Stagflation

April 29, 2024

Get used to it, and become familiar with it, because the title of today’s note is a word that you are going to hear thrown around a lot.

According to Investopedia, Stagflation is an economic cycle characterized by slow growth and a high unemployment rate accompanied by inflation. Economic policymakers find this combination particularly difficult to handle, as attempting to correct one of the factors can exacerbate another. I am not an economist, so I don’t have a strong view on the “flations,” but I can look at the market to determine what regime is likely.

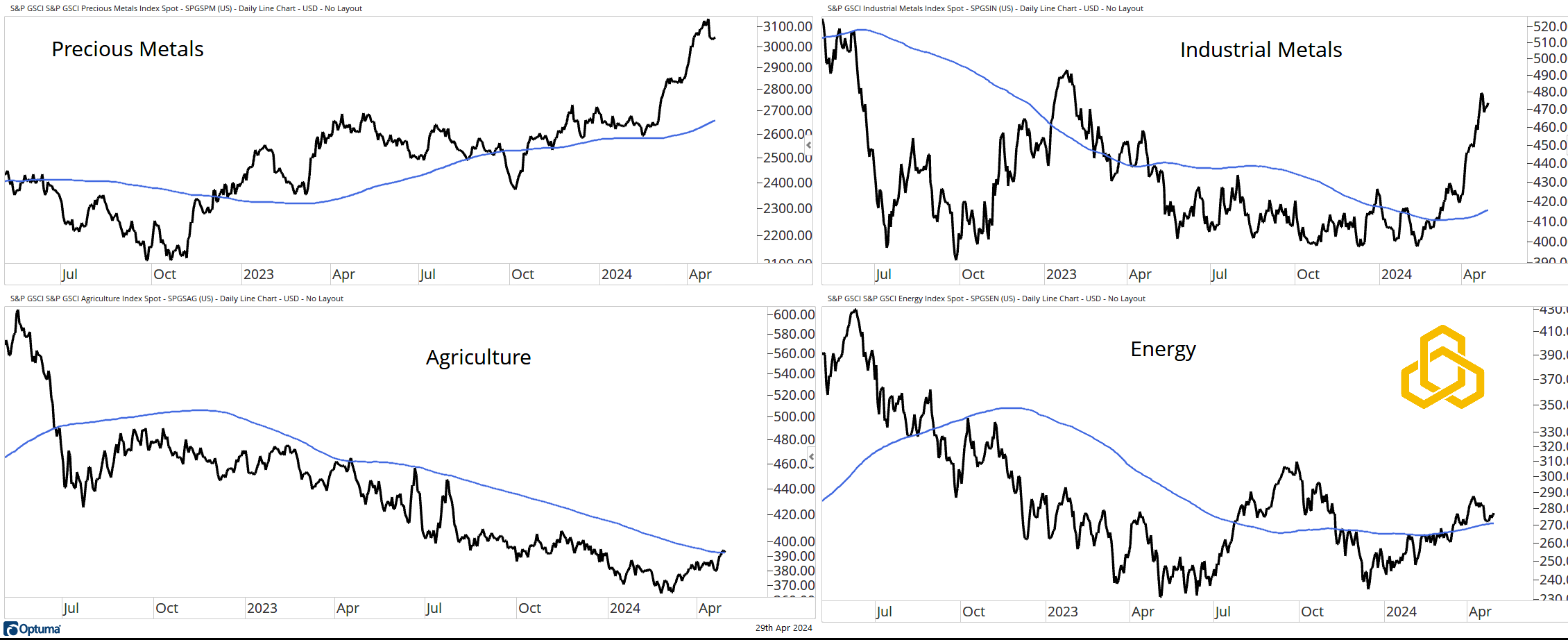

Commodities

Chances are that most investors do not own enough commodities.

The conversations that I have involve an investor telling me that they own commodity stocks. While there may be some benefit to this, the stocks are a step removed from the asset that matters. Across the complex, there are signs of strength in the commodity market.

The metals have received most of the attention, but now Energy & Ags are in the process of reversing higher. All four groups are above their respective 200-day moving averages. Generally, commodities are seen as an inflation hedge.

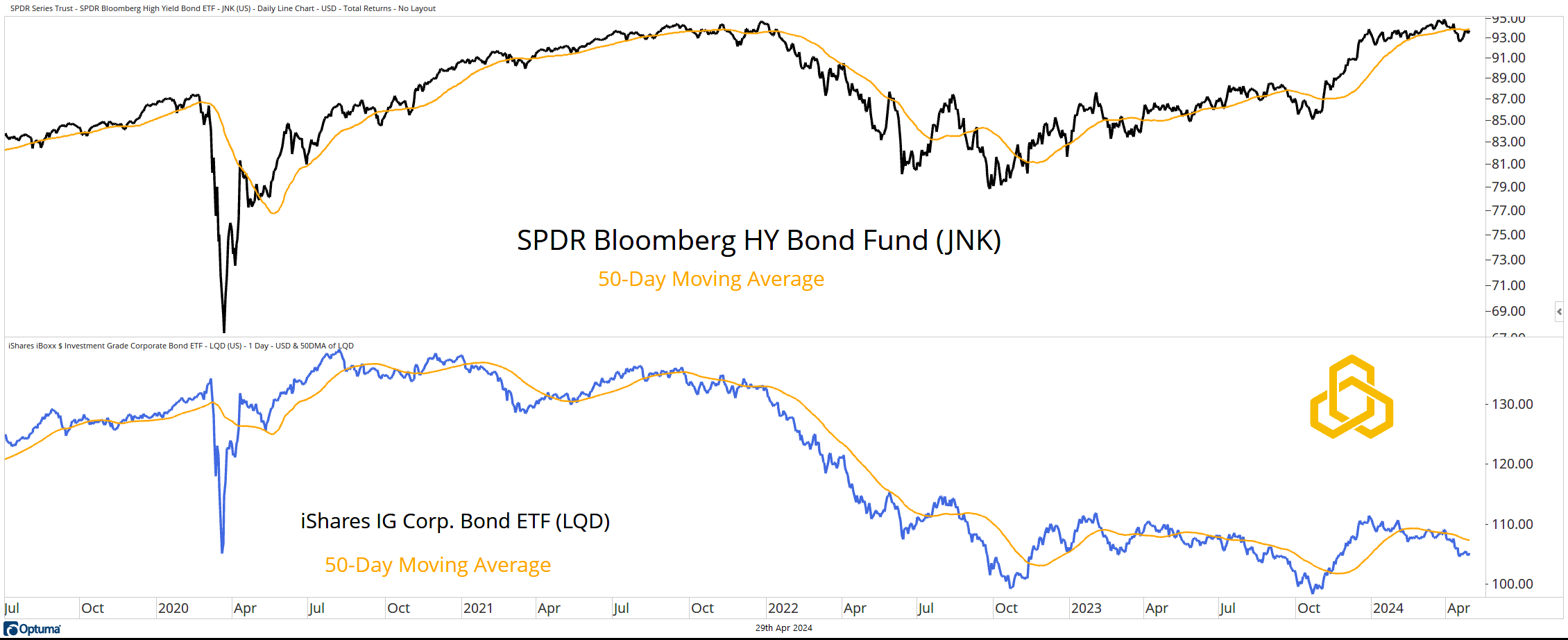

Corporate Bonds

Bonds continue to roll over. We have written, at length, over the past two years about the shift to a positive stock/bond correlation. I am not going to belabor the point here other than to say that our references there have had to do with treasuries.

Today, we will highlight that corporates are coming under attack. Both High Yield and Investment Grade bonds are below their 50-day moving averages on a total return basis.

Perhaps this is due to fears of slowing growth?

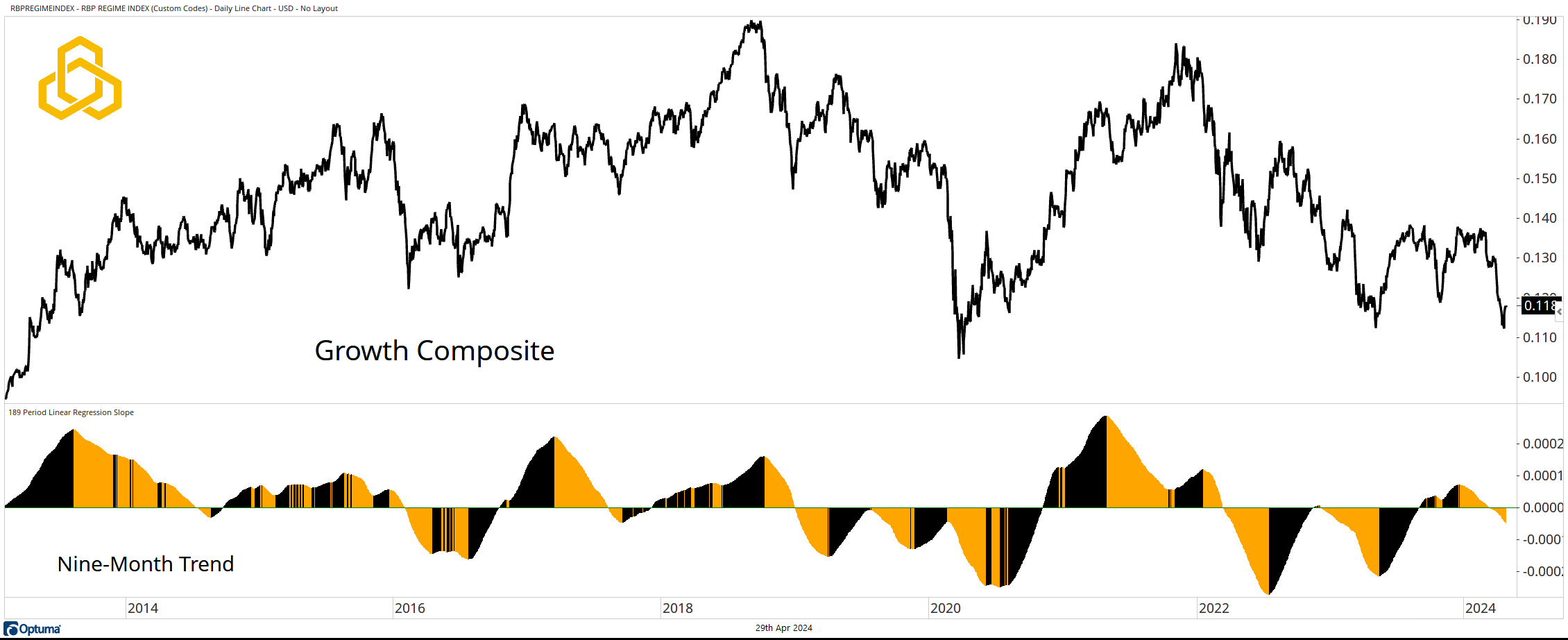

Growth Composite

The Growth Composite is a blend of key ratios across the equity, fixed income, and commodity markets such as Copper/Gold, High Yield/Treasuries, and Regional Banks/REITS. It allows me to “play an economist” without being one. A rising composite is a sign that the market is pricing increased economic growth, and a falling line signals the opposite. The nine-month rolling trend recently turned negative.

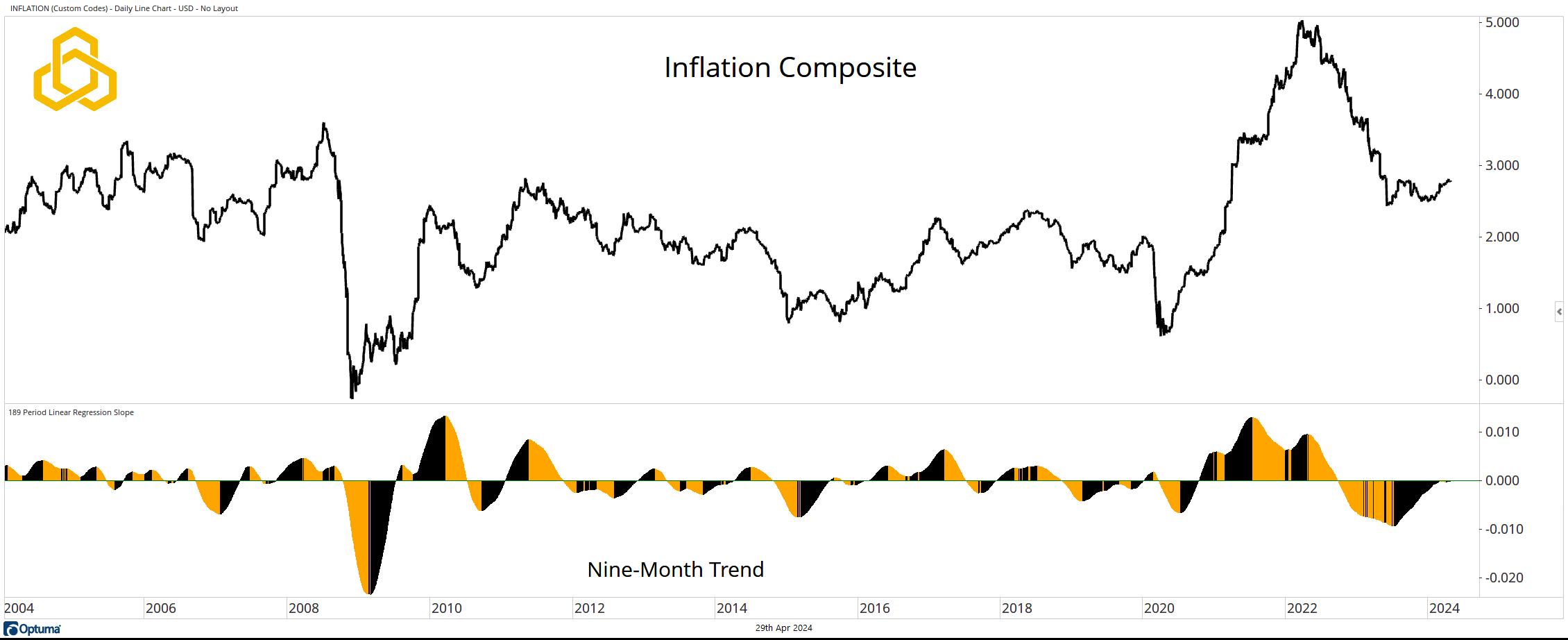

Inflation Composite

The Inflation Composite is a blend of important inflation metrics such as CPI and Forward Rates. It has been moving higher since the start of 2024 and the nine-month trend is on the verge of crossing above zero.

S&P 500

Last week, we noted that the S&P 500 closed lower for six consecutive days and that a rally was likely in the near term. That is exactly what played out. However, the index remains below the 50-day moving average (gold), which opens the door to a test of the rising 200-day moving average (blue). This dynamic plays out as the S&P enters the seasonally weak May-October period and in the face of the stagflation elements highlighted above.

*All Charts from from Optuma as of April 28, 2024. Past performance does not guarantee future results.

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-321-20240429