This is an Important Week

As I sit to write early on a May Monday, stock investors—especially the “buy and holders”—are rejoicing over the prospects of a weekend tariff deal between the U.S. and China. This development comes as stocks sit at key inflection points that we highlighted in our work last week. The bears held the line during last week’s action but today brings early indications of a reversal.

Obviously, we are not making decisions based on tariff headlines or trading in Sunday night into Monday morning futures markets—but we are always mindful of shifts in the data.

S&P 500

Beginning as we always do with the S&P 500, we can see that bulls pushed the index to the flattish 60-week moving average but were unable to move above it. The bears held their ground, and the index closed in the middle of the weekly range.

Retaking the moving average would be a major win for equity bulls. A reversal of Monday’s strength leading to a flat or down week would keep the bears in control.

Source: Optuma

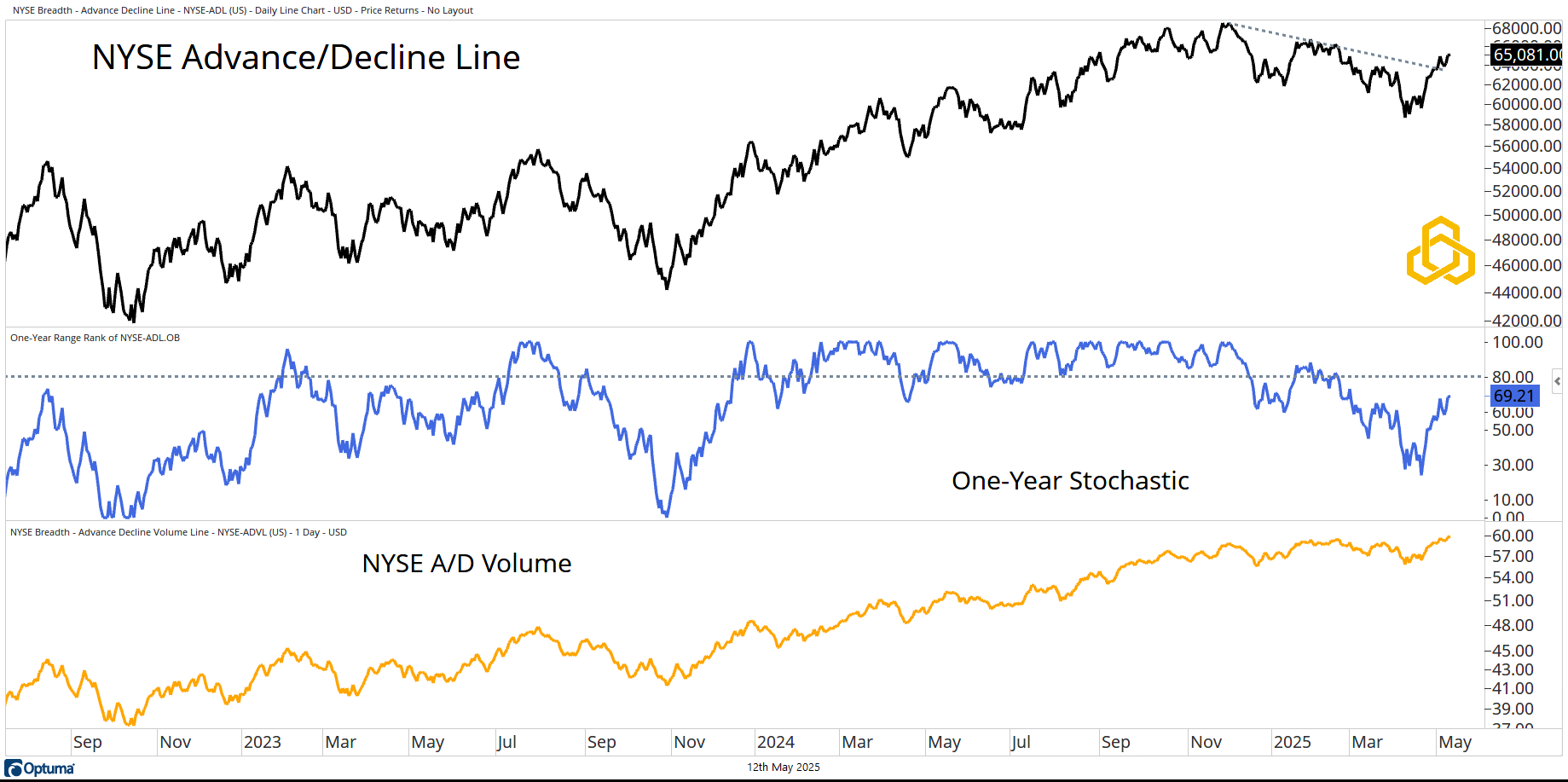

NYSE Breadth

Breadth metrics improved during the week despite a flat close, which is key to the bull case for stocks. The NYSE Advance/Decline Line has broken a negative trend and is now eyeing the November high. The one-year stochastic also improved to 69.21 last week and appears poised to move back above 80.

More importantly, we’re seeing greater volume of trading in advancing stocks compared to declining ones. The NYSE Advance/Decline Volume Line closed the week at a new high.

Source: Optuma

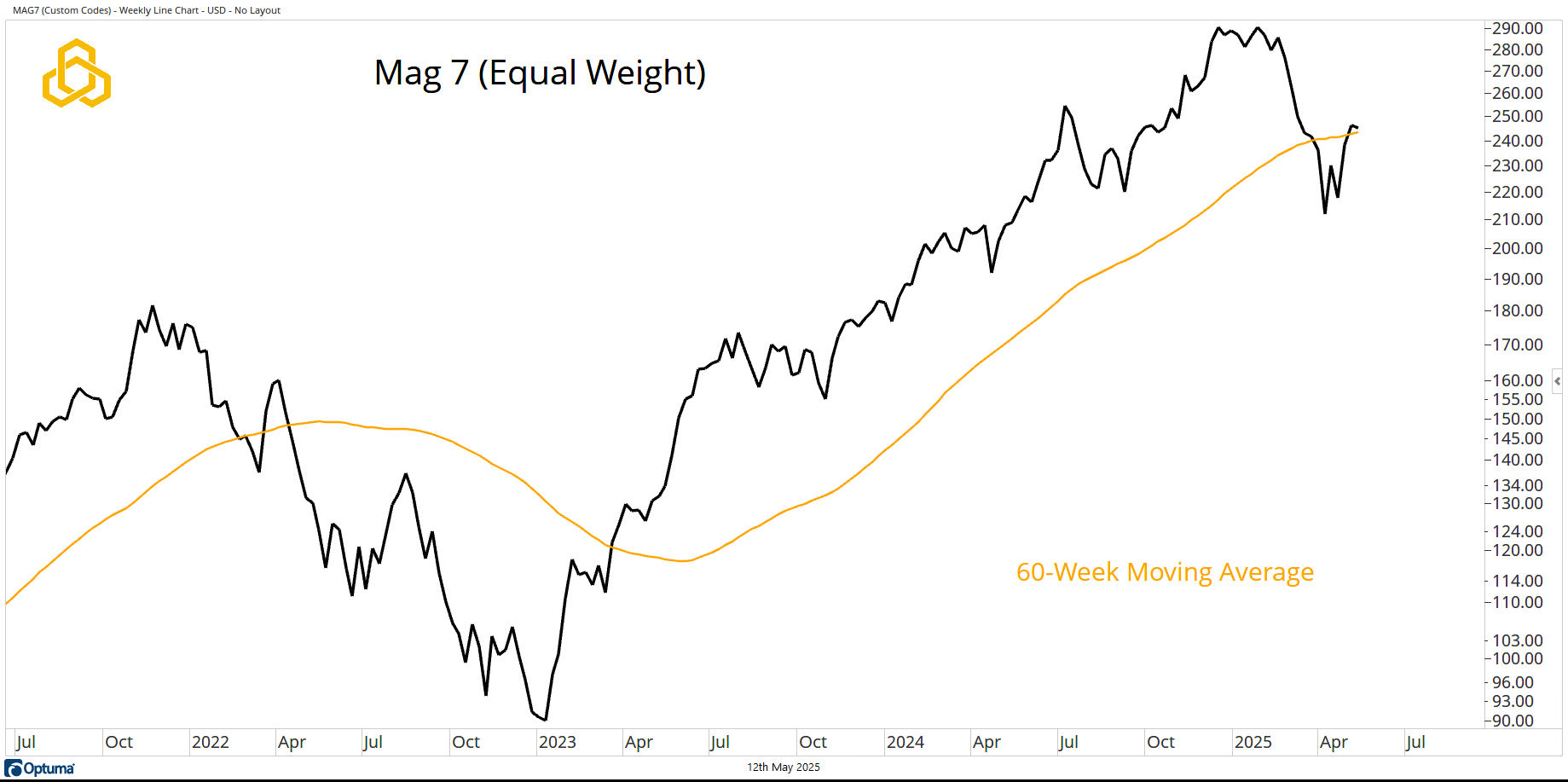

The Mag 7

While improving breadth metrics are important, in a market dominated by megacap stocks—and with investors and the media so focused on a single capitalization-weighted index of 500 U.S. stocks—those megacaps need to perform well for the index to truly thrive.

In the accompanying chart, we can see an equal-weight version of the Mag 7 stocks. This “index” has moved above its 60-week moving average, a notable technical development. Not only is breadth improving, but so is the performance of the biggest stocks in the most widely watched equity benchmark.

Source: Optuma

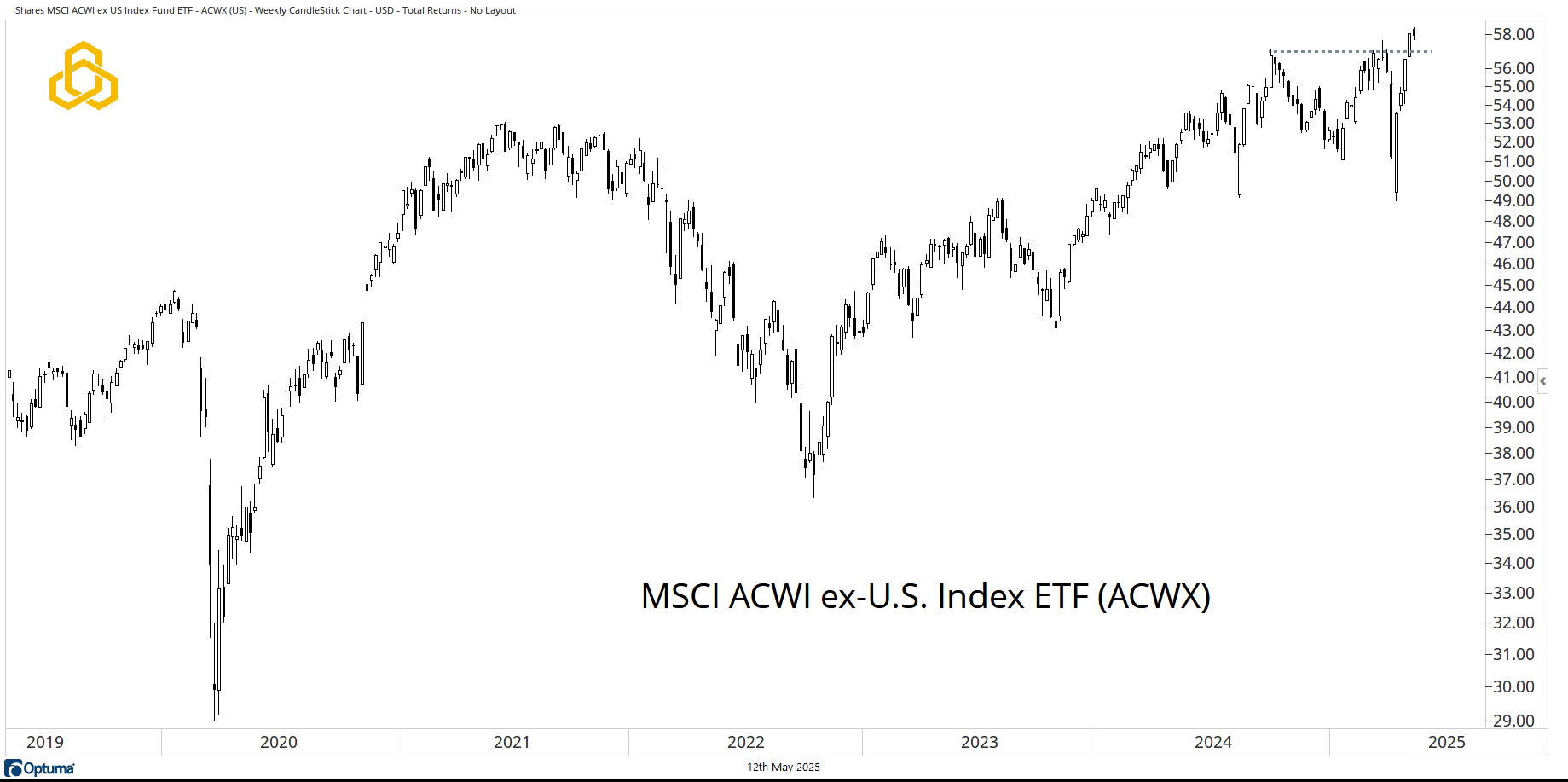

Global Stocks

While home-country-biased U.S. investors wake up to S&P 500 futures marching higher, many may not even realize that global stocks are also performing well. The iShares MSCI ACWI ex-U.S. ETF (ACWX) is trading near record highs.

This speaks to broad market health, as strength has extended beyond the U.S. and the S&P 500. It’s a big world out there, and if other markets are participating to the upside, that’s likely a positive sign.

Source: Optuma

Why is this week important? If the S&P 500 can break and hold above its 60-week moving average while participation continues to broaden, the bulls will likely take control. At the same time, if global stocks can hold their breakout, it would offer much broader confirmation of equity strength.

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-315-20250512