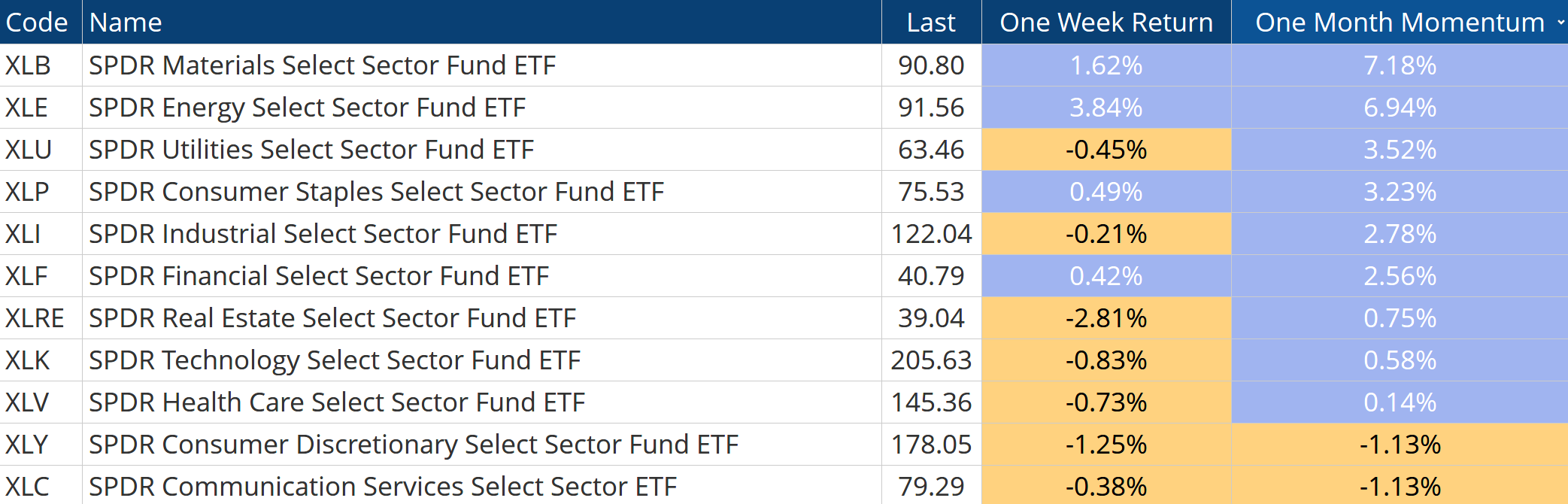

The short-term sector rotation under the surface of the S&P 500 is beginning to send both an inflationary and cautious message. Over the past month, the two best-performing sectors have been Materials and Energy, two groups with close ties to the commodity market (they were the best-performing sectors last week as well). Commodities are often seen as an inflation hedge. The next two best sectors over the past month have been Utilities and Consumer Staples, two traditionally defensive sectors.

Gold

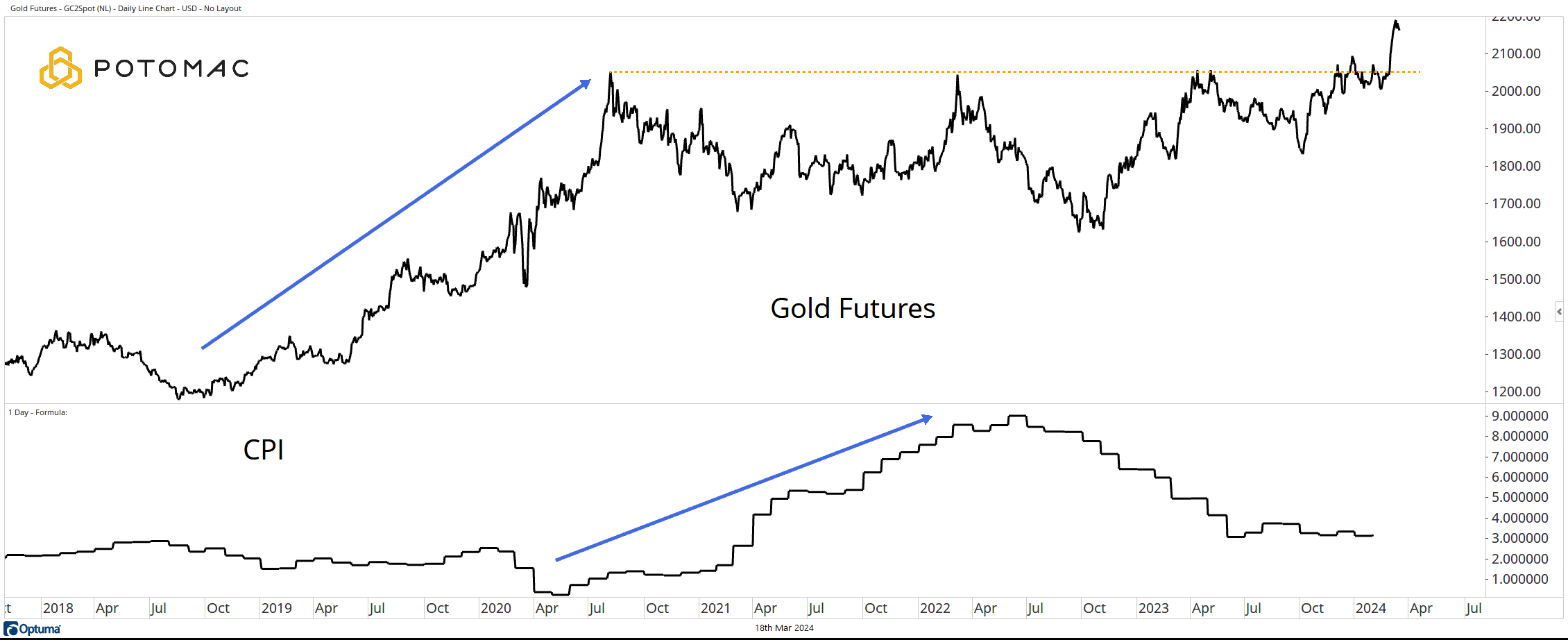

Gold has finally broken up and out of a three-and-a-half-year consolidation. If we believe that markets are discounting mechanisms, we can note that Gold rallied from October 2018 until August 2020 in anticipation of the move higher by the Consumer Price Index (CPI).

Is the current breakout a sign that inflation is about to turn higher again?

Bitcoin

While physical gold has broken to new highs, digital gold has too. Bitcoin made new highs last week before pulling back during trading this weekend. However, if we once again assume that markets are discounting mechanisms, we can note that Bitcoin turned higher in March 2020 and continues to rally as CPI turned to the upside to make a trip toward 9%.

*All charts from Optuma as of March 17, 2024. Past performance does not guarantee future results. As of this writing Dan Russo holds bitcoin in a personal account.

Potomac Fund Management ("Company") is an SEC-registered investment adviser. This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page. The company does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to the Company website or incorporated herein, and takes no responsibility for any of this information. The views of the Company are subject to change and the Company is under no obligation to notify you of any changes. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable or equal to any historical performance level.

PFM-311-20240318