Some Warning Signs

June 17, 2024

.jpg?width=670&height=377&name=Some%20Warning%20Signs%20Email%20Cover%20(1).jpg)

In our note on May 28th, we said that we would keep life simple for the summer.

We mentioned that we were going to focus on the market’s trend, the health of that trend, and the confirmation of that trend. Since then, the S&P 500 has continued to grind higher, closing on June 14th at a new all-time weekly high.

When push comes to shove, it is hard to argue with new highs. However, there are some dynamics playing out behind the scenes that our process finds important and should be watched closely.

Let’s call them “warning signs” for now.

S&P 500

The S&P 500 closed at a new weekly high last week, well above the rising 60-week moving average. For those who are only concerned with the path of this index of 500 stocks, and are content with blindly following its path, new highs are good.

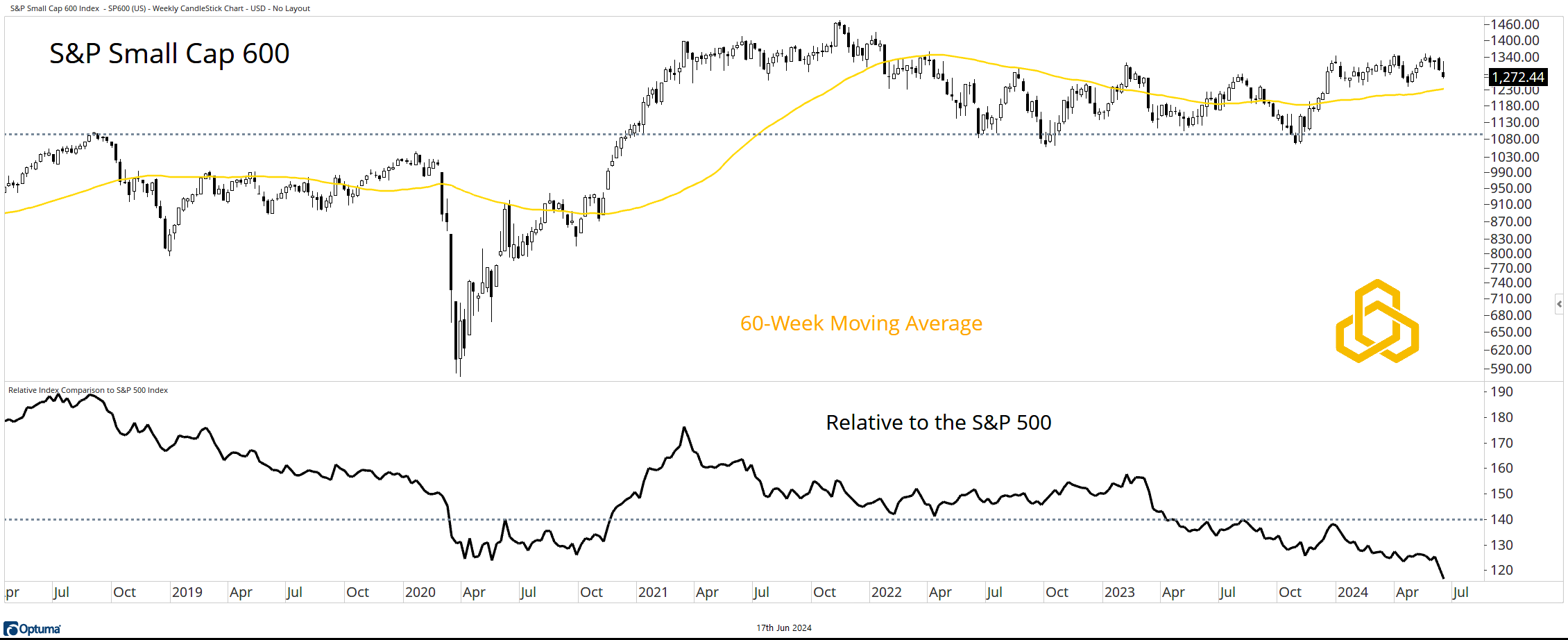

S&P 600

The S&P 600 Index of small-cap stocks paints a less bullish picture of the market environment. The index did not close at an all-time high last week. In fact, it has not seen all-time highs in over two and a half years. Sure, it trades above the 60-week moving average, but that measure of trend is lower than it was two years ago - warning sign #1.

Dow Jones Transportation Average

The Dow Transports have been in a well-documented consolidation since peaking November 2021. However, the index has deteriorated over the past few weeks, pushing below the 27-week moving average, which is now lowering as well - warning sign #2.

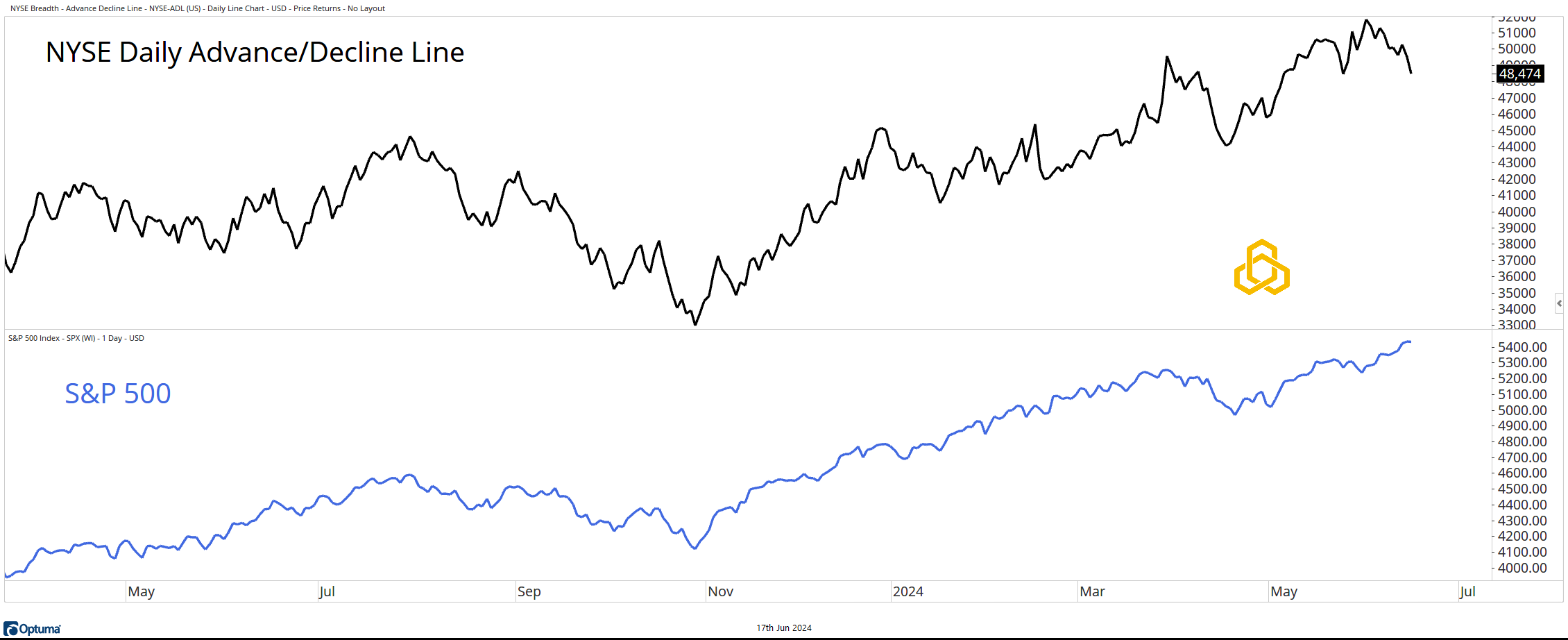

NYSE Advance/Decline Line

In strong bull markets, we expect to see more stocks going up than down, which would tell us that the trend is healthy. Since May 30th, as the S&P 500 grinds to new highs, the NYSE Advance/Decline Line has been moving lower - warning sign #3.

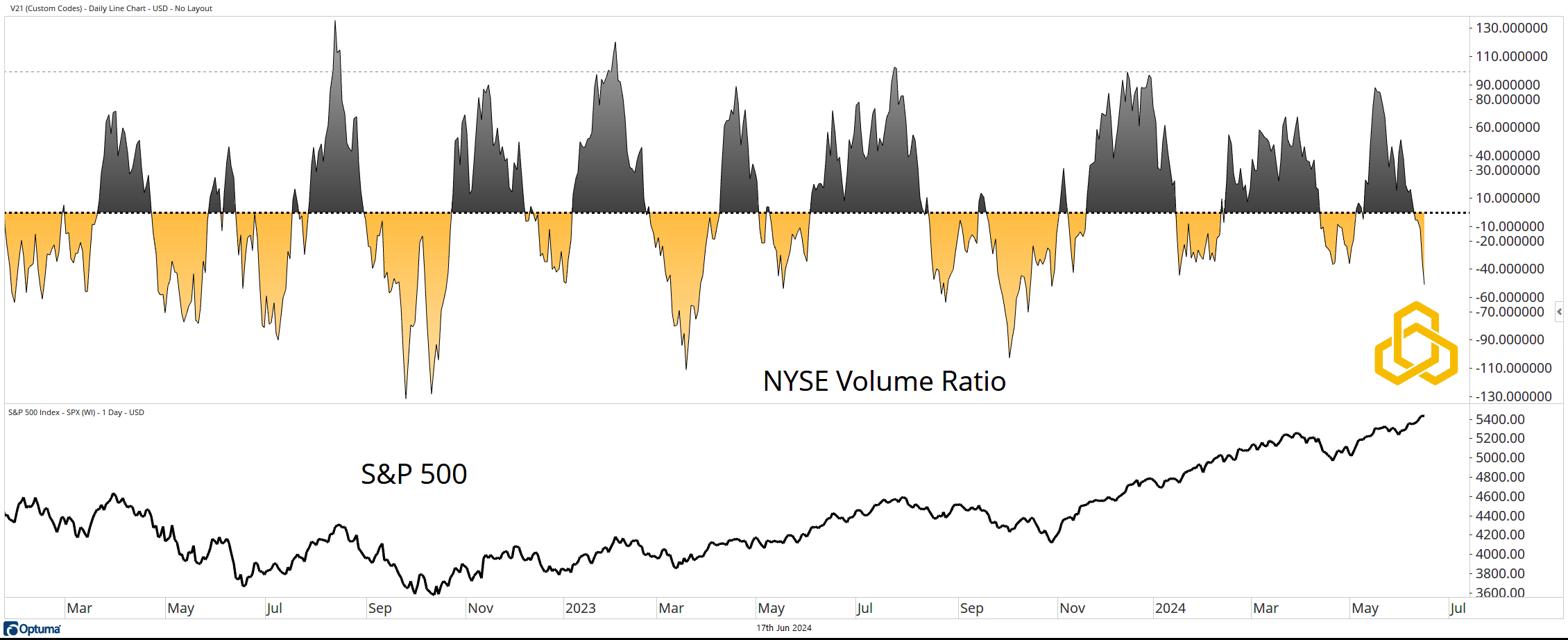

Volume Ratio

Just as we expect to see more stocks go up in a bull market, we expect more volume trading in advancing stocks versus declining stocks. Unfortunately, the NYSE Volume Ratio has made a new low for the year - warning sign #4.

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-336-20240617