Things Are Probably OK!

June 2, 2025

This week’s title isn’t overly complex or sophisticated—but it’s probably true. We say “probably” because nothing is ever guaranteed in this business. Still, based on what we’re seeing in the markets, the odds favor things being OK.

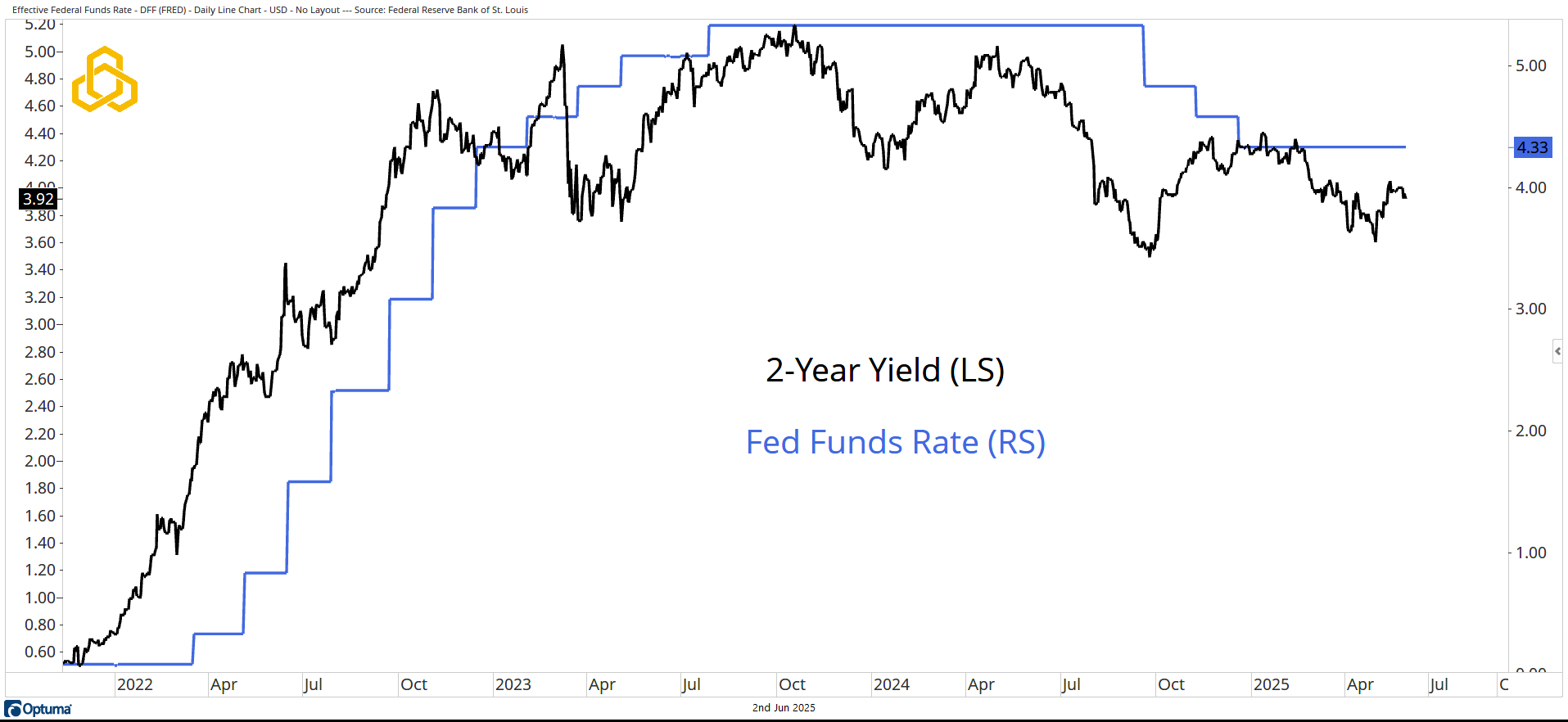

The headlines around tariffs will come and go—get used to it. Yes, they’ll contribute to volatility. But as we’ll see below, volatility is diminishing, with implied volatility now sitting below realized. At the same time, junk credits maintain a bid. If things were not OK, we’d likely see these dynamics reversed.

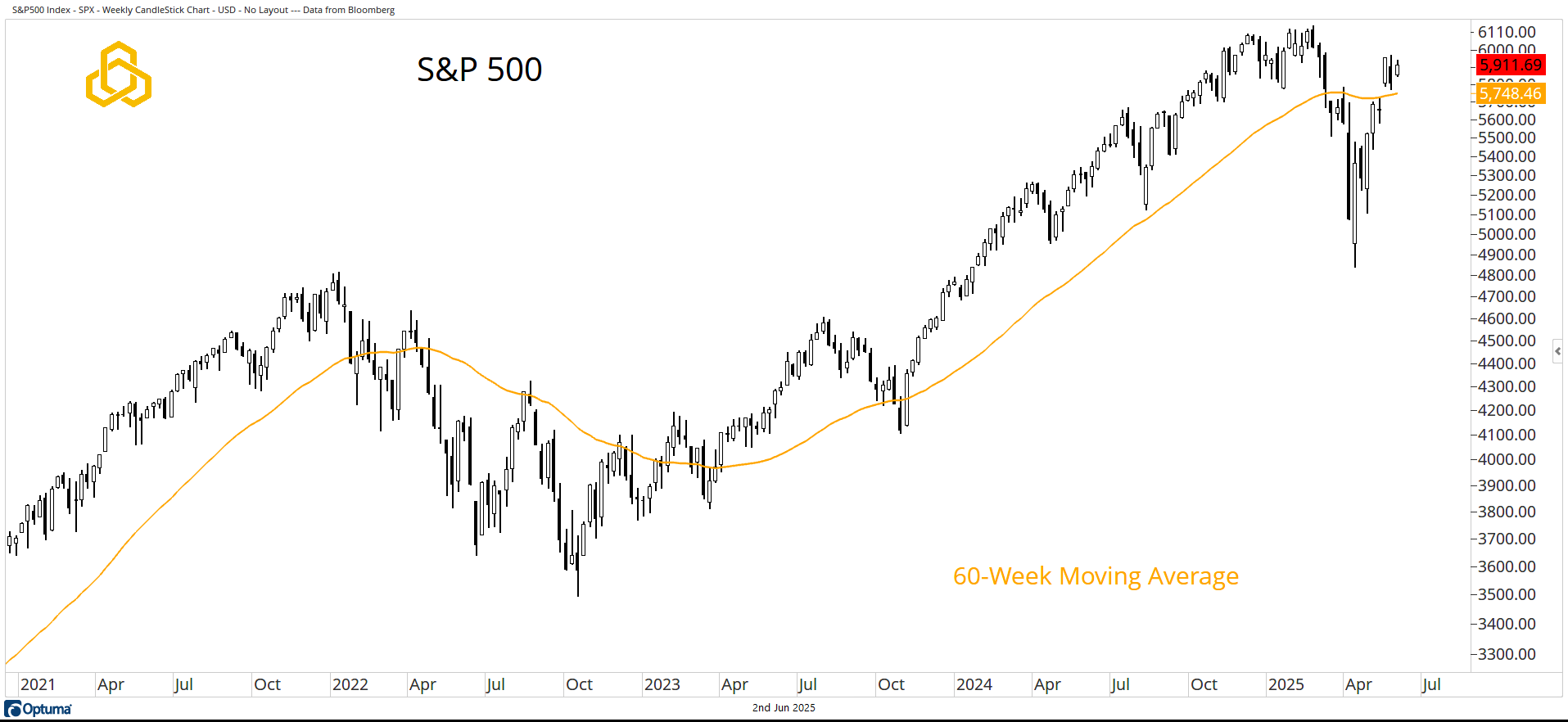

S&P 500

The index on everyone’s mind just logged its third consecutive week above the 60-week weighted moving average and remains within a stone’s throw of record highs. At the same time, after a brief dip, the moving average has turned higher once again.

Source: Optuma

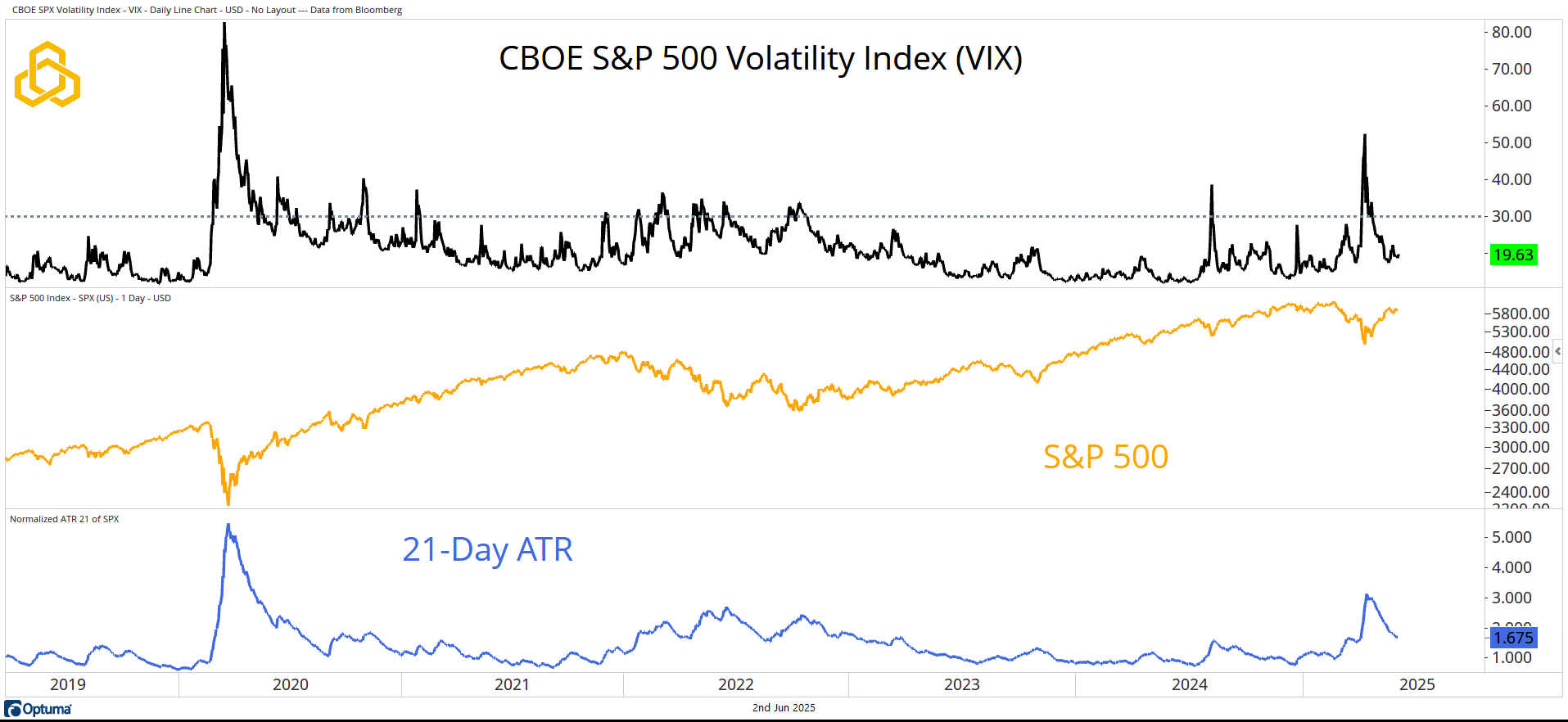

Volatility

While the S&P 500 holds above its key moving average, the S&P 500 Volatility Index (VIX) has been steadily moving lower. At 18.57, the VIX now implies roughly 1.16% daily moves for the S&P 500 over the next month. Meanwhile, the 21-day average true range (ATR)—a proxy for realized volatility—has collapsed to 1.675%.

When investors are concerned that things are not OK, they tend to bid implied volatility above realized. That’s not happening here.

Source: Optuma

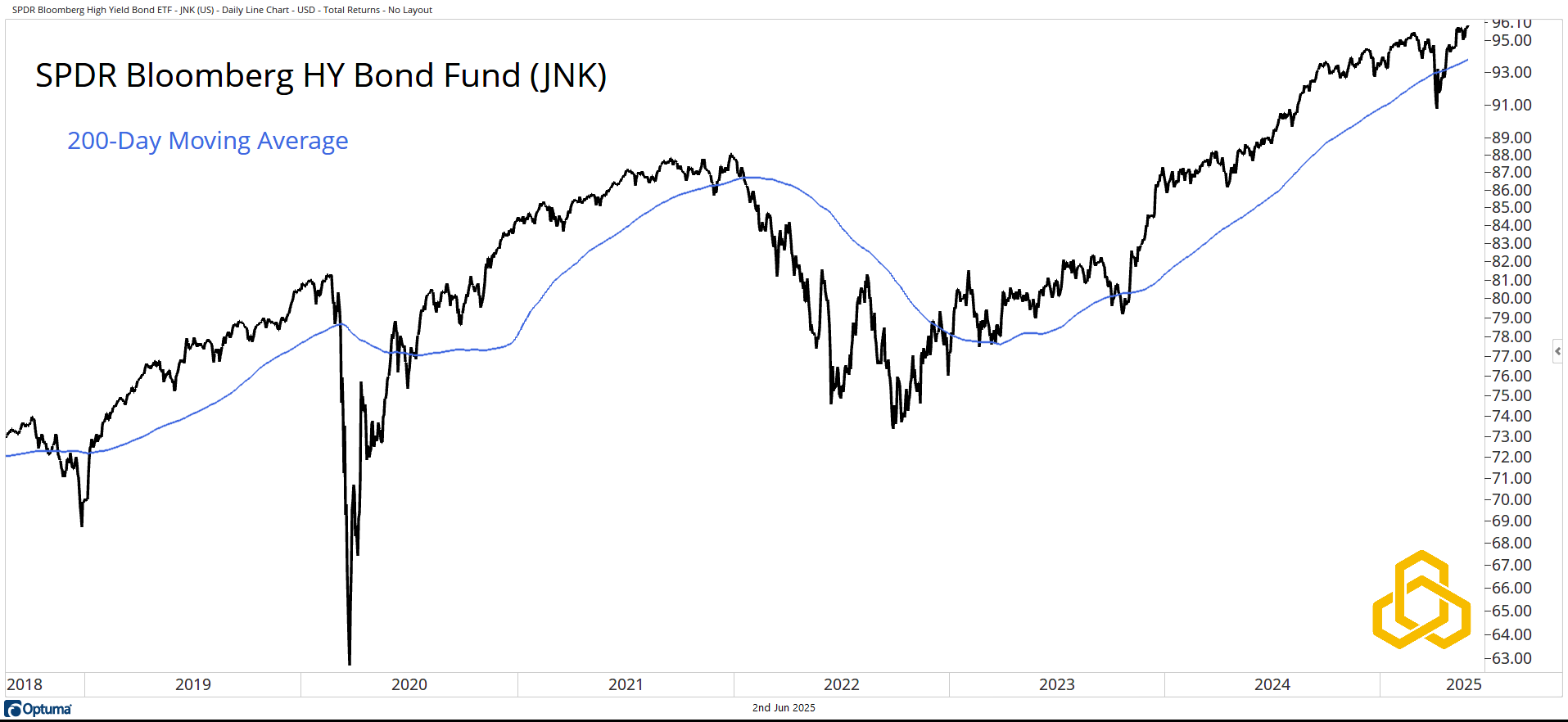

Junk Bonds

On a total return basis, the SPDR Bloomberg High Yield Bond Fund (JNK) is trading at a record high, above a rising 200-day moving average. If things were not OK, it would be hard to believe junk bonds would be hitting record levels.

Source: Optuma

Final Take

We’re not ignoring macro risks or pretending there’s no room for surprises. But when the S&P 500 is stable, volatility is compressing, junk bonds are rallying, and the Fed has flexibility—things are probably OK.

Source: Optuma

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-319-20250602