Listening to the Message of the Market

August 12, 2024

Last week, we discussed the “possible” rationale for recent weakness in the market: the Yen Carry Trade. That prompted questions from some readers about what we are doing about it. I want to address that here. Specifically, regarding the Yen Carry Trade, we are doing nothing.

We continue to follow our tested, objective process. We do not optimize this process for a specific state of the world. If we looked back in history at the number of times the Yen Carry Trade has been unwound as a trading signal, the sample size would be small, and the results of the analysis would be useless.

However, if the unwinding of a trade like this one causes our systems to flash sell signals, leading to the composite model exiting the market, then we will follow those signals the same way we always do. We remain of the view that if something is important enough, it will show up in our data.

We listen to the message of the market.

Three-Month Returns

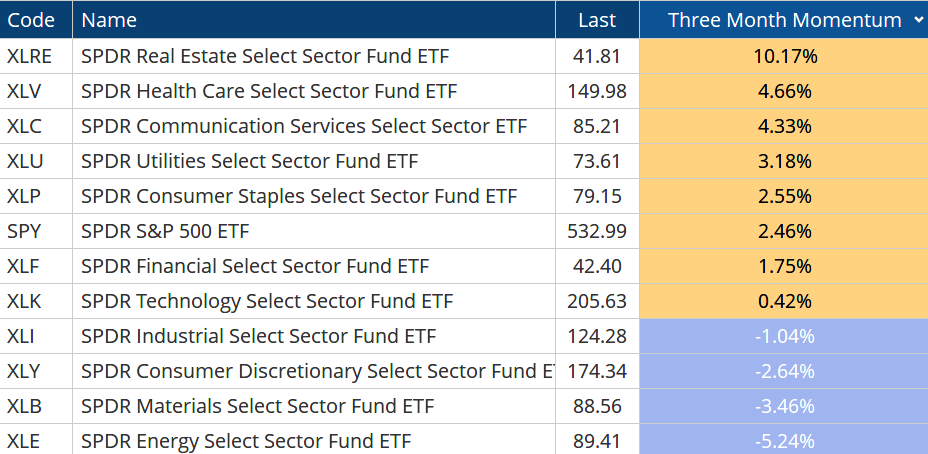

The interesting thing about the market is that it will give you messages. Over the past three months, back to May when perhaps five people were paying attention to Japan specifically, four of the top five performing sectors are defensive in nature. The fifth, Communication Services, actually includes many defensive stocks as well.

All five are beating the S&P 500 over this timeframe. Note the two most economically sensitive groups, Materials and Energy, are at the bottom of the list.

*Chart from Optuma as of the close of trading on August 9, 2024.

New Highs / New Lows

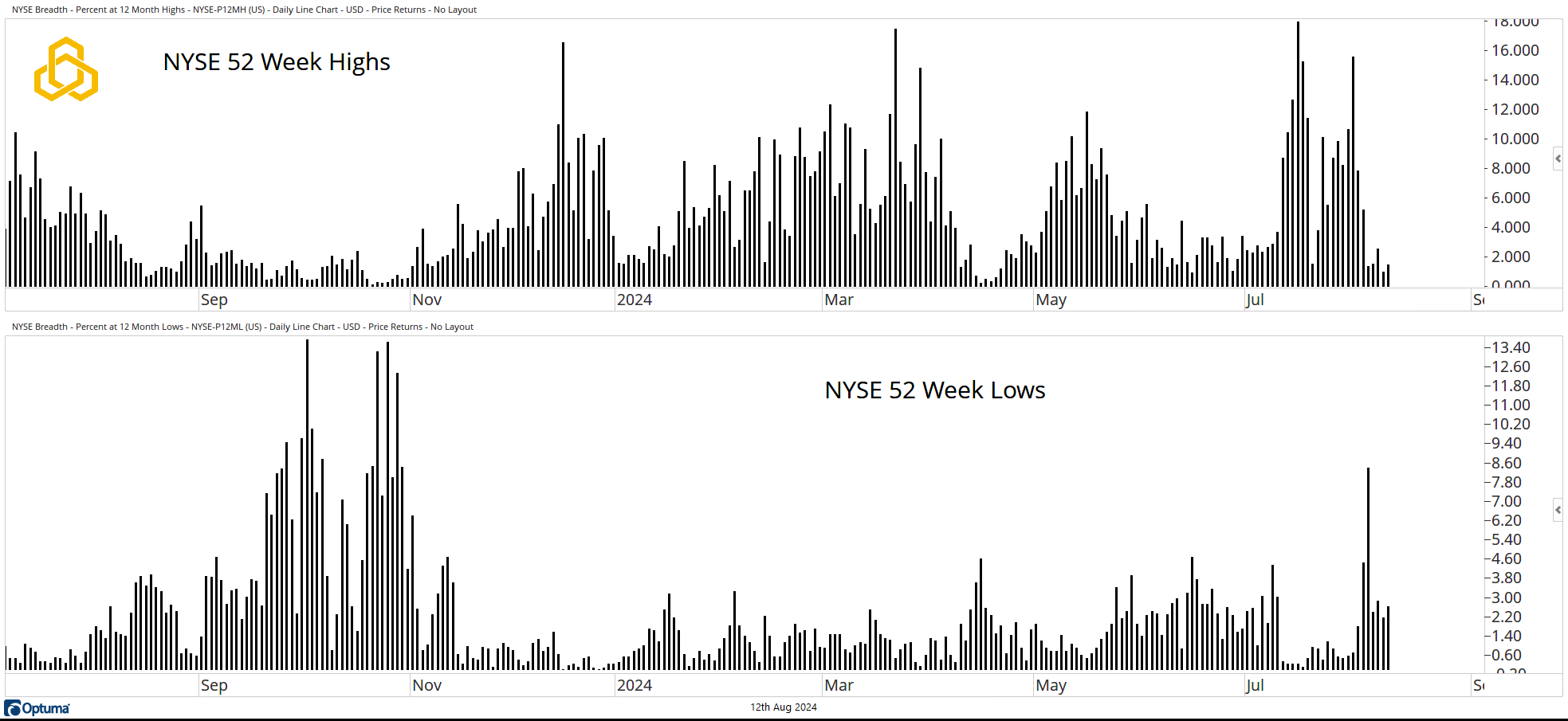

Over the past week, as the market rebounded from Monday’s swoon, we have seen more stocks making new 52-week lows and fewer stocks making new 52-week highs. The levels are not alarming yet, but the direction can’t be ignored.

*Chart from Optuma as of the close of trading on August 9, 2024.

Commodities

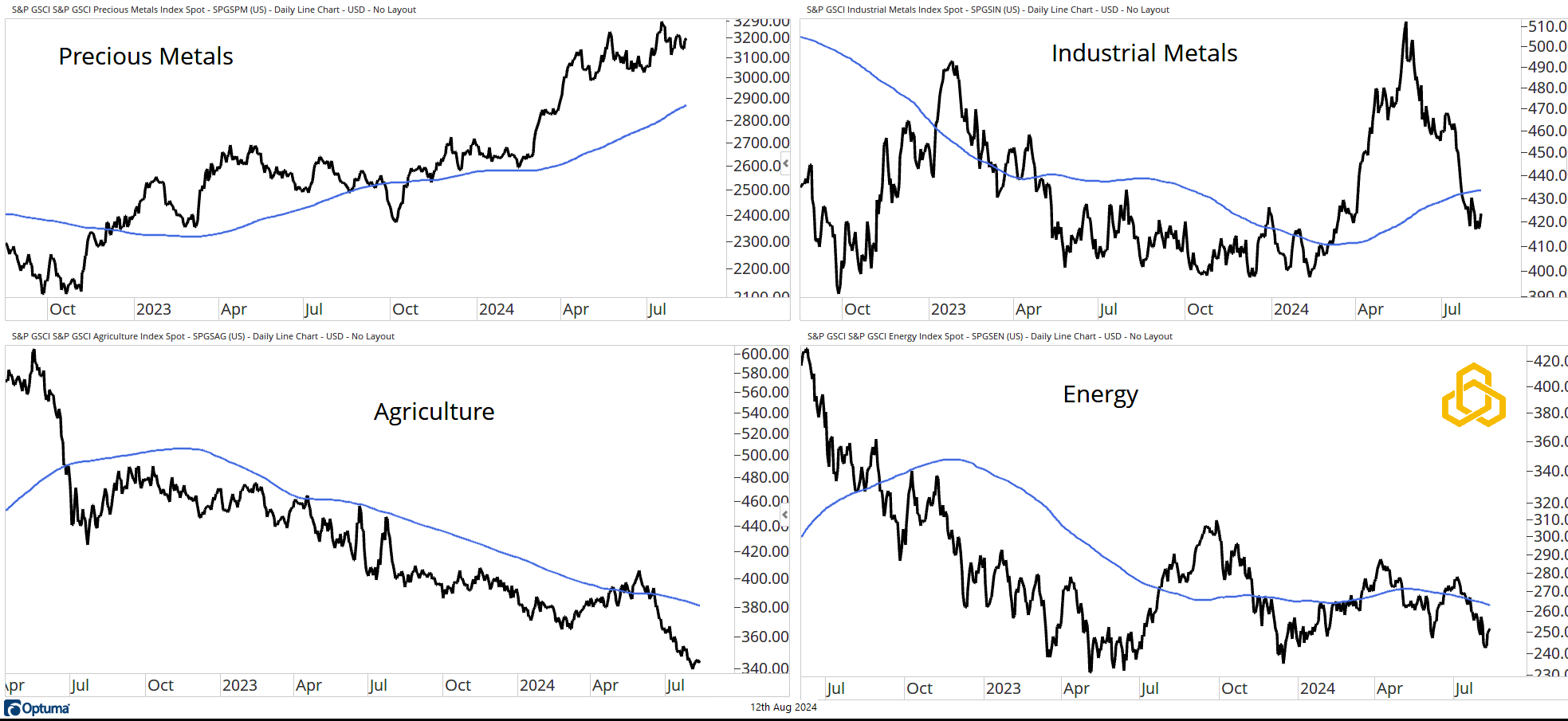

Within the commodity complex, only the Precious Metals are in an uptrend, above a rising 200-day moving average. The more economically sensitive commodities are flashing a warning sign.

*Chart from Optuma as of the close of trading on August 9, 2024.

High Yield Credit Spreads

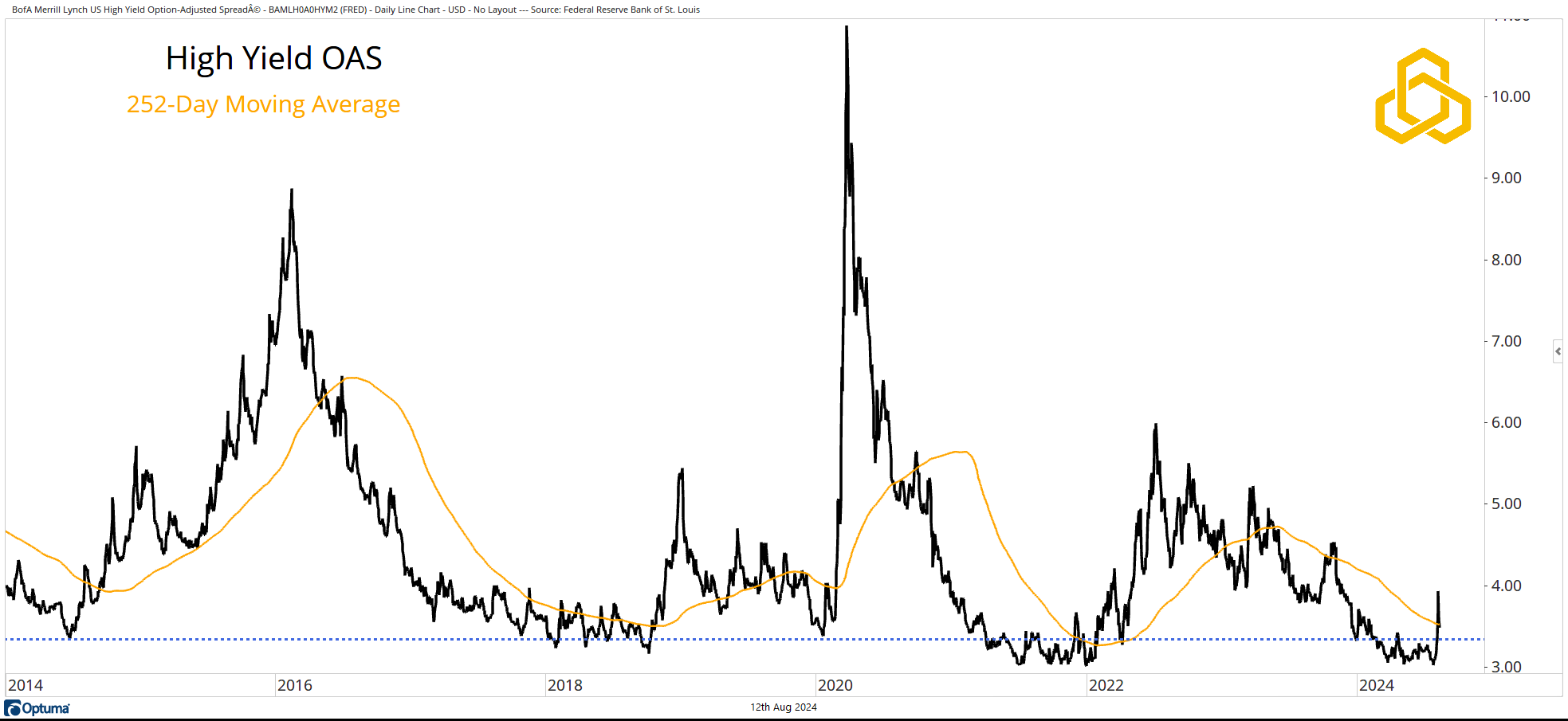

The High Yield Option-Adjusted Spread (a measure of high-yield credit relative to treasuries) has spiked above its 252-day moving average from levels where we have seen spikes in the past (4Q 2018 and early 2022 being the most recent).

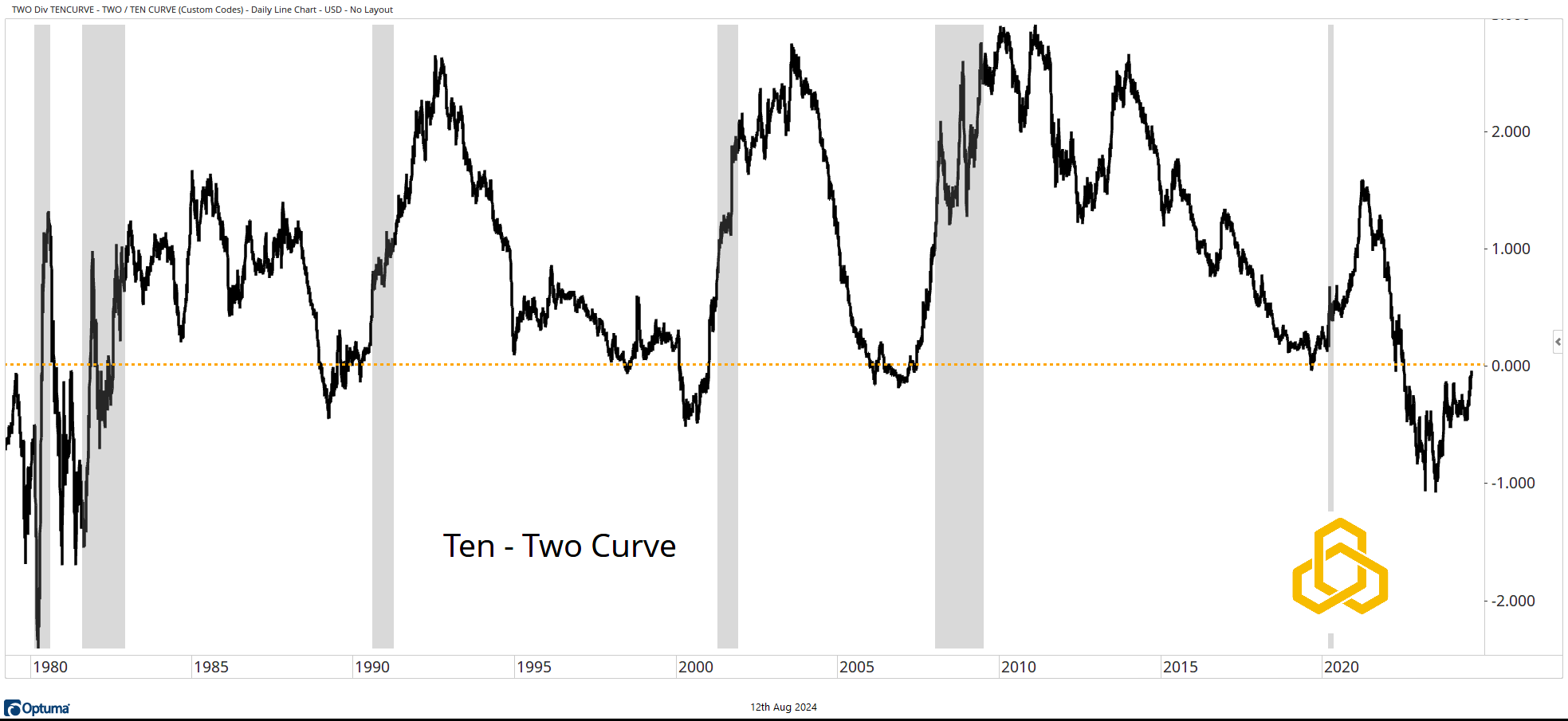

The Curve

When the Ten-Year – Two-Year Curve inverted in April 2022, the permabears jumped at the chance to tell us that a recession was coming. The fact that the curve has remained inverted for more than two years without said recession has emboldened the Perma bulls even more than usual.

We have long contended that the inversion is a distraction. The un-inversion is usually what signals that a recession is close. The curve has been steepening and is close to un-inverting.

*Chart from Optuma as of the close of trading on August 9, 2024.

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-623-20240812