Who Has the Burden of Proof?

One of my favorite exercises when it comes to the market is determining who has the burden of proof. Which side—the bulls or the bears—needs to make the stronger case? Despite a sharp rally last week that saw the S&P 500 close higher by more than 5% (amid a lot of volatility), the burden is still on the bulls.

Last week, we highlighted that the tide had turned lower but noted that there could be short-term opportunities. A case can be made that the rally in the equity market was one of them after stocks moved "too far, too fast" to the downside. The bulls need to build on that momentum in the holiday-shortened week if we are to see the kind of “V-bottom” that has become somewhat customary over the past decade-plus.

S&P 500

The S&P 500, as mentioned earlier, gave investors a wild ride on the way to a more than 5% advance. However, the index remains well below a declining 60-week moving average. Bulls will take solace in the fact that the 2022 high was not breached, but it is hard to make a compelling case beyond calling this a countertrend move.

Source: Optuma

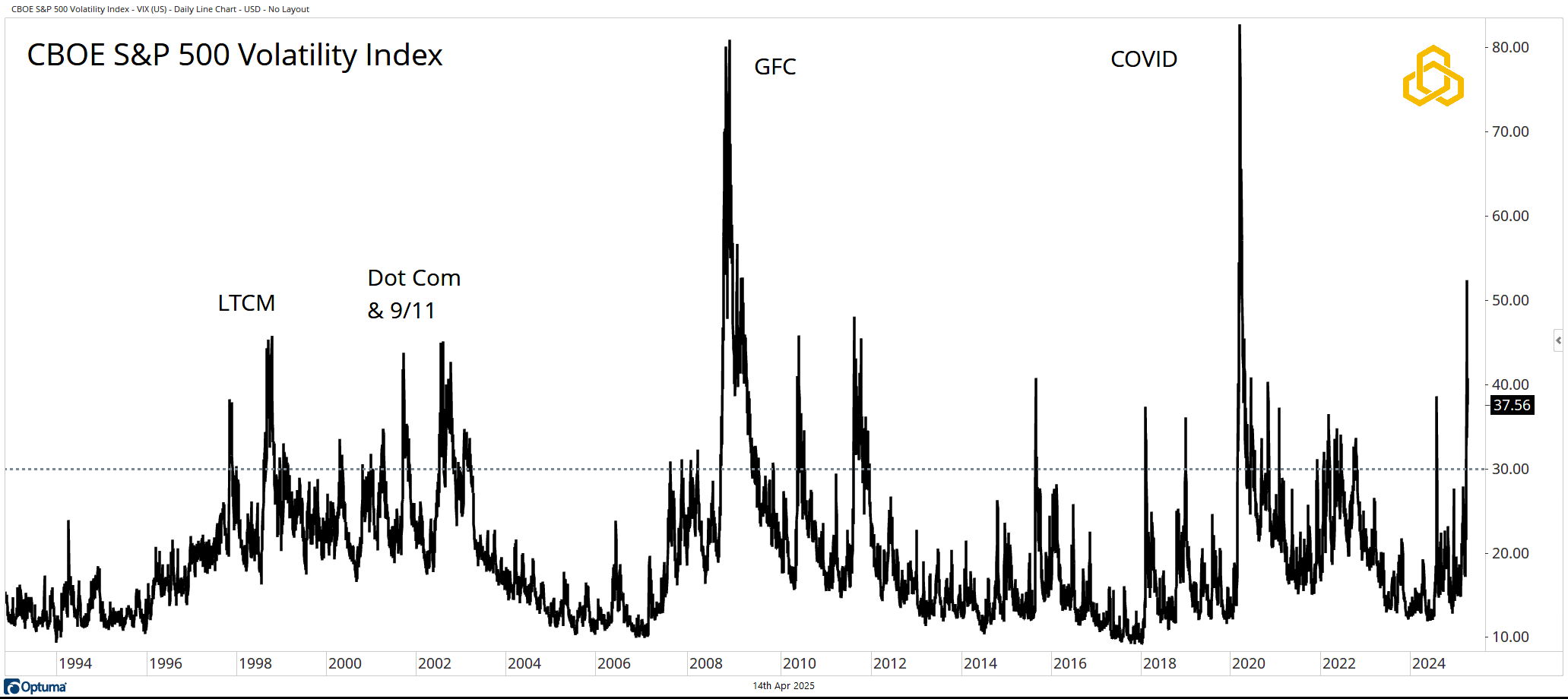

CBOE Volatility Index (VIX)

Last week, we noted that spikes in the CBOE Volatility Index tend to be short-lived. Absent a major “event” along the lines of Long-Term Capital Management, September 11th, the Dot-Com Bubble, the Global Financial Crisis, or COVID, it is hard for the VIX to sustain moves above the 30–50 range.

Based on history, no one should be terribly surprised that the equity market saw a rally last week. Now that the VIX is moving lower, stocks will have to stand on their own; especially if the VIX moves below 30 in the near term.

Source: Optuma

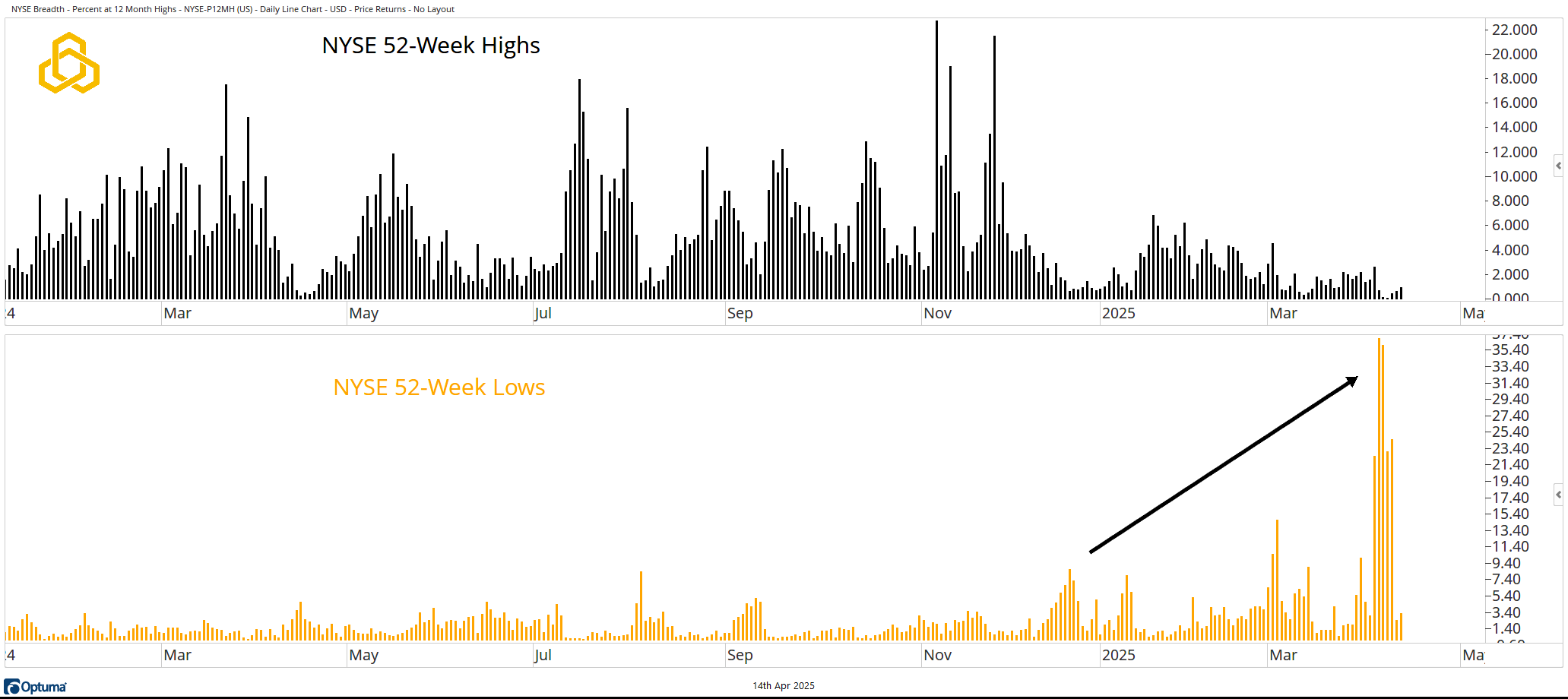

NYSE New Highs & New Lows

Despite the move higher last week, there were still many more stocks making new lows than new highs. Given such a steep decline in the stock market, it is not reasonable to expect a large improvement in new highs so soon. However, bulls do want to see new lows begin to abate. That is not happening—at least not yet.

Source: Optuma

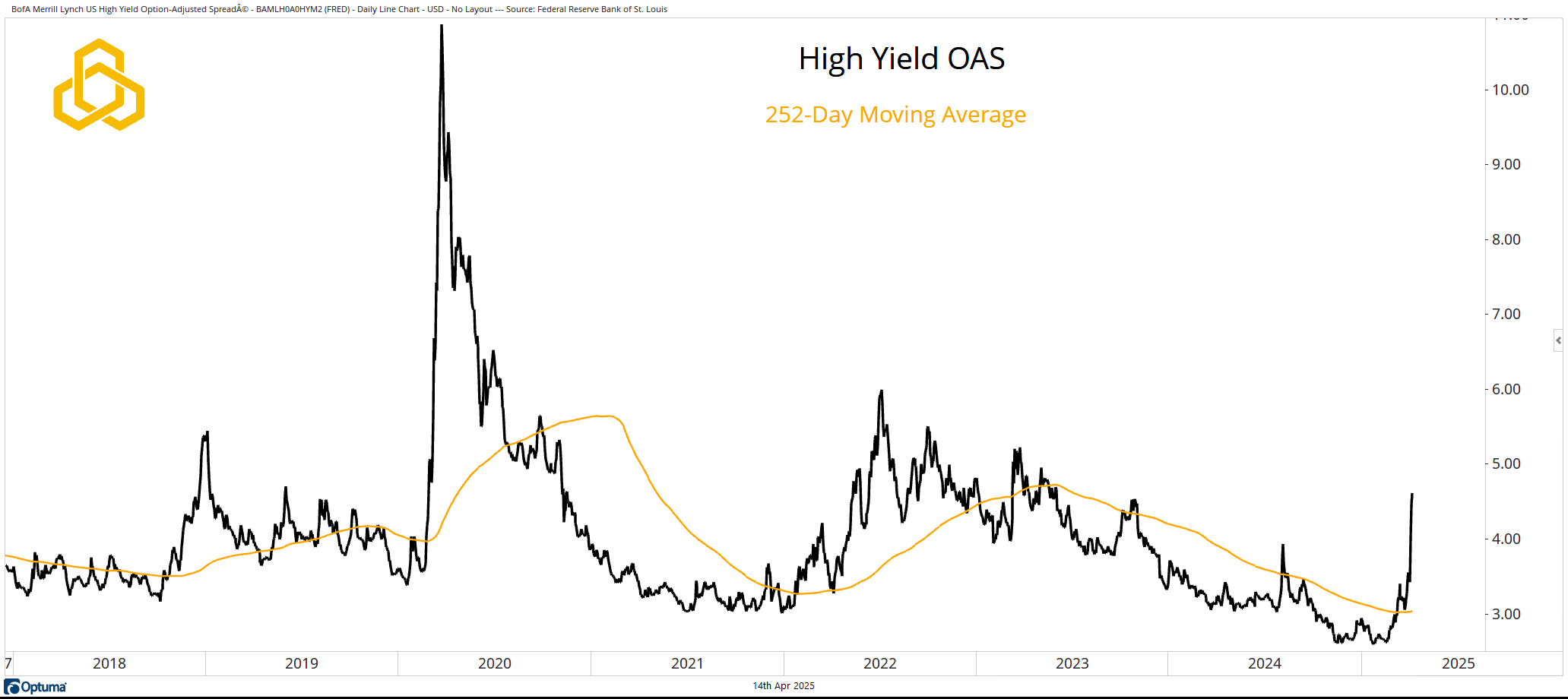

High Yield Credit Spreads

While the VIX has begun to feel some of the pressure lift, high-yield credit spreads continue to show signs of stress. The High Yield OAS (a measure of the difference between rates on high-yield bonds vs. Treasuries) closed the week “on the wides” of the move so far. The spread is above the 252-day moving average, which is beginning to turn higher.

This is not a good sign from an intermarket perspective.

Source: Optuma

If we return to last week’s analogy of the swimmer in the ocean, the VIX presented an opportunity to catch a wave heading toward shore within the context of a falling tide. There was a chance for the swimmer to make some progress, but that window is likely closing. Conserving energy (capital) may soon be the best course of action.

The burden of proof is with the bulls.

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-311-20250414