Well, That's Different

September 3, 2024

The S&P 500 is knocking on the door of a new high as all return from the holiday weekend. We have written at length about the breadth improvements that have been playing out over the past few weeks, and how they confirm the strength in the equity market. We are not going to belabor that point today.

Today we are going to focus on the composition of the advance and how it is unlike what many investors are used to.

S&P 500

The main U.S. Index has all but erased the summer swoon and is on the cusp of a new high. The steadily rising 60-week moving average serves as an important guide. It is hard to argue the bear case based on this trend.

Source: Optuma

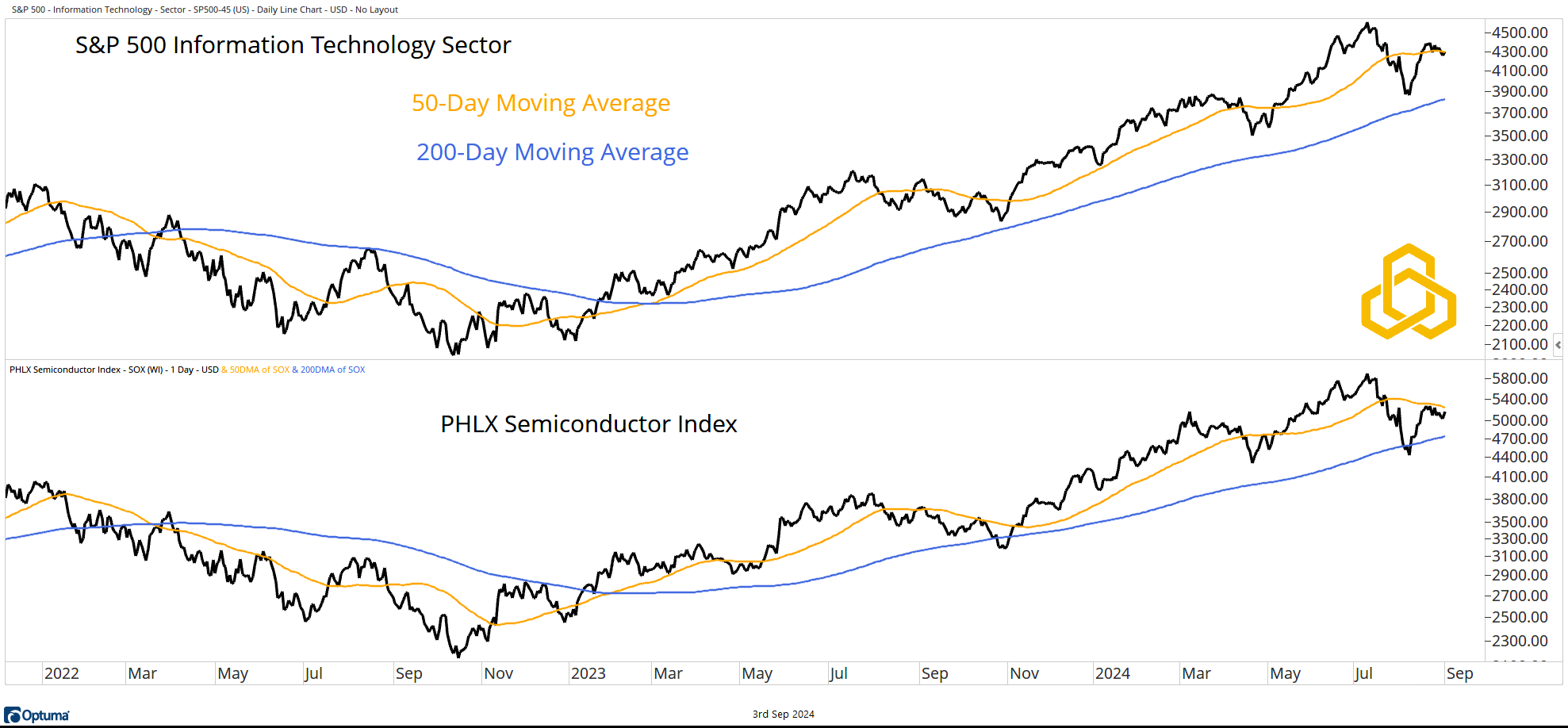

Technology and Semiconductors

Now we get to the part that is different. We have all become accustomed to bullish trends being led by the Technology sector in general, and the Semiconductor industry in particular. Look no further than the fact that last week in New York City there was a “watch party” for the release of Nvidia Corp’s. earnings (I did not attend). Make what you will about what this says about sentiment.

However, the Technology sector is not threatening new highs as it fights the flat 50-day moving average above the 200-day moving average. At the same time, the semis are below a declining 50-day moving average while holding above its 200-day.

Source: Optuma

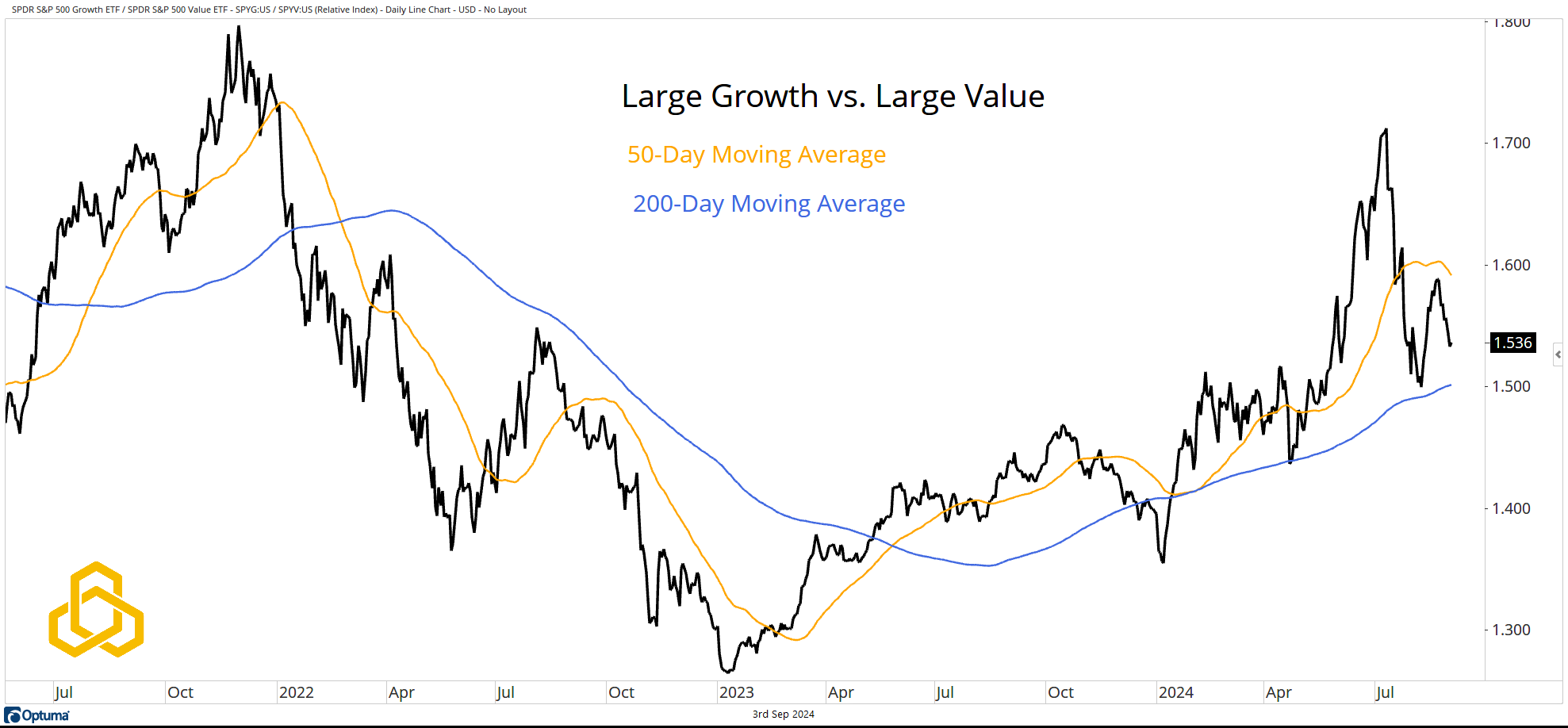

Growth vs. Value

Broadening the scope a bit, we can see that Large Cap Growth trades below the 50-day moving average relative to Large Cap Value. A sustained move below the 200-day moving average could be a signal that the trend has turned decisively negative.

Large Cap Growth is the home of many of the Technology behemoths that investors love to follow.

Source: Optuma

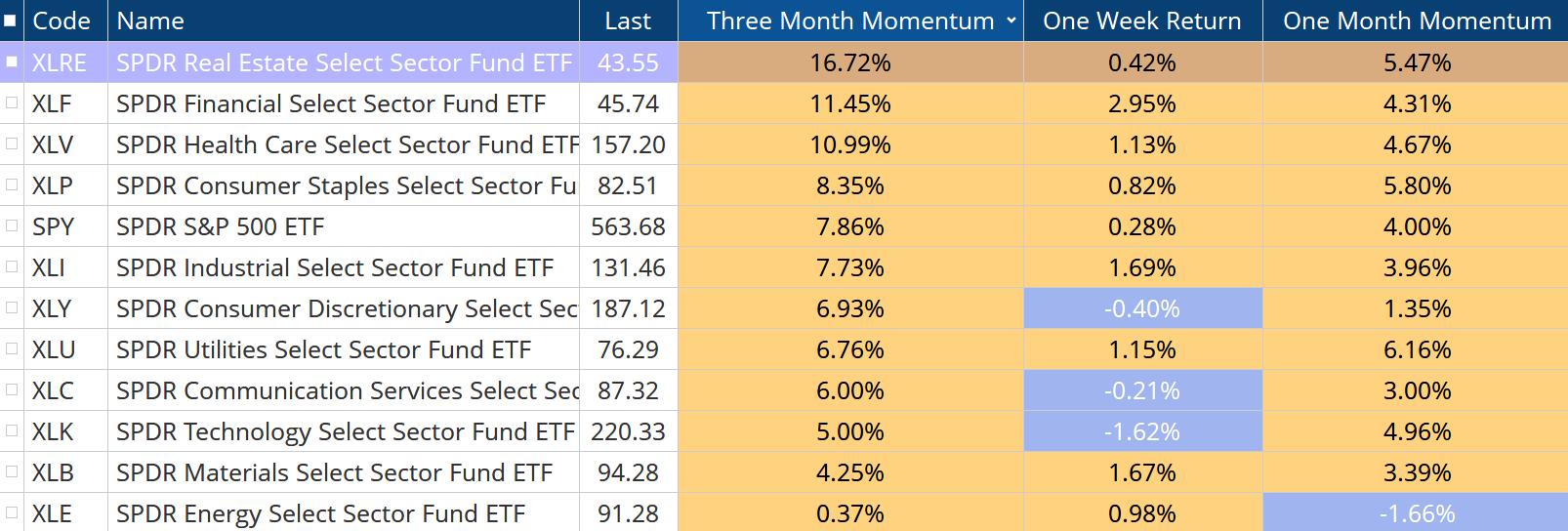

Sector Returns

Looking at the eleven sector ETFs (sorted by three-month returns) we can see Real Estate is at the top of the list followed by Financials, Health Care, and Staples. Last week, as the S&P 500 closed a new record high, the Technology sector was the biggest loser.

Bears will point out that the defensive nature of leadership is a sign of an impending top. Trend and breadth disagree.

Source: Optuma

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-353-20240903