Pretty Decisive

May 19, 2025

If you knew nothing but the appearance of the weekly candles for the major averages, you’d be hard-pressed to be bearish. Yes, I know the U.S. credit rating was downgraded after the week was complete—but we’re focused on market data. If the downgrade proves meaningful, it will filter through market prices. But we don’t know if that will happen, nobody does. What we do know is that stocks around the world put in a decisively strong week.

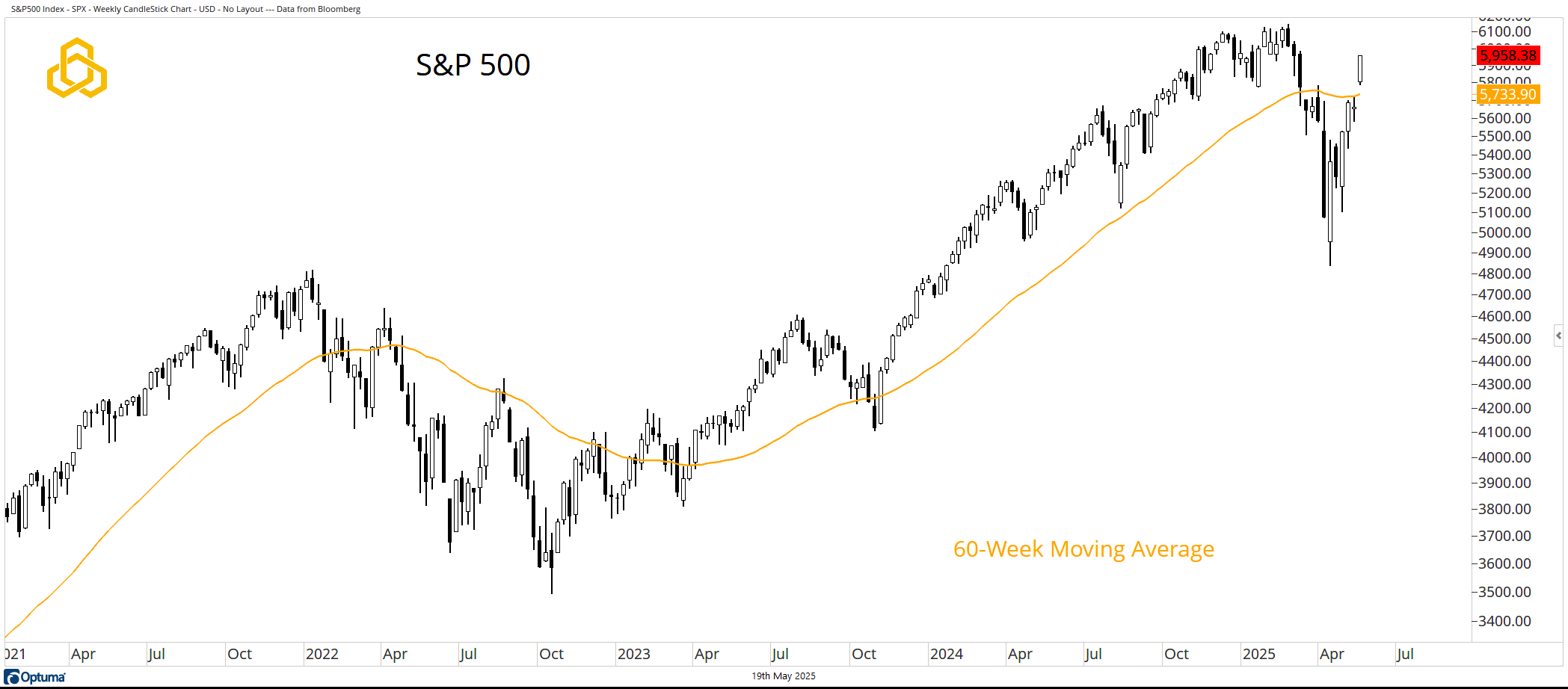

S&P 500

The S&P 500 didn’t just trade through the 60-week moving average—it vaulted over it with a Monday gap. From there, the index never looked back, closing at the high of the week. If that was all you knew, you’d be bullish.

Given the U.S. credit rating cut, it’s logical to expect some near-term weakness. However, as long as the index remains above the 60-week moving average, the odds favor a run to new highs.

Source: Optuma

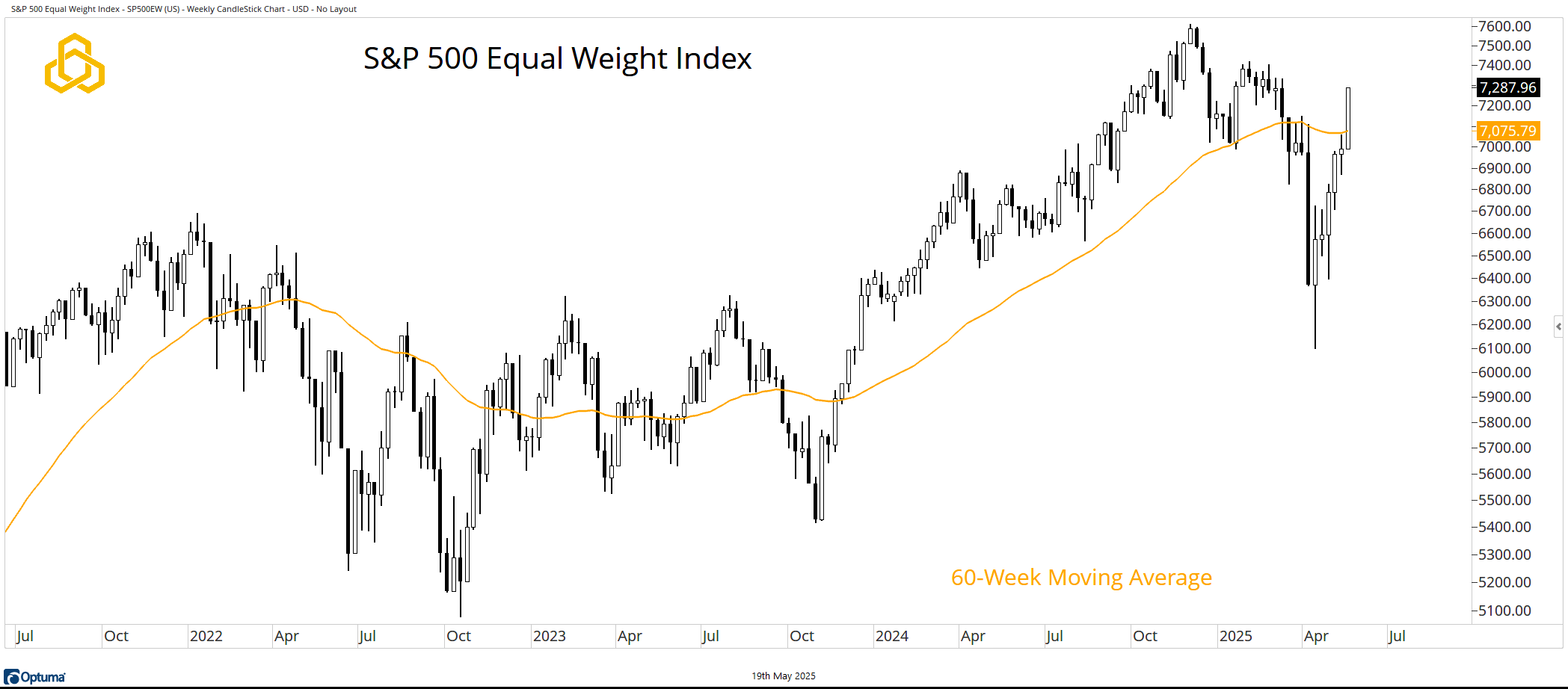

S&P 500 Equal Weight

In a sign that equity strength was broad-based, the Equal Weight S&P 500 also powered through its 60-week moving average. The move was more like a fullback hitting the line and plowing through, but the result was the same: a weekly close at the top of the range, with eyes now on the highs.

Source: Optuma

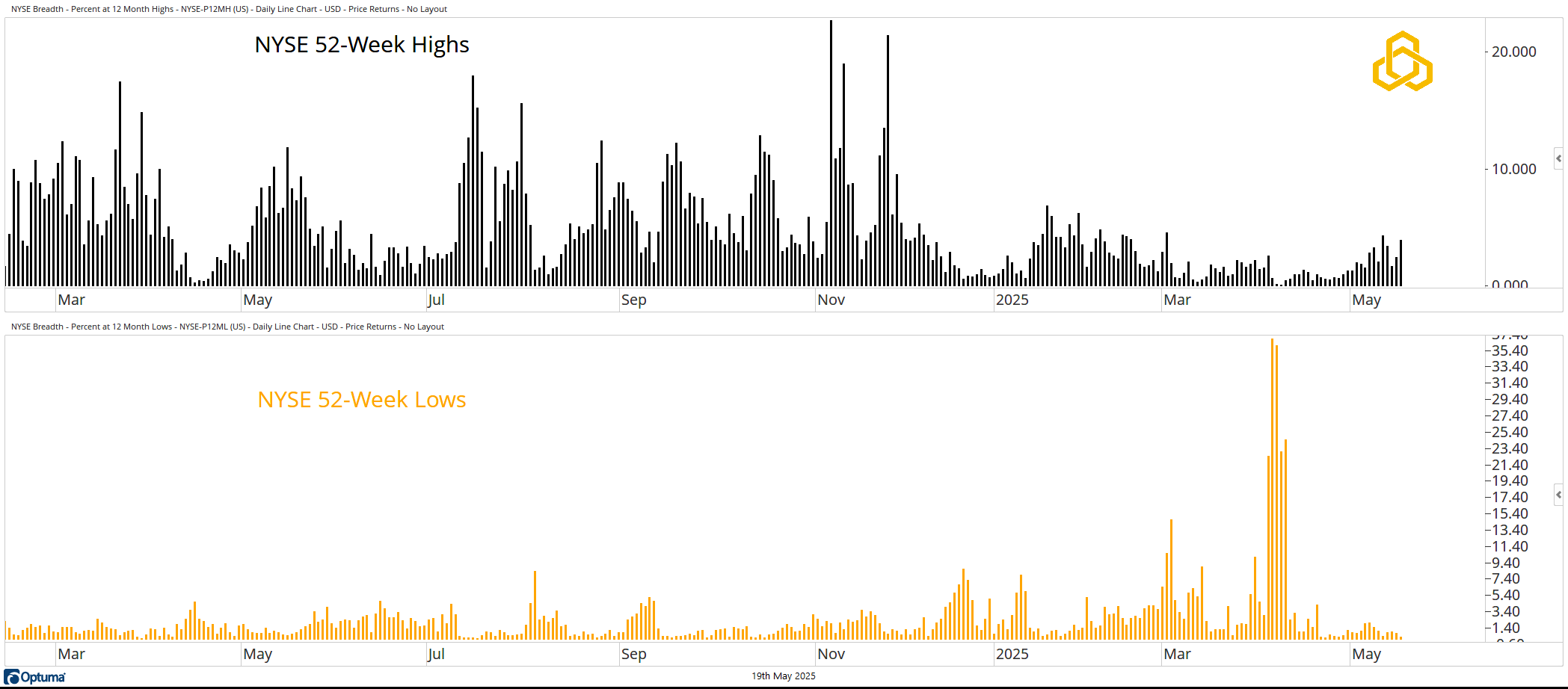

NYSE New Highs & Lows

As both versions of the S&P 500 made decisive upside moves, new 52-week lows on the NYSE became virtually nonexistent. At the same time, new highs are trending in the right direction.

Source: Optuma

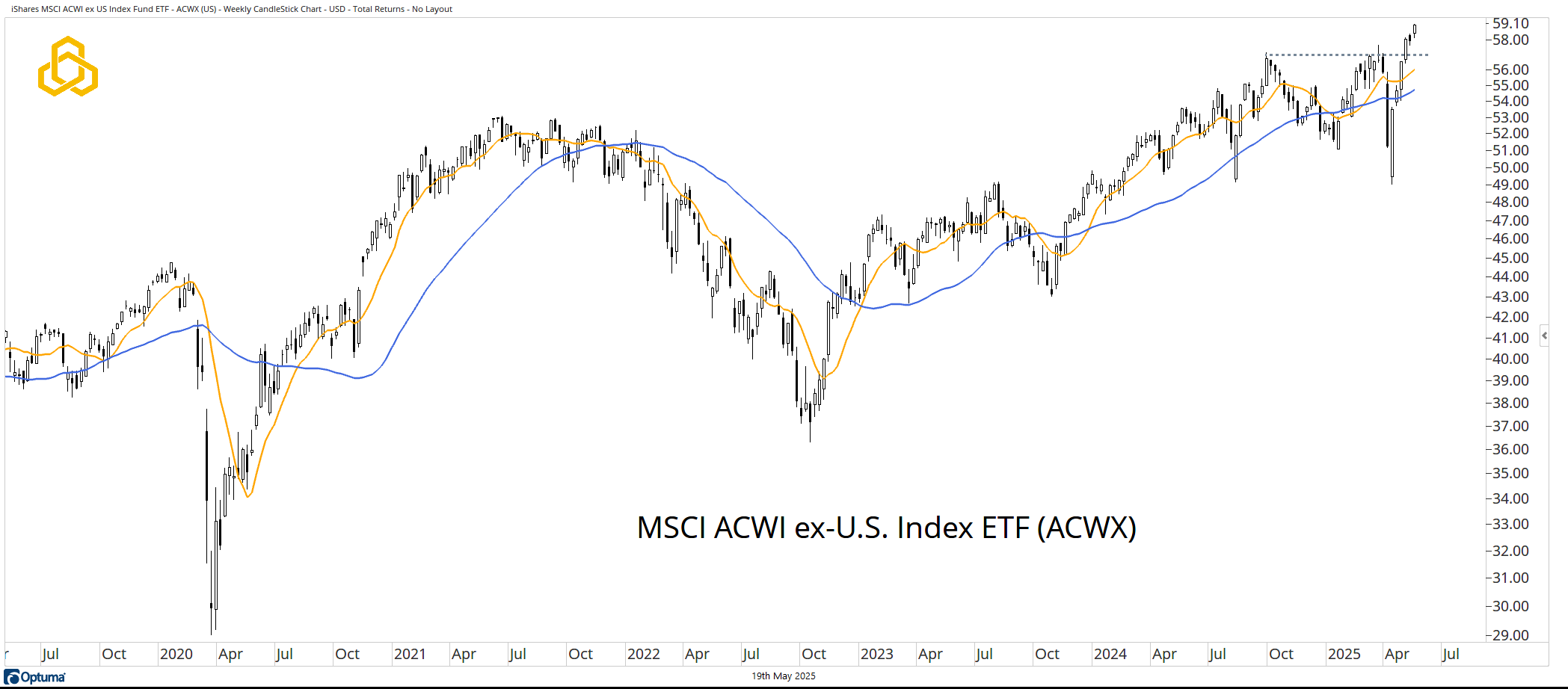

It’s Not Just the U.S.

In another nod to the broadness of equity strength, the MSCI ACWI ex-U.S. ETF (ACWX) traded to—and closed at—a new high last week. The fund is above both its rising 10-week and 40-week moving averages, which is a clearly bullish dynamic by trend-following standards.

Source: Optuma

Rates

Fine—we’d be remiss not to at least pay some lip service to the weekend news. After the close of trading on Friday, the U.S. had its credit rating cut by Moody’s (yes, the same Moody’s that rated mortgage debt heading into the global financial crisis).

Rates across the curve have been stuck in a range for years. Perhaps this will be the catalyst for a breakout move higher? Regardless, there’s still a lot of work to do before a clear trend emerges. But, if the U.S. is not a AAA credit, who is?

Source: Optuma

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-317-20250519