The Shift

March 17, 2025

We have seen the shift, possibly in more ways than one. The first shift that we care about has to do with who has the benefit of the doubt. For a long time, it resided with the bulls. We were willing to give them a lot of latitude because that is what the evidence suggested. However, that benefit now sits with the bears following key downside extensions over the past week.

The second shift could be global. For more than 15 years, having international exposure has been a drag on portfolios. We know that many have advocated for the “token” allocation outside the U.S. for “diversification,” but that has been the exact wrong thing to do. However, the past few weeks have demonstrated that there may be a change taking place.

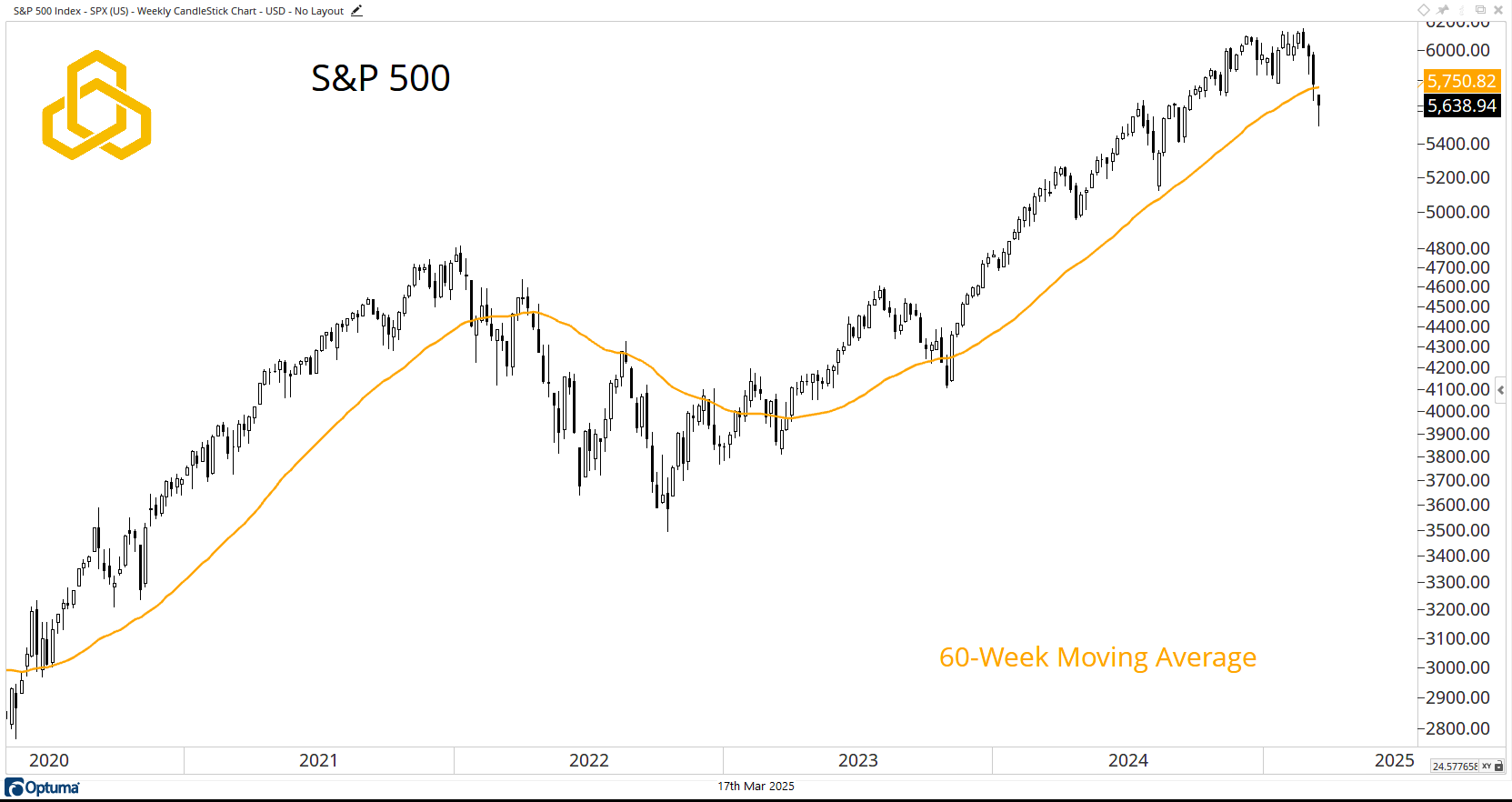

S&P 500

Starting with the S&P 500, we see that the index closed below the 60-week moving average last week. This was the first weekly close below this key measure of trend since October 2023. At the same time, the slope of the moving average is beginning to decrease. Clearly, there is a shift in the market trend.

Source: Optuma

NYSE Advance/Decline Line

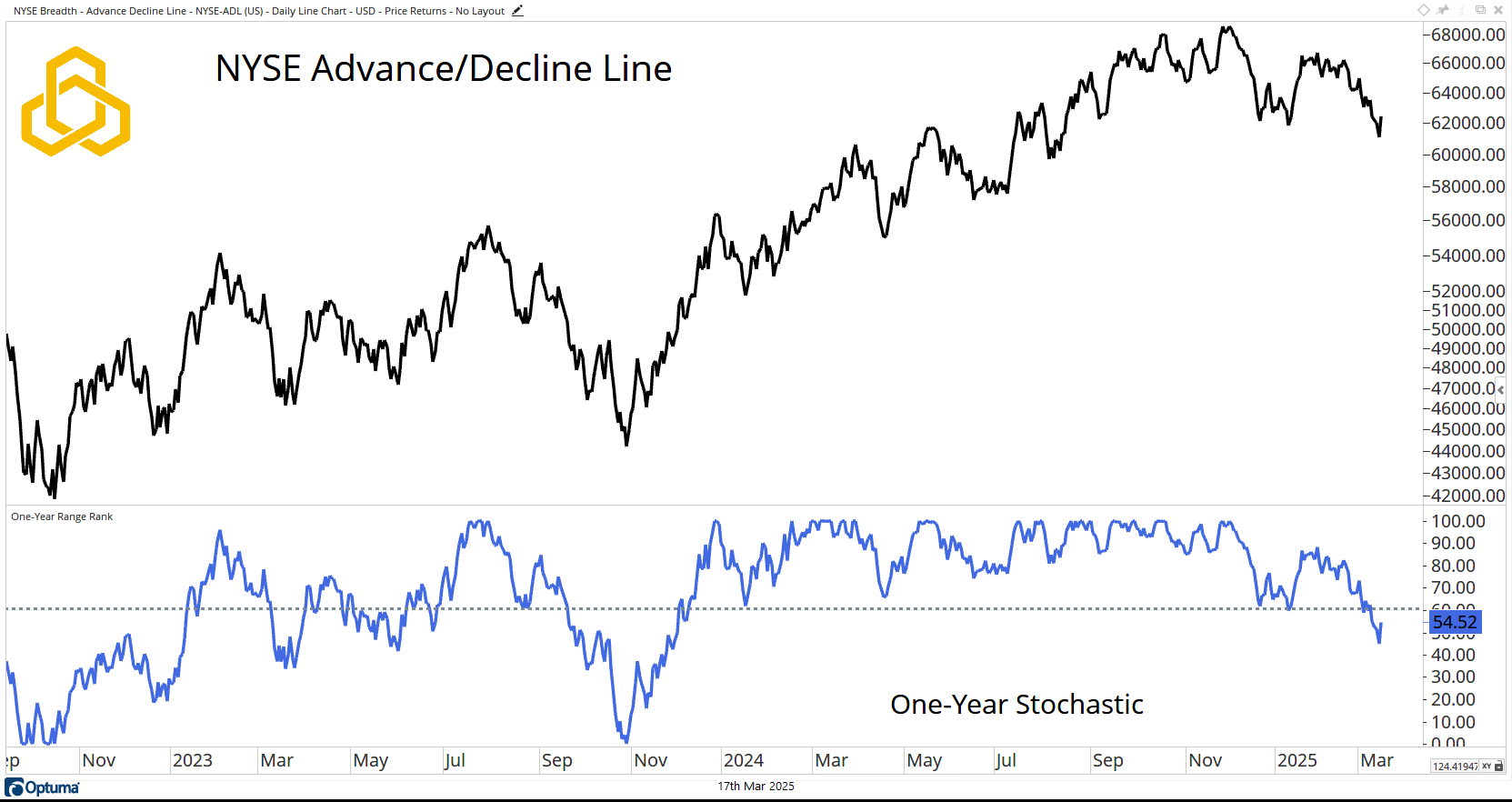

The NYSE Advance/Decline Line has been a mainstay in these pages over the past few weeks. It was there to give the benefit of the doubt to the bulls as breadth was “holding up.” That is no longer the case based on the one-year stochastic of the A/D Line. The stochastic now resides below 60% after spending much of 2024 above 80%. That shift is noteworthy.

Source: Optuma

Dow Jones Transportation Average

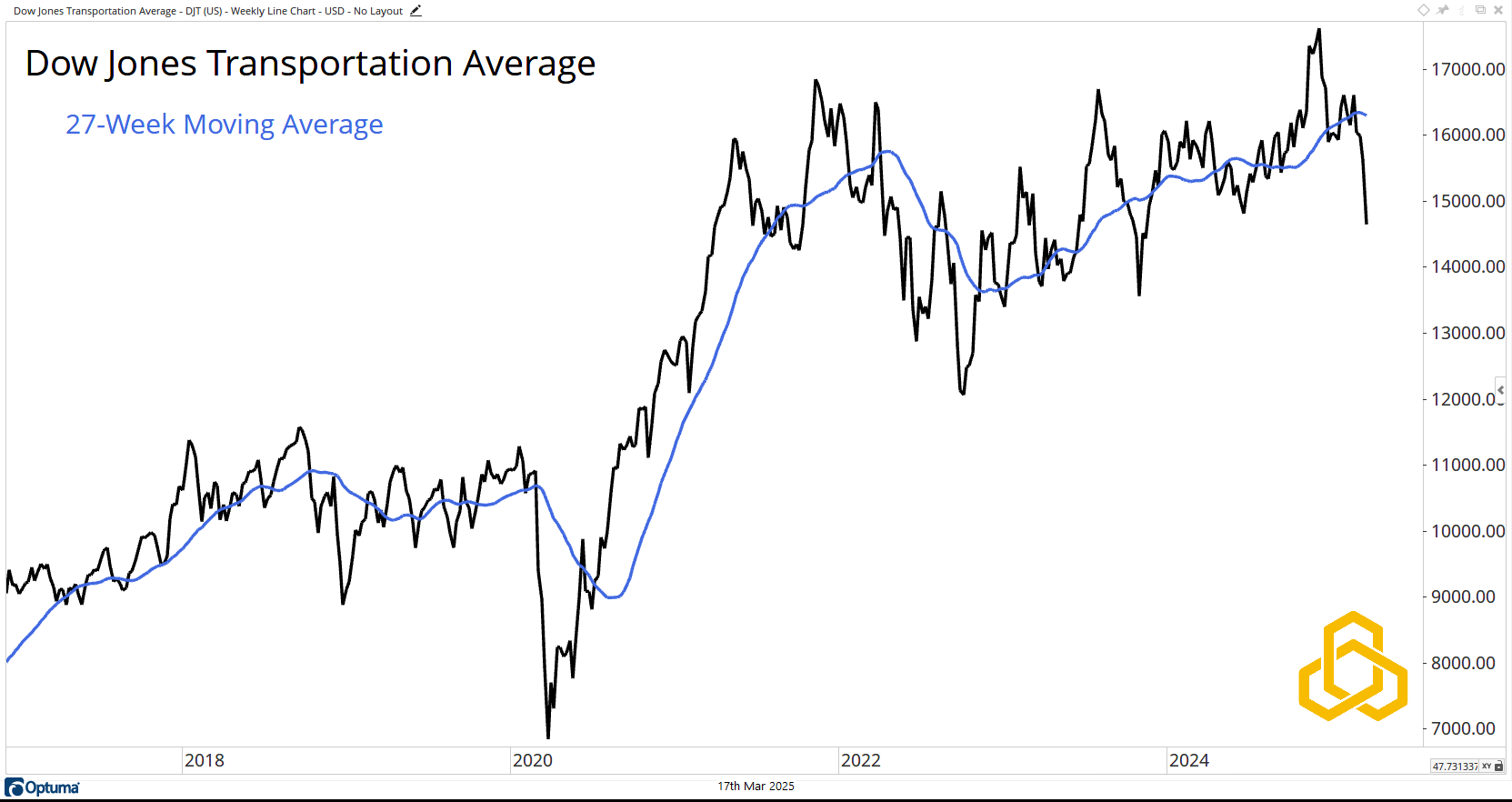

The Dow Transports are a key intermarket theme in our work. When the average traded to a new high in November, it was viewed positively in our models. However, the Transports failed to hold, broke lower, tried to stabilize at the 27-week moving average, and then failed again—miserably.

The Transports are well below the now-declining 27-week moving average. Another bearish shift.

Source: Optuma

International Equities

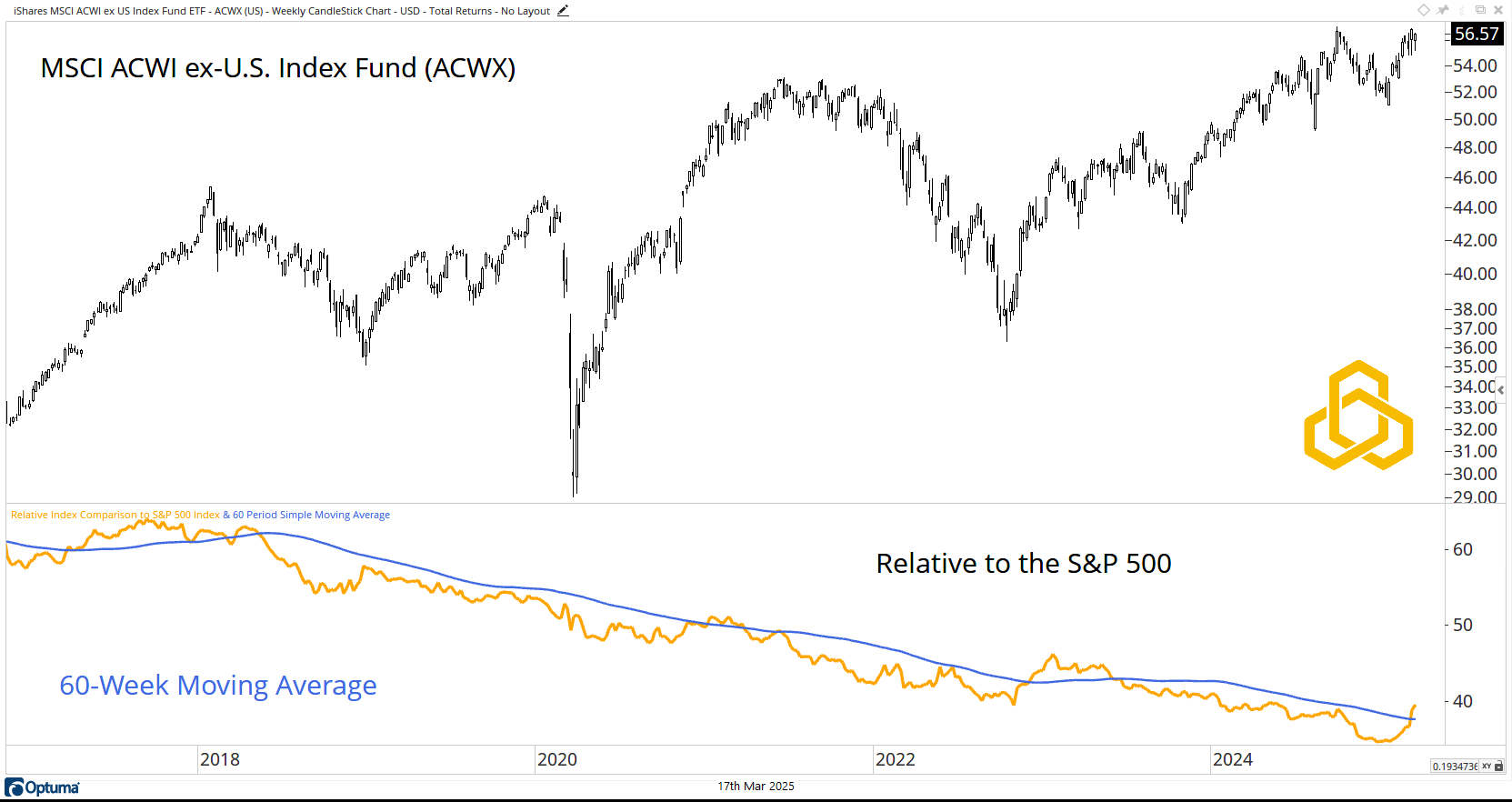

The ACWI ex-U.S. Index Fund has been an underperformer relative to the S&P 500 for more than a decade and a half. Token exposure here has been a drag on client portfolios. However, there may be a shift playing out.

The fund is trading near a record high on a total return basis, and the relative trend has moved above the 60-week moving average. This is a POSSIBLE shift that would mark a major change in the investment landscape. Note the emphasis on "possible"—nothing is confirmed yet.

Source: Optuma

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-306-20250317