Soft Landing Confirmed?

August 26, 2024

The title of this week’s note is in the form of a question. Not because I am fan of Jeopardy, but because I am willing to admit that I honestly do not know. However, I have a feeling that soft landing is the narrative that will receive a lot of play in the coming weeks. The small summer swoon was all the bears could muster. Last week we pointed out that the bond market was signaling all clear. We will only know with the benefit of hindsight. For now, investors seem to think that Chairman Powell has pulled off the unthinkable.

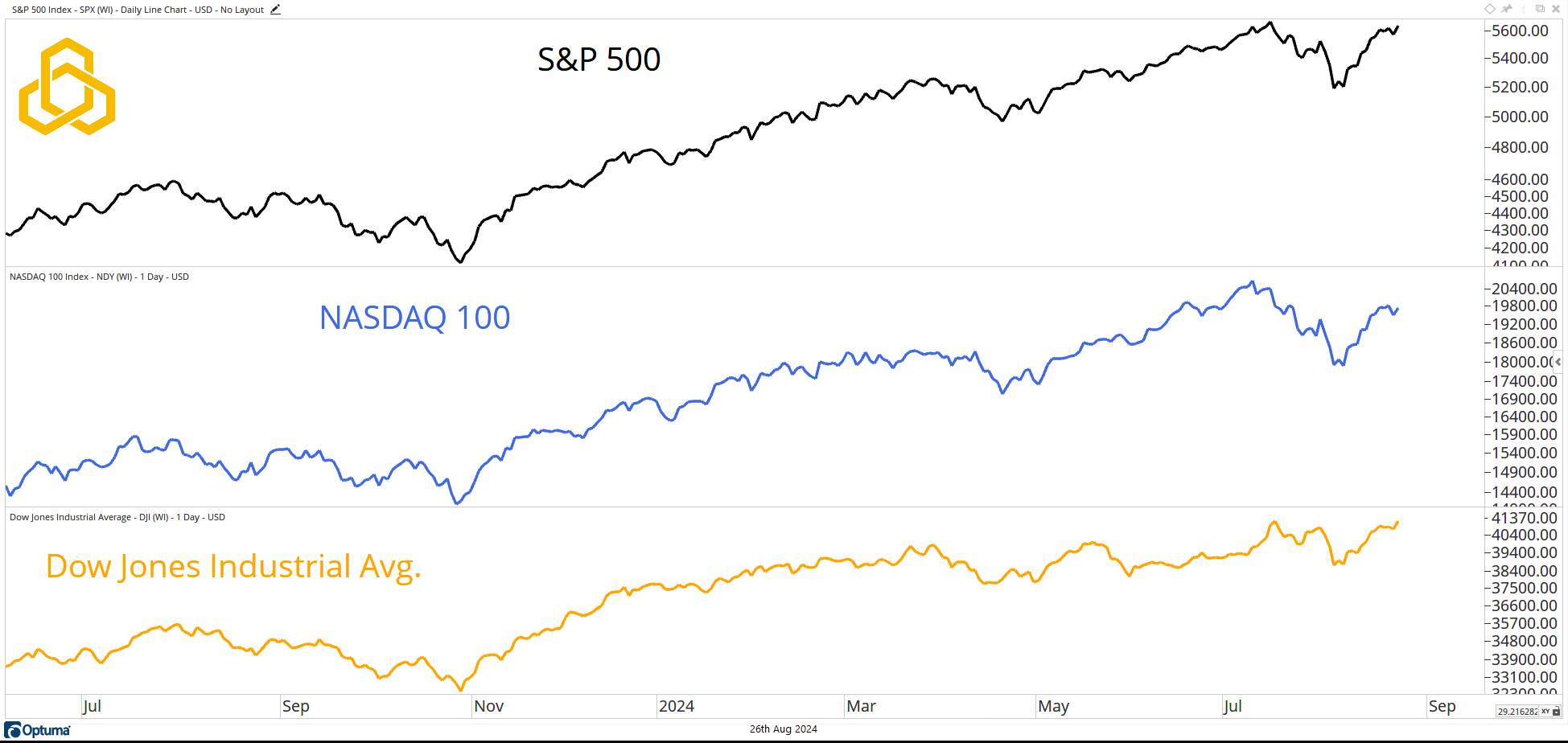

Major U.S. Averages

The three major averages in the United States are all trading at or near all-time highs. Surprisingly, the one that is furthest from record levels is the NASDAQ 100, everybody's darling. The fact that the S&P 500 and Dow Jones Industrial Average are leading the NASDAQ signals that there is broader participation in the advance than many bears think. This is not a market whose rebound is being led by only a handful of names.

Source: Optuma

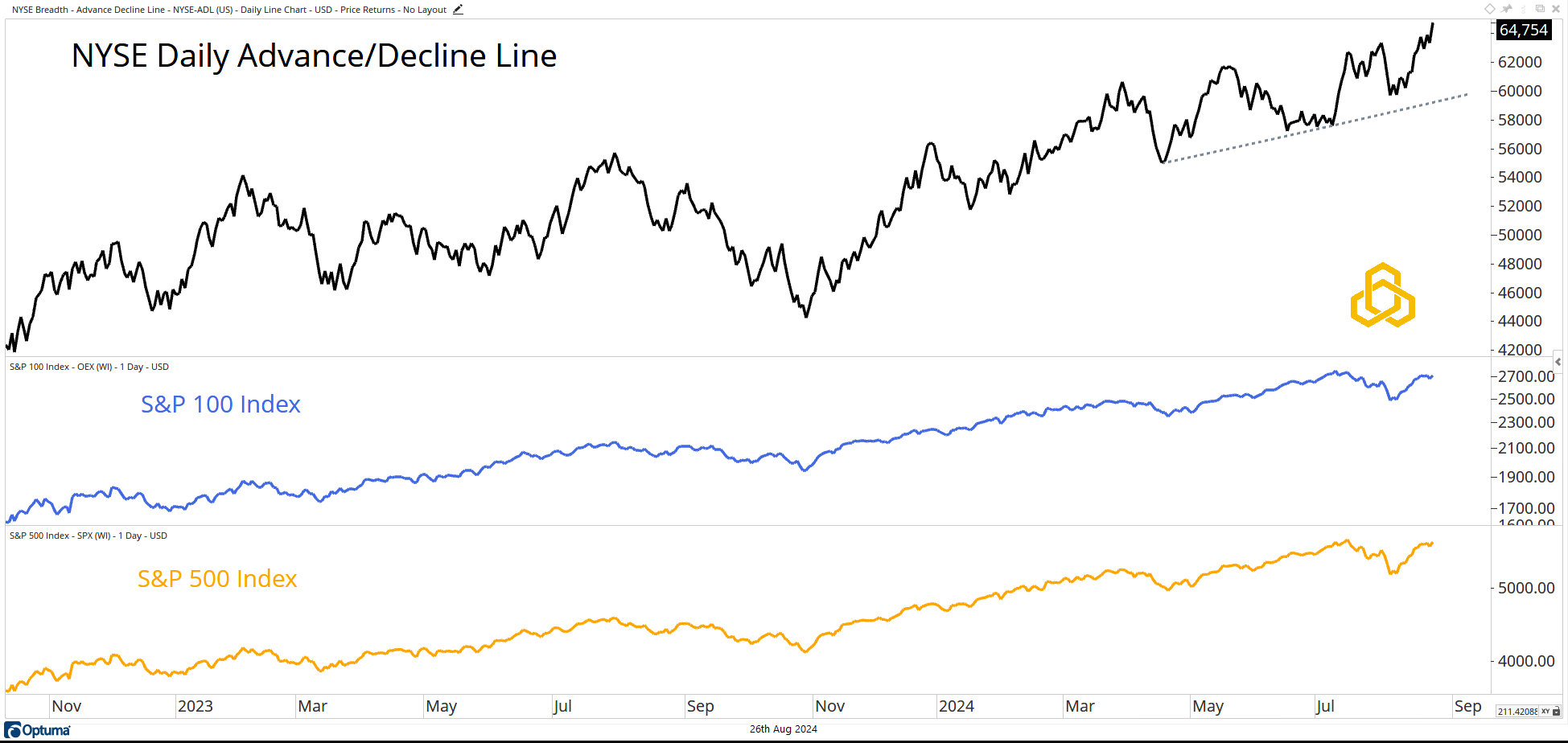

NYSE Advance/Decline Line

Long-time readers of our work know that the Advance/Decline Line is an indicator that we follow closely. It has reached new highs AHEAD of the S&P 500 and the S&P 100, increasing the odds that those two indices will follow suit.

Source: Optuma

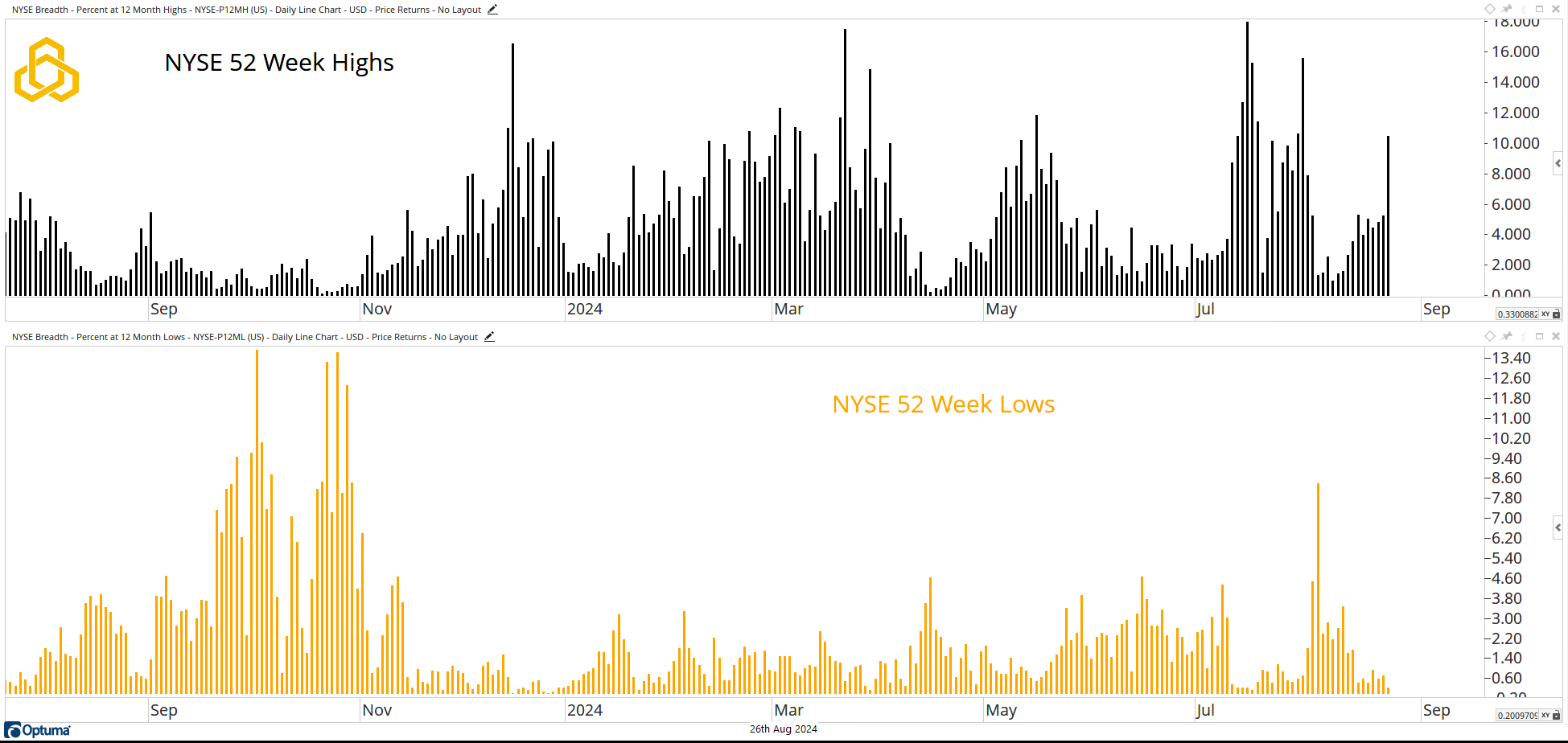

NYSE New Highs & New Lows

We continue to see more new highs than new lows on the New York Stock Exchange. One would imagine that a hard landing would involve a decline in equity prices. It is hard to have a sustained decline without a lasting increase in new lows / decrease in new highs.

Source: Optuma

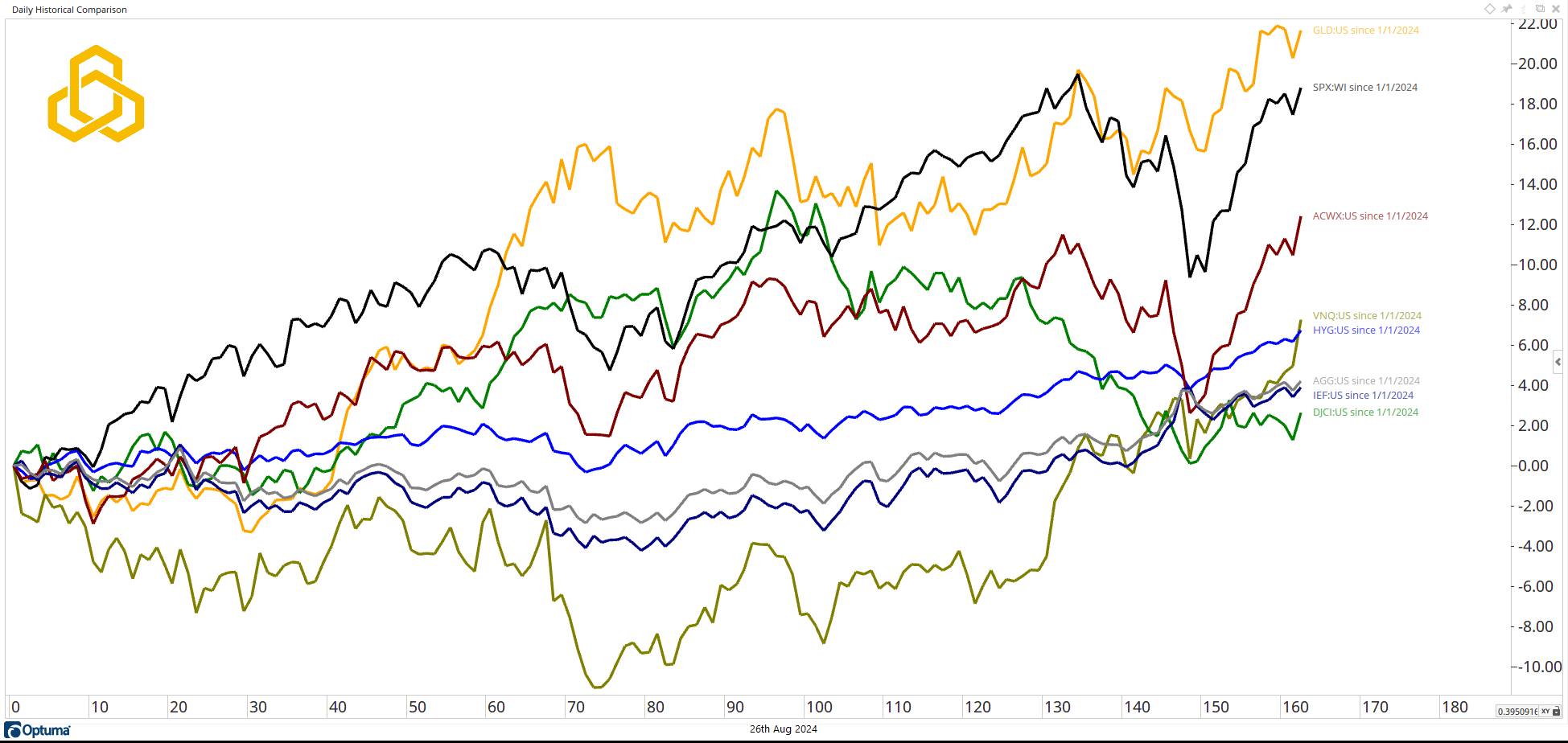

Major Asset Classes

Looking across major asset classes (Gold, U.S. Stocks, International Stocks, Real Estate, High Yield Bonds, Investment Grade Bonds, Treasuries, and Commodities), we can see that all are positive year-to date.

Source: Optuma

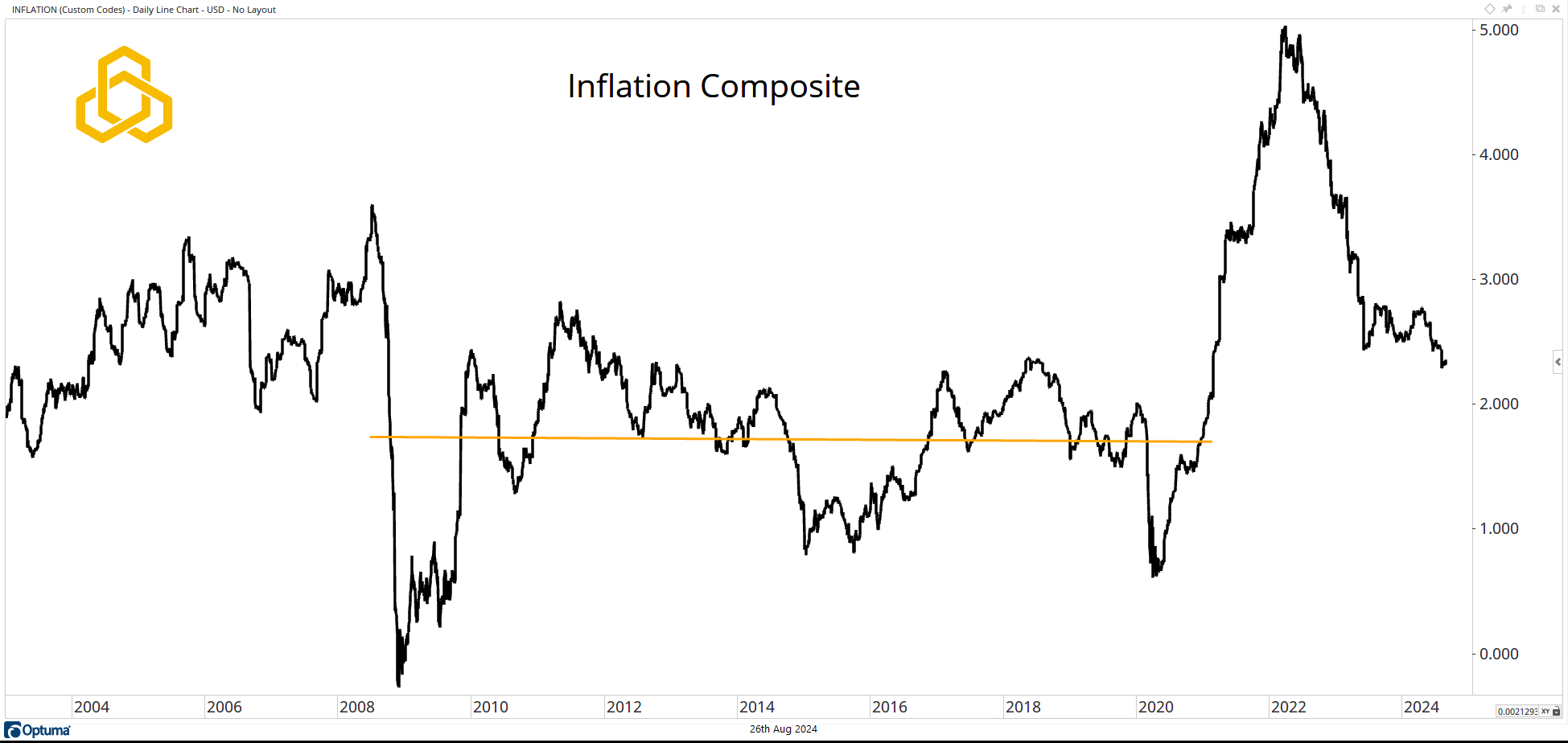

Inflation Composite

The key driver behind the market pricing in a soft landing is inflation. Our Inflation Composite has been trending lower for more than two years. Investors believe that elevated inflation levels are now in the rearview mirror. In fact, even Chairman Powell thinks that this issue is behind us, signaling that rate cuts are on the horizon during a speech last week in Jackson Hole.

I will only note that current levels are well above the trend that was in place from 2008 (Global Financial Crisis) to 2021.

Source: Optuma

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-351-20240826