We Made It

October 28, 2024

The title of this week’s note refers to the fact that Thursday marks the end of the “worst six months” of the year for the stock market—the conclusion of the “sell in May and go away” period.

This year provides an excellent example of why seasonality should be only a small part of an investment process and likely should never be the main catalyst for investment decisions.

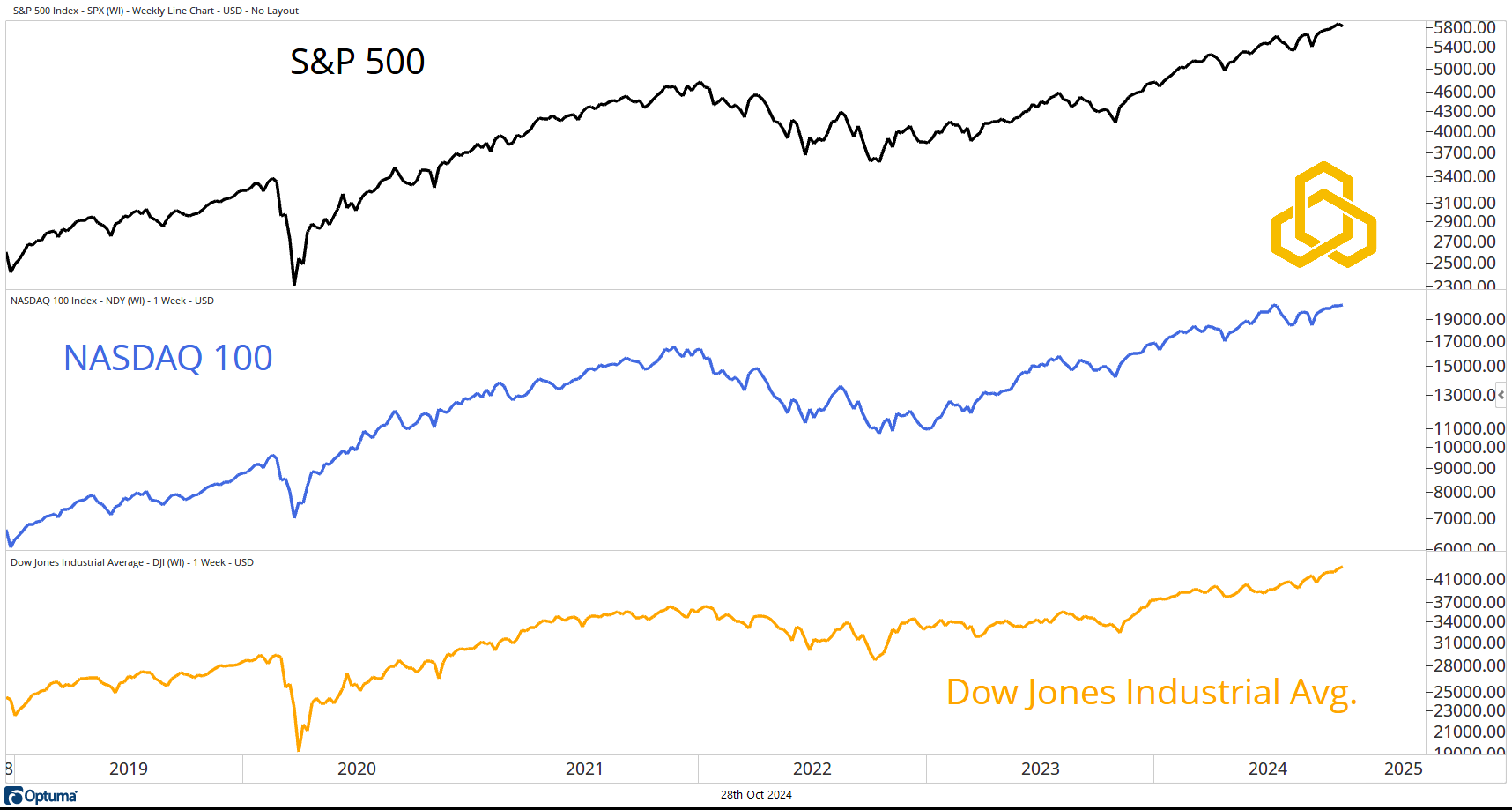

Major U.S. Averages

The major averages in the United States (S&P 500, NASDAQ 100, and Dow Jones Industrial Average) are all trading at or near all-time highs. Long-time readers know that I don’t argue with the market. Just consider the arrogance required to tell the market that it’s wrong.

All-time highs are bullish. Who am I to argue?

Source: Optuma

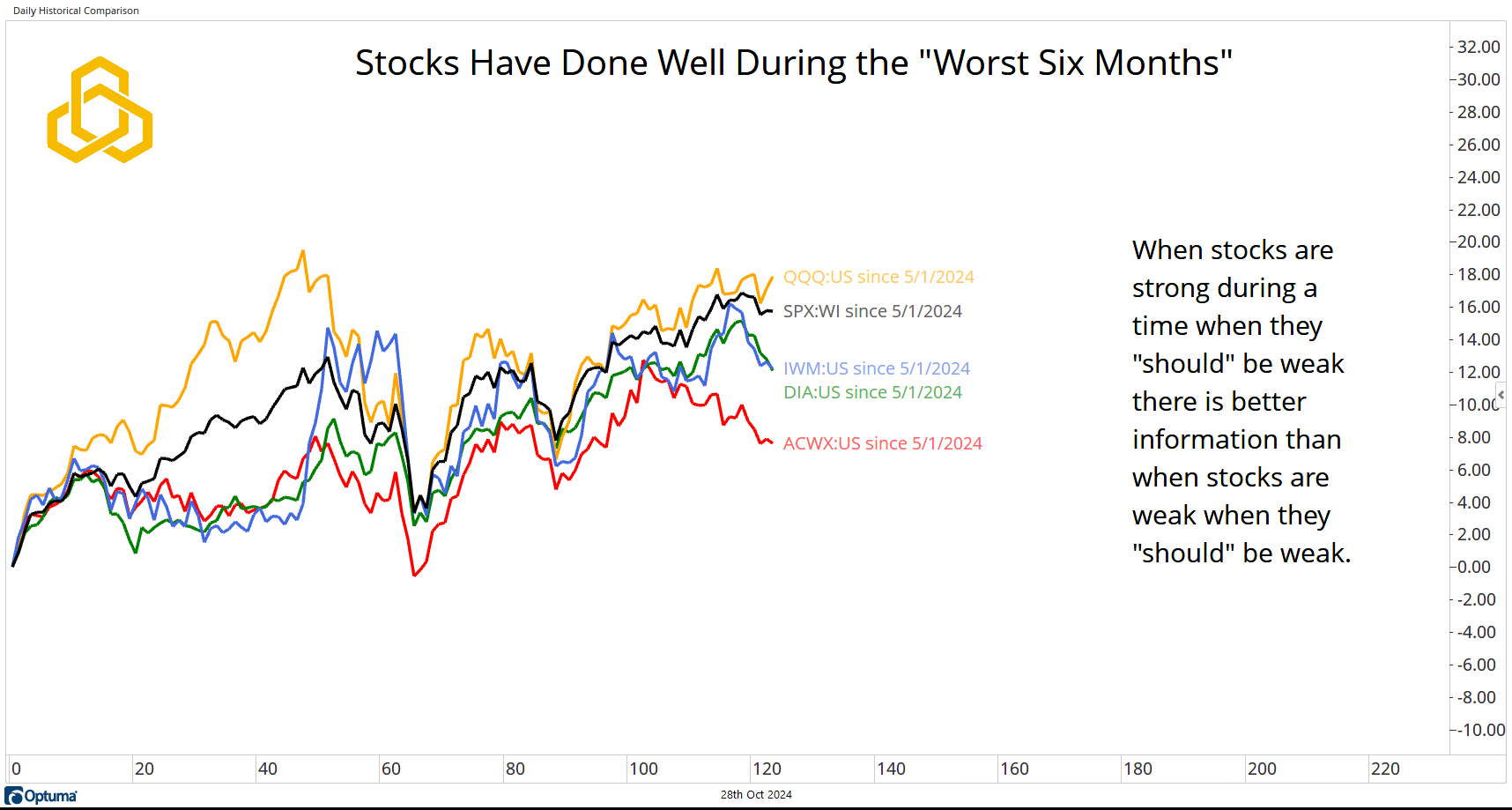

The “Worst Six Months”

We all know the old adage, “Sell in May and go away.” It stems from the seasonal pattern showing that the May to October period is typically the weakest of all six-month periods throughout the year.

Based on this logic, we’d normally expect to see less-than-stellar performance during this period. If this six-month stretch ends up being weak, we could nod our heads and think, “That’s what’s supposed to happen.”

However, we’re more interested when the expected doesn’t happen. In 2024, the “worst six months” actually gave investors solid performance. The U.S. posted double-digit returns, while the rest of the world delivered positive mid-single-digit gains.

Source: Optuma

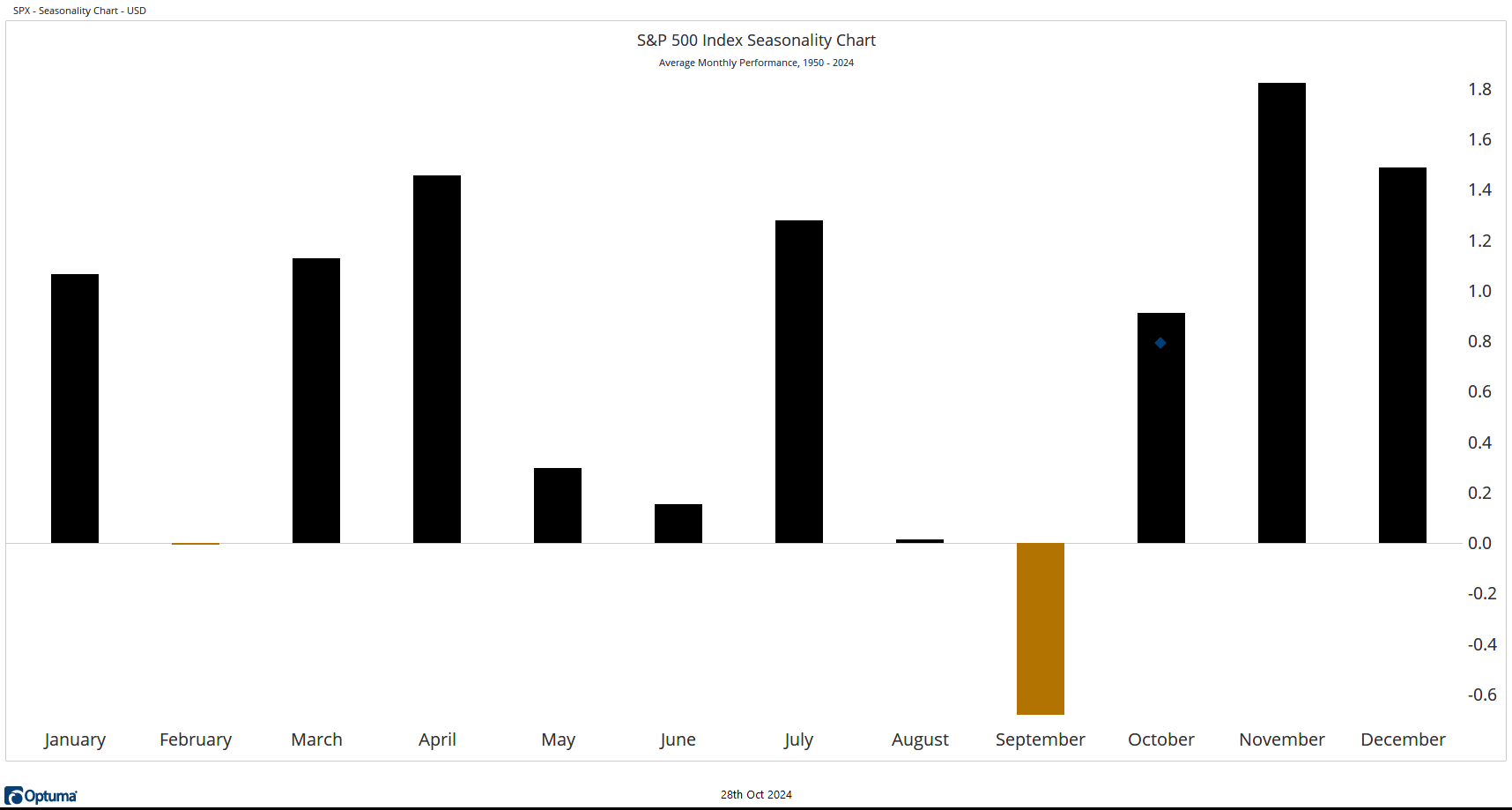

And Now, The Best Six Months

Looking at the S&P 500, the November to April period is known as the “best six months” of the year, with November and December as bullish standouts.

February tends to be the weakest month during this period, usually showing slightly negative performance on average.

Should this period prove to be strong, we’ll simply nod and think, “That’s what’s supposed to happen.” However, if it is weak, investors should take note.

Source: Optuma

While seasonality can play a role in an investment process (it’s a part of ours), it shouldn’t be the sole reason for making an investment decision. (Short-term trading is a different story, which we’ll address separately.)

Investors who reduced equity exposure in May solely because they followed the “sell in May…” mantra are worse off for it in 2024.

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-367-20241028