You Have to Look Under the Surface

December 16, 2024

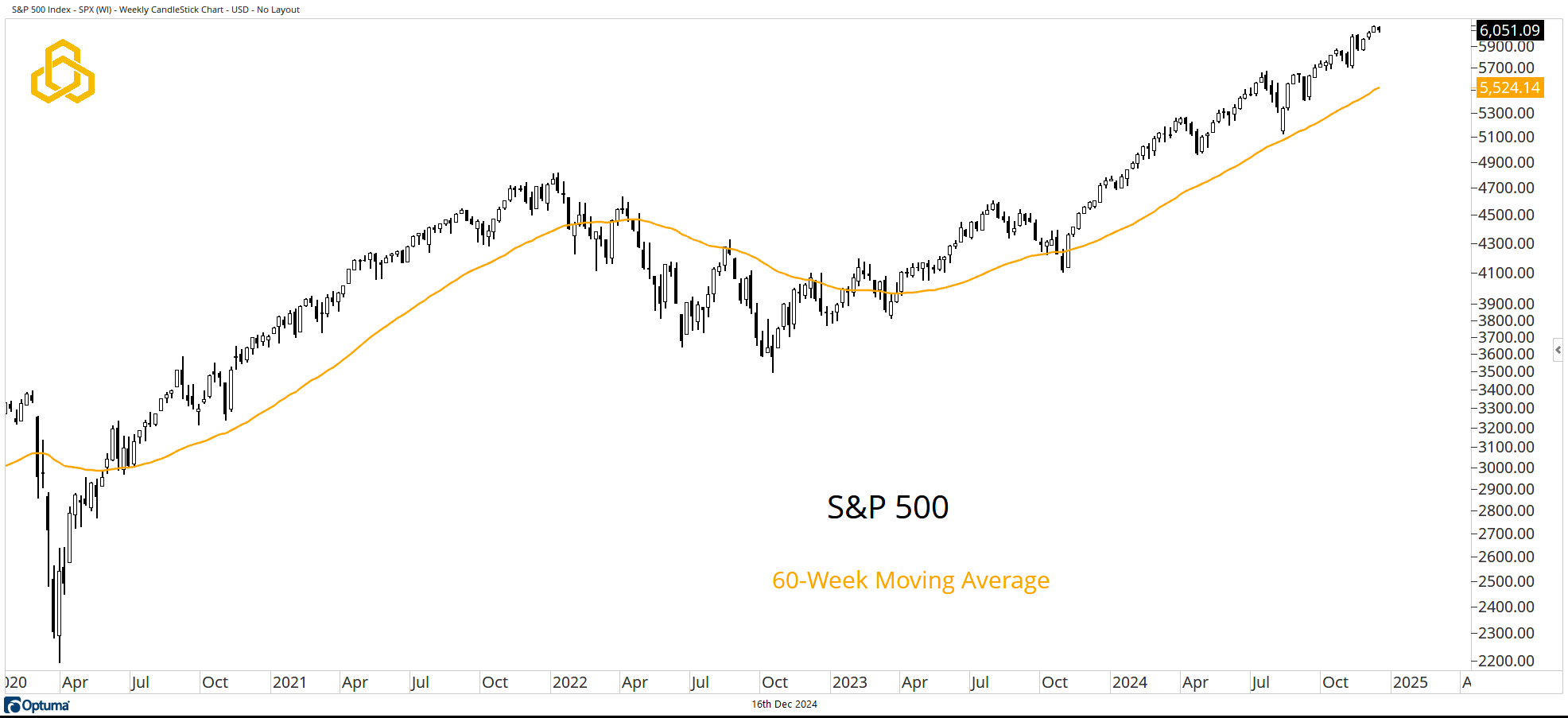

The S&P 500 took a small rest last week. If all you did was look at the index, there wouldn’t be much, if anything, that appears concerning. However, when analyzing a capitalization-weighted index, it’s crucial to understand what’s happening under the surface.

Strength from the largest stocks can support the index while turbulence brews beneath. That dynamic seems to be unfolding as we head into a new week. If the largest names begin to come under pressure, it will be difficult for the index to hold near record levels.

Source: Optuma

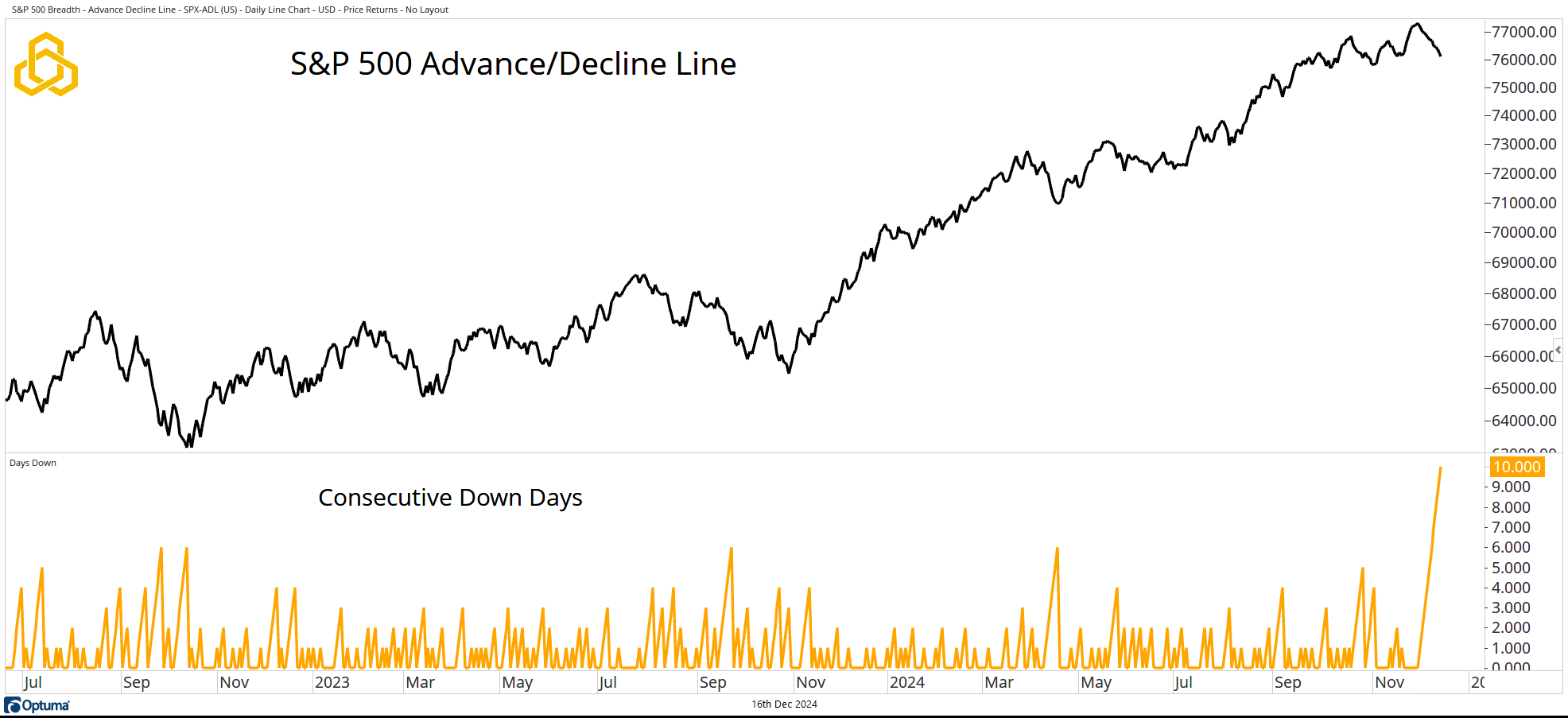

S&P 500 Advance/Decline Line

While not explicitly part of our composite systems, we noticed an interesting dynamic in the Advance/Decline Line for the S&P 500. There have been ten consecutive down days for this indicator. Put simply, for ten days in a row, more S&P 500 stocks have closed lower than have closed higher.

Source: Optuma

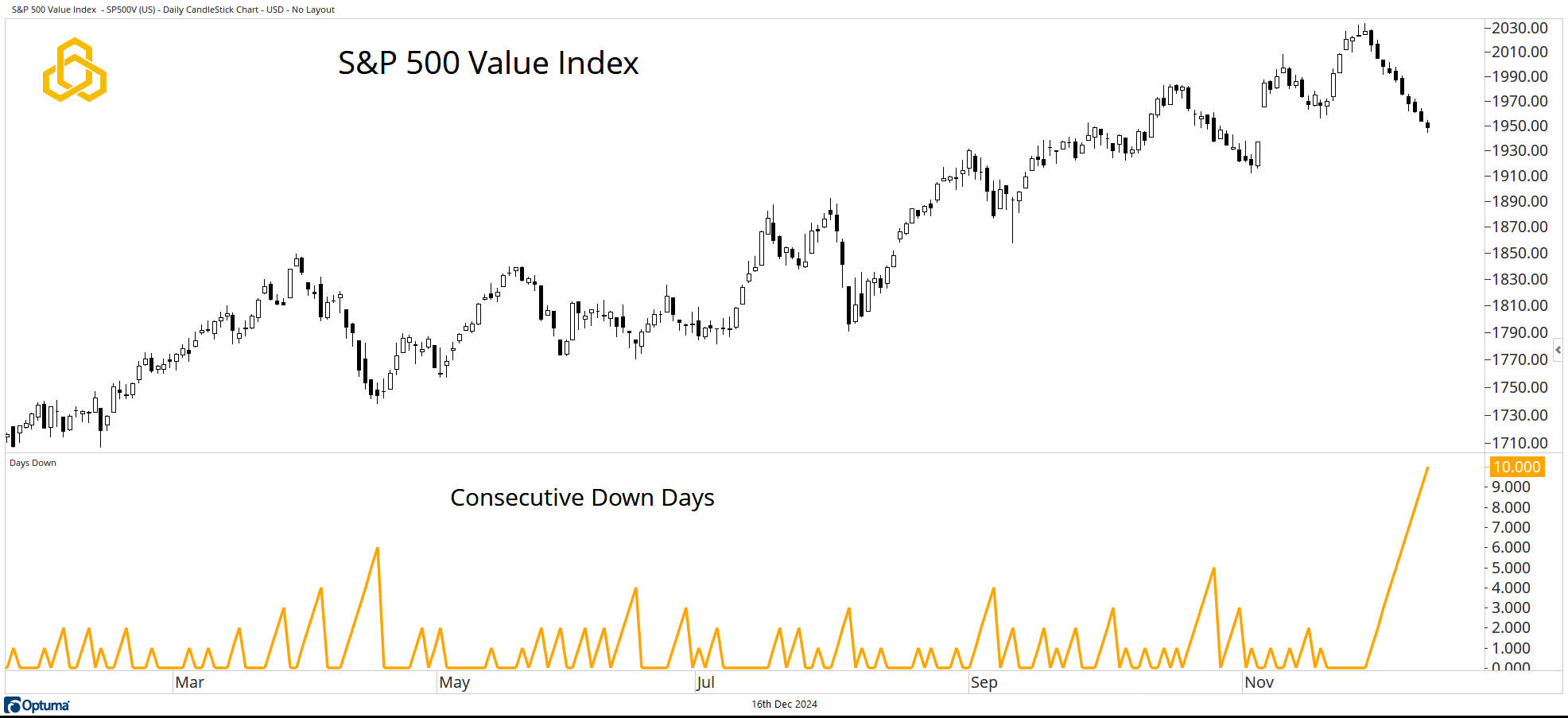

S&P 500 Value Index

Last week, we highlighted the renewed strength in the “growth” factor. On the “value” side of the ledger, the S&P 500 Value Index has closed lower for ten consecutive days.

Why is this significant? The largest stocks in the index tend to be the “growth” names. Because the S&P 500 is cap-weighted, a small group of stocks can keep the index aloft while underlying conditions weaken. If these growth leaders begin to falter, as value stocks have begun to do, it will be difficult for the broader index to maintain its strength.

Source: Optuma

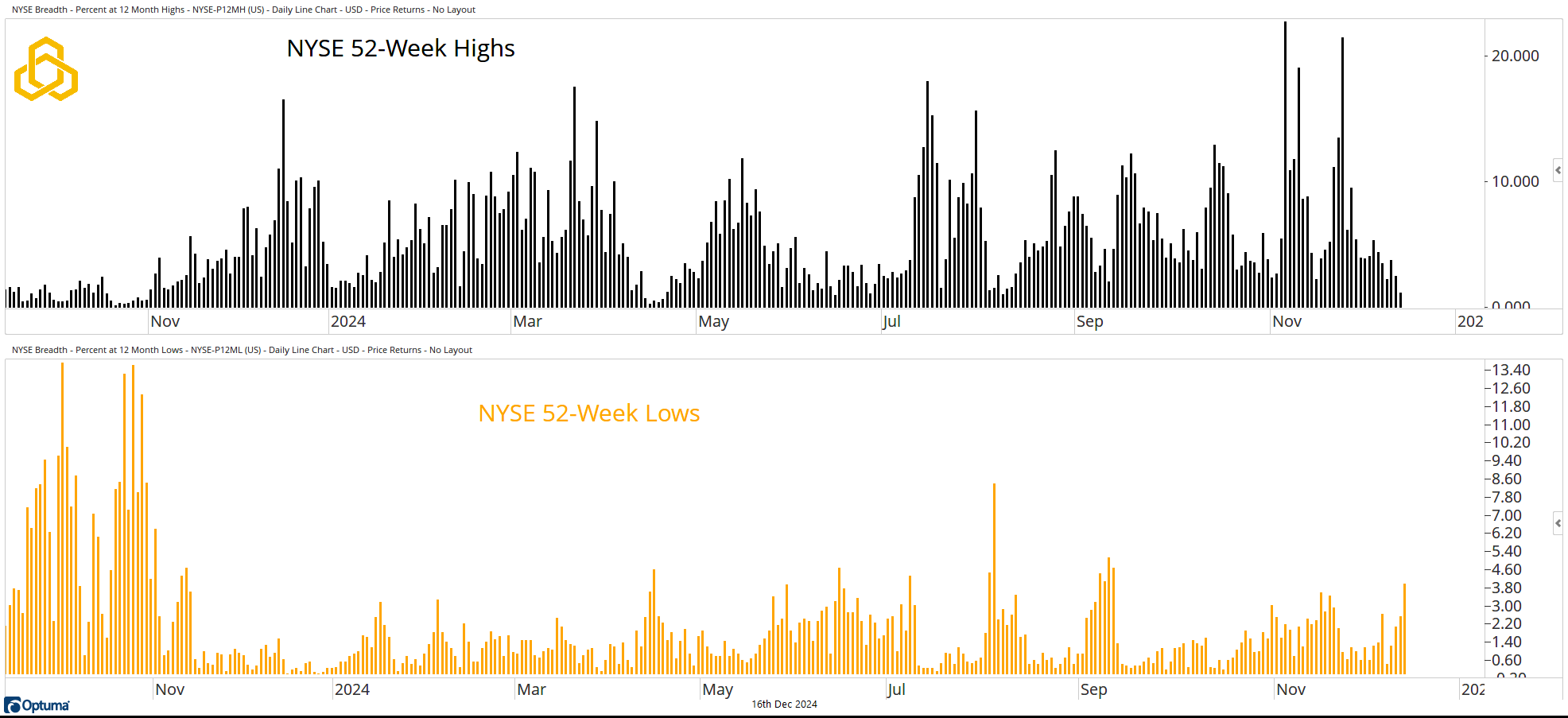

NYSE New Highs and New Lows

Lastly, the number of new 52-week highs on the New York Stock Exchange peaked on November 6 and has been trending lower since. Meanwhile, we are starting to see an uptick in new lows.

Source: Optuma

Until now conditions have been bullish for equities. However, if the dynamics described above continue, the broader averages could see pressure.

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-378-20241216