Unconfirmed Highs

July 9, 2024

In what is likely to be the theme of the summer, the S&P 500 has made another new closing high while fewer stocks took part in the rally. For investors who hug the S&P 500 tighter than a one-year-old hugs his or her teddy bear, breadth does not matter, if the index continues to make new highs, they blissfully go about their day, blithely unaware of what is brewing under the surface of the market.

However, if bad breadth becomes a factor, markets begin to decline, these investors will feel every bit of the drawdown. Some may argue (wrongly) that they are not concerned because they have bonds in their portfolio to “protect” them. However, our readers know that the stock bond correlation has flipped positive and has been strengthening.

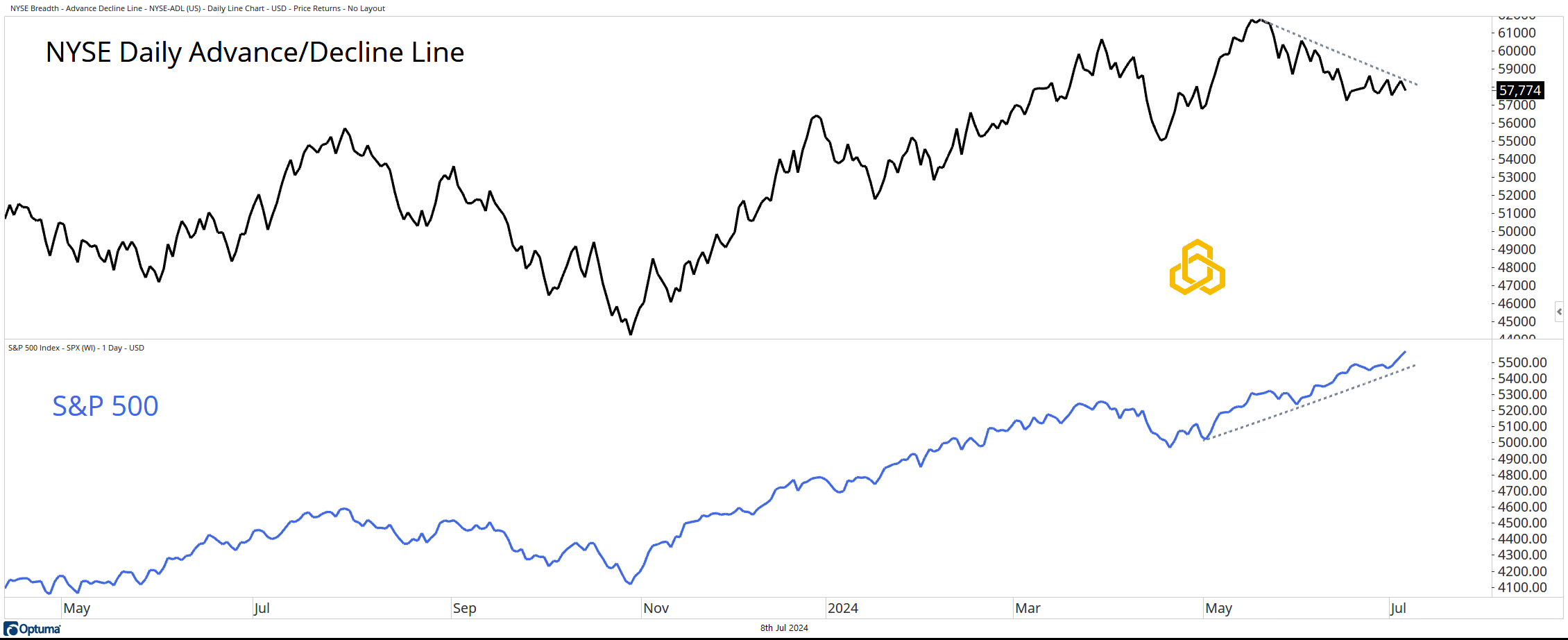

NYSE Advance/Decline Line & the S&P 500

Divergences are only warning signs…until they are not.

The S&P 500 made another all-time closing high on Friday while the NYSE’s Advance/Decline Line made a lower high during the week. In a strong bull market, we expect to see more stocks going up than going down. We have not seen that so far this summer.

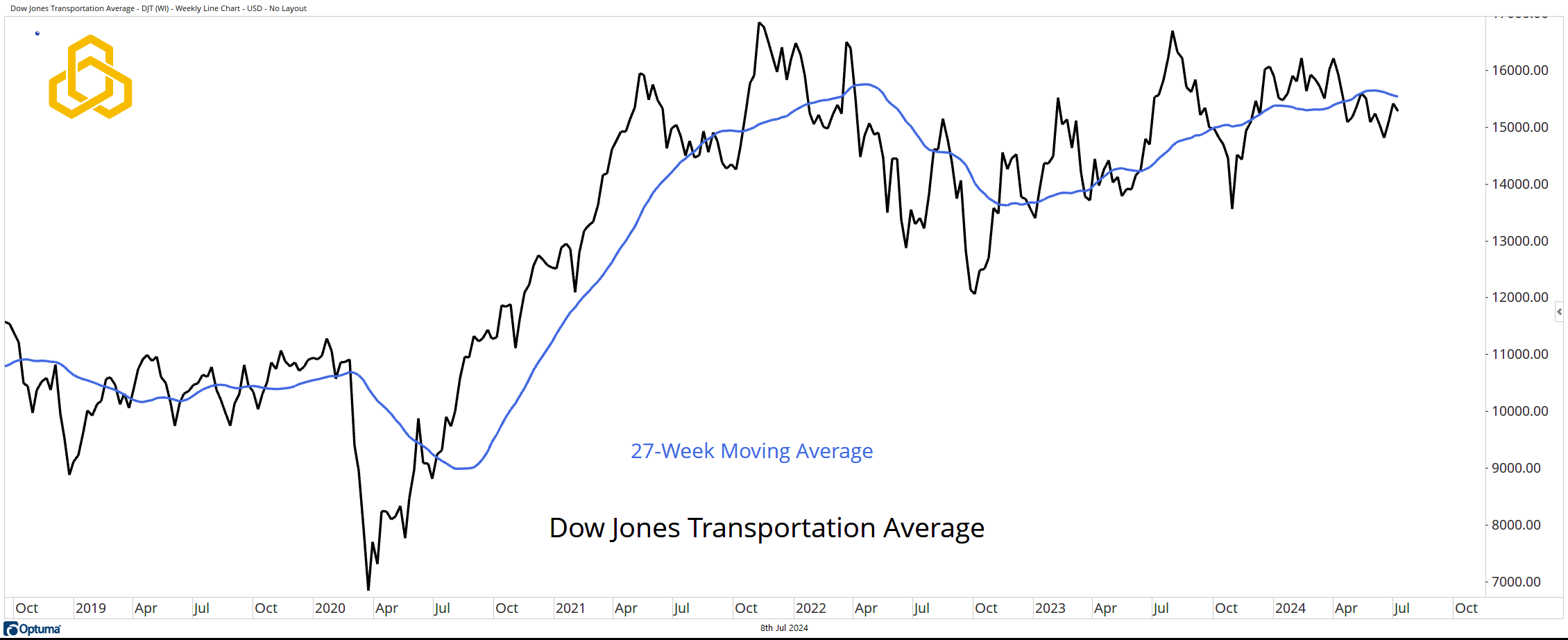

The Dow Jones Transportation Average

The Dow Transports play a key role in our work, and they remain mired in a sideways consolidation, currently trading below the 27-week moving average. Equity bulls want to see this average get into gear with the broader indices.

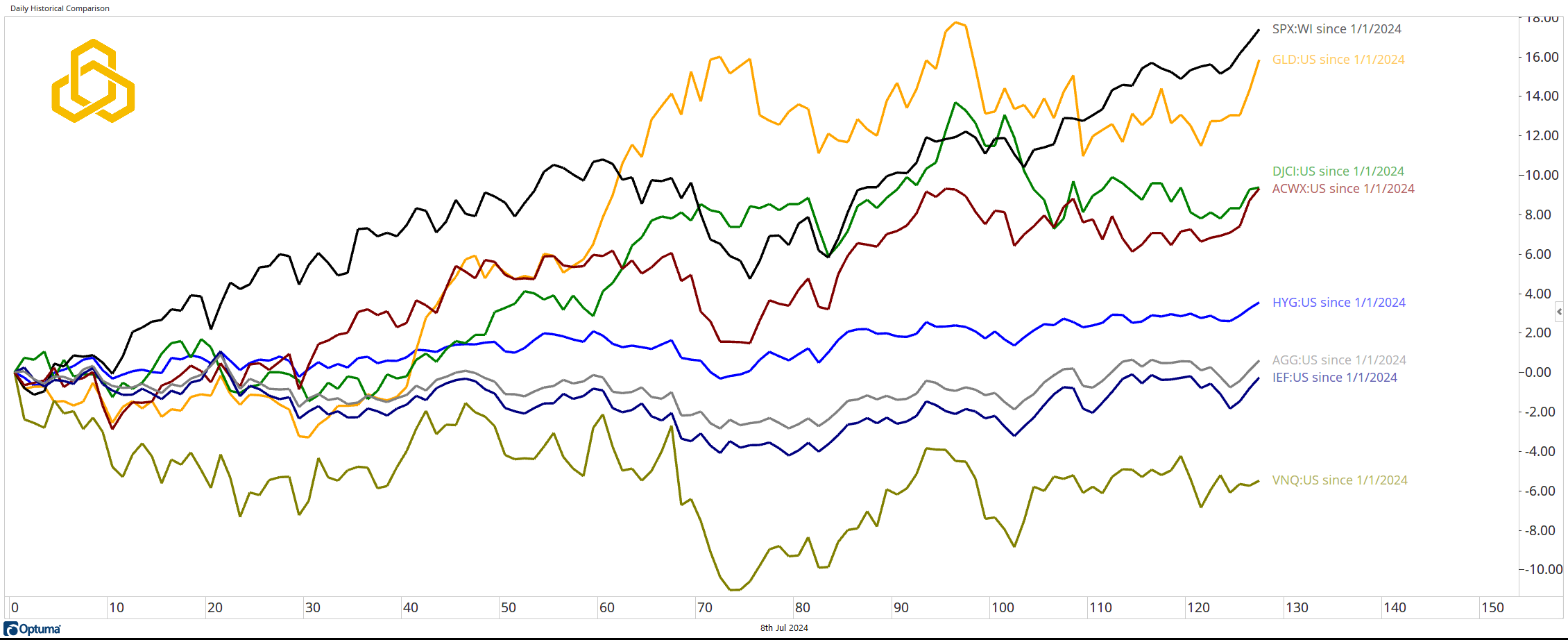

Asset Performance (YTD)

The average index hugger who is content to get the average of the equity market is not paying much attention to the lack of confirmation because despite the deterioration under the surface, their horse is winning the race.

Year-to-date, the S&P 500 is at the top of the list, fending off a strong push from Gold but comfortably ahead of all other challengers. Commodities and International Stocks are faring well and are likely still under-owned. Bonds are adding little-to-no value while Real Estate remains an also ran.

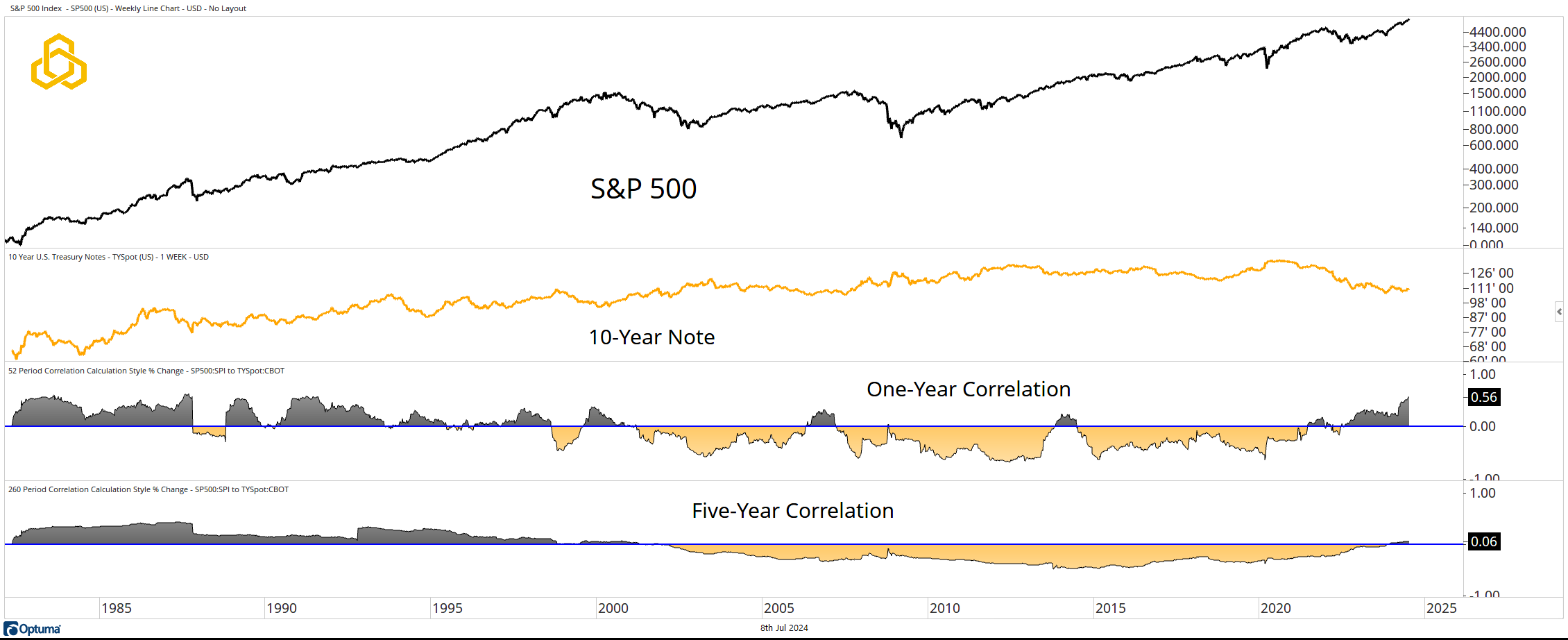

Stock/Bond Correlation

As we wrote above, bonds are not adding much value this year, but the passive investor may not care as their beloved S&P 500 rides to new highs every week. However, these same investors will argue that the bonds are in the portfolio to provide protection if equities slide lower.

However, we continue to note that the relationship between the two assets as flipped positive. In fact, the one-year correlation is now the highest it has been since the early 1990s (I heard all things 90s were making a comeback, so this fits). The five-year correlation continues to grind higher as well.

For those who have not, it is time to rethink the “40” on the 60/40.

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-341-20240709