Time to Kill the Traditional Stock Bond Portfolio?

May 20, 2024

It takes a long time to change ingrained behavior, but it seems the investors who will be the most rewarded soon will do just that. We have written and spoken at length about the shift in stock/bond correlations that has been playing out for two years and counting.

However, most of us have spent our entire careers in an environment where stocks and bonds have been inversely correlated. This means that when we “run our tests” looking back at the last 20-25 years, we will tend to see results that support a traditional stock/bond mix for strategic portfolios.

However, we continue to believe that the bond side of the book will not act as it did from 2000 – 2022. We also believe investors currently do not own enough uncorrelated (to stocks) assets in their strategic portfolios.

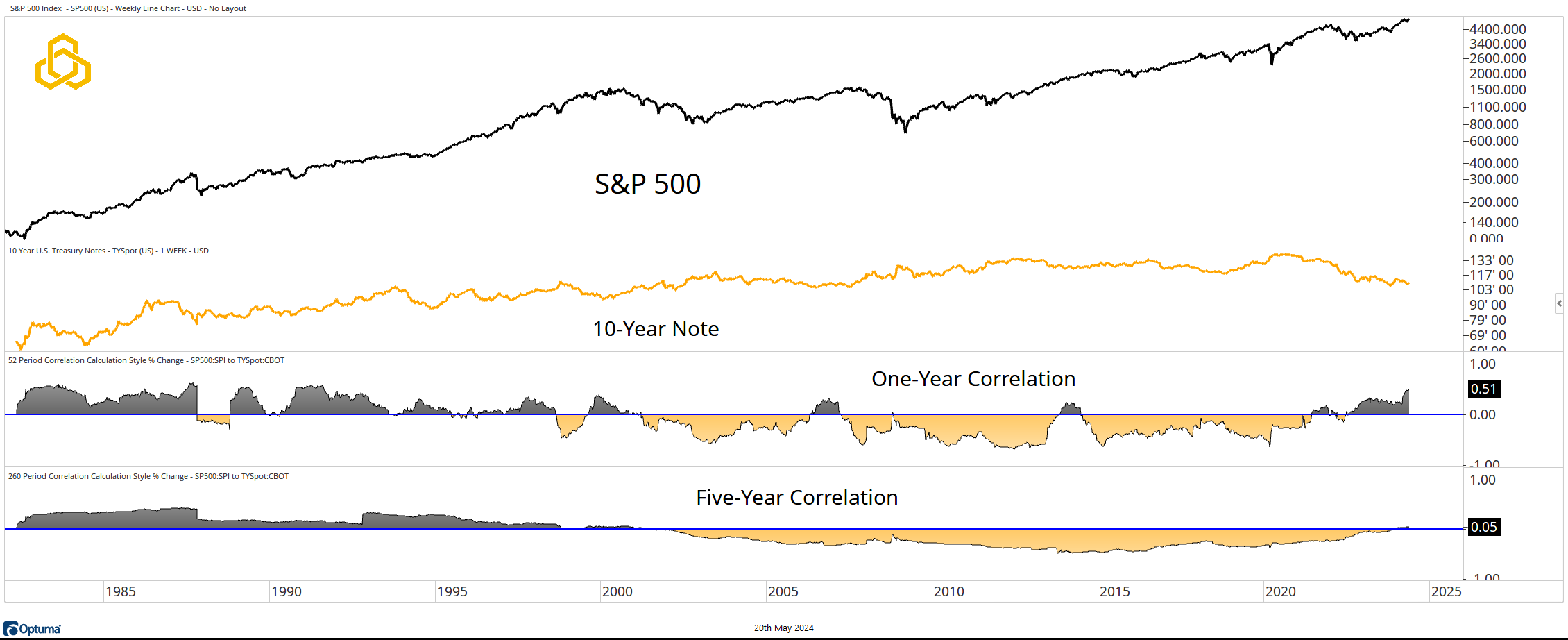

Stock / Bond Correlation

We use this chart frequently and will continue to do so for as long as it takes for the message to sink in broadly. The one-year correlation is now at levels not seen since the early 1990s. At the same time, the five-year metric continues to grind higher.

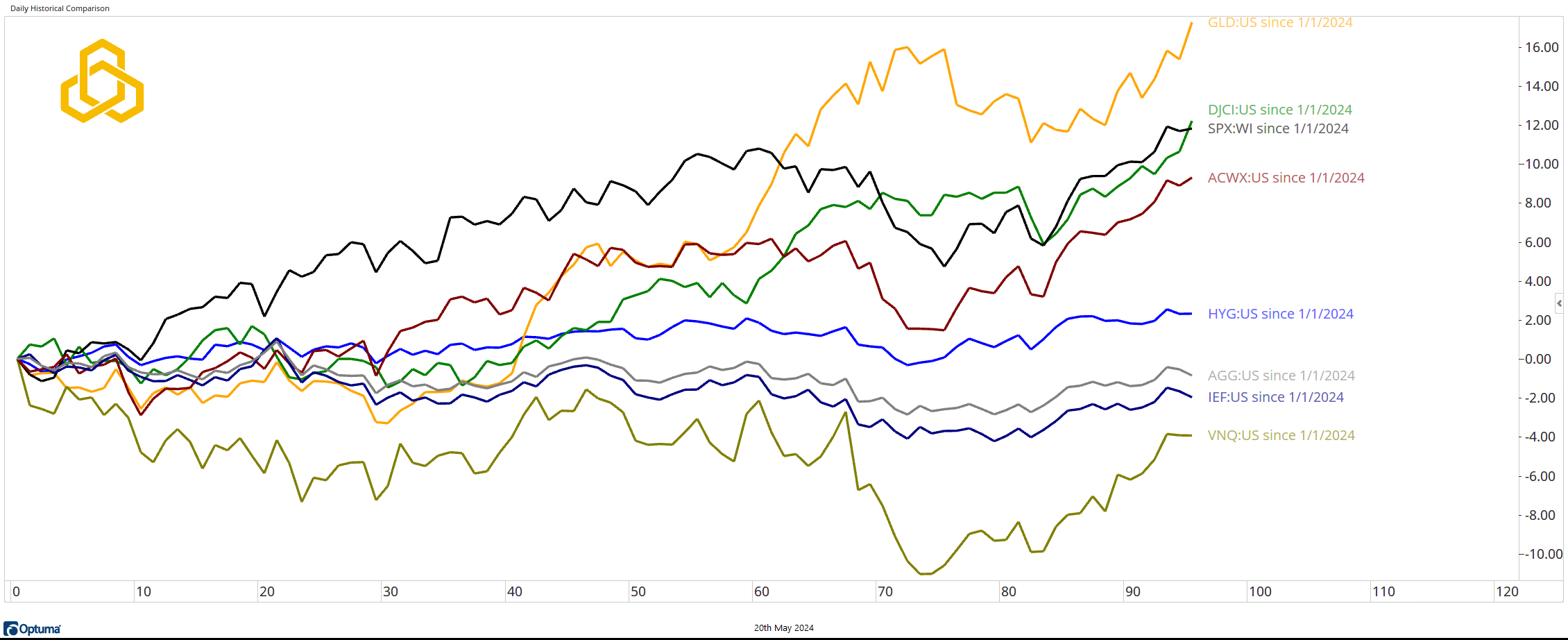

Relative Asset Comparison

Since the start of the year, the SPDR Gold Shares ETF (GLD) has been in the lead. Last week, the Dow Jones Commodity Index (DJCI) moved into the number two position. Equities are well represented, with both the S&P 500 (SPX) and the ACWI ex-US ETF (ACWX) holding spots three and four. Note the position of bonds in 2024 AFTER their disastrous year in 2022.

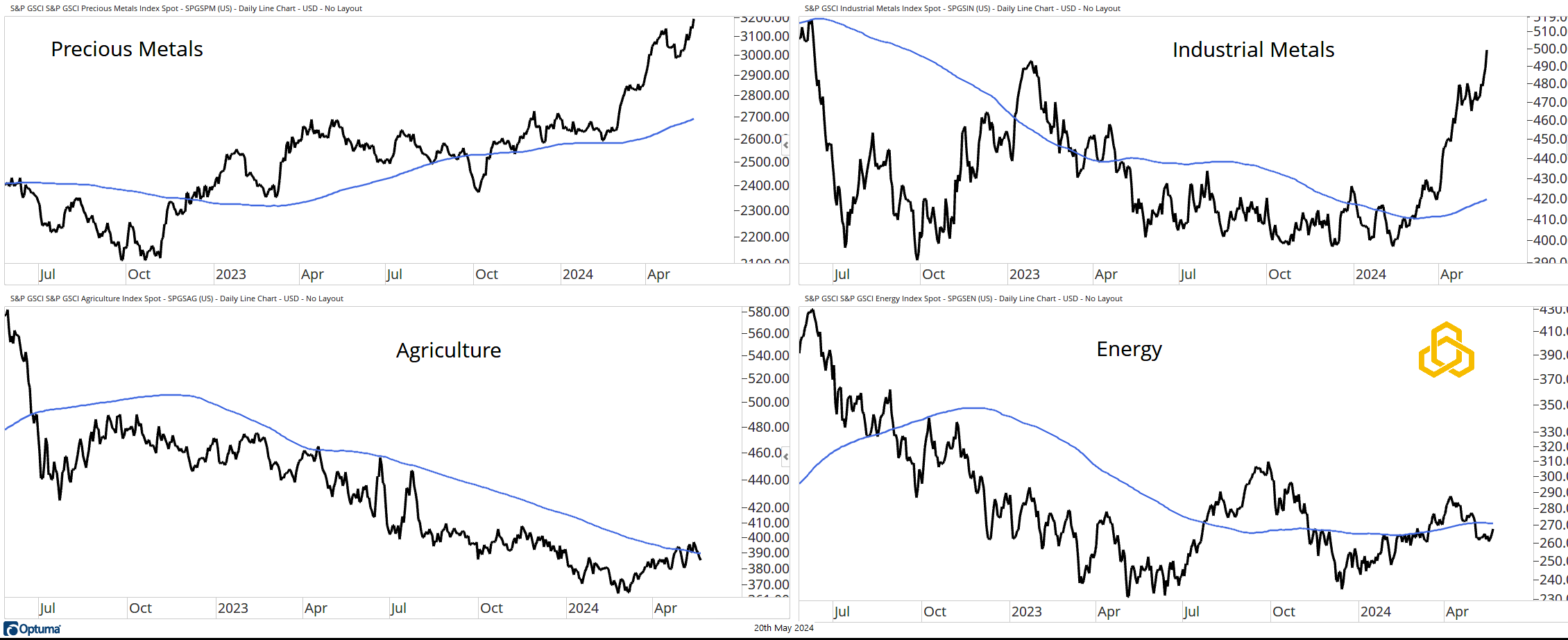

Commodities

While we continue to believe that strategic portfolios are likely underweight commodities and can benefit from an allocation, we also believe that selection within the complex is important for those with exposure.

The metals have relative strength, with both Precious and Industrial above rising 200-day moving averages. Despite a historic run in Cocoa, Agricultural Commodities are fading from a declining 200-day moving average. Finally, despite tension in the Middle East, Energy is moving sideways below a flat moving average.

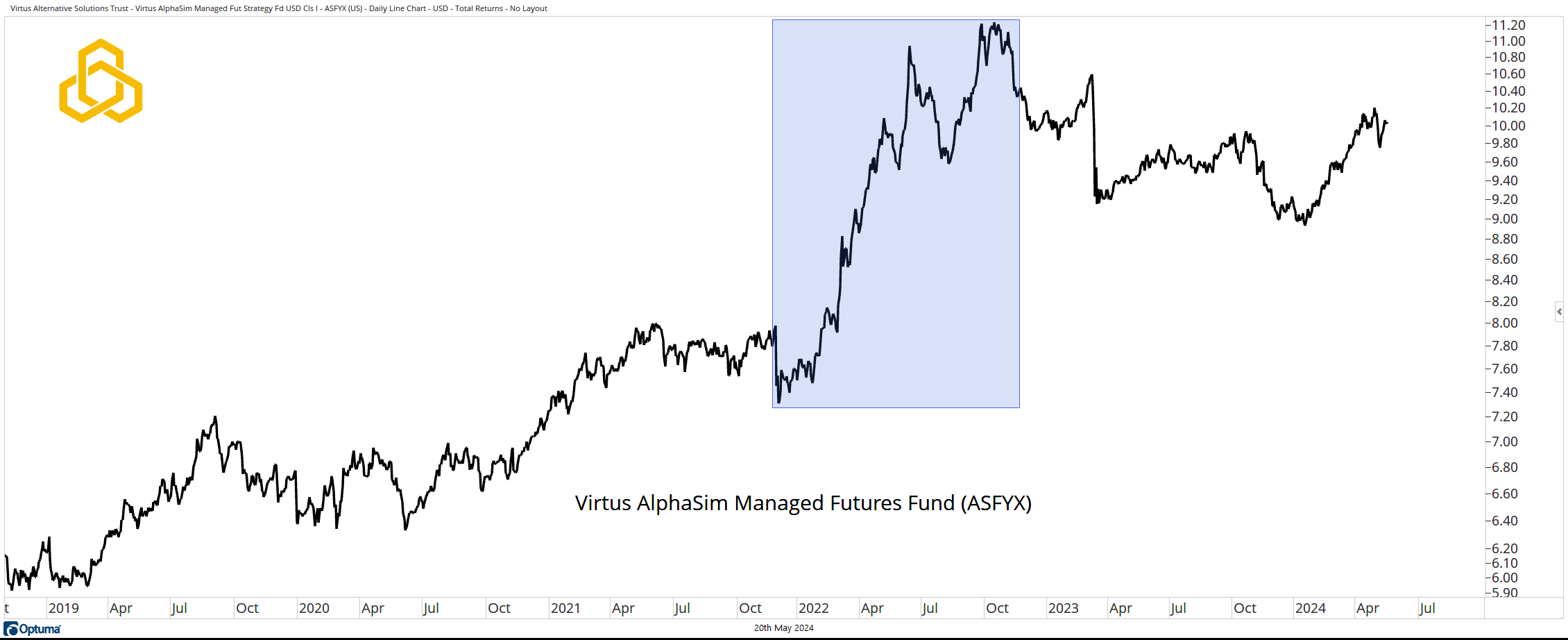

Managed Futures

Managed Futures (or CTA) Funds attempt to find the best trends in the market and ride them until they have turned. Rather than making a strategic allocation to a broad asset class such as commodities, they attempt to own the commodities trending higher while avoiding or shorting the ones moving lower. This process repeats across assets. If bonds are moving lower, these funds will likely be short bonds. If the Japanese yen is weakening against the U.S. dollar, they will likely be short the yen against the greenback.

Note the strong trend in 2022 when bonds failed to provide the safety that investors had grown to depend on.

*This is just one example. There are many managed futures strategies in the market.

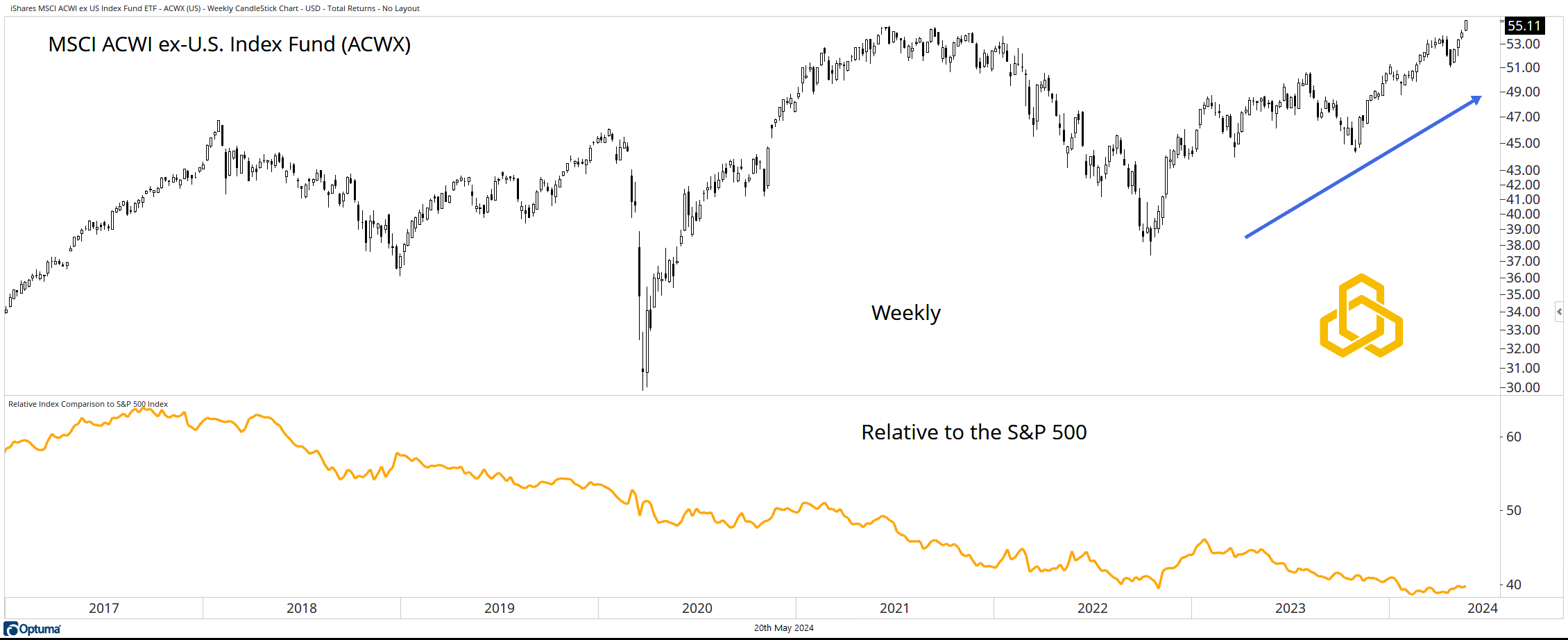

International Equities

While we have spent most of our time picking on the bond side of the traditional stock/bond portfolio, it does not mean that we simply set it to the S&P 500 and forget it on the stock side of the ledger.

The MSCI ACWI ex-US Index ETF (ACWX) traded at a new high last week with U.S. equities. The relative trend remains bearish, but we think this theme should be on the radar. There will come a time when the

U.S., particularly the S&P 500 & NASDAQ 100, is not the only equity game in town.

*All Charts from Optuma as of the close of trading on May 17, 2024. Past performance does not guarantee future results.

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-327-20240520