Which Is It?

February 12, 2024

The S&P 500 closed the week above the much-watched 5,000 level. Here is where I will inject my rant that round numbers in the market are only important because they make nice “milestone” headlines and targets for Wall Street strategists who are rarely right anyway. There is nothing particularly special about the 5,000 level other than that. So, congrats to the analysts who guessed correctly on the S&P 500 at 5,000.

As the index makes new highs, many of the red flags that we highlighted last week remain in play. It is important to note that they can correct themselves through time rather than price. This week we note other “somewhat confusing” trends in the market from a risk-taking perspective.

S&P 500 – Risk On but Extended

New all-time highs for the most watched and most benchmarked index in the U.S. are good for most equity investors. The S&P 500 remains above the rising 60-week moving average, but we note that it has entered extended levels. The 60-week Z-Score stands at 2.383 vs. a 10-year high of 2.805. Over the past decade, trips above the 2-mark have been short-lived.

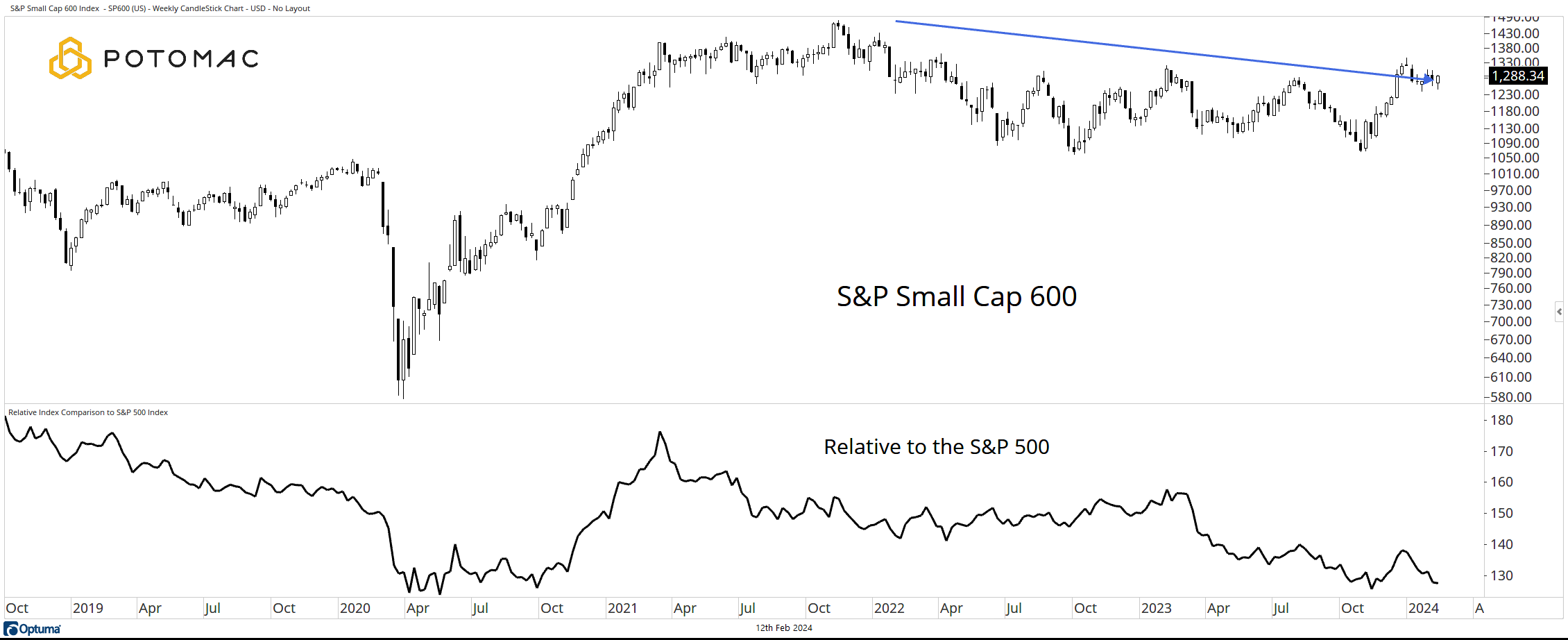

S&P 600 – Risk Off

When bearish investors want to make a strong point, they will often point out how the Russell 2000 (small caps) is weak. This is unfair because many of the 2,000 stocks in that index are extremely low quality (I am being nice here). The top end of the small-cap landscape is the S&P 600. This group, while not as weak as the R2K, is still more than 10% off its high and has been a steady underperformer.

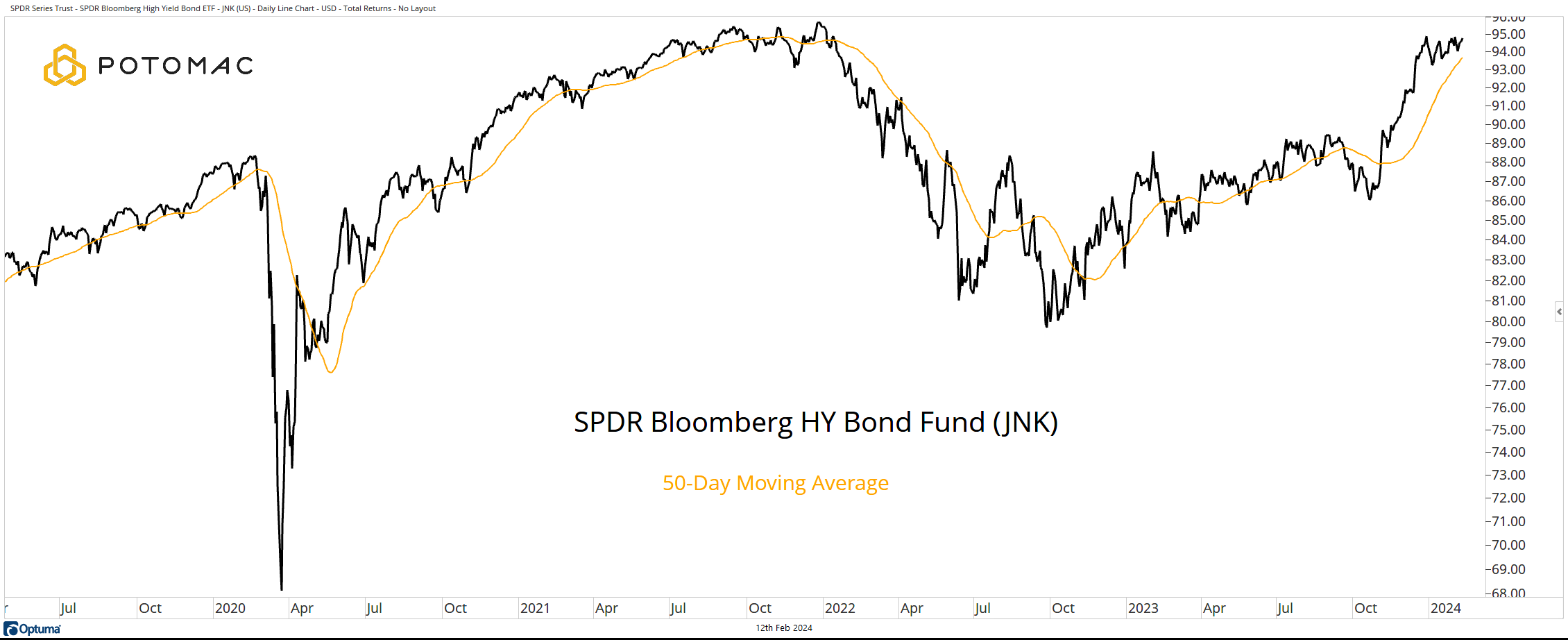

High Yield Bonds – Risk On

We have not heard much about it in the mainstream financial media, but high yield bonds are on the verge of making a new high above a rising 50-day moving average.

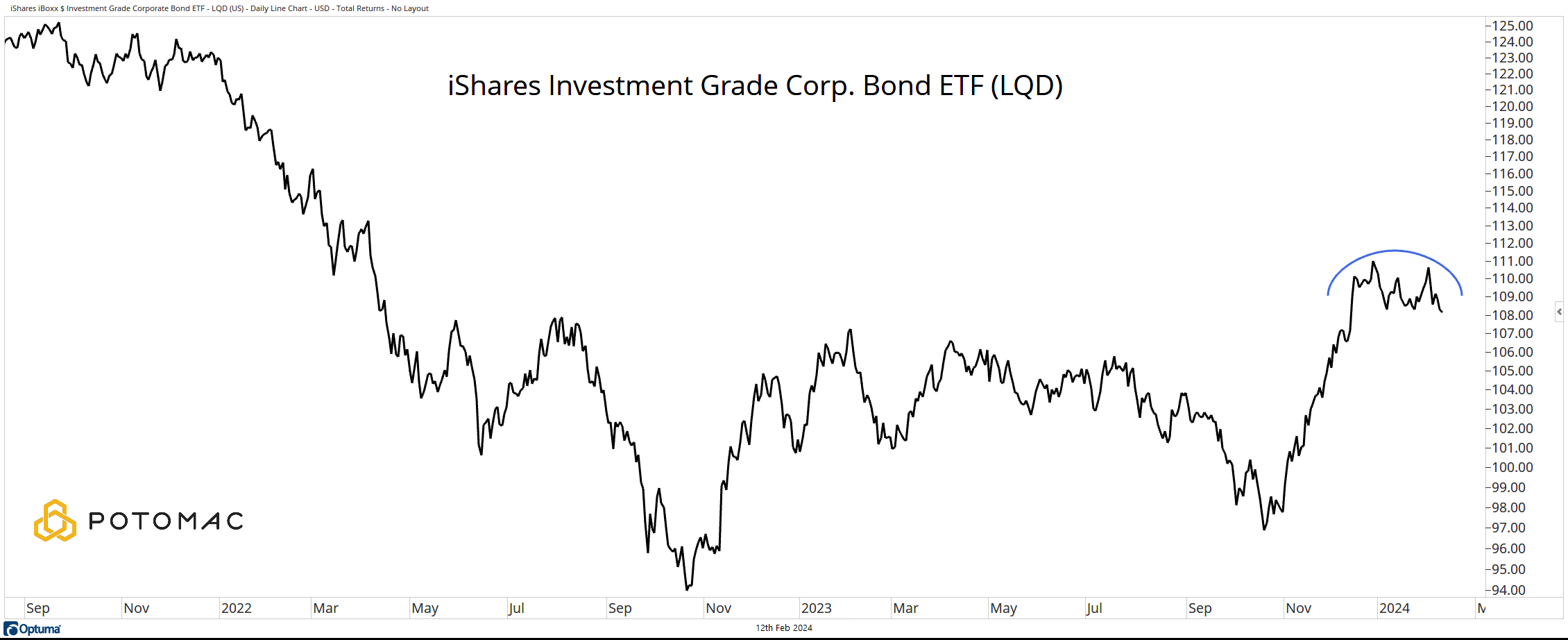

Investment Grade Bonds – Risk Off

As high yield attacks the old highs, investment-grade bonds appear to be in the process of rolling over while trading nowhere near prior peaks.

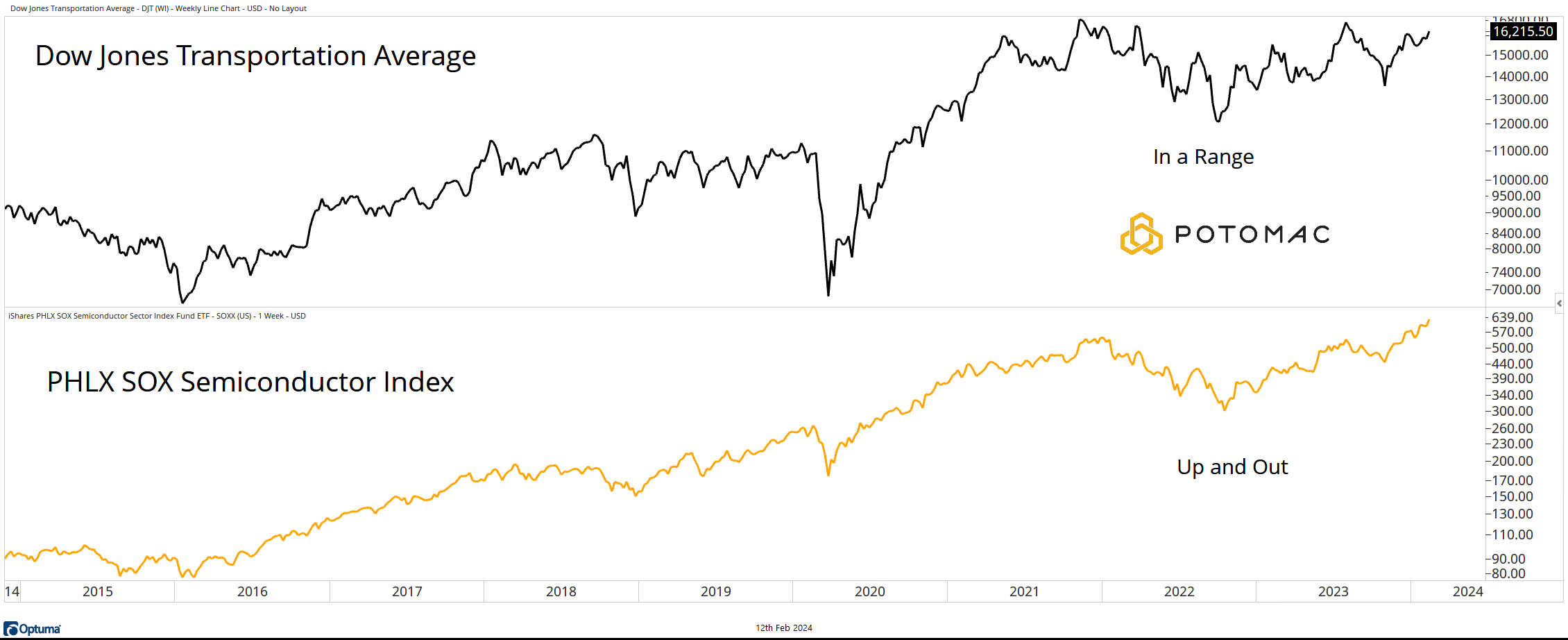

Transports vs. Semiconductors

Finally, we leave you with this mixed message. Transports remain below their highs, refusing to confirm strength in the broader equity market. At the same time, semiconductors are breaking to new highs.

*All charts are from Optuma as of the close of trading on February 9, 2024. Past performance does not guarantee future results.

Potomac Fund Management ("Company") is an SEC-registered investment adviser. This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page. The company does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to the Company website or incorporated herein, and takes no responsibility for any of this information. The views of the Company are subject to change and the Company is under no obligation to notify you of any changes. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable or equal to any historical performance level.

PFM-305-20240212