I Don't Know...

Dan Russo, CMT June 23, 2025

The title of today’s missive is my attempt to get in front of the inevitable questions.

What does greater escalation in the Middle East mean for the market?

“I don’t know.”

What stocks will do best if there’s a larger war?

“I don’t know.”

Shouldn’t Treasuries rip higher?

“I don’t know.”

What I do know is that the market does not seem overly concerned. And if that changes, the Federal Reserve appears to have room to move rates lower—by about two cuts. It wouldn’t be a surprise to see the dip buyers mentioned in last week’s note show up again.

S&P 500 (Weekly)

The S&P 500 closed lower for the second consecutive week—the first such stretch since March. But the move was slight, and likely not enough to shake “buy and hold” investors out of position. The index remains above the rising 60-week moving average and is roughly 3% off all-time highs.

Source: Optuma

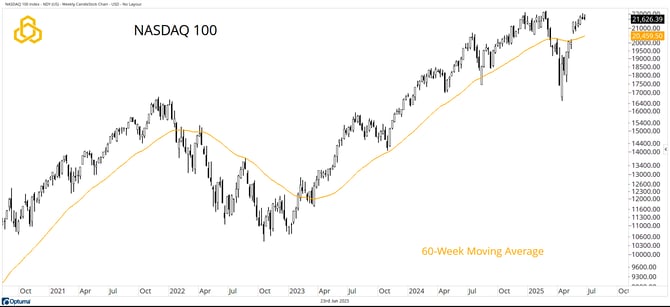

NASDAQ 100 (Weekly)

The NASDAQ 100 exhibits a lot of the same qualities as the S&P 500. This does not look like a concern on the part of investors.

Source: Optuma

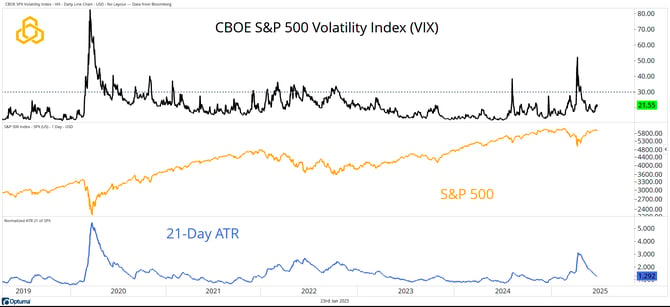

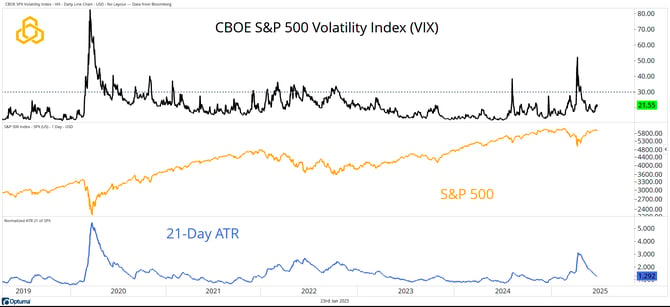

CBOE S&P 500 Volatility Index (Daily)

Yes, the VIX has moved higher. No, it’s nowhere near panic levels. As of 6:35 a.m. on June 23, the VIX stood at 21.02, which implies daily moves of ~1.31% over the next month.

For context, the 21-day Average True Range (ATR)—a proxy for one-month realized volatility—is currently ~1.29%. In short: investors expect the next month to look a lot like the past month.

Source: Optuma

Fed Funds & the 2-Year

The charts above don’t reflect current market distress, but if sentiment does shift, the Fed will have flexibility.

Here’s the math: the Fed Funds Rate (blue, R/S) is currently 39 basis points above the 2-Year Yield (black, L/S). That implies roughly two cuts of room, should conditions deteriorate.

Is this exact science? No. But it’s a useful frame of reference.

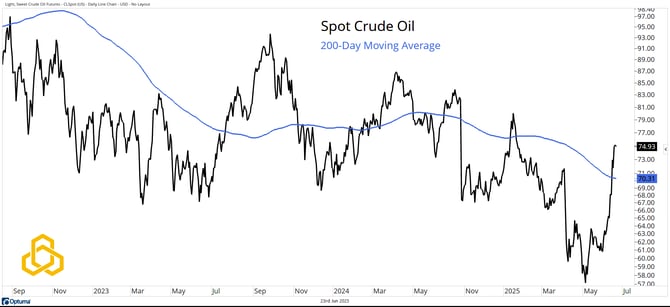

Crude Oil: The Wild Card

The wildcard in this entire calculus is Crude Oil. Spot prices bottomed out nearly two months ago, and crude has since moved above its 200-day moving average. However, it’s not extending that move in early Monday trading.

A quick pullback in crude would reinforce the idea that markets aren’t overly concerned. But a continued move higher would suggest otherwise—and may reintroduce inflation concerns, making rate cuts less likely.

Source: Optuma

Final Thought

We don’t know how geopolitics will evolve. We don’t know which assets will respond or how quickly. But the market has not yet priced in fear. And for now, that’s the most important thing we do know.

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-322-20250623