Why Argue? Confirmed Highs Are Bullish

October 7, 2024

I generally do not view arguing with the market as a productive use of time. To me, it would be like arguing with the ocean. Imagine standing on the beach as the tide rises, with each wave crashing closer to where you’ve decided to place your chair, and yelling at the ocean, "You should not come this close."

The S&P 500 closed the week at record levels, confirmed by breadth and intermarket themes. The tide is rising, and it’s hard to see it any other way. It’s even harder to look at this market and “tell” it that it should be doing anything else.

S&P 500

As stated above, the index closed the week at a new high, above a steadily rising 60-week moving average. While it may be tempting to try to be the hero and call a top, history has shown time and again that such calls have a low probability of success.

Source: Optuma

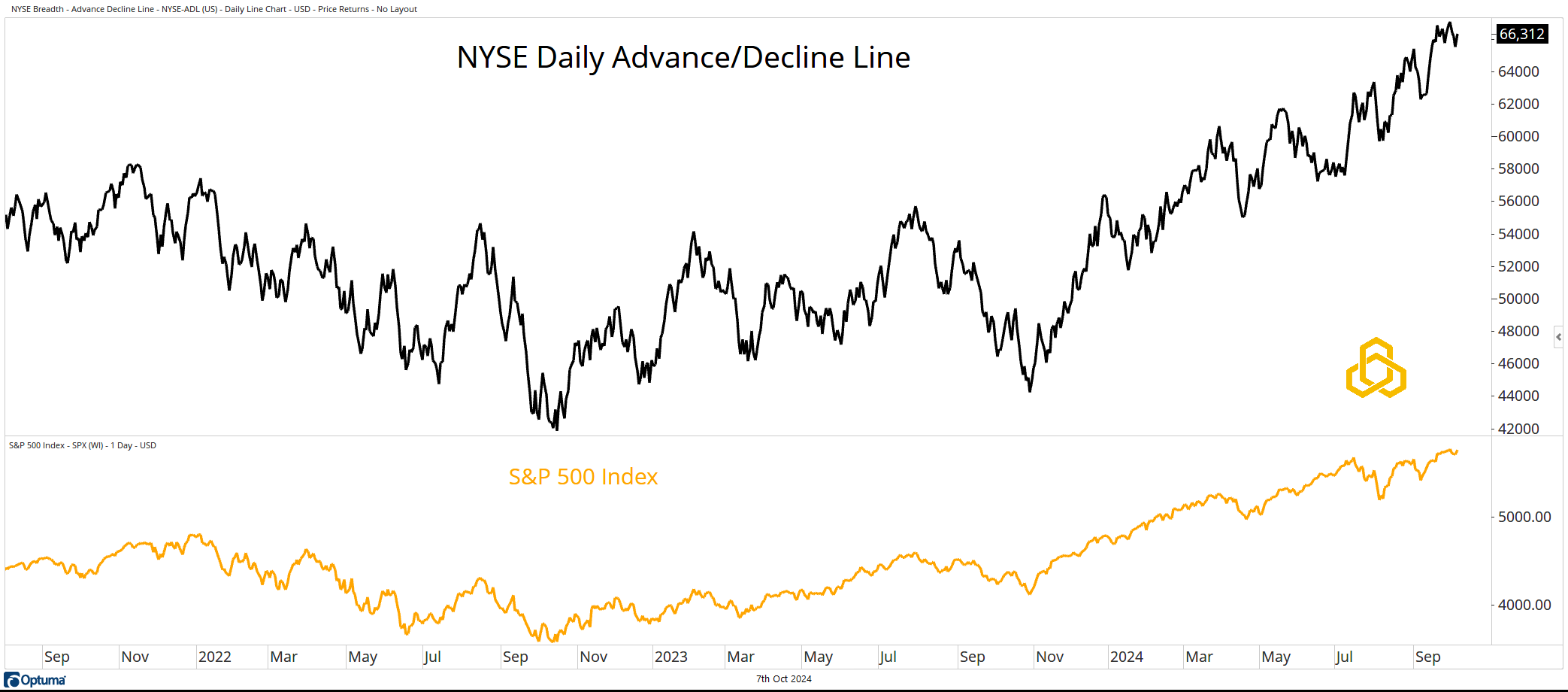

NYSE Advance/Decline Line

On the daily timeframe, the NYSE Advance/Decline Line is trading near all-time highs, signaling that the underlying health of the market’s price trend is solid.

Source: Optuma

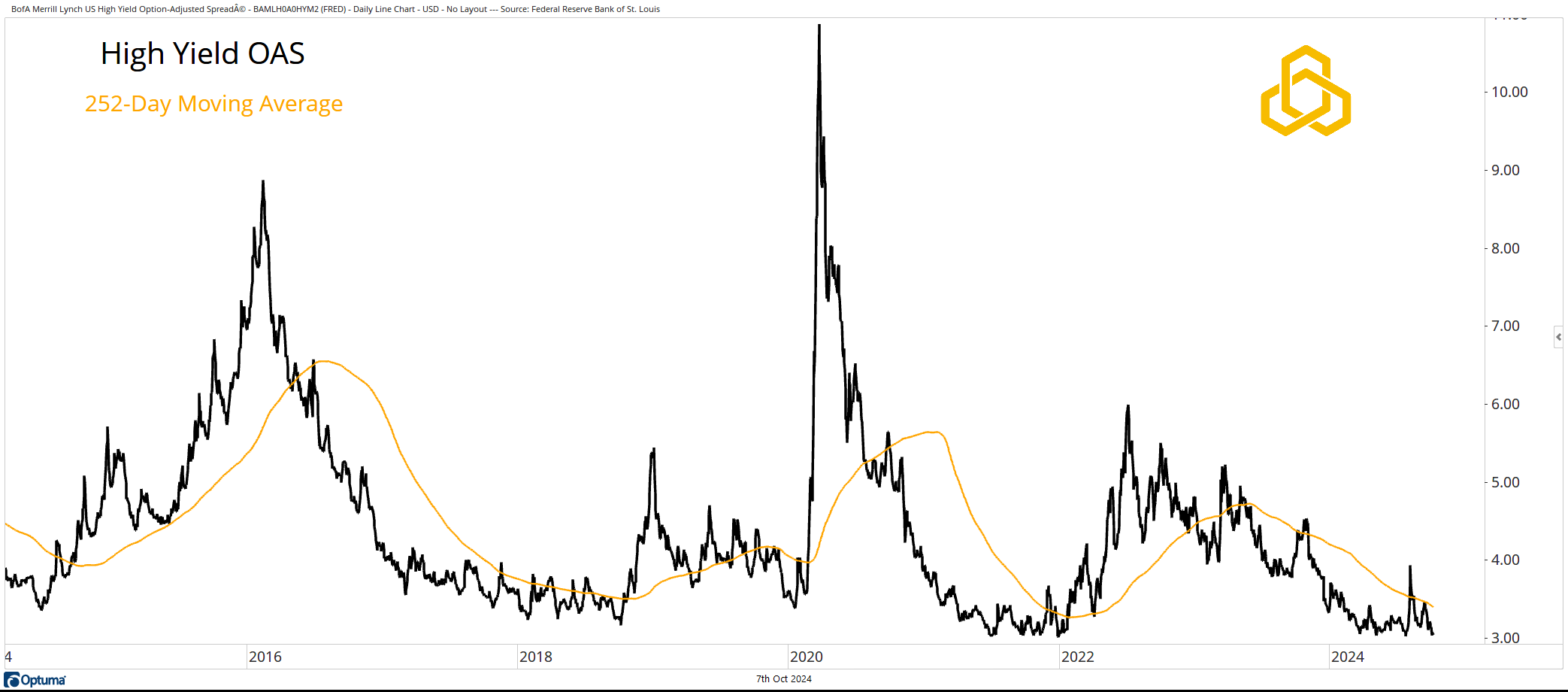

Credit Spreads

The High Yield Option-Adjusted Spread (OAS) measures the difference between "safe" Treasury bonds and "risky" high-yield bonds. The spread tends to widen in times of stress. Currently, it sits below the declining one-year moving average and near the lows of the past decade.

Source: Optuma

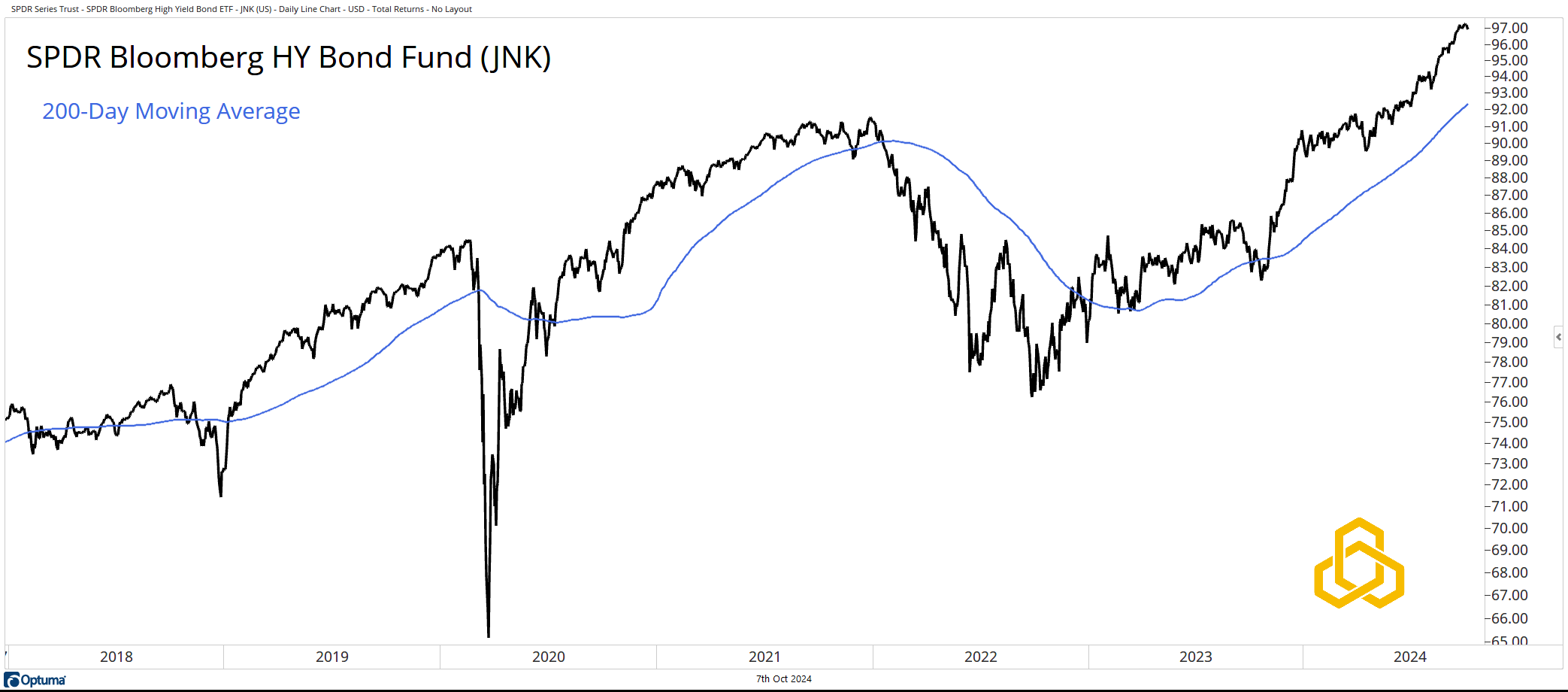

High Yield Bonds

A simpler way to view high-yield bonds is through the trend in the SPDR Bloomberg HY Bond Fund (JNK). On a total return basis, the fund is trading near all-time highs, above a rising 200-day moving average.

Source: Optuma

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-360-20241007