Something for Everyone

May 13, 2024

Stocks rallied for a third consecutive week, but there is much debate about the health of the rally.

Bulls will point to market internals (breadth) and argue that the NYSE Advance/Decline Line is breaking to new highs, while new 52-Week Highs are also trending higher.

Bears will likely agree that the market is still being Chop’t (see last week’s note) and that sector leadership is not encouraging.

S&P 500

A three-week rally has taken the index within striking distance of all-time highs. At the same time, the 60-week moving average has moved higher, not aligning with the prior highs set in early 2022, near 4,800.

The 60-week Z-Score is slightly extended, at a reading of 1.76, but it is not at levels that should be overly concerning at this point.

Advance Decline/Line

As the index threatens new highs, the NYSE Advance/Decline Line is surpassing its prior highs.

Clearly, this is a win for the bulls, as healthy uptrends feature more stocks advancing than declining. To the extent that this persists, the bull case becomes stronger.

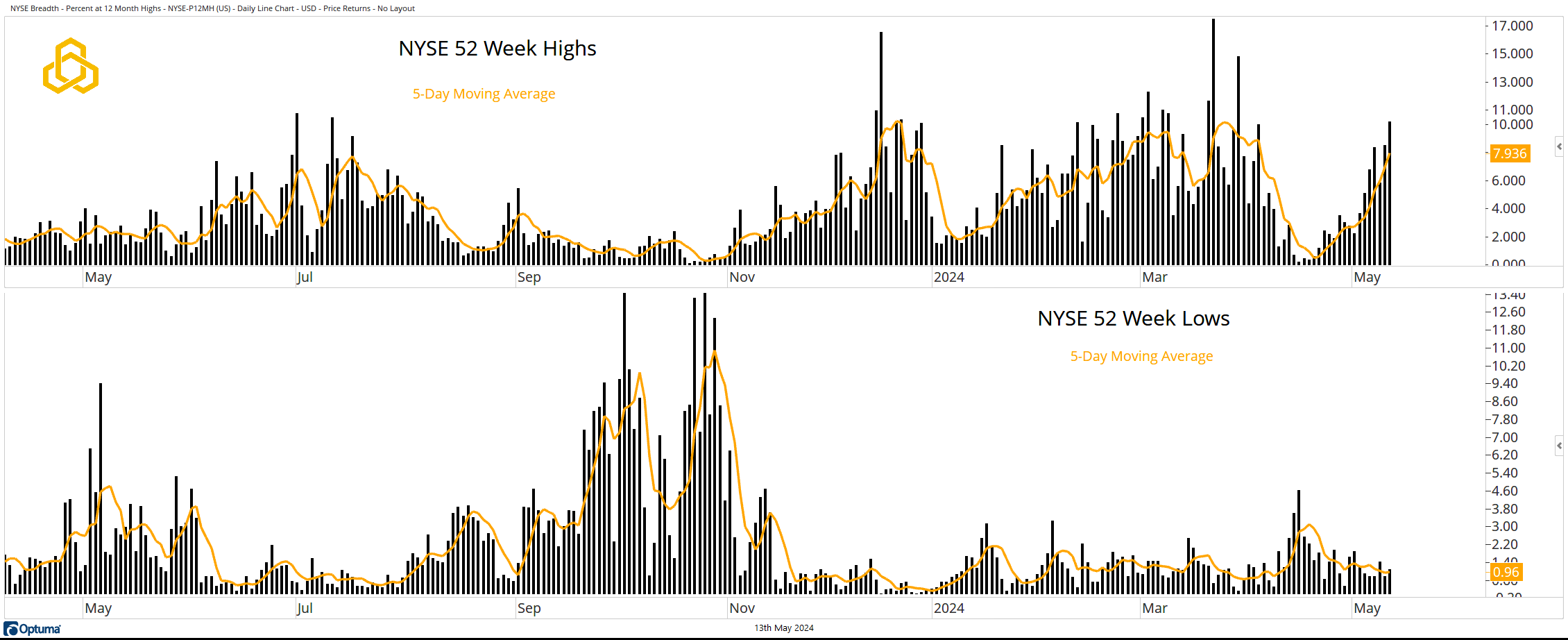

52-Week Highs & Lows

On the NYSE, the 5-day moving average of stocks making new 52-week highs is rising, while the same metric for stocks making new lows is falling.

In fact, we have not seen persistent new lows since the market made a local bottom in October 2023.

It is hard to have a strong downtrend if more stocks are making new highs than new lows.

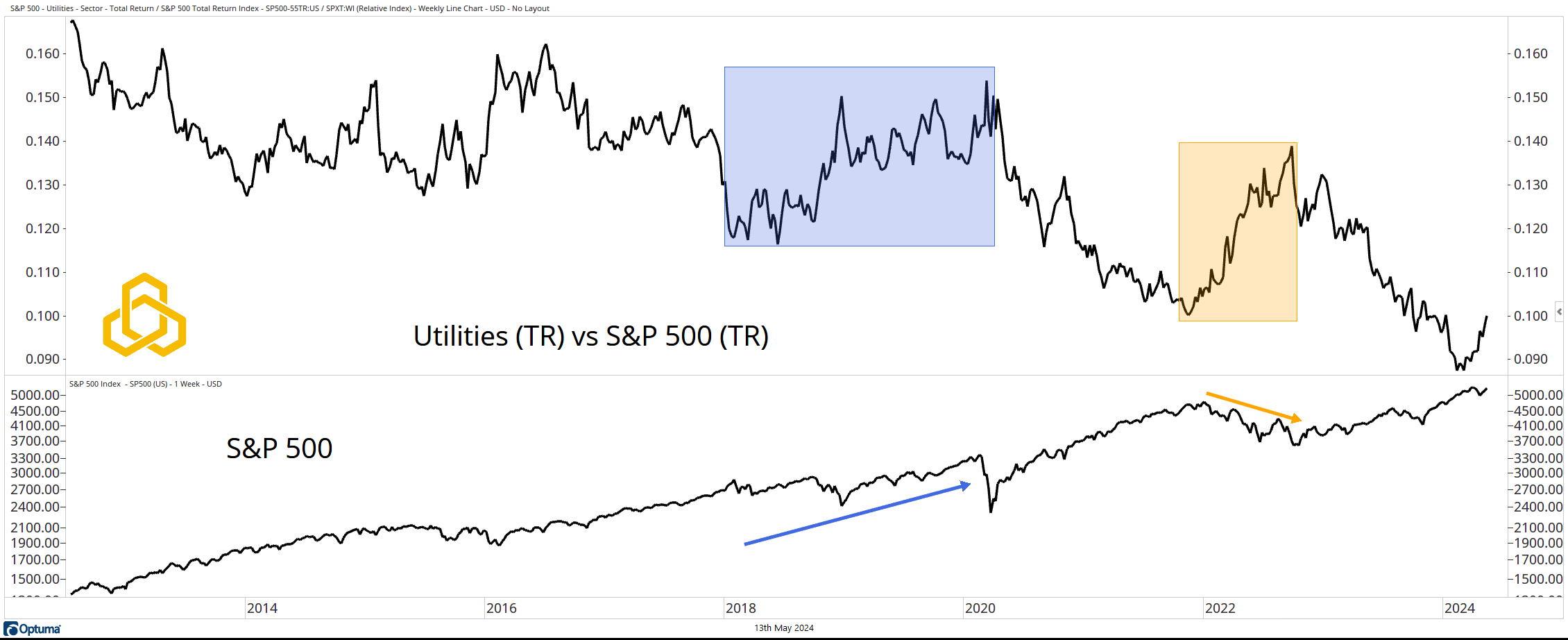

Utilities

The bears appear to be hanging their hats on sector relative strength. They are highlighting the fact that leadership from Utilities means that the broader market is ripe for a fall. Recent history shows that this does not ALWAYS have to be the case.

The Utes outperformed from 2018 – 2020, and the S&P 500 performed well (blue box and arrow). However, in 2022, Utility leadership played out as the S&P 500 suffered a bear market (gold box and arrow).

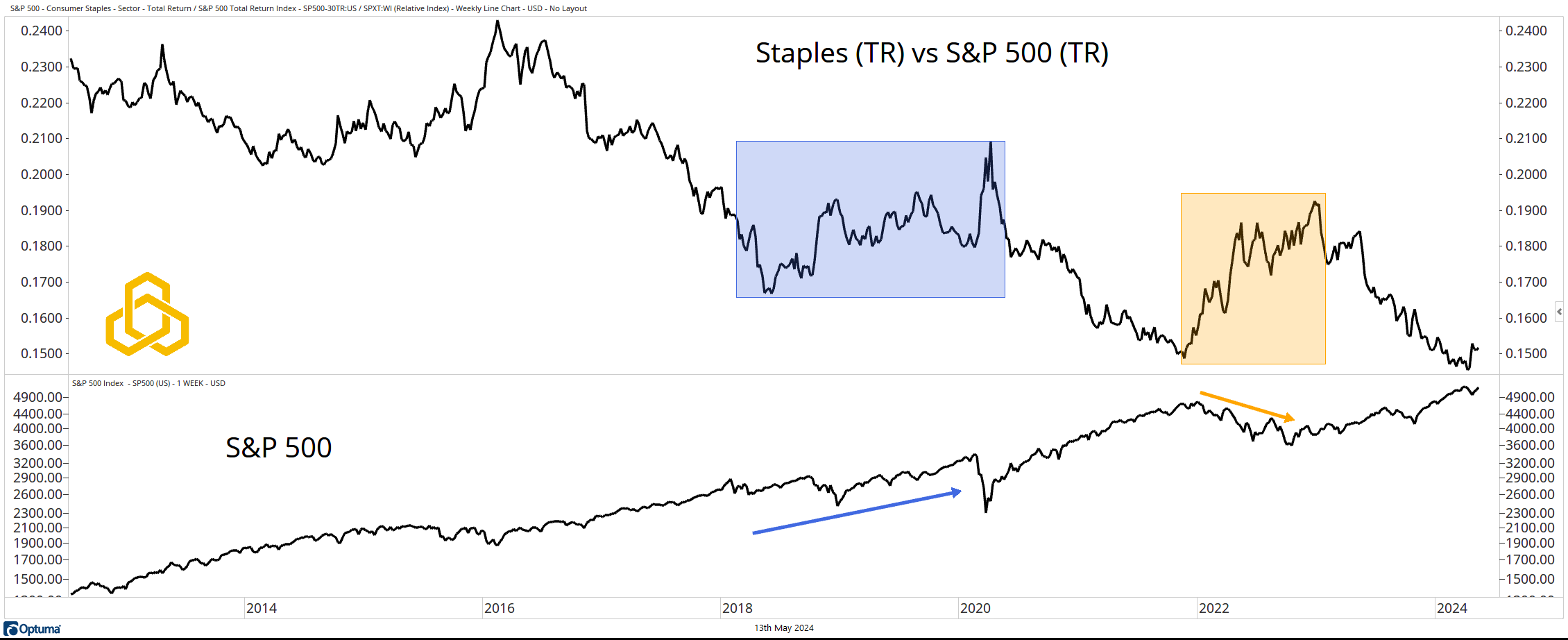

Staples

The bears are making the same case with Staples. But the same counterpunch can be thrown.

Conclusion

Both the bulls and the bears can make a strong case here. But there are always people who can make a case to support their cause. The truth is in the testing and the resulting probabilities. The rest is just narrative; you know how we feel about narratives.

*All charts from Optuma as of May 11, 2024. Past performance does not guarantee future results.

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-325-20240513