Time for a Q&A Session

January 22, 2024

We always try to answer three simple questions.

-

What is the market’s trend?

-

How healthy is that trend?

-

Is that trend confirmed by intermarket themes?

Based on the combinations of answers to these questions, we can assess the odds of continuing that trend or the risk of a reversal. The use of the word odds here is key. There are no sure things in the market; upsets can and do happen. That’s why we play the games.

What’s the Trend?

This one is easy and straightforward. The trend is bullish.

The S&P 500 closed the week at a new all-time high. That's right; in the face of an aggressive tightening cycle and numerous calls for a recession, the most widely benchmarked market in the U.S. (and possibly the world) went out at all-time highs. That puts it above the rising 60-week moving average.

How Healthy is that Trend?

This is where the waters become a little muddy, where the odds have the potential to shift. In strong uptrends, we expect to see a lot of stocks moving higher.

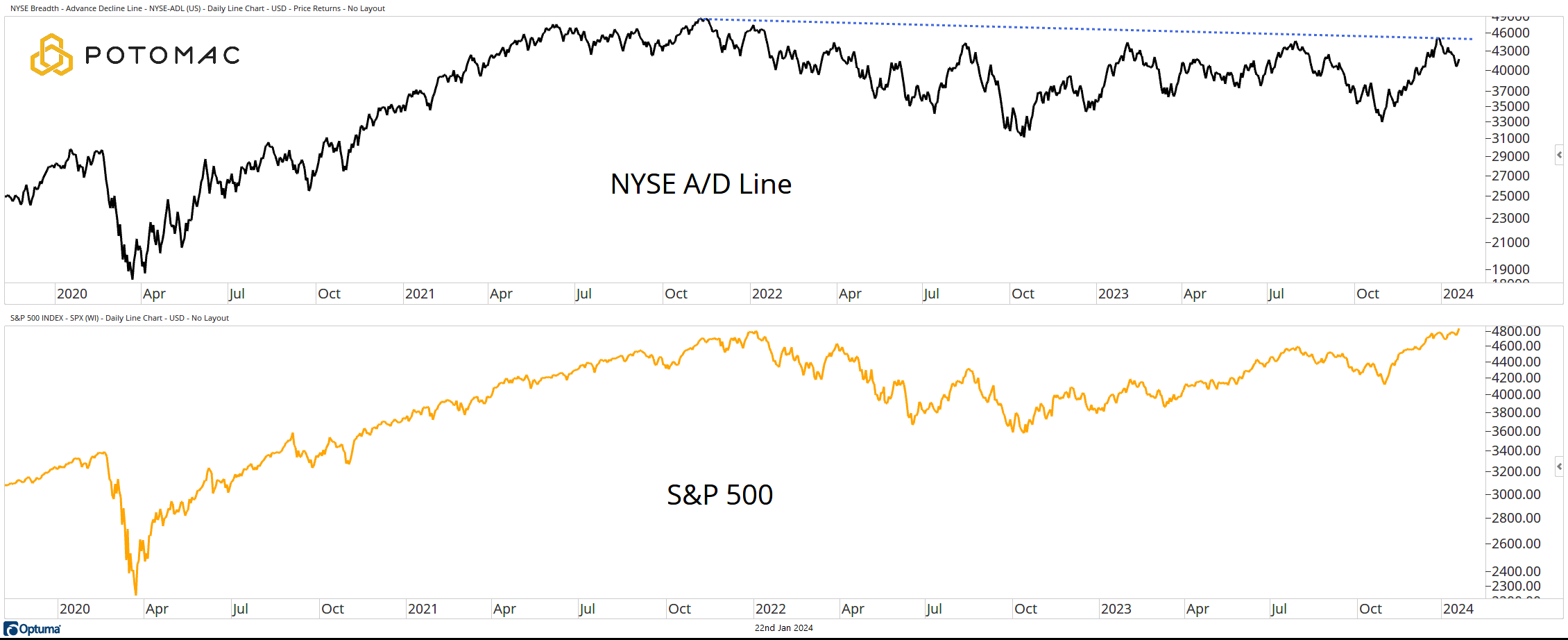

However, as the S&P 500 makes new all-time highs, the NYSE Advance/Decline Line is in the process of making a lower high. To be fair, the A/D line has been under pressure for two years.

That mattered in 2022 as stocks moved lower, but it did not act as a headwind to 2023 market gains. We will keep an open mind for 2024.

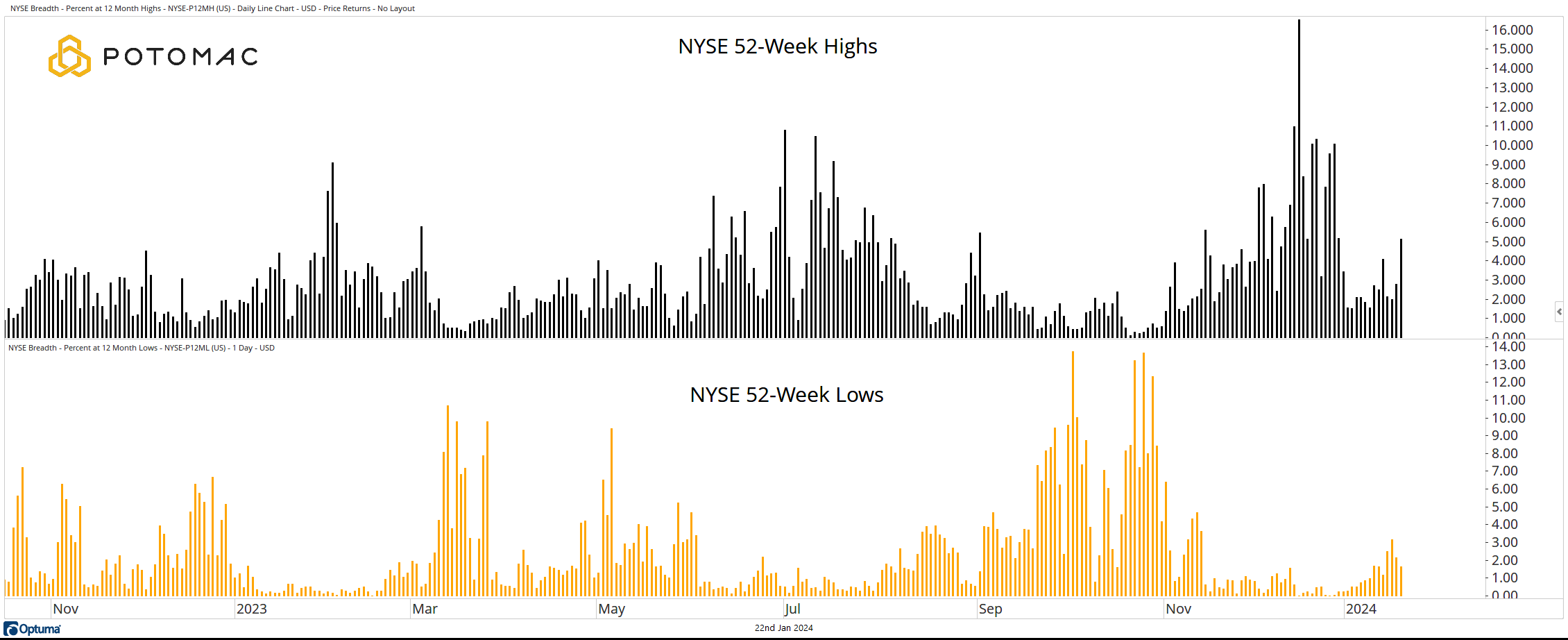

In a healthy bull market, we expect to see more stocks making new 52-week highs than those making new 52-week lows. That is exactly how 2023 ended. That is not what we are seeing thus far in 2024.

In fact, the 52-week high list peaked on December 14th and has been trending lower ever since. New 52-week lows are beginning to lift their heads off the mat as well.

Is the Trend Confirmed by Intermarket Themes?

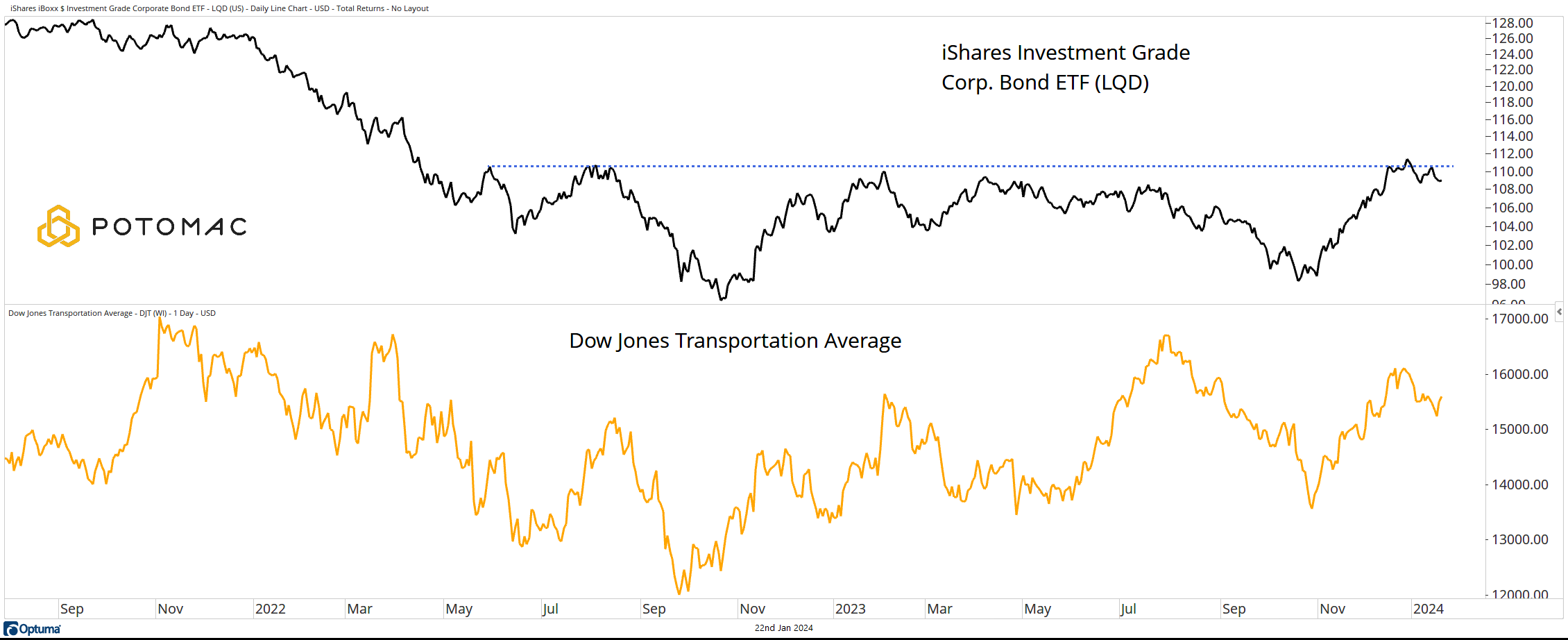

Two of the key themes on which we focus are the Bonds and Transports. Those who have been following along for nearly two years know that we have been highlighting a shift back to a positive stock/bond correlation. If we are correct, weakness in the bonds should be considered a red flag for stocks. The corporate bond ETF (LQD) is beginning to reverse at resistance and has not been able to sustain strength on rally attempts since 4Q2022.

At the same time, the Dow Jones Transportation Average has not notched new all-time highs with the broader equity market.

All of this leaves us with an uptrend that may be starting to become unhealthy.

Is a reversal guaranteed? No.

Are the odds increasing? It certainly seems that way.

We will keep playing the games, assessing the odds and adjusting based on those odds.

Interesting, but not Useful?

There was a chart making the rounds over the weekend depicting the S&P 500 at all-time highs while the Russell 2000 is nearly 20% from an all-time high (~18% on a total return basis).

Most of the people highlighting this dynamic also note that it has never happened before, ever!

That said, it is hard to know if this is a useful data point or just an interesting one.

*All Charts from Optuma as of the close of trading on January 19, 2024

Potomac Fund Management ("Company") is an SEC-registered investment adviser. This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page. The company does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to the Company website or incorporated herein, and takes no responsibility for any of this information. The views of the Company are subject to change and the Company is under no obligation to notify you of any changes. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable or equal to any historical performance level.

PFM-302-20240122