Now What?

Sep 23, 2024

For the first time in more than four years, the Federal Reserve cut interest rates. This move did not come as much of a surprise to investors, as Fed Fund Futures were pricing in a 69% chance of a 50-basis-point cut on the morning of the event.

While many will debate the rationale behind the cut, we freely admit that those debates are largely a waste of time for our investment process. We will continue to focus on the price impacts of “key events” and how those impacts flow through our systems and composite models.

What Happens When the Federal Reserve Cuts Rates for the First Time?

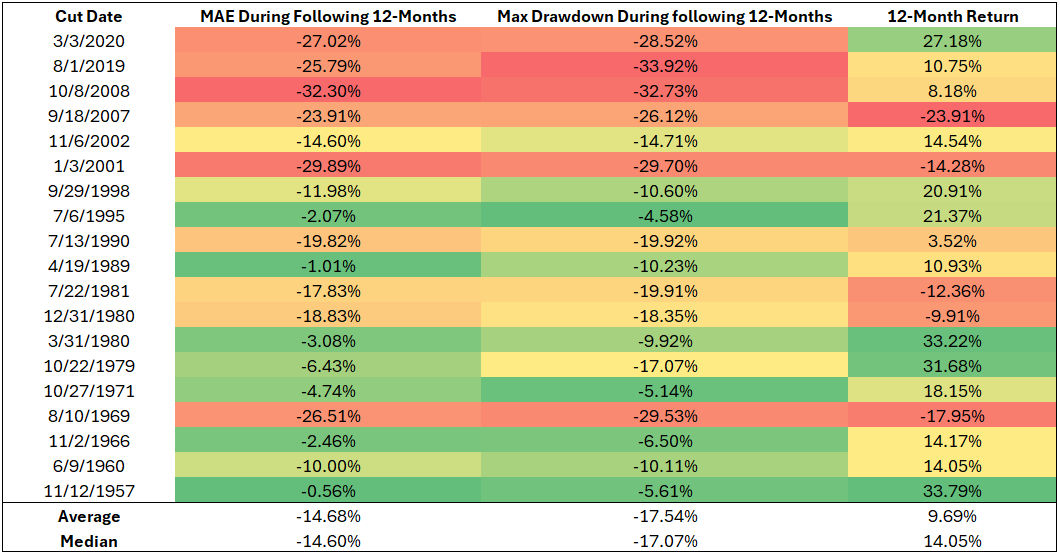

At Potomac, we dislike the types of analysis that simply look at an event and tell you how an asset performed over the next X-number of months—usually 12, so we will stick with that. We dislike it because it's incomplete. There is rarely any mention of what the journey is like. What does the investor have to endure to arrive at that outcome 12 months later? The table below highlights key metrics for the S&P 500 Index following the first cut of the cycle.

Source: Potomac, Norgate, Y-Charts, Federal Reserve

Maximum Adverse Excursion (MAE) shows us the largest amount by which the index was underwater from the signal date. Maximum Drawdown (MDD) tells us the maximum amount the index declined from its high-water mark during the period.

Inflation

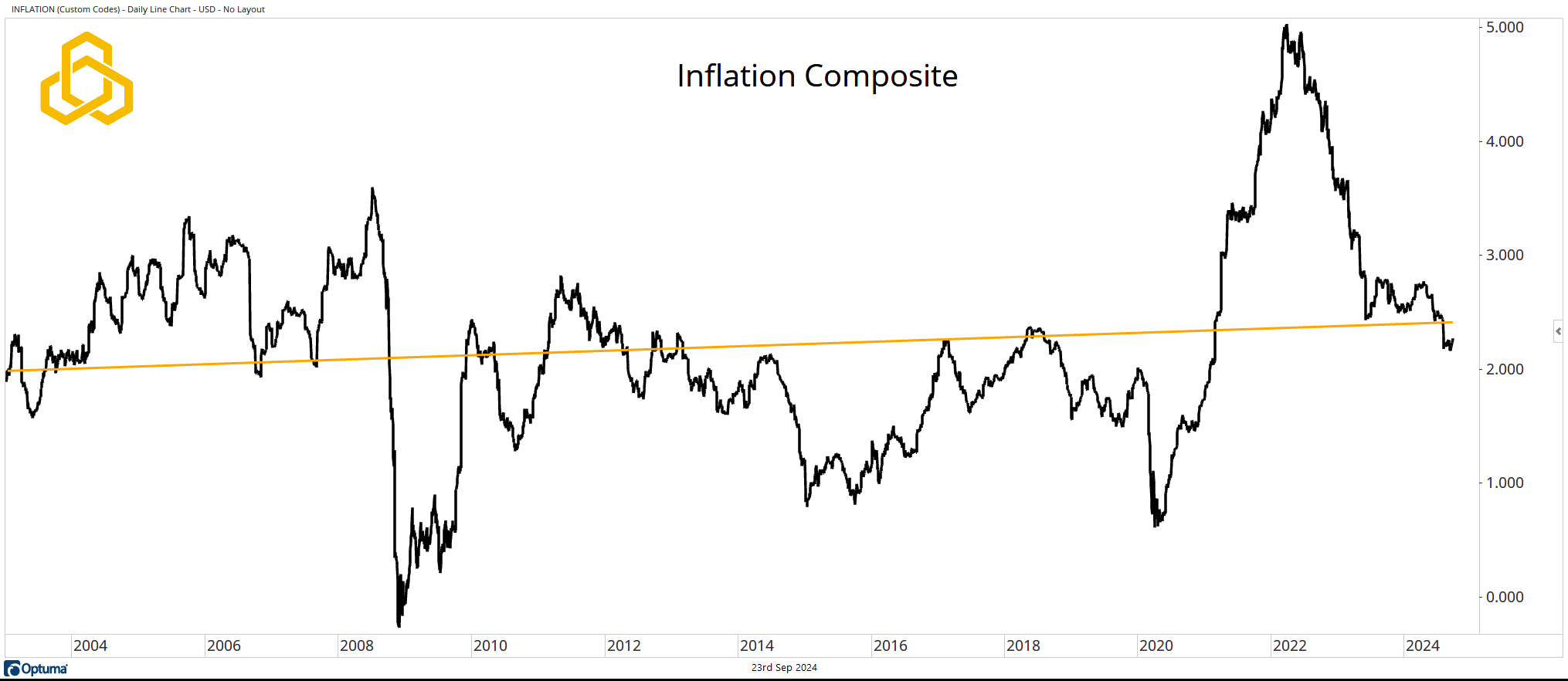

Going forward, inflation metrics will likely be the key variable. Why? Because the Federal Reserve is assuming another 50 basis points of cuts this year and 100 basis points of cuts in 2025. At the same time, they are assuming a steady unemployment rate, near current levels. Some may argue that 200 bps of cuts with unemployment holding steady is a recipe for higher inflation (all else equal).

Our Inflation Composite (a combination of CPI, five-year, and ten-year forwards) is slightly below the trend of the last 20+ years. Will that remain the case? Will there be a reacceleration of inflation? Will there be a big spike in unemployment?

Source: Optuma

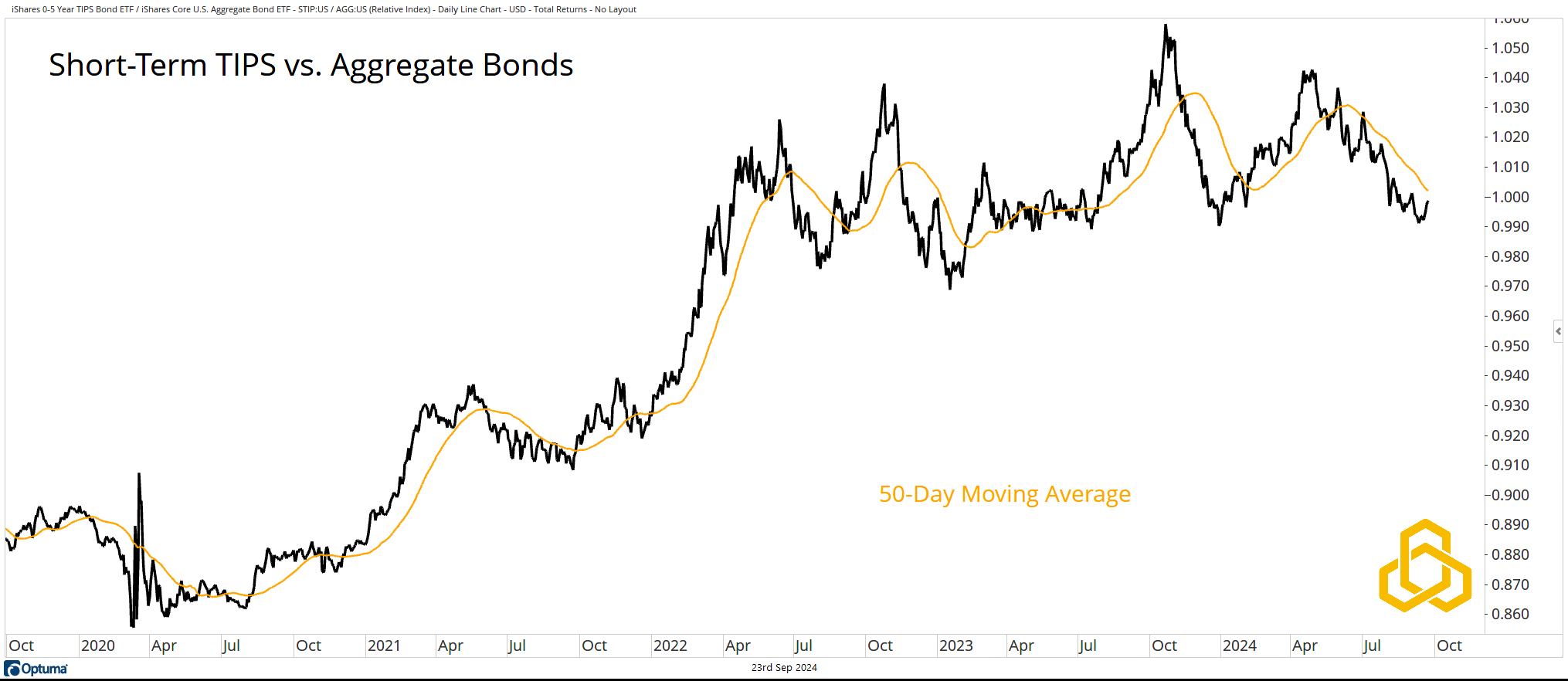

What Does the Market Think of Inflation?

So far, the market is not concerned about a possible reacceleration of inflation. The ratio of Short-Term TIPS to Aggregate Bonds is sitting in a two-year consolidation below a declining 50-day moving average. This is a far cry from the outperformance that TIPS delivered in 2020 and 2021. An upside inflation surprise would likely catch the greatest number of investors out of position.

Source: Optuma

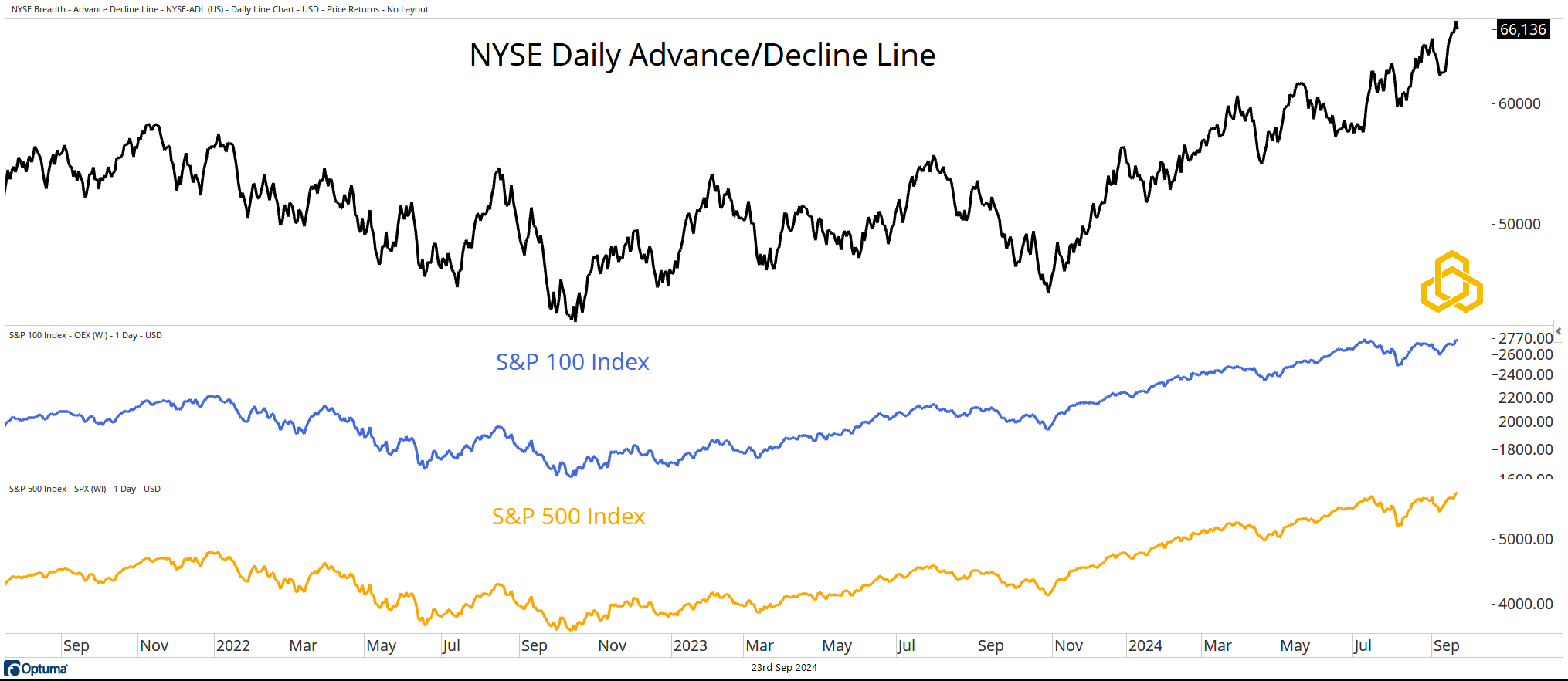

Equities Are Only Focused on New Highs

For now, the equity market has one focus: new highs. Both the S&P 500 and the S&P 100 are trading at record levels. The bullish trends are confirmed by breadth, as the NYSE Advance/Decline Line is also at record highs.

Given this dynamic, it is hard to imagine a severe decline from current levels without a significant change in the inflation or employment picture.

Source: Optuma

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-359-20240923