The Dash for Trash

March 7, 2024

The dash for trash is on!

One of the more hated pockets of the equity market, and deservedly so, has been Small Capitalization stocks. They have gone nowhere for more than two years but are in the process of breaking from a long consolidation pattern.

At the same time, high-yield bonds are nearing new highs on a total return basis with no signs of stress in the credit market. These dynamics play out as the S&P 500 remains in an extended position above its 60-week moving average.

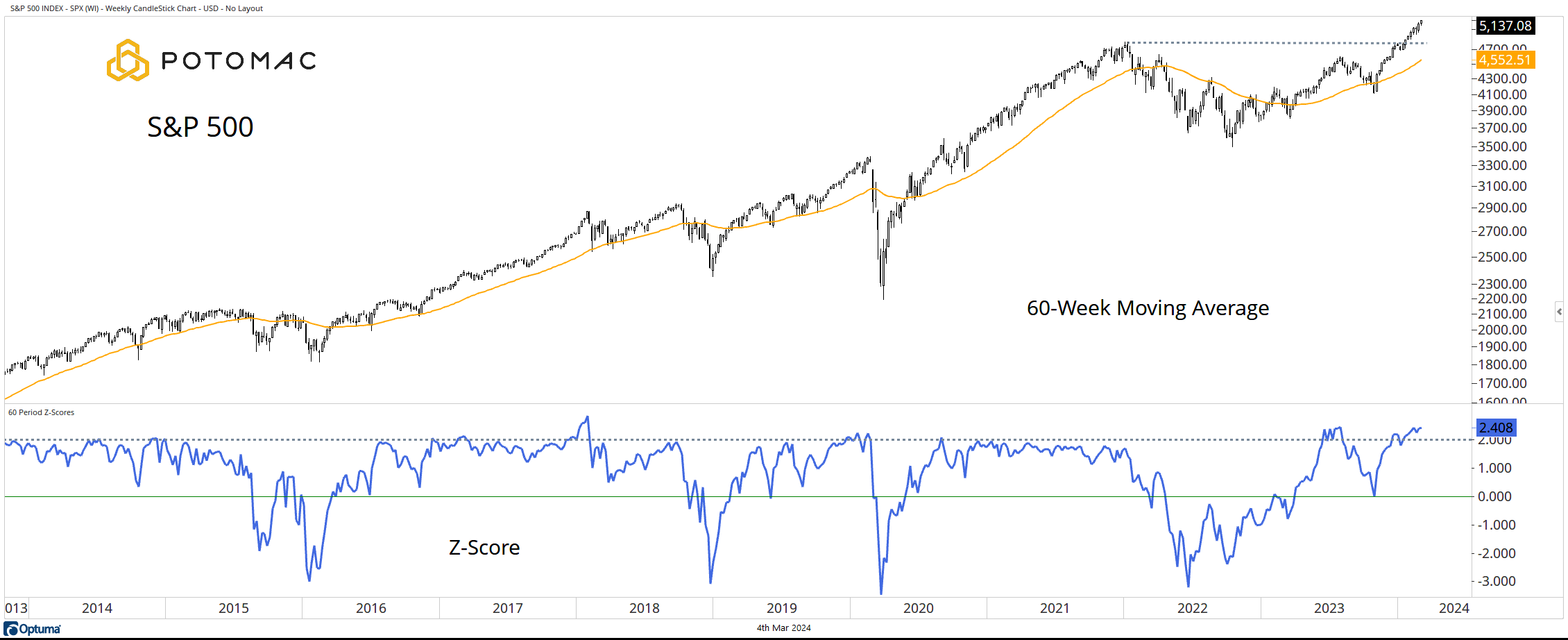

S&P 500

It was another record-setting week for the S&P 500 as it extends beyond the breakout level at the 2022 highs. The index is trading with a 60-week Z-Score of 2.408, meaning it is nearly 2.5 standard deviations above the 60-week moving average.

While not a sell signal alone, we note that the index does not spend much time being this extended.

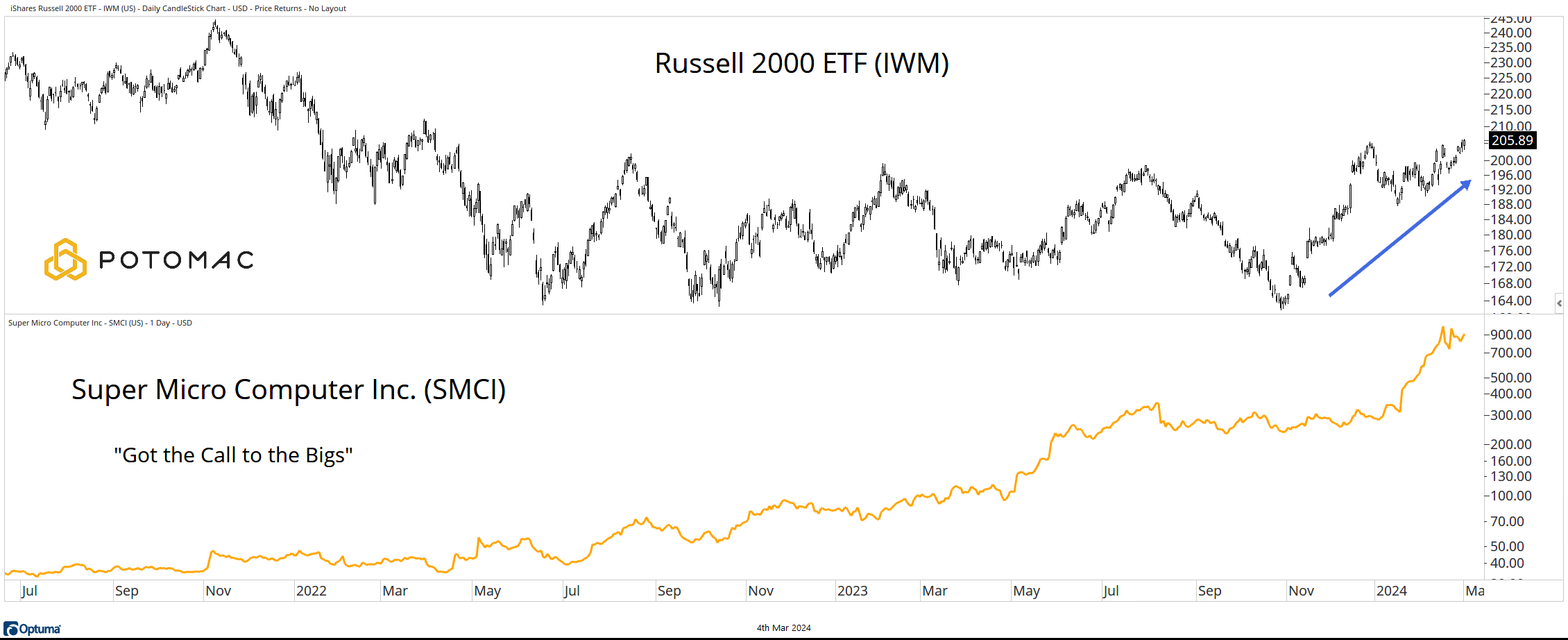

Russell 2000

The iShares Russell 2000 ETF (IWM) is the most widely used proxy for small capitalization stocks. It has been stuck in a range for more than two years despite strong performance from the October 2023 lows.

There are many who put a lot of weight behind the performance of small caps as a signaling tool, but we must wonder why. The best stocks in the index eventually leave the index.

For example, Super Micro Computer Inc. (SMCI) will soon be moving to the S&P 500. The stock is up nearly 300% from the October lows. For the baseball fans, SMCI has gotten the “call to the bigs.”

Regardless, we can see that investors are in the mood to own the smalls, which are some of the lowest quality names in the market.

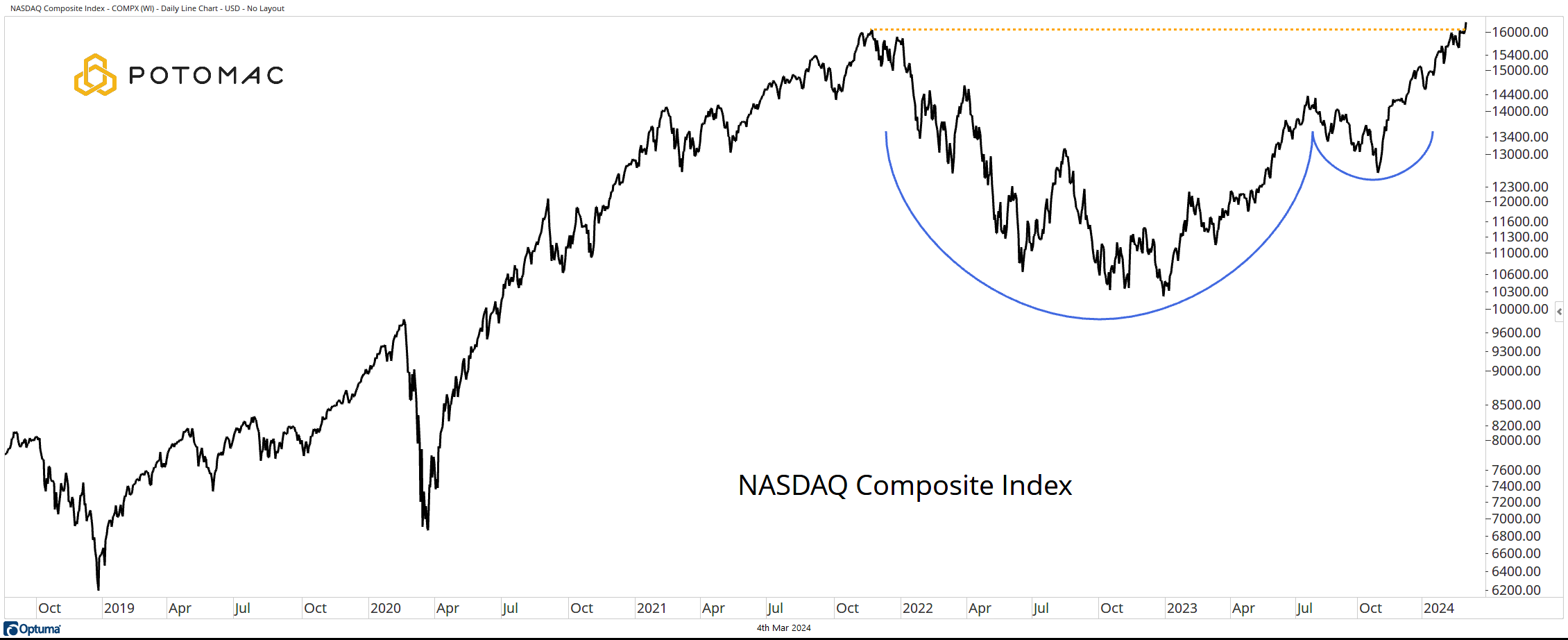

NASDAQ Composite Index

Not to be outdone and not to be confused with the NASDAQ 100 index, the NASDAQ Composite is trading at new highs.

While the NASDAQ 100 is the cream of the crop of stocks, the Composite includes the entire NASDAQ. This includes all the low-quality companies as well. Some may grow to become stars, but that is a low probability outcome.

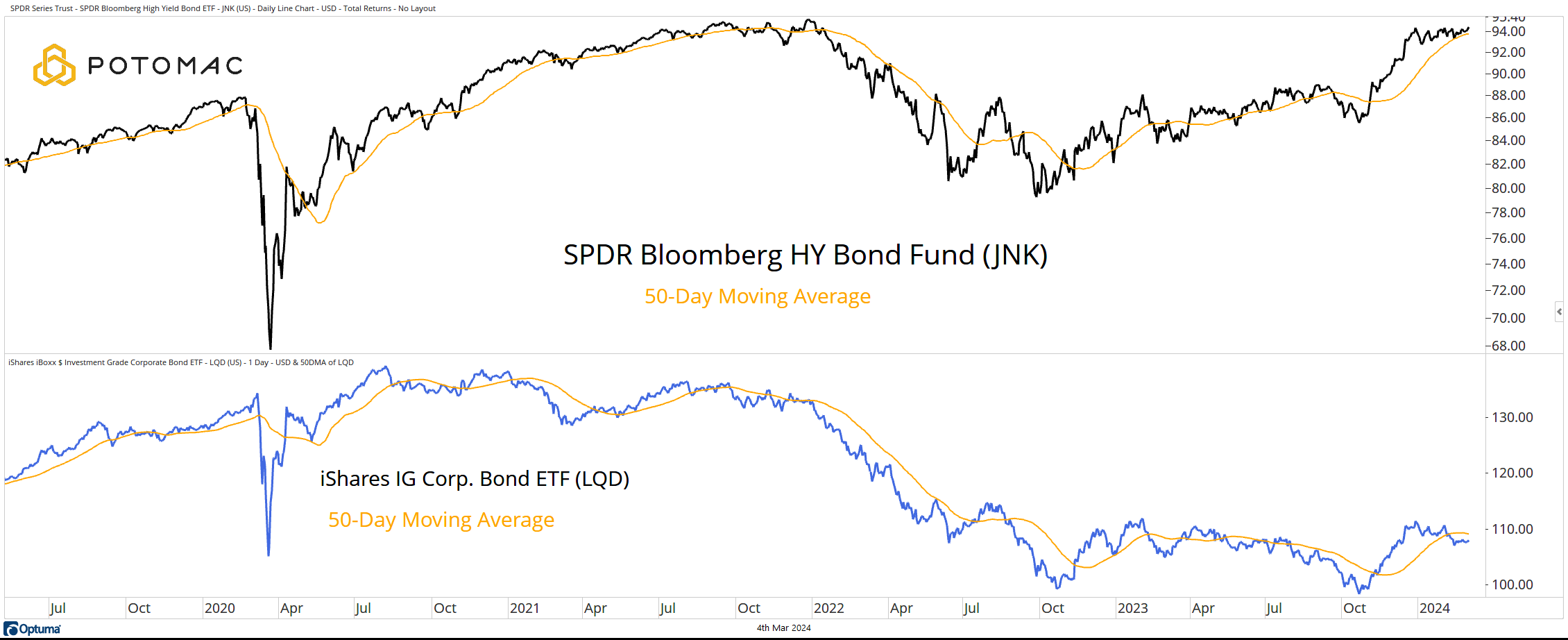

High Yield

In the credit markets, there is also a dash for trash. On a total return basis, the Bloomberg High Yield Bond Fund (JNK) is nearing new highs above the 50-day moving average. However, the iShares Investment Grade Corporate Bond ETF (LQD) is below the 50-day moving average and not close to threatening former highs.

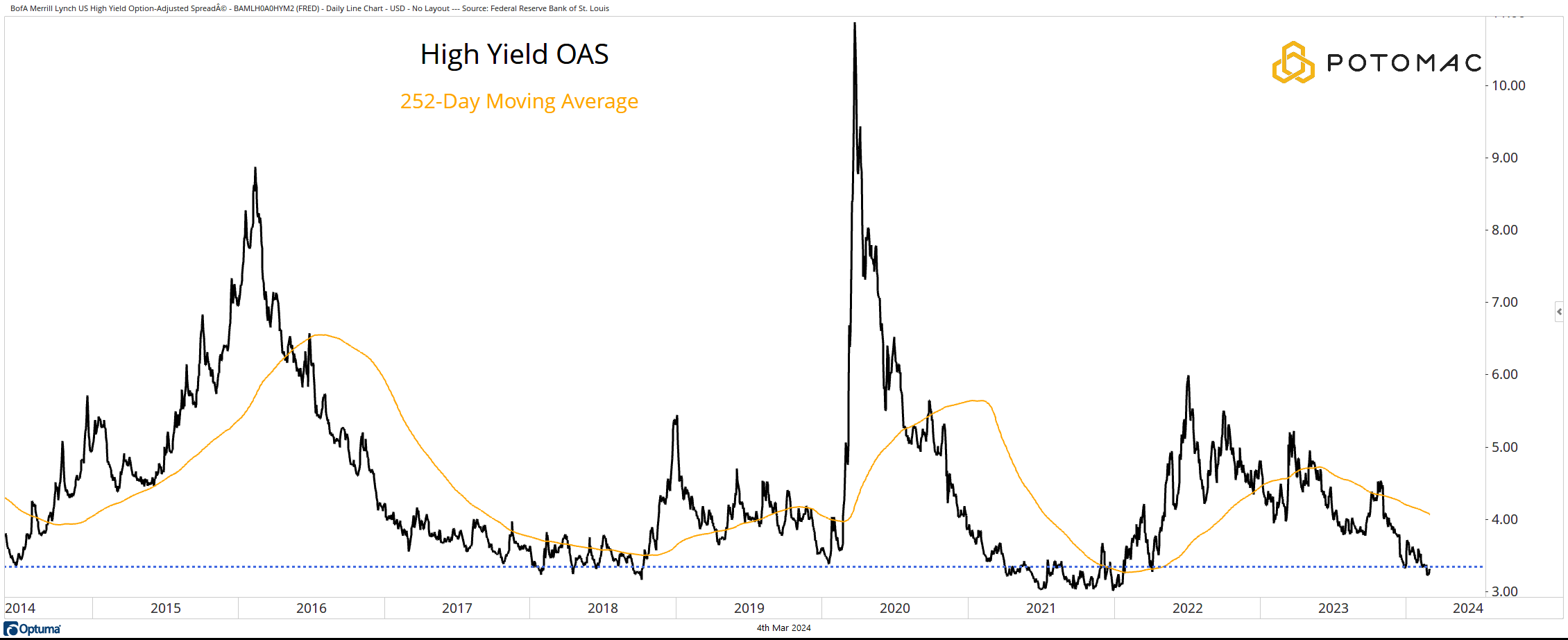

Credit Spreads

Finally, we leave you with Credit Spreads. The High-Yield Option Adjusted Spread is a way to measure the difference between high-yield credit and Treasuries…trash vs. safe investments.

The spread is below the declining one-year moving average and nearing decade lows.

*All charts and data from Optuma as of the close of trading on March 1, 2024. Past performance does not guarantee future results.

Potomac Fund Management ("Company") is an SEC-registered investment adviser. This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page. The company does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to the Company website or incorporated herein, and takes no responsibility for any of this information. The views of the Company are subject to change and the Company is under no obligation to notify you of any changes. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable or equal to any historical performance level.

PFM-309-20240304