The Bulls Are Thankful

November 25, 2024

As we enter the holiday-shortened week, the bulls truly have much for which they can be thankful. The cyclical rally in the S&P 500 from the October 2022 lows remains strong. The trend is healthy based on the performance of various breadth metrics. We have entered a seasonally strong part of the year. Volatility is diminishing as election uncertainty has abated, and the S&P 500 has held the November 6 gap that we highlighted last week.

Interestingly, the bullish dynamics for the market are playing out while the darlings of the cycle—big growth stocks—have been underperforming for the past four months. Imagine what could happen if they resume their leadership position.

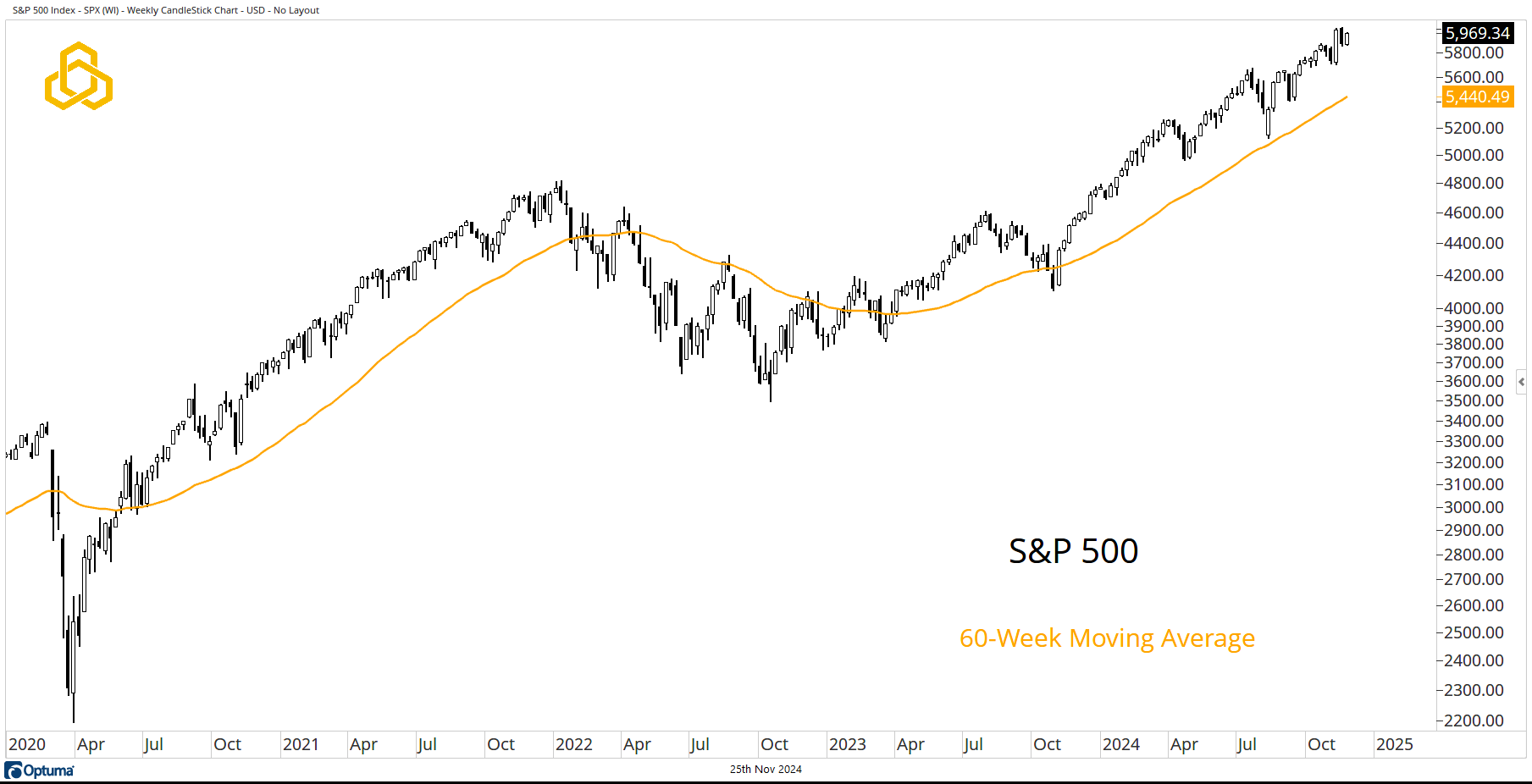

S&P 500

Truthfully, it is becoming boring writing about this index week in and week out. The steady uptrend above the consistently rising 60-week moving average remains intact.

Source: Optuma

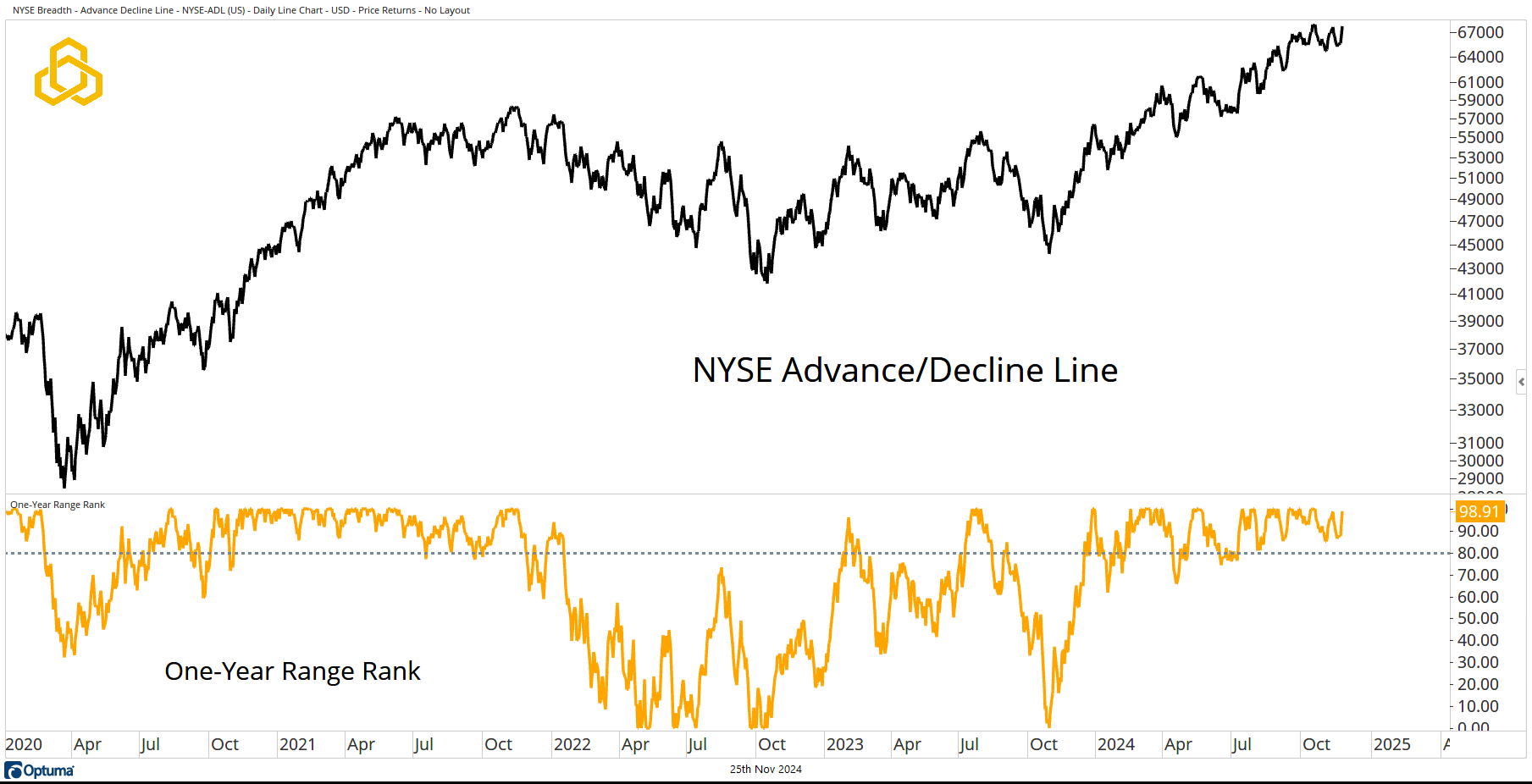

NYSE Advance/Decline LineThe NYSE’s A/D Line is nearing new all-time highs. Some bears have tried to highlight short-term divergences in this indicator while offering little to nothing in the way of quantifying those divergences. We note that the one-year stochastic (or range rank) has spent much of 2024 above the 80% mark.

Source: Optuma

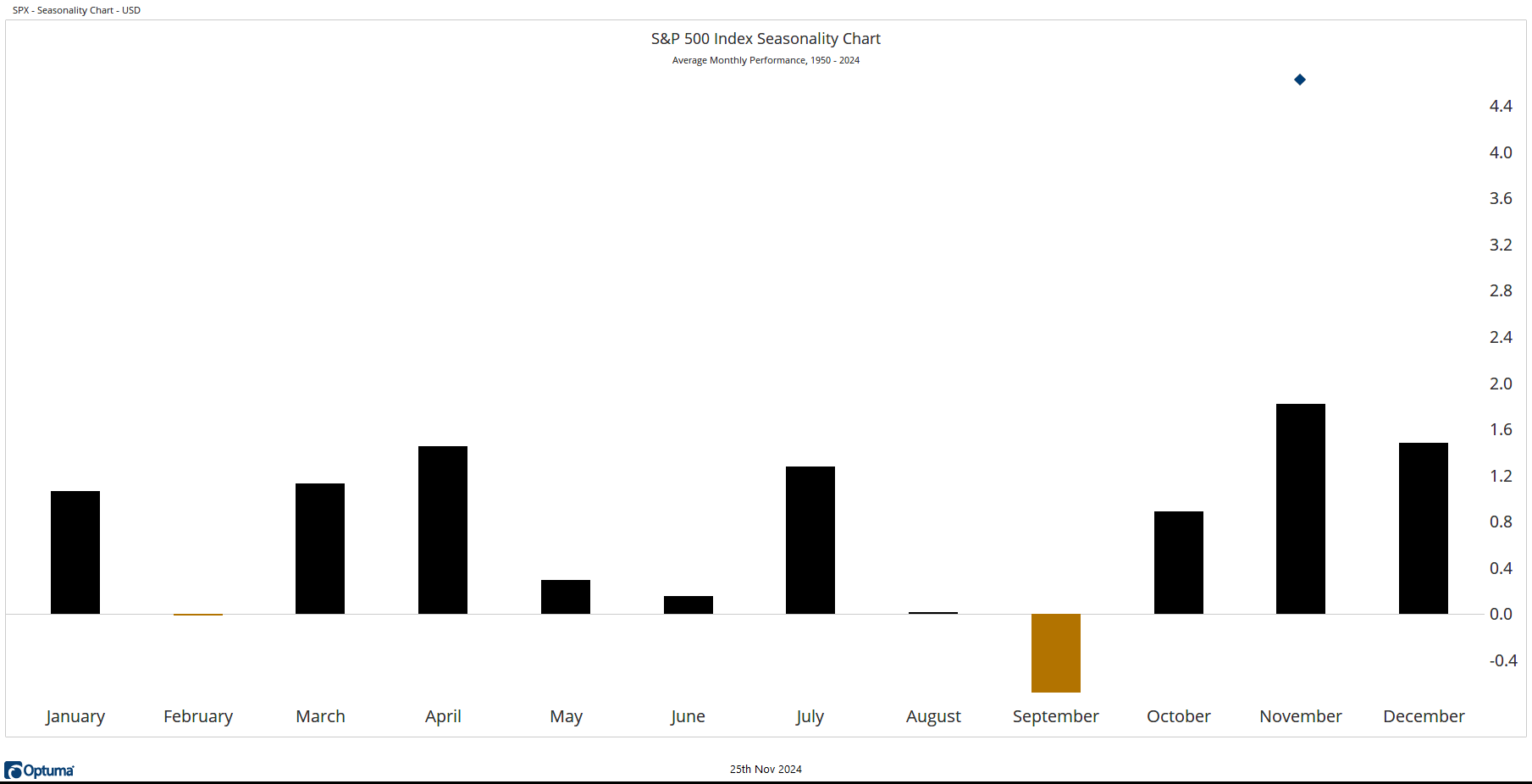

November is Novembering

November is seasonally the strongest month of the year. Thus far, 2024 is not doing anything to change that dynamic. Note the blue diamond above the November bar to get a sense of this year’s performance in November versus the “normal” November.

Source: Optuma

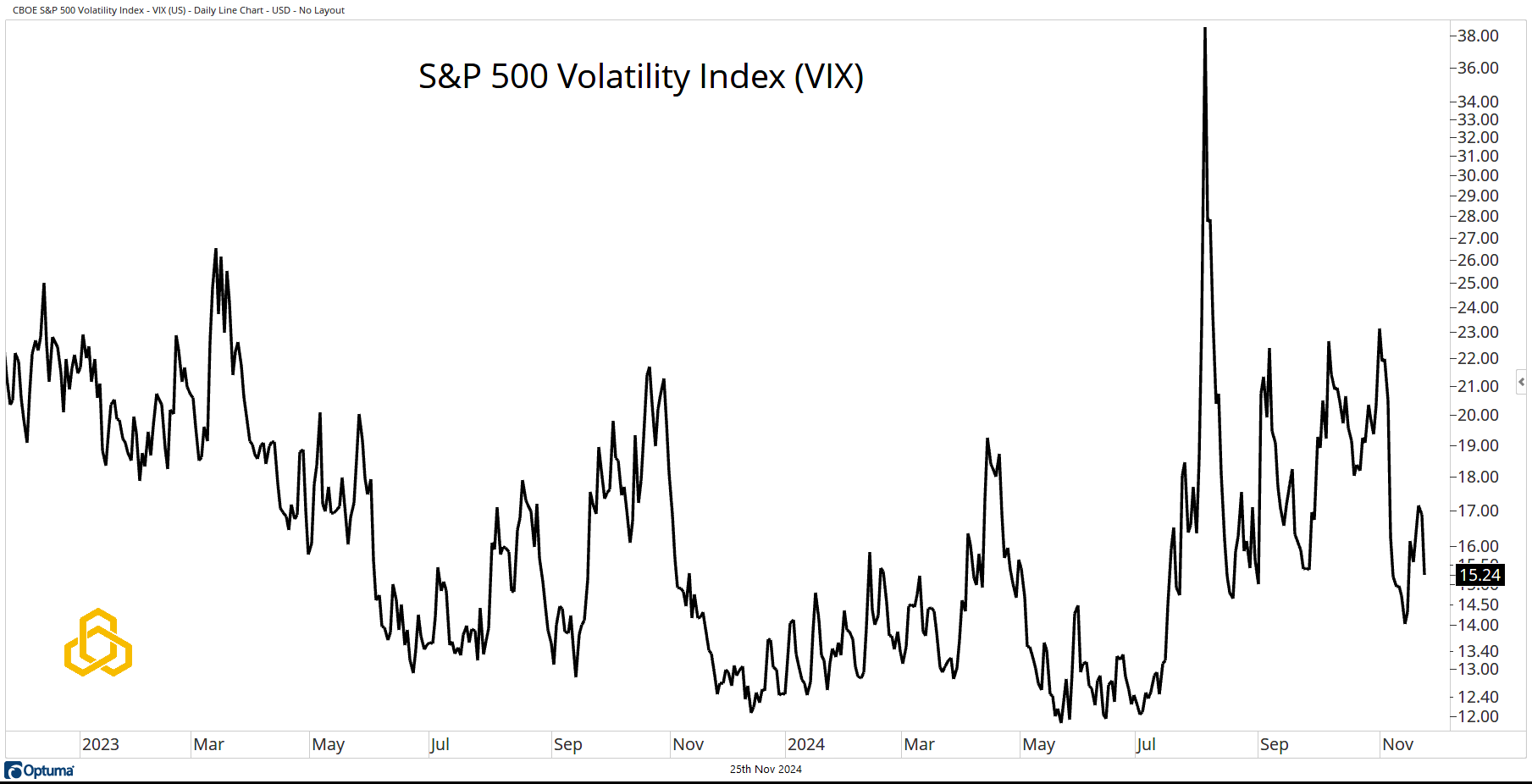

S&P 500 Volatility Index

The S&P 500 Volatility Index (VIX) is back in the mid-teens. Uncertainty ahead of the presidential election produced readings in the mid-20s, but that uncertainty has since abated.

Source: Optuma

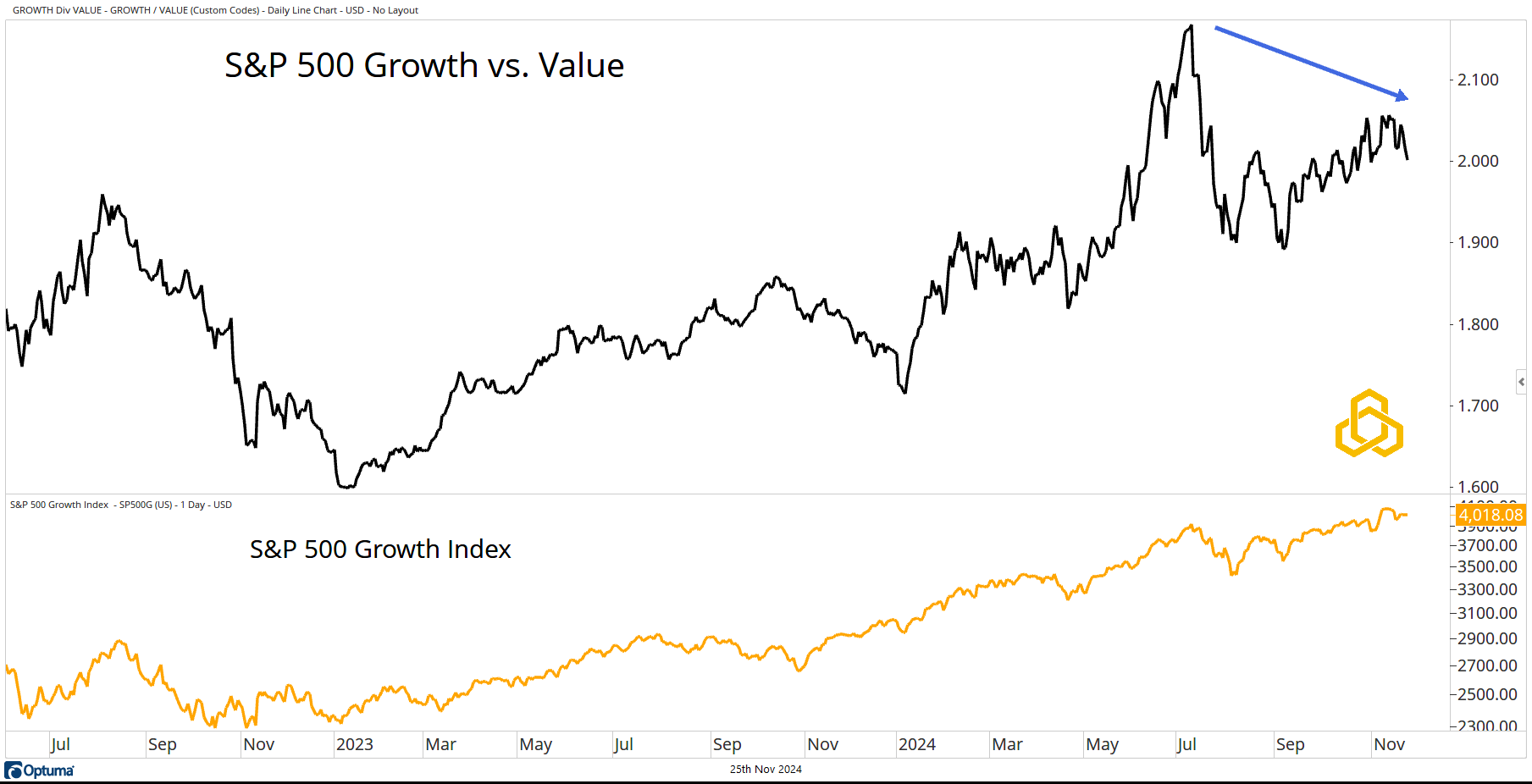

S&P 500 Growth vs. Value

The big growth stocks have been the darlings of the market since the start of 2023. However, more recently, they have not been keeping pace with their value peers. This is not to say that growth has been declining; it simply means that growth has not been as strong as value.

Arguably, this is healthy as stocks beyond the “Mag 7” join the leadership ranks.

Source: Optuma

All of us at Potomac wish you a Happy Thanksgiving spent doing what you love with the people who mean the most to you!

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-374-20241125