We Just Focus on the Data

January 27, 2025

I know it’s coming, so I am going to get in front of it right now by answering all questions with “I don’t know,” followed by the title of this note.

“What does Deep Seek mean for U.S. stocks?”

“Is Nvidia going to sell off?”

“Is AI the new arms race, and did China just pass the U.S.?”

The answers to these questions are beyond my expertise and do not directly impact how we invest. As always, if an event is important, it will be filtered through price trends and market data. So, with that in mind, here is what I know…

S&P 500

The S&P 500 closed last week at record levels. That’s right, you might not realize it as you read this on Monday, but the weekly close for the most-followed index in the United States is at all-time highs.

Recall that we said breadth would need to improve to keep the bulls happy, and improve it has. At the same time, the larger trend—see the 60-week moving average—has not wavered in its bullish position.

Source: Optuma

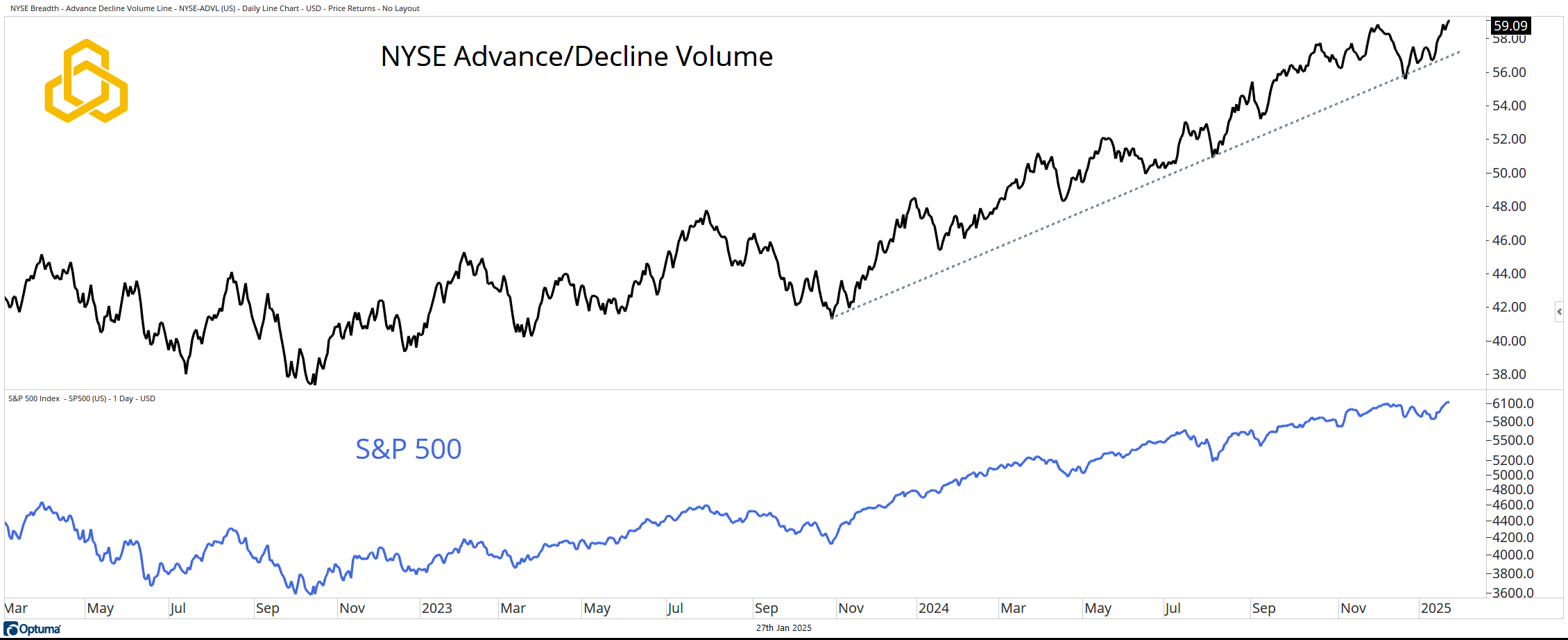

NYSE Advance/Decline Volume Line

The NYSE A/D Volume Line measures the running total of the difference between volume in advancing stocks and volume in declining stocks. In a bull market, we expect to see more volume trading in the stocks that are going up. The line has been in a steady uptrend since October 2023 and made a new high with the S&P 500 last week.

I will note that other breadth metrics that are key to our process have also continued to improve.

Source: Optuma

Technology & Semiconductors

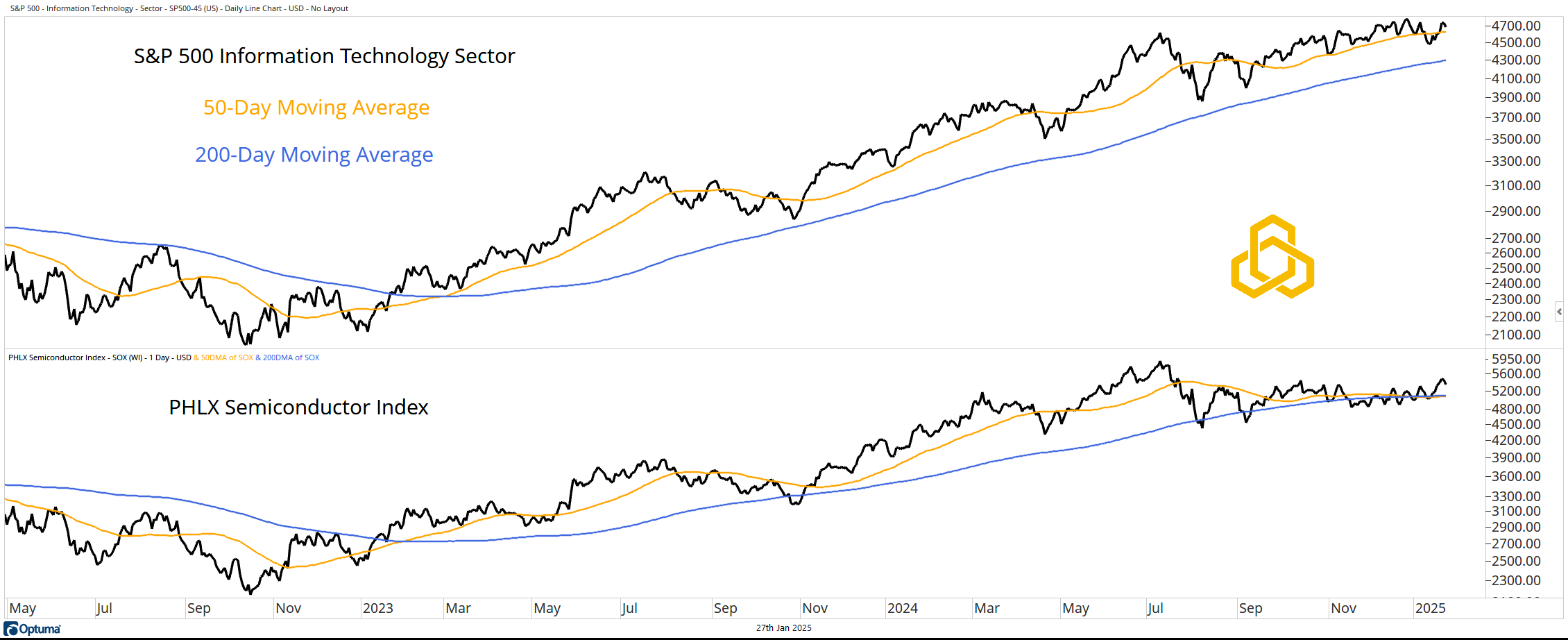

The Deep Seek news over the weekend will have the largest impact on the Technology sector and the Semiconductor industry group (for now).

Here is what is interesting: the Technology sector has been grinding sideways since July 2024. It has been dancing with the 50-day moving average, and while it is above the 200-day moving average, it has clearly lost momentum. Meanwhile, the Semiconductors have been in consolidation since March 2024, crossing the moving averages, which themselves are pinched. Long story short, these have not been all that attractive for some time.

Source: Optuma

Sector Performance

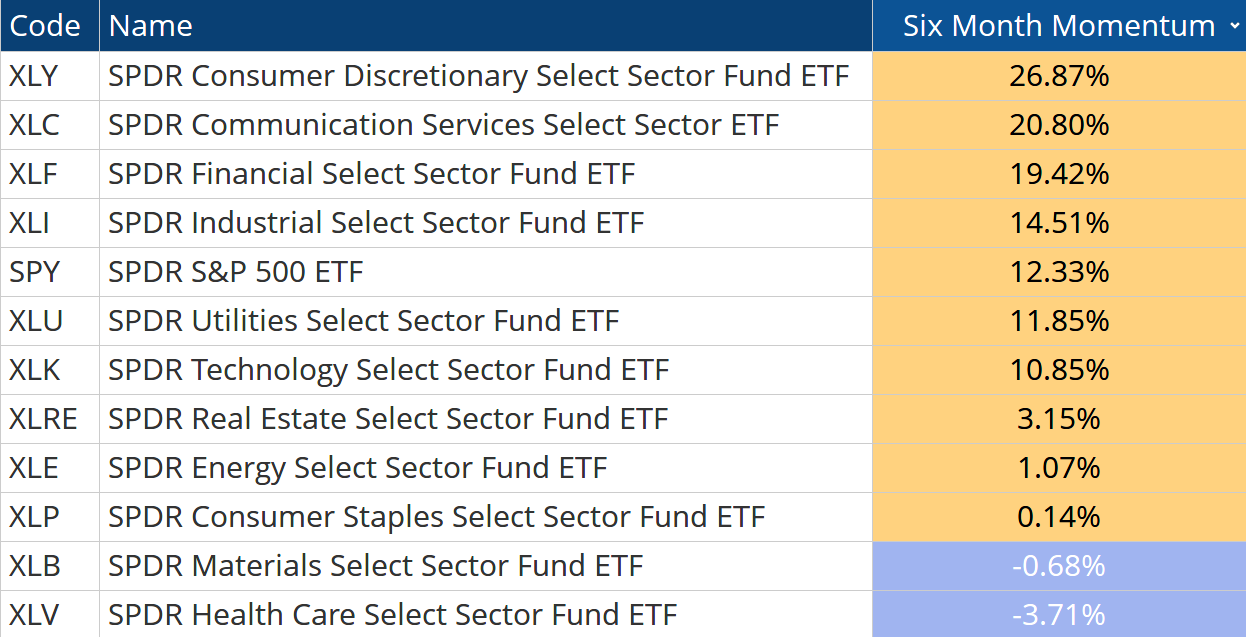

In fact, a simple six-month sector rotation ranking would show you that Technology (XLK) is lagging the S&P 500 (SPY) and even sits behind the more conservative Utility sector (XLU).

Source: Optuma

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-386-20250127