Just the Facts

November 11, 2024

It’s easy to get caught up in the news, especially when it’s as significant as electing a new U.S. president. Right now, everyone is trying to interpret the potential impacts of new policies, key appointments, and the composition of government branches.

When it comes to markets, however, we focus solely on the facts. We look at the trend (whether it’s up, down, or sideways), the health of that trend (measured by market internals), and confirmation of that trend (from an intermarket perspective).

Based on these factors, it’s difficult to argue on behalf of the bears.

What is the Trend?

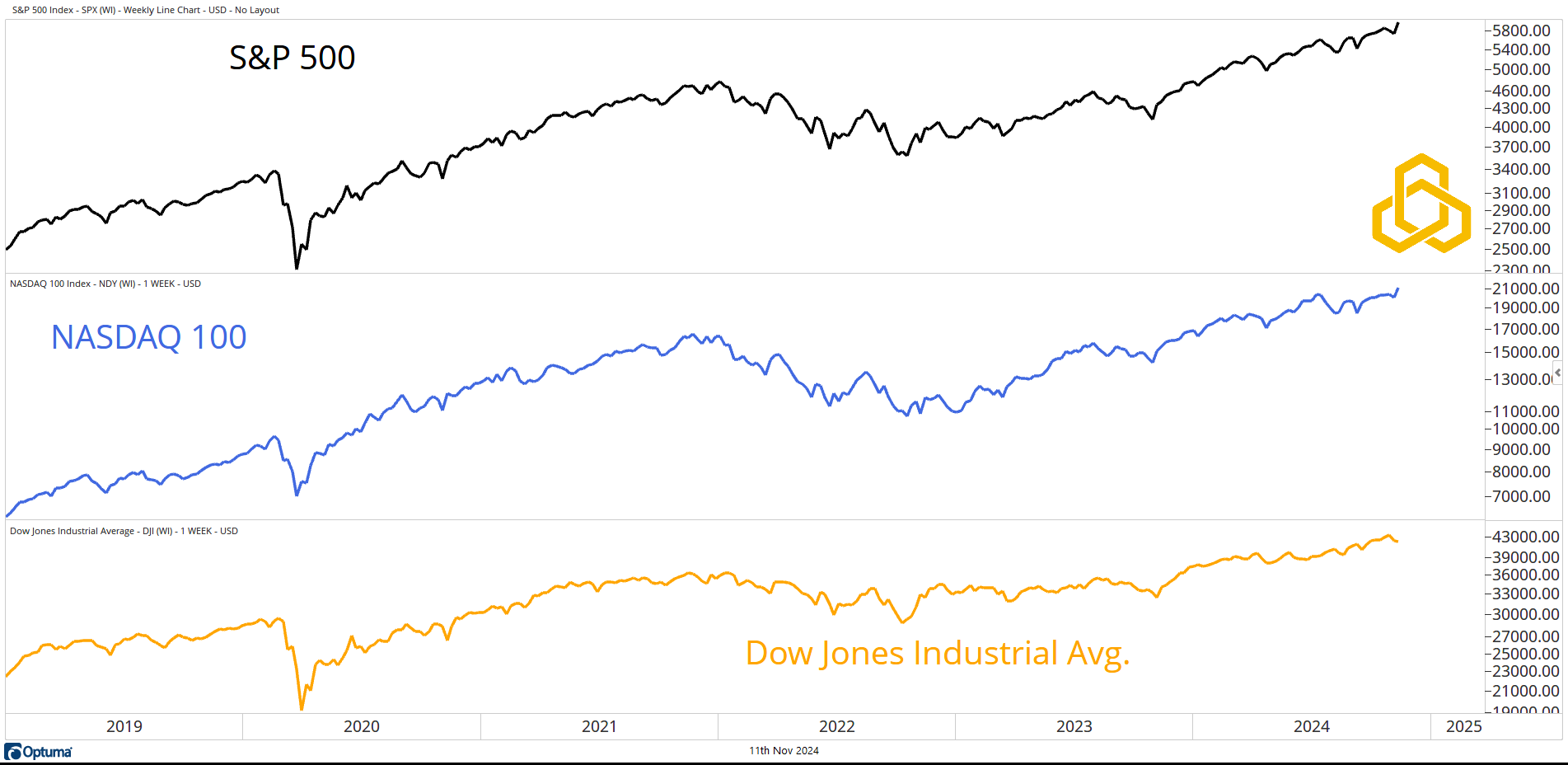

The S&P 500, NASDAQ 100, and Dow Jones Industrial Average all closed at or near all-time highs.

Source: Optuma

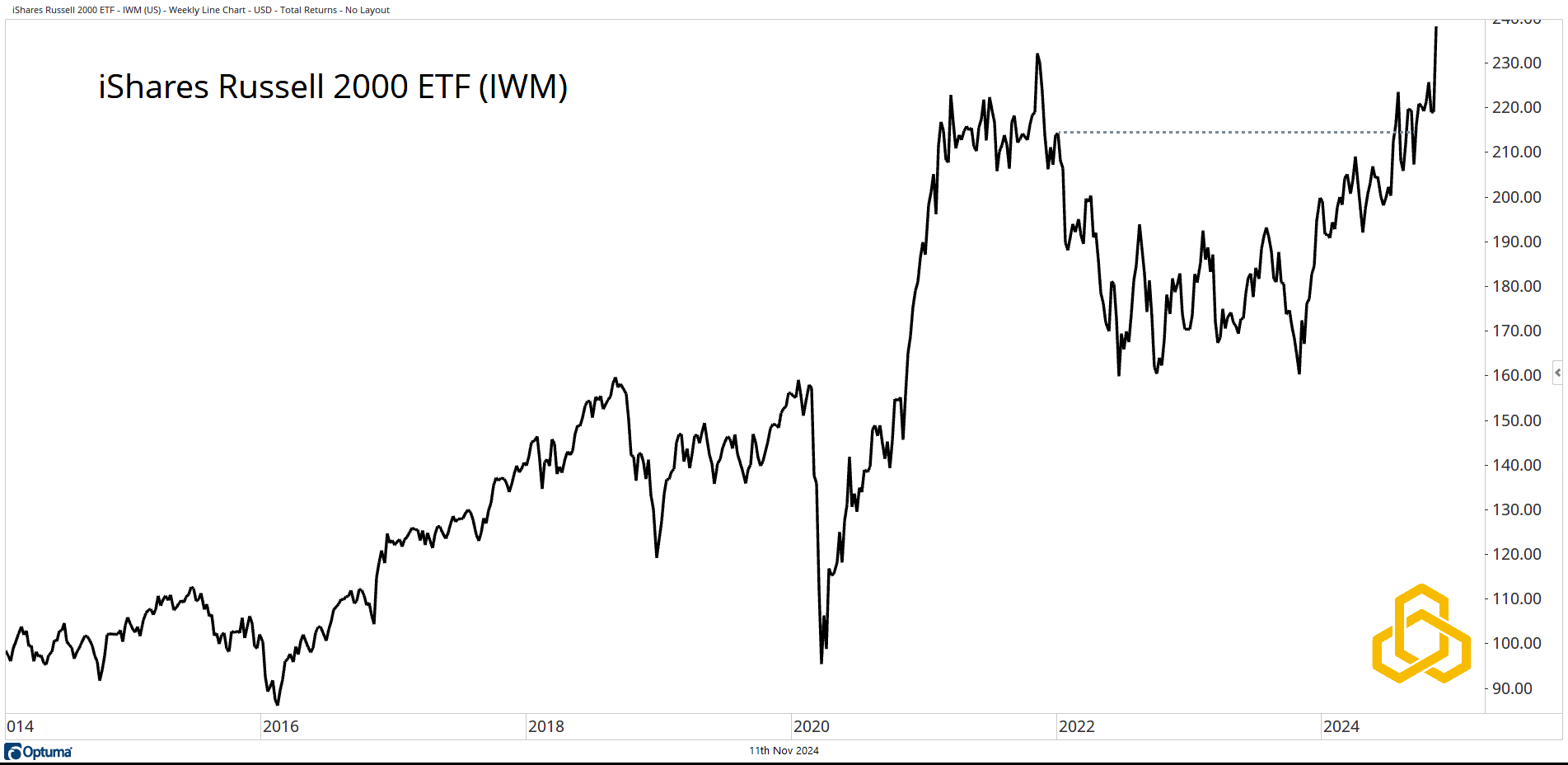

Even small-cap stocks joined the rally. The iShares Russell 2000 ETF (IWM) surged to close the week at record levels, marking a high for the first time in over three years.

Source: Optuma

How Healthy is the Trend?

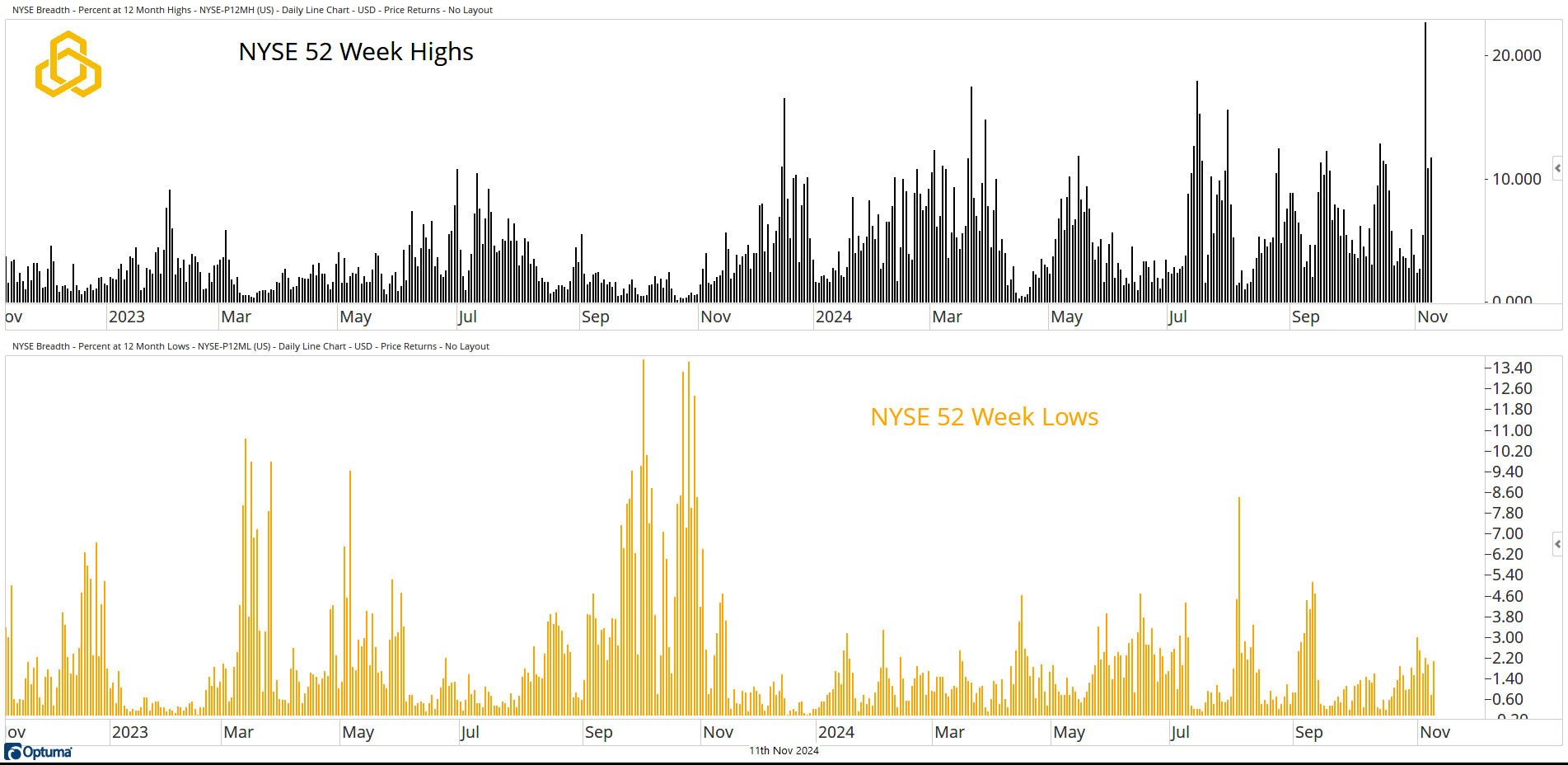

On November 6th, the percentage of stocks on the New York Stock Exchange jumped significantly, reaching more than a two-year high. Importantly, there hasn’t been a sustained or meaningful rise in new lows in 2024.

Source: Optuma

* See also last week’s note highlighting the Advance/Decline Line’s healthy levels.

Is the Trend Confirmed?

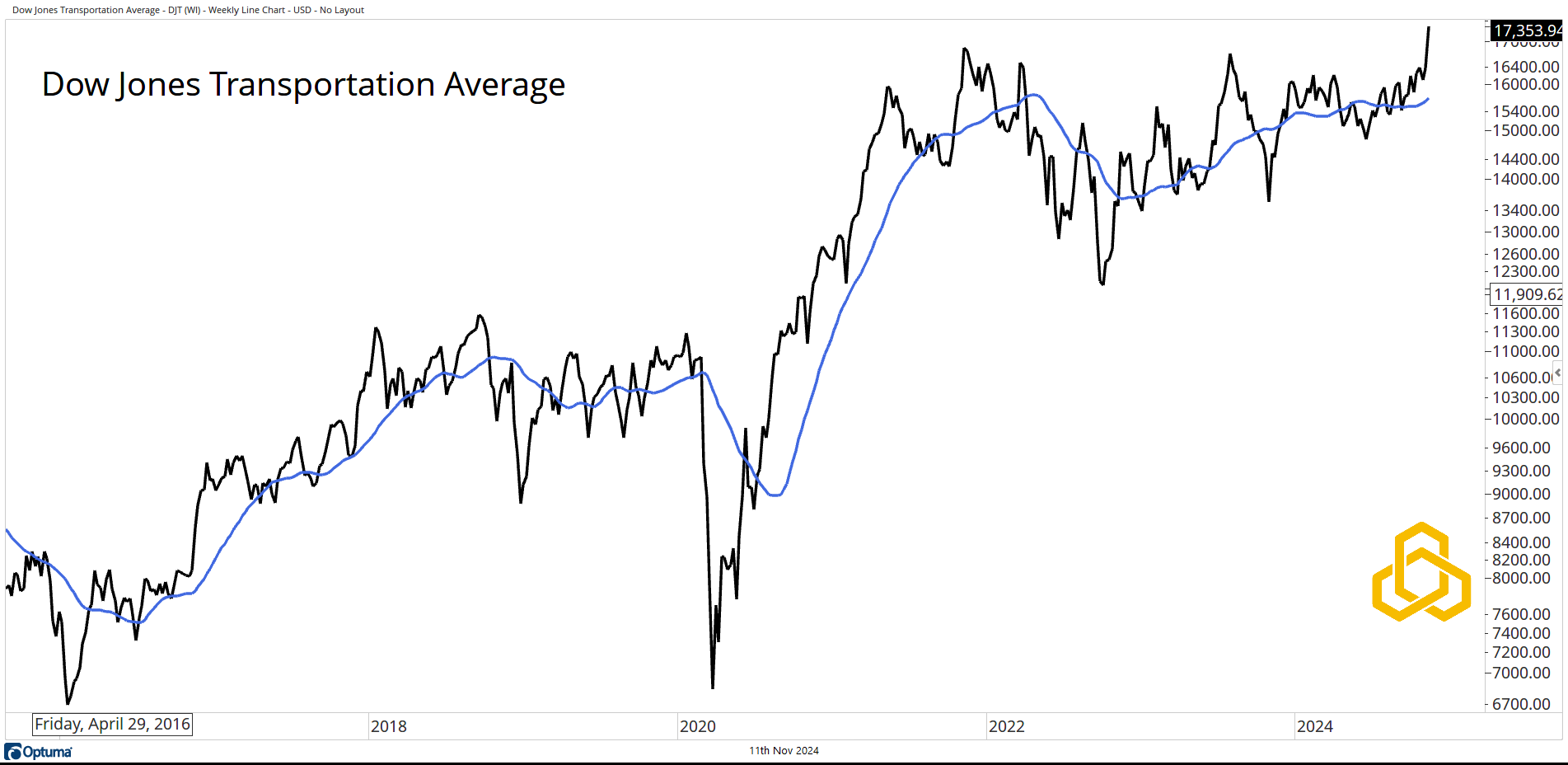

Last week, the Dow Jones Transportation Average broke out of a three-year consolidation above a rising 200-day moving average. According to Dow Theory, this bullish move CONFIRMS the trends in the broader indices.

Source: Optuma

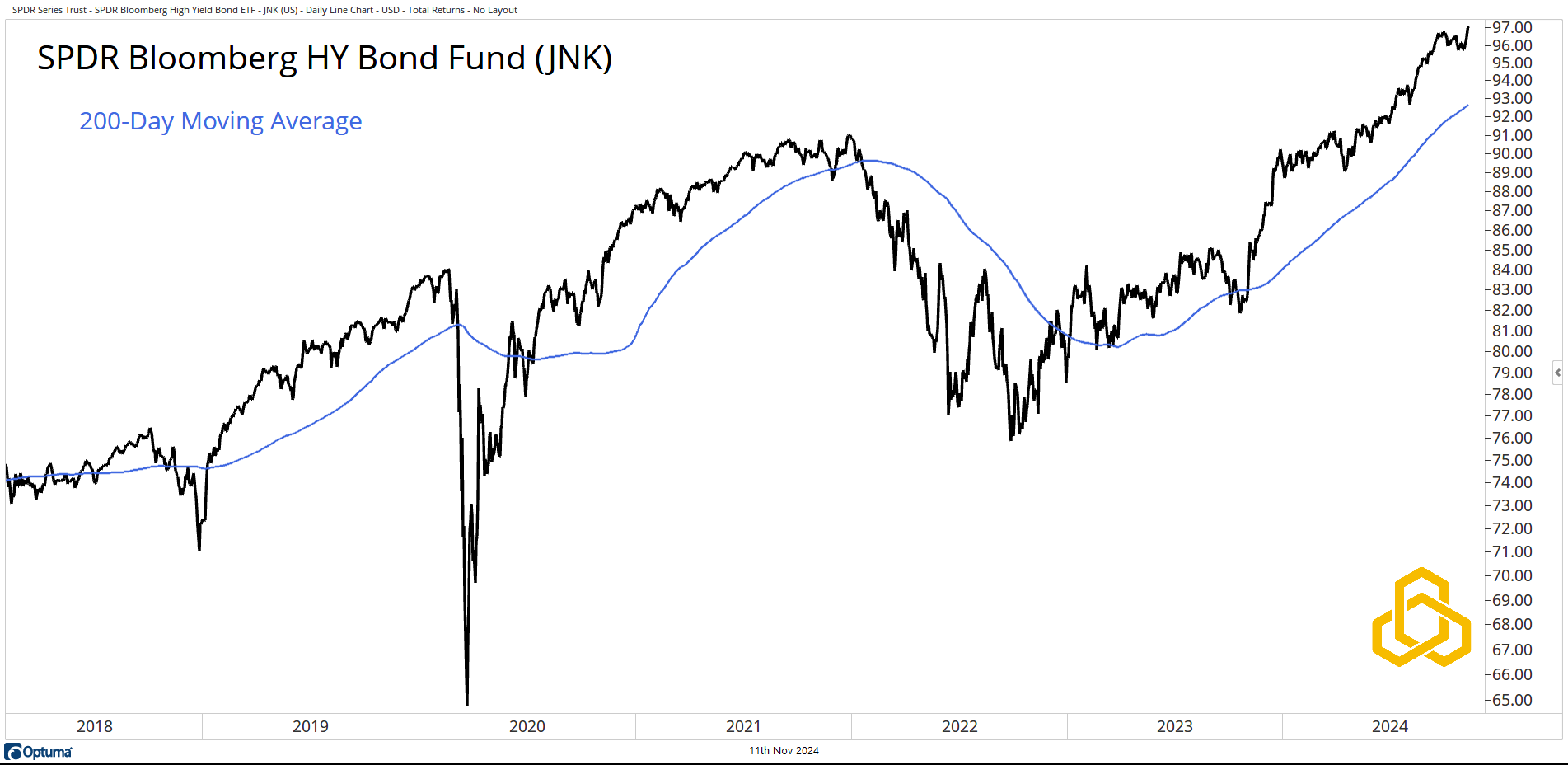

On a total return basis, the SPDR Bloomberg High Yield Bond Fund (JNK) is also in a strong uptrend, trading above a rising 200-day moving average and closing last week at record levels.

Source: Optuma

Finally, with today being Veterans Day in the U.S., we’d like to extend a heartfelt Thank You to all the men and women who have served our country.

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-372-20241111