We Just Focus on the Data – Tariff Edition

February 3, 2025

For the third weekend in a row, there was “an event” for investors to think about. First, it was the inauguration, then we were awash in what to make of Deep Seek, and this past weekend was all about tariffs.

Just as last week with Deep Seek, we are not going to try to react to every headline, pretending to “know” what tariffs mean for every sector of the stock market or for every investable asset class. The fact of the matter is that these “events” and the reaction of prices are more nuanced than the soundbites that will get thrown around. As always, we just focus on the data.

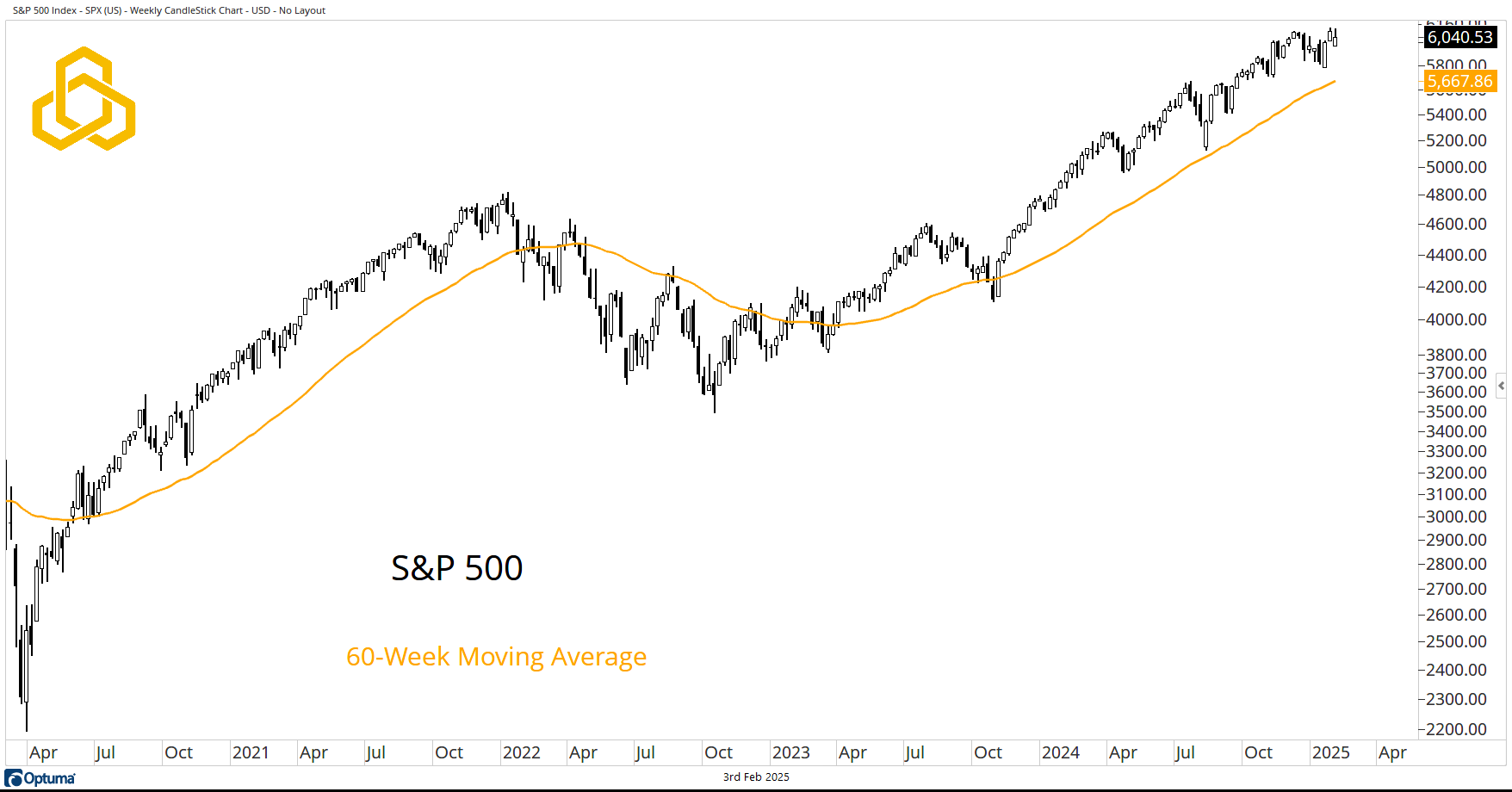

S&P 500

The S&P 500 closed lower on the week, but despite a Friday afternoon selloff, the index finished very close to the center of its weekly range, not near the lows. Traders with a very short-term focus can highlight the fact that the index failed to reach a higher high for the week. If that is your timeframe, there is likely some information there for you. However, an intermediate to longer view will see that the index remains in an uptrend above a steadily rising 60-week moving average.

Source: Optuma

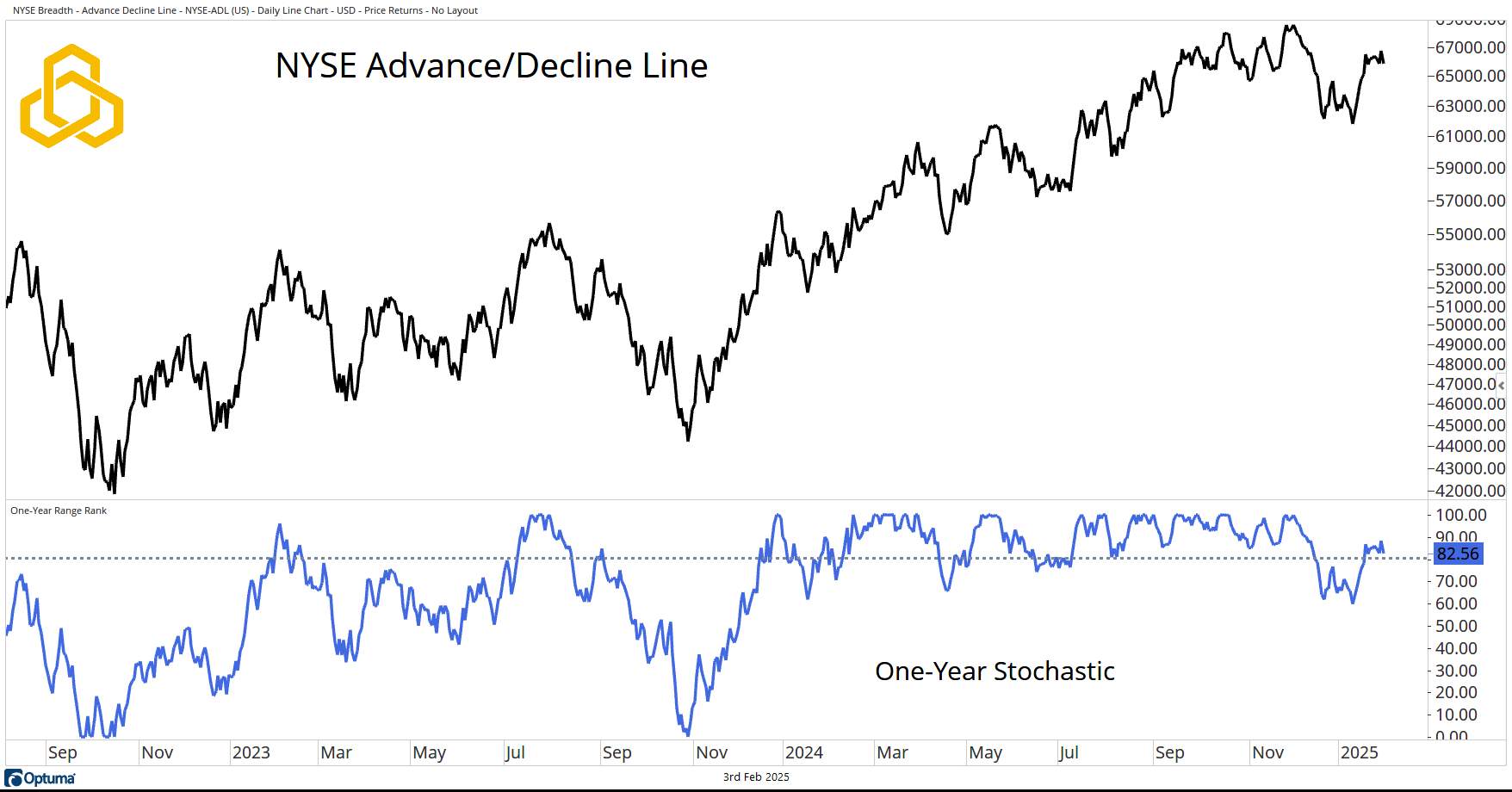

NYSE Advance/Decline Line

Despite the down week for stocks, the NYSE’s Advance/Decline Line remains in a solid position relative to its one-year range. The one-year stochastic sits at 82.56 (readings of 100 indicate a close at a one-year high while readings of zero point to a close at a one-year low).

To have confidence that there is a meaningful decline in store for the stock market, we would need to see greater and more sustained deterioration in market breadth, i.e., more stocks going down than going up.

Source: Optuma

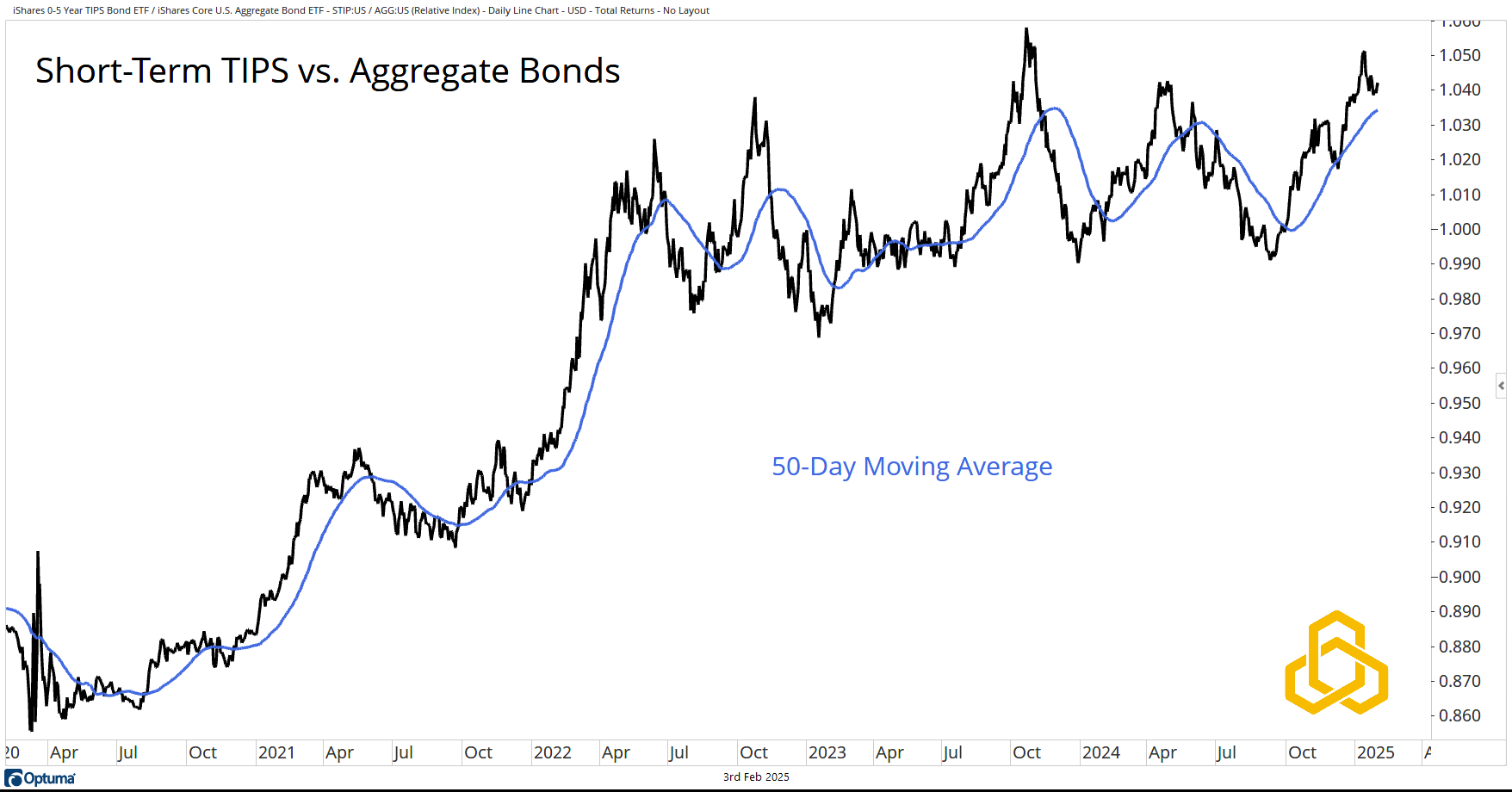

Short-Term TIPS vs. Aggregate Bonds

Some have made the case that tariffs will be inflationary in the U.S. If that is the case, we would expect to see the ratio of Short-Term TIPS (STIP) vs. Aggregate Bonds (AGG) break from the choppy consolidation that has been in place since June 2022. Thus far, that is not the case. Recall that tariffs have been a major talking point since the inauguration, so the events of this past weekend should not be a complete surprise to the market.

Source: Optuma

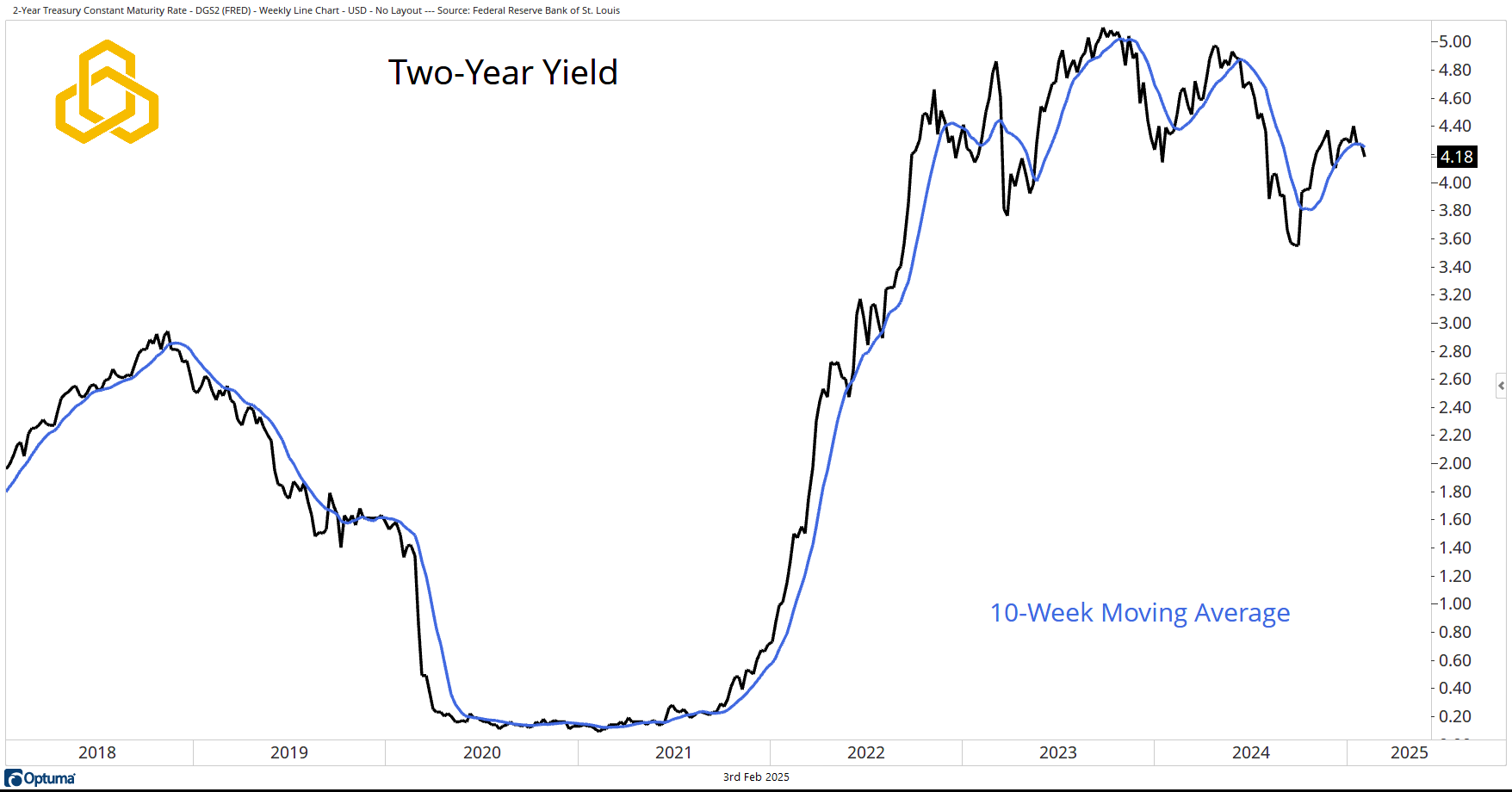

Two-Year Yield

Finally, we will watch the bond market closely. In particular, we are looking for a flight to safety at the short end of the curve. The Two-Year Yield has been consolidating, but with a slight downside bias, around the 10-week moving average. A meaningful breakdown would likely carry larger implications from a risk-taking perspective, but this has not played out yet.

Source: Optuma

As always, there are going to be a lot of moving parts around what investors perceive to be a major event. As always, we will let the data determine our views as it flows through our models.

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-387-20250203