The Bond Market Calls the Fed

January 6, 2025

Over the holidays, I revisited Michael Lewis's classic Liar’s Poker. For anyone breaking into the financial industry in the 1990s or early 2000s, this was essential reading. It’s been 25 years since I first read it, but noticing it on my shelf recently, I decided to dive in again. While the book has little to do with the actual game of “Liar’s Poker,” I’ll admit there was a time when I was an avid player. Back on the NYSE floor, we even kept a brown bag full of dollar bills behind the trading post, ready for a quick, random game at any moment.

This nostalgia aside, the bond market appears to be engaged in its own game of calling the Federal Reserve. Much like in poker or Liar’s Poker, “calling” here suggests disbelief in the information conveyed by the other player. In this case, the Fed conveys that inflation is under control and interest rates should trend lower. The bond market, however, is effectively screaming, “I CALL.”

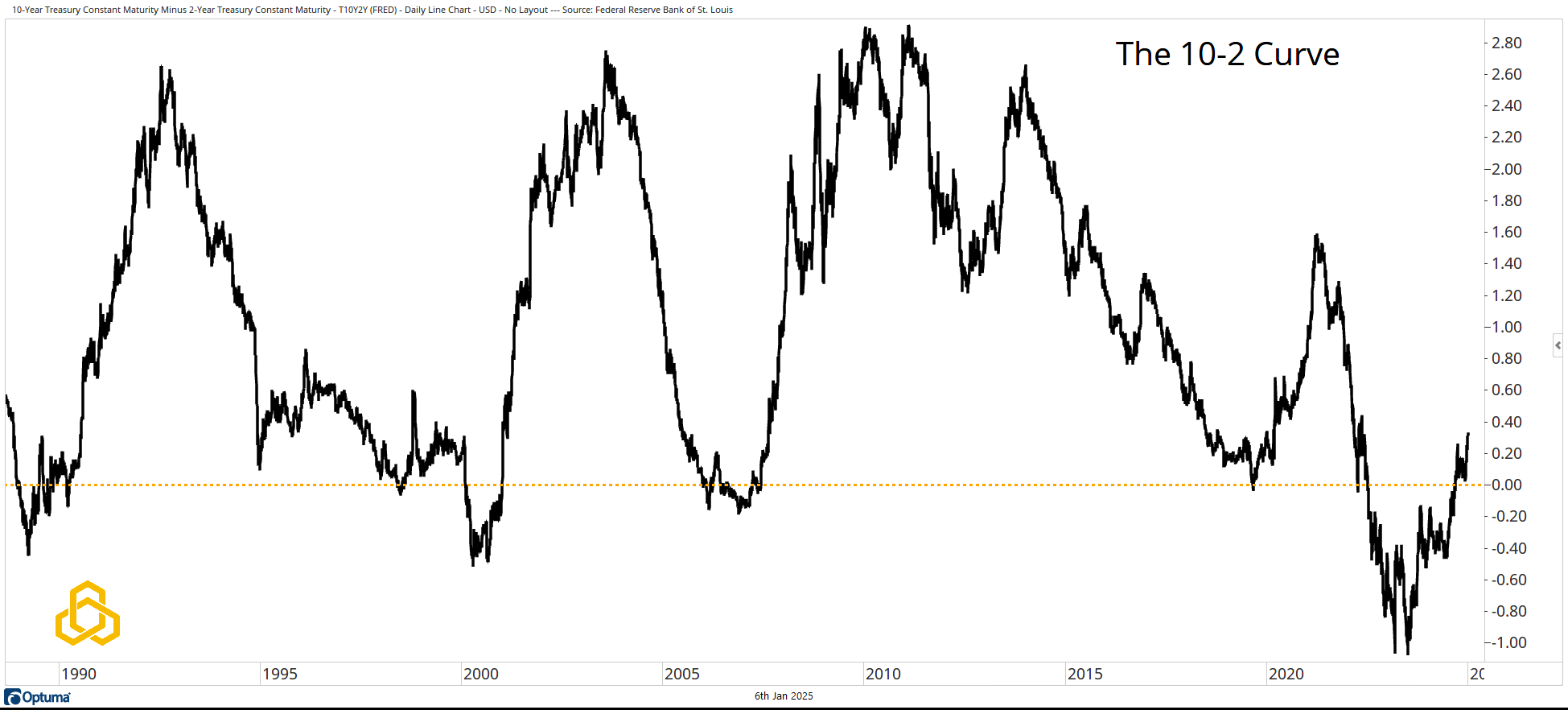

The 10-2 Curve

The most widely referenced version of the yield curve—the difference between the 10-Year Treasury Yield and the Two-Year Yield—un-inverted in September, coinciding with the Federal Reserve’s rate-cutting cycle. The curve has since steepened to its highest point since crossing above zero.

Source: Optuma

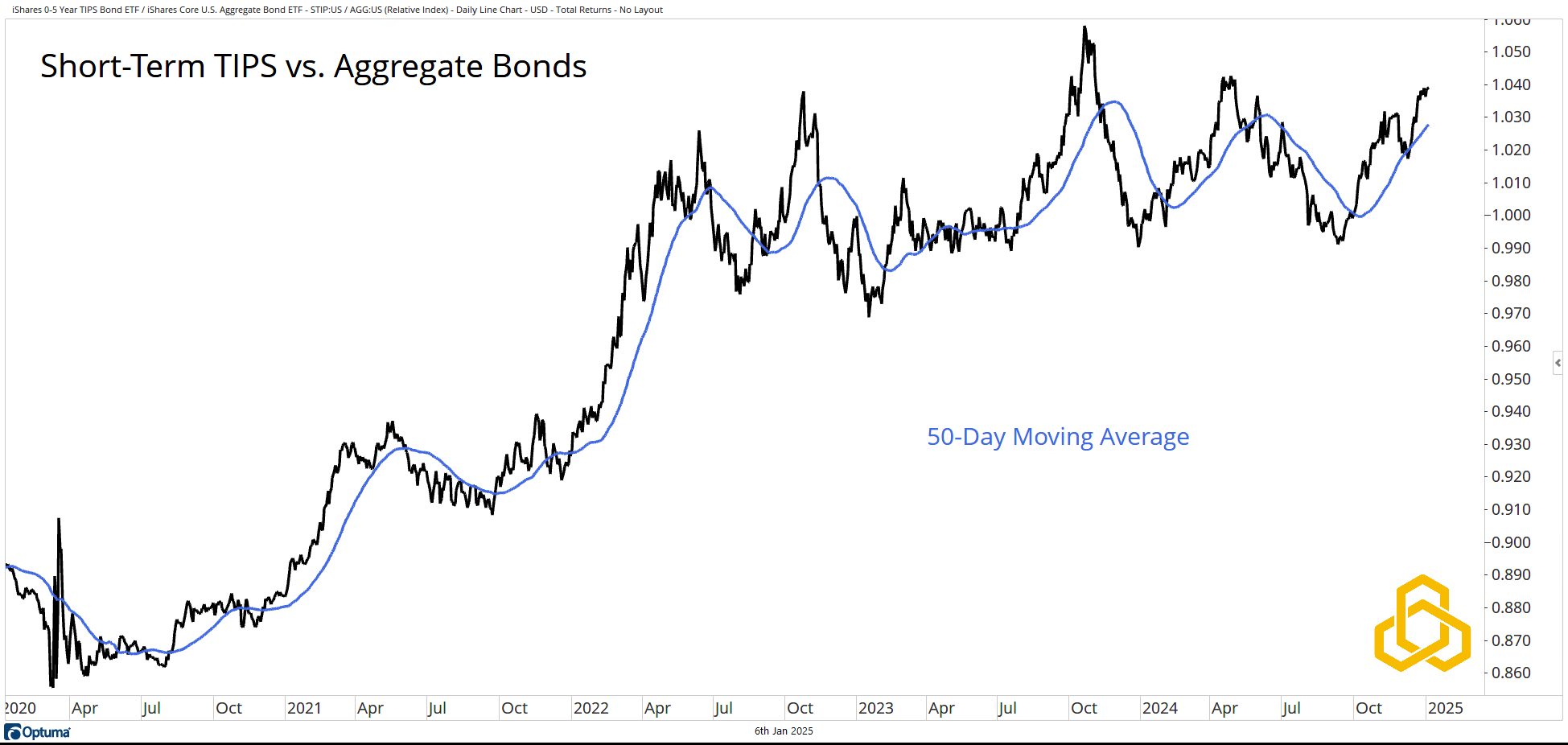

Short-Term TIPS vs. Aggregate Bonds

Is the steepening curve merely a reflection of an improving growth outlook that can sustain itself without inflationary pressures? While this is possible, investors should pay close attention to the ratio of Short-Term TIPS to Aggregate Bonds. Sustained strength above the rising 50-day moving average signals that inflation may not glide smoothly to the 2% target the Fed has emphasized.

Source: Optuma

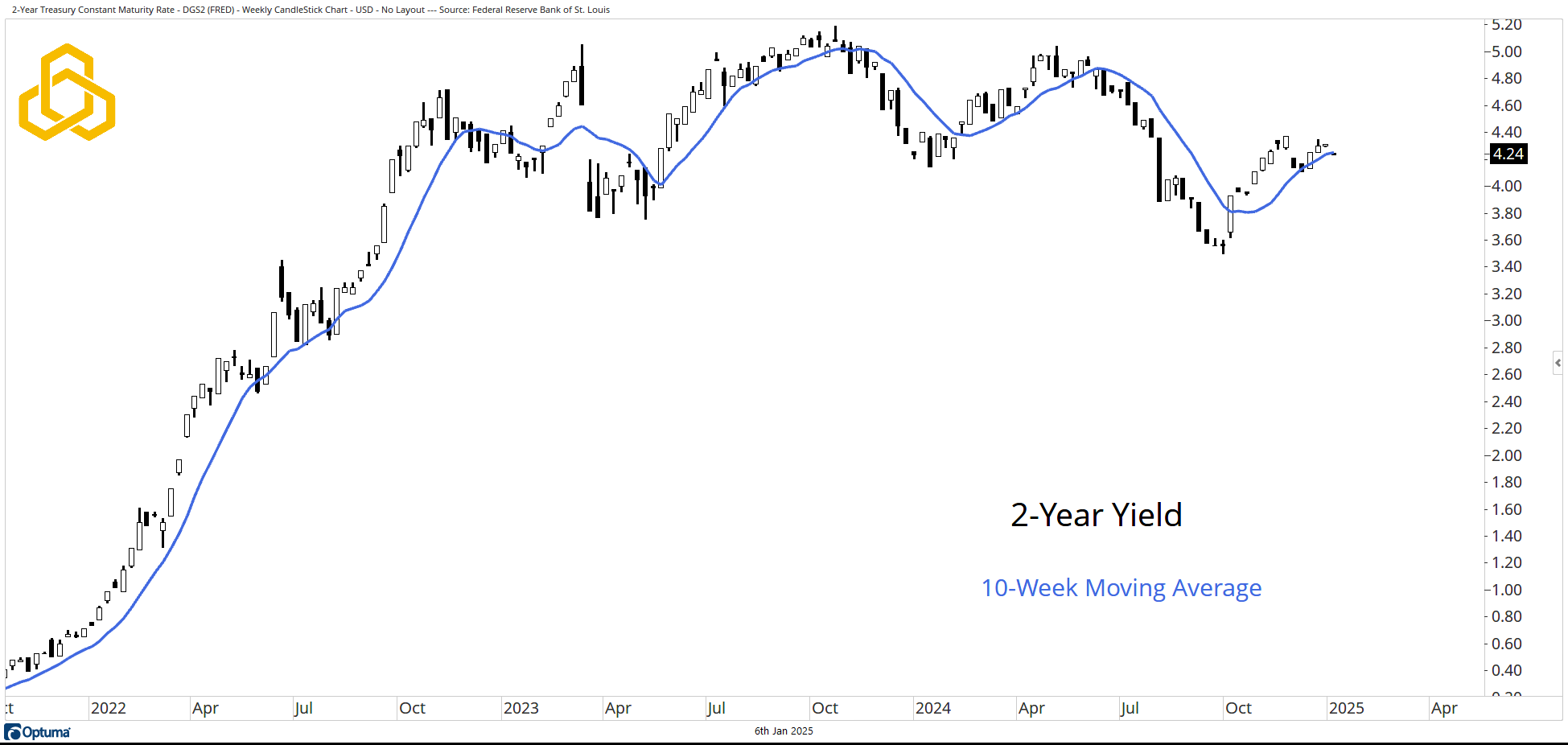

The Two-Year Yield

The Fed’s intent to lower rates has at least paused the relentless climb in yields that characterized much of 2022. However, we don’t see a collapse in yields toward some theoretical neutral rate. Instead, the two-year yield appears to be consolidating around its now-rising 10-week moving average.

Source: Optuma

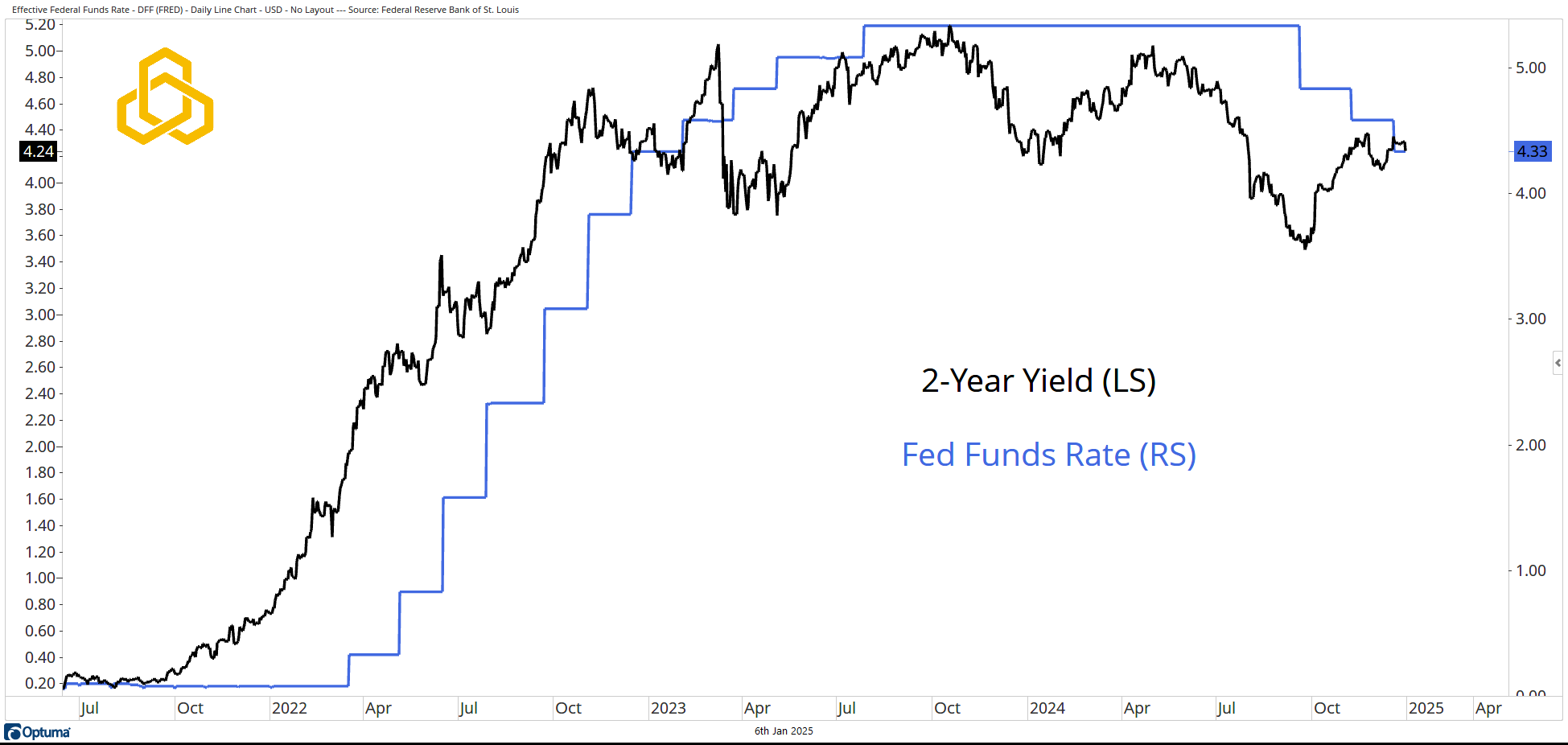

Two-Year Yield & the Fed Funds Rate

Notably, the rise in the two-year yield (black line) aligns closely with the start of the Federal Reserve’s cutting cycle (blue line). This dynamic suggests a disconnect between the Fed’s signaling and the bond market’s expectations.

Source: Optuma

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-381-20240106