The Defense is on the Field

March 31, 2025

As the quarter comes to a close, the market’s defensive squad is on the field. For the past few weeks, we have been highlighting the weakening conditions as it relates to trend, breadth, and intermarket themes. Those conditions remain intact and, if anything, have become worse.

It is hard to make a compelling case for U.S. markets with these conditions in place, putting investors in a position to rely on a tested risk management process until there are signs of a change.

S&P 500

The trend of the S&P 500 continues to weaken, closing below a flat 60-week moving average for a third consecutive week. Perhaps more telling is the fact that the bulls tried to rally the index above said moving average but were turned away. Another nuance of last week’s trading is the fact that the index closed very near the low of the week. If the market were a football game between the bulls and the bears, we can definitely say that the bears have the ball.

Source: Optuma

NYSE Advance/Decline Line

In a healthy bull market, we expect to see more stocks going up then going down. Unfortunately, that has not been the case for some time. When the S&P 500 made a new high earlier this year, the A/D Line failed to confirm. Breadth has only weakened since then, pushing the one-year stochastic well below the 80% level that defined trading for much of 2024. This is not a good look for U.S. equity bulls.

Source: Optuma

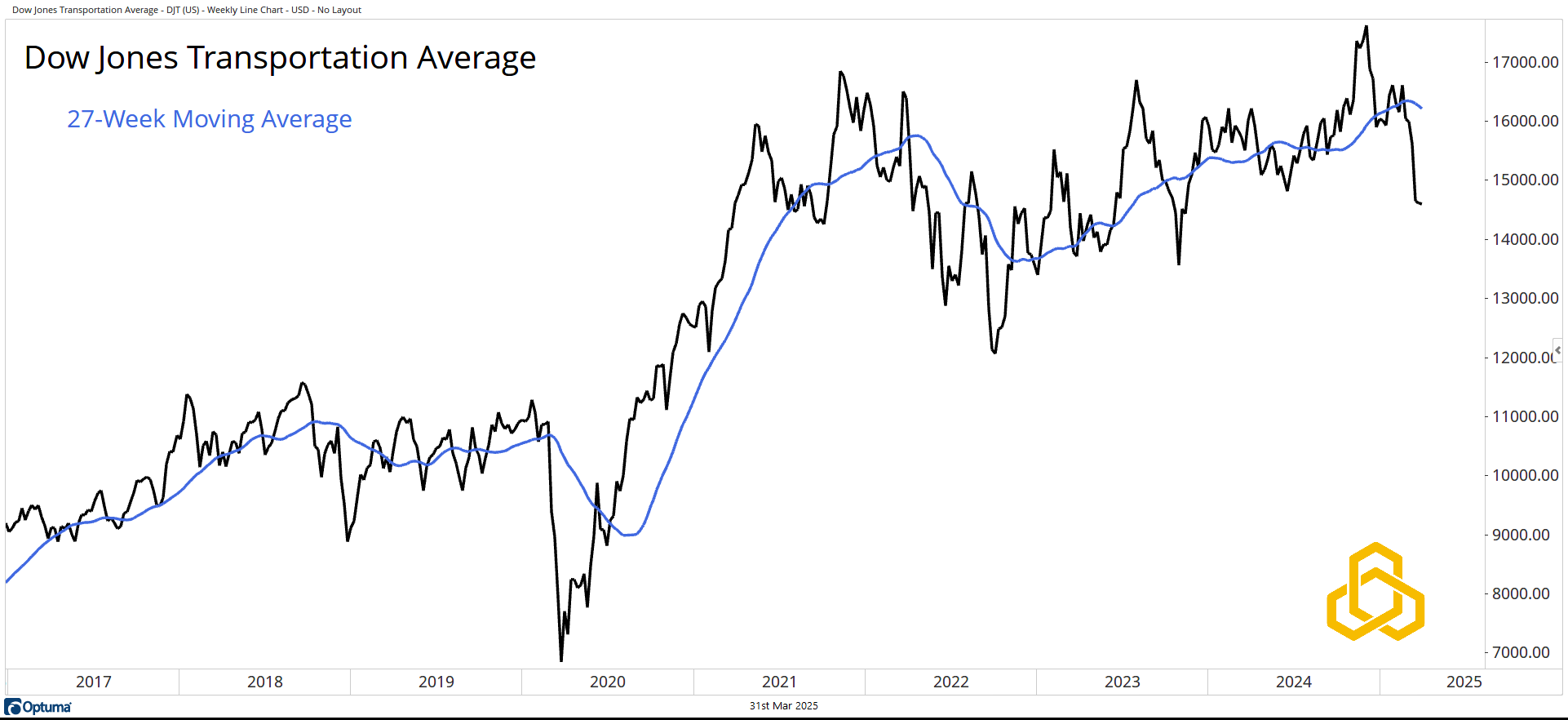

Dow Jones Transportation Average

The Dow Transports were arguably the first shoe to drop on this market after failing to sustain their push to new highs. The average is now well below a declining 27-week moving average and mired in a four-year trading range.

Analyzing the Transports in relation to the broader market is the key to Dow Theory, a concept that dates to the late 19th century and still holds in modern markets.

Source: Optuma

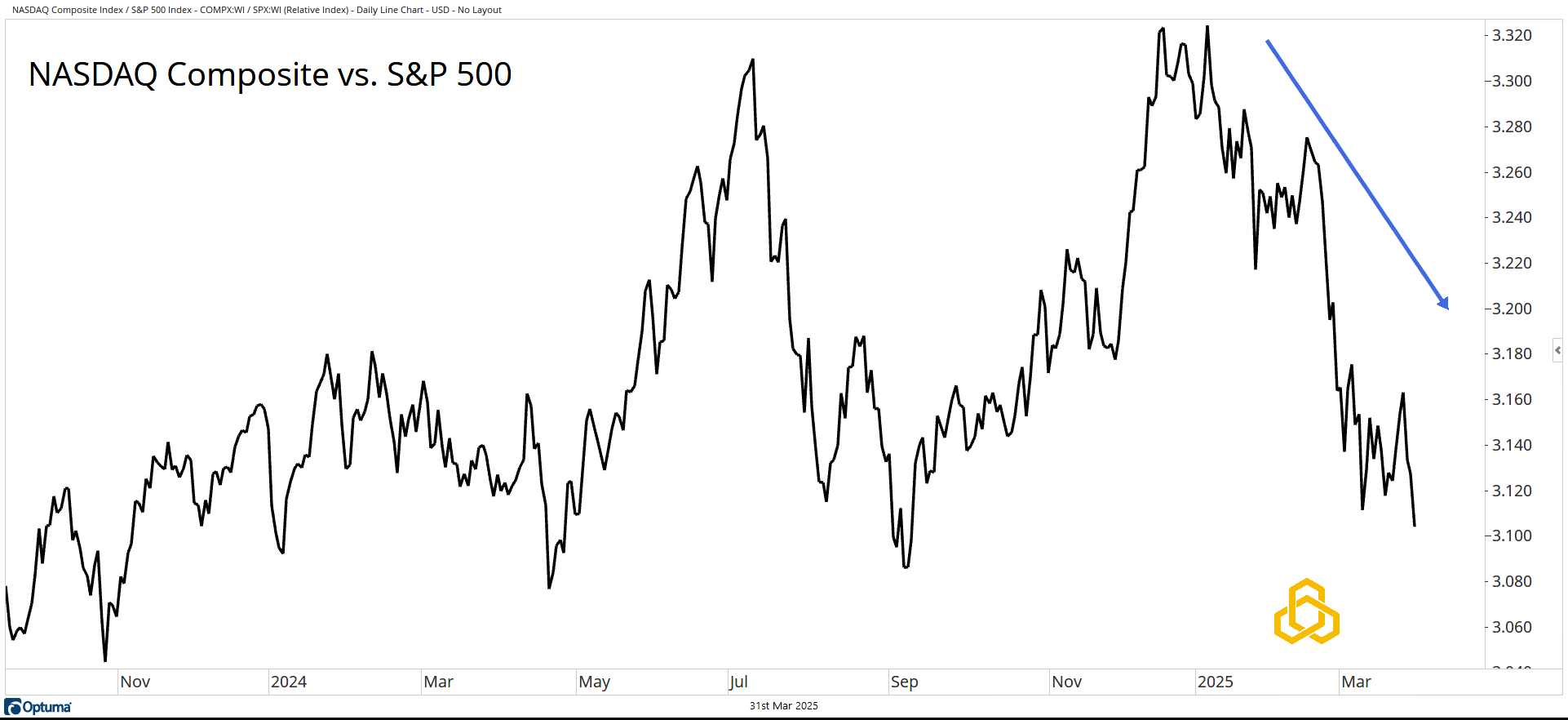

NASDAQ Composite vs. S&P 500

While Dow Theory may seem “dated” to some analysts, there is also bearish confirmation from a more modern part of the market. Looking at the NASDAQ Composite index relative to the S&P 500, we can see severe underperformance since the start of 2025.

Source: Optuma

S&P 500 Information Technology

If investors are looking for a villain in this story, it is the Technology Sector. With the largest weighting in the S&P 500, this group has been working through a topping process since July 2024. Given the cap-weighted structure of the S&P 500, it is hard for the index to make progress when Technology is not playing well.

Tech closed at the low of the year, below the 50 and 200-day moving averages, with the former now crossing below the latter.

Source: Optuma

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-308-20250331