The Bonds That Keep Us Together

January 29, 2024

It's been a while since we took a look at the bond market in isolation. While five charts on a Monday morning won't cover the entire fixed income landscape, we believe there's an interesting message in these high-level takeaways. The biggest takeaway is that risk appetite may be returning to the bond market.

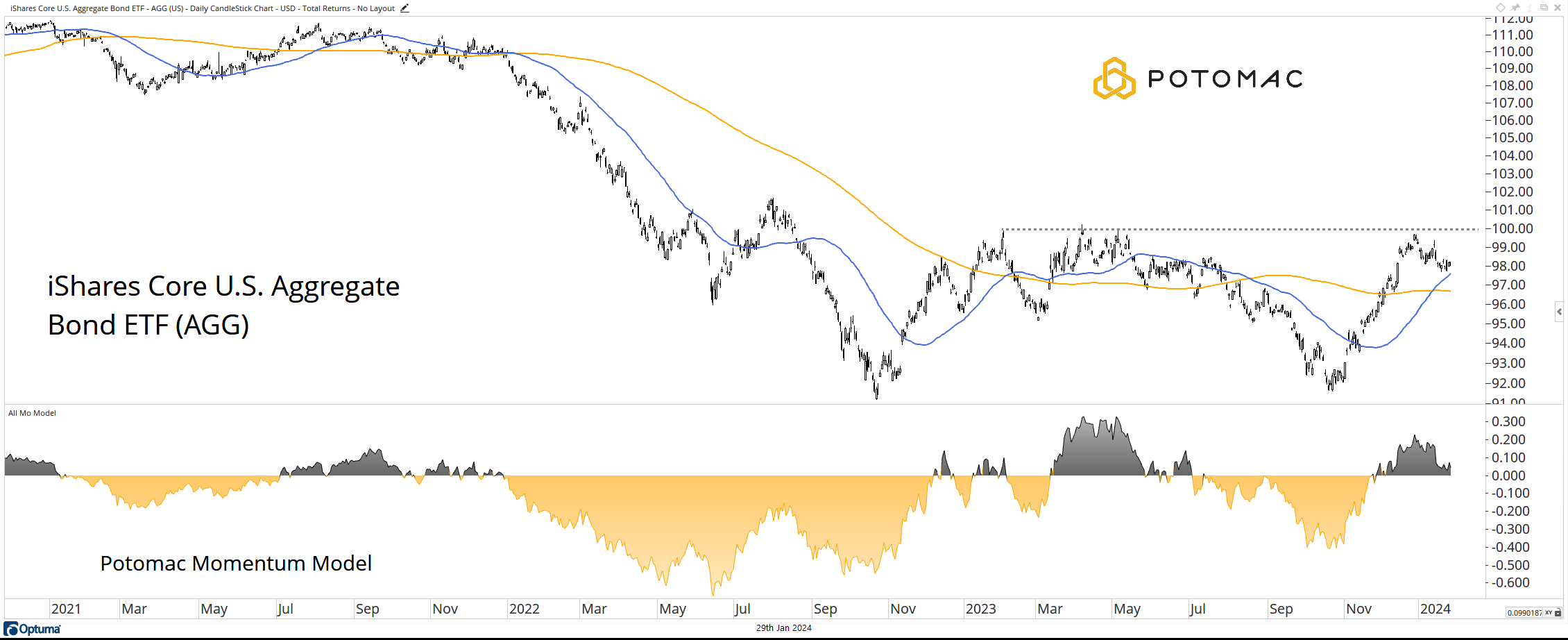

The Bond Market Broadly

After a relentless two-year downtrend, the iShares Core U.S. Aggregate Bond ETF (AGG) is in the process of building a base above the 50 and 200-day moving averages (blue and gold respectively).

Simultaneously, the Potomac Momentum Model for AGG has been positive since November 2023. A move above the $100 level would likely signal that the reversal process has been completed.

Volatility

For those following our work, we've been closely watching the volatility in the fixed income market. The ICE BofA MOVE Index has been making progress to the downside after persistently elevated levels.

For those unfamiliar, the MOVE Index can be thought of as the VIX for bonds. Lower volatility in the space, could be a bullish tailwind for bond prices.

Risk-On?

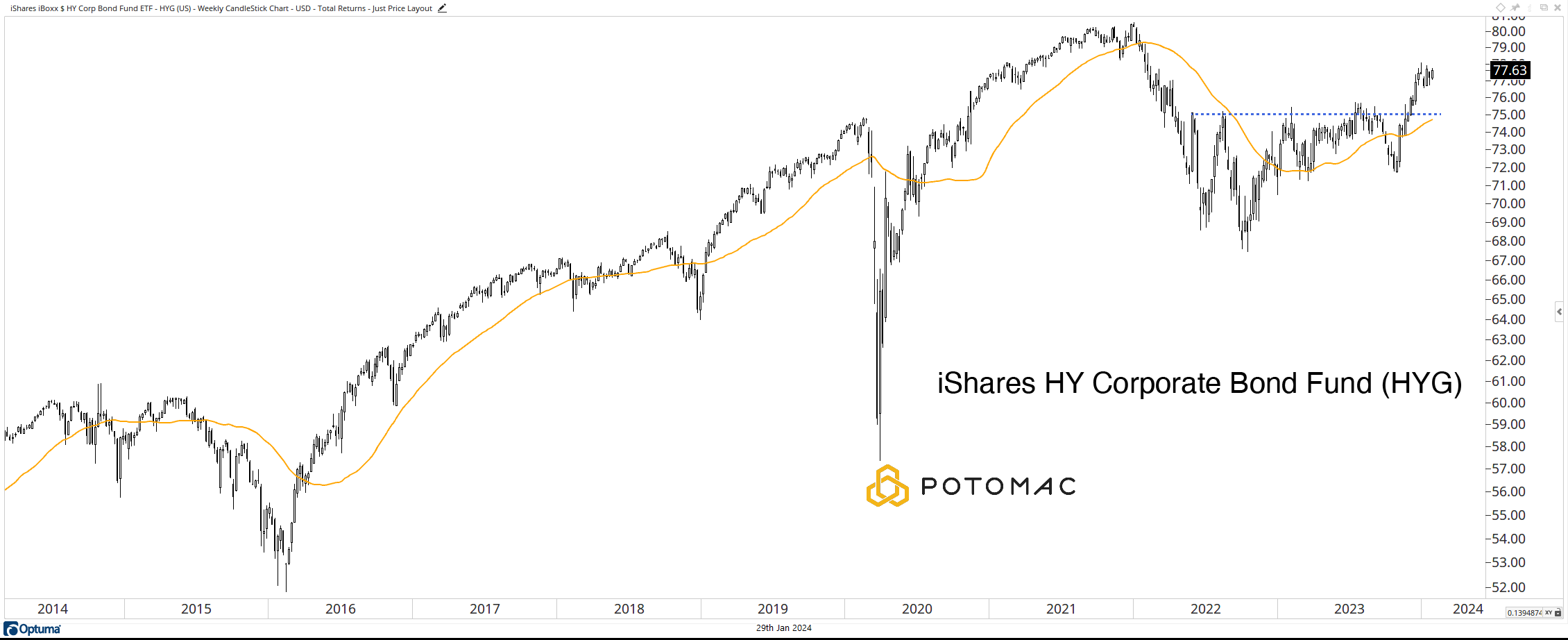

As bonds catch a bid broadly and volatility subsides, there's a slight risk-on tone in fixed-income land. The weekly candles for the iShares HY Corporate Bond Fund (HYG) are above the 40-week moving average, which is rising, and have taken out resistance in the $75-$76 zone.

The door is now open for a test of the highs.

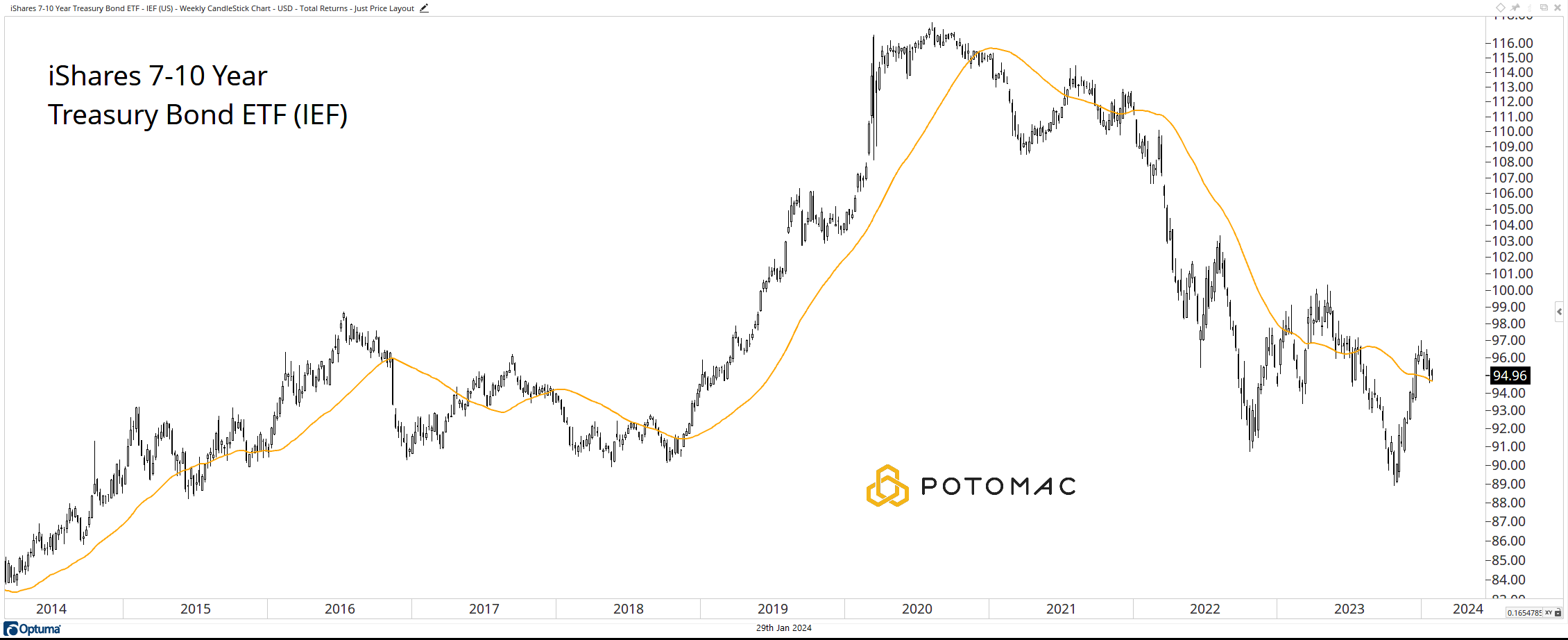

At the same time, the “safer” iShares 7-10 Year Treasury Bond ETF (IEF) remains in a downtrend. The 40-week moving average is nearing levels last seen before the 2019-2020 bull run.

Why?

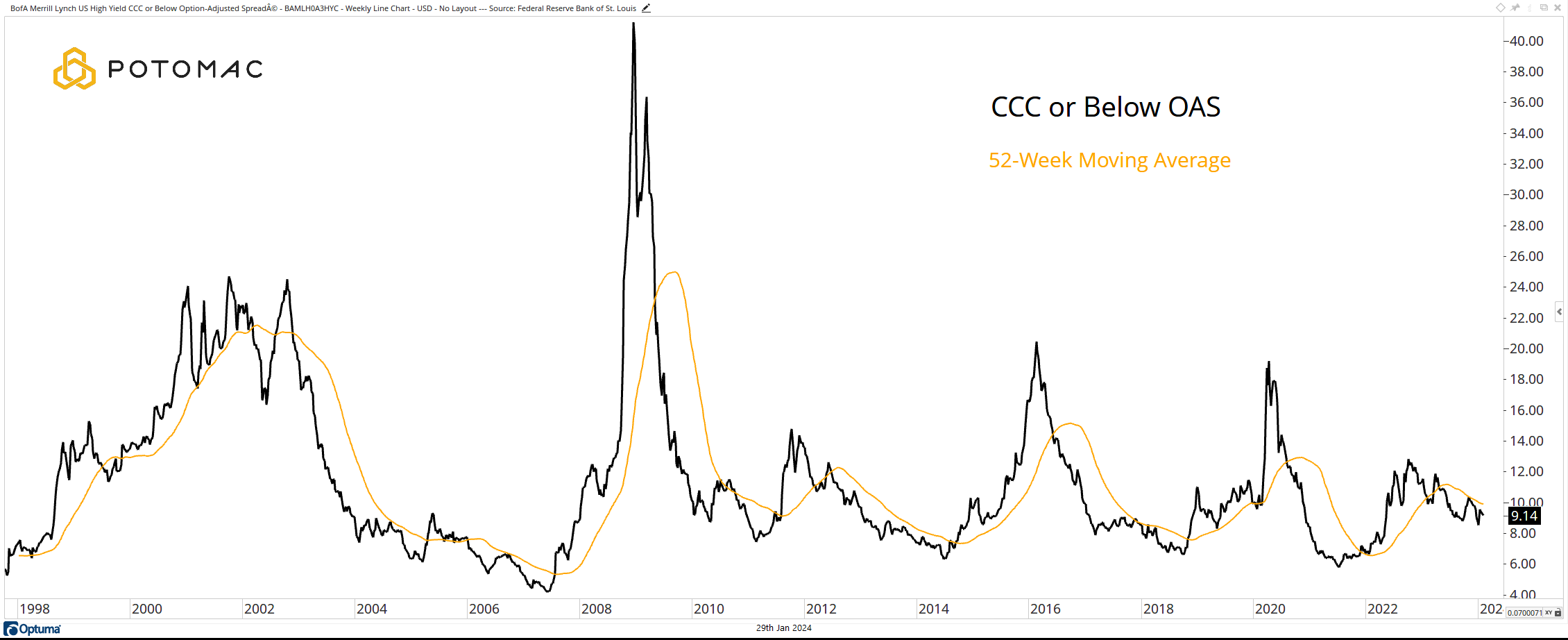

For those who would like to have a narrative about “why” all the above is playing out, we offer up the lack of meaningful stress in the worst depths of the credit market.

The CCC or Below credit spreads are contracting below the one-year moving average. But you know what we think of narratives.

*All Charts from Optuma as of the close of trading on January 26, 2024

Potomac Fund Management ("Company") is an SEC-registered investment adviser. This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page. The company does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to the Company website or incorporated herein, and takes no responsibility for any of this information. The views of the Company are subject to change and the Company is under no obligation to notify you of any changes. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable or equal to any historical performance level.

PFM-303-20240129