Stocks Are Not the Problem… Rates Could Be

May 27, 2025

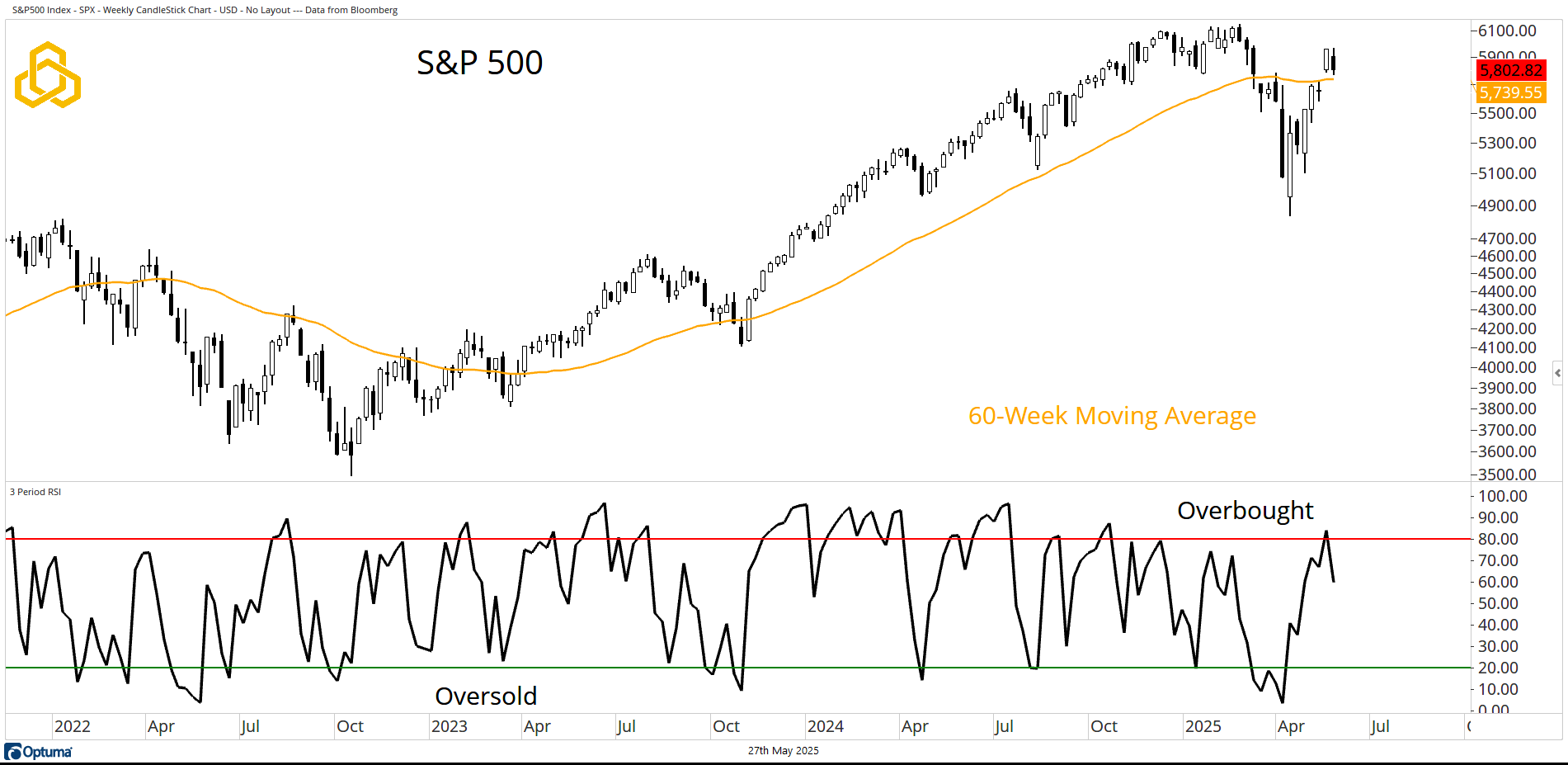

“Given the U.S. credit rating cut, it’s logical to expect some near-term weakness. However, as long as the index remains above the 60-week moving average, the odds favor a run to new highs.”

We wrote these words a week ago in this space and part one has played out. The S&P 500 became overbought, the credit rating was cut, and last week we saw stocks take a breather.

S&P 500

The S&P 500 remains above its 60-week moving average despite last week’s hit to equity prices. Many will blame the downgrade of the U.S. credit rating, but we would note that the index had simply become overbought. One simple way to visualize this is to look at the 3-week RSI, which rallied above 80 prior to last week’s decline.

Source: Optuma

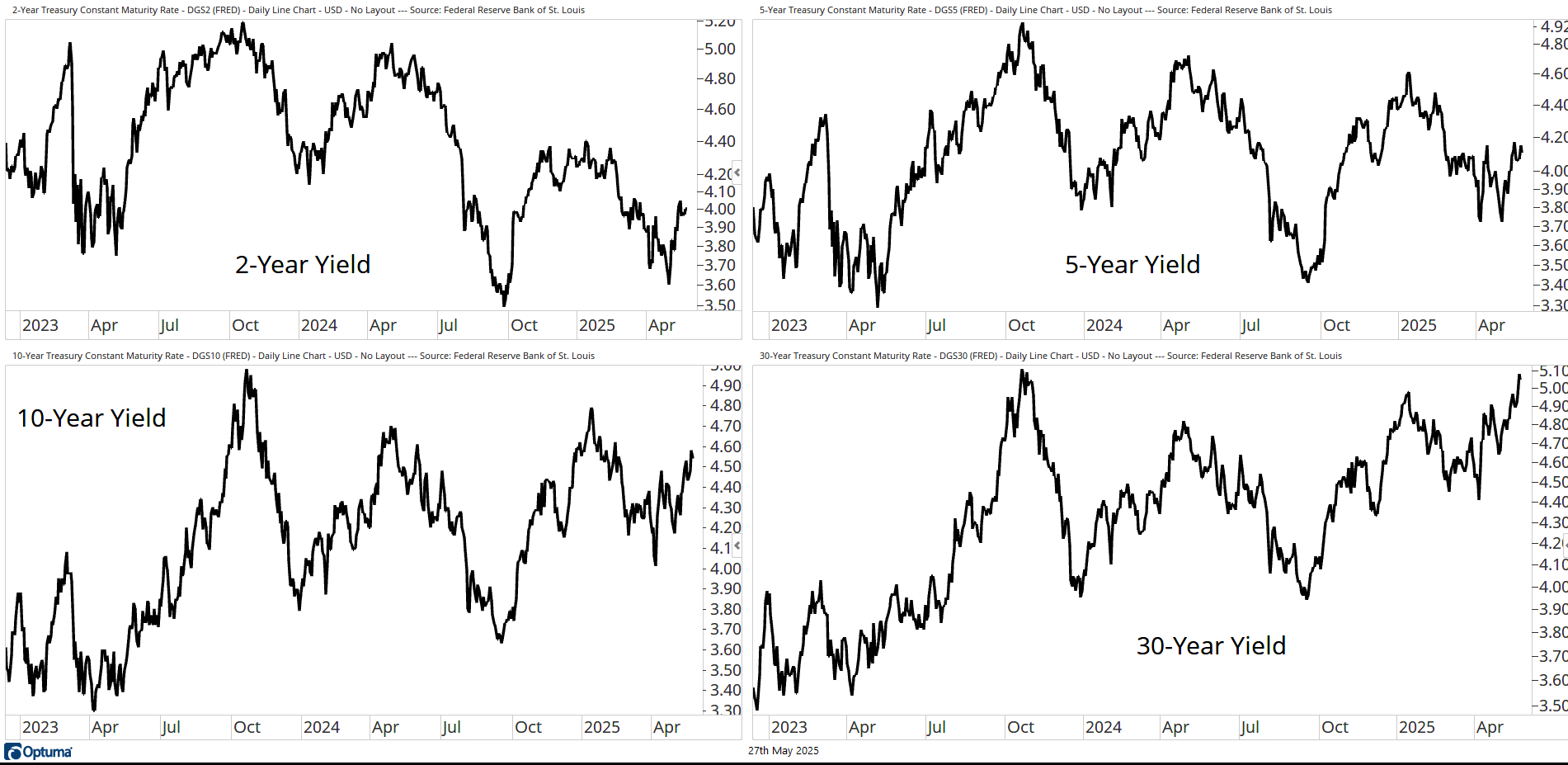

Rates

If I were to put on my discretionary hat and look for trouble spots in the market, I’d point to rates. From the two-year to the 30-year, Treasury yields have been moving higher across the board.

Now, a slow grind higher isn’t necessarily a bad thing. But a rapid acceleration to the upside would not be a welcome development.

Source: Optuma

Inflation?

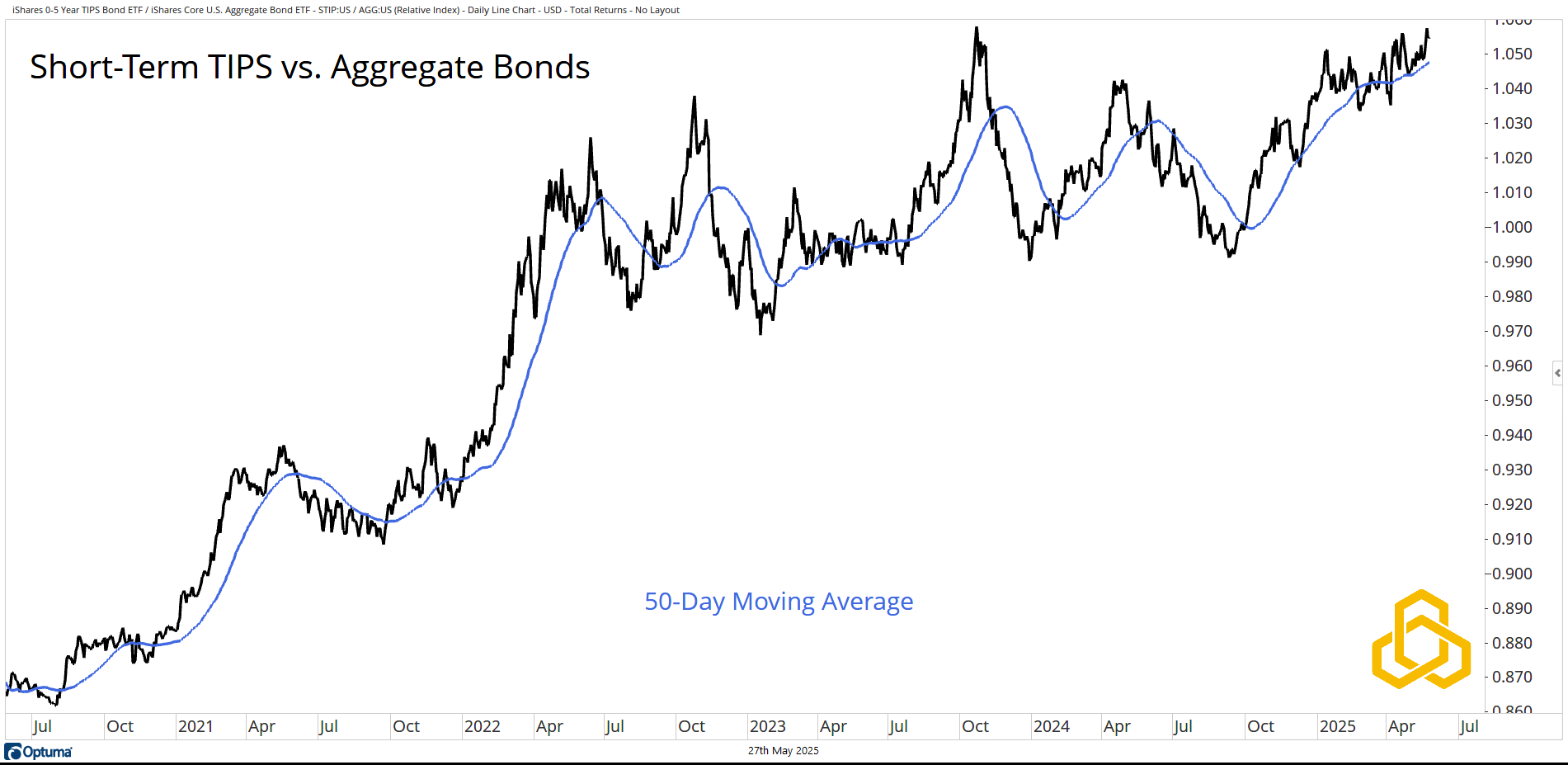

Why are rates moving higher? I genuinely don’t know—but if I had to offer a thesis, still wearing that discretionary hat, it would be this: the market may be coming to terms with the likelihood of some level of tariffs on imports.

These tariffs will likely end up much lower than the draconian starting points that were floated as negotiating tactics. But here’s the key: lower tariffs are actually more inflationary than severe ones. The former may lead to higher prices without destroying demand. The latter would likely destroy demand outright.

This is a long way of saying the market may be anticipating higher inflation. Look no further than short-term TIPS versus aggregate bonds—trading near record highs and above a rising 50-day moving average—for confirmation.

Source: Optuma

Bottom Line

The pause in equities last week is perfectly normal after a strong run. If you're looking for something to worry about (not that we would recommend it), focus on rates and inflation expectations. Stocks are not the problem—rates could be.

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-318-20250527