It’s Not Just a Growth Story

March 24, 2025

Many have argued that recent market weakness is purely a function of the “growth trade” rolling off. Darlings such as Tesla (TSLA) and Nvidia (NVDA) have seen major declines in 2025, pushing the broader cap-weighted indices lower. Arguably, this is a problem for index investors, as the largest weights in the index are causing the most pain.

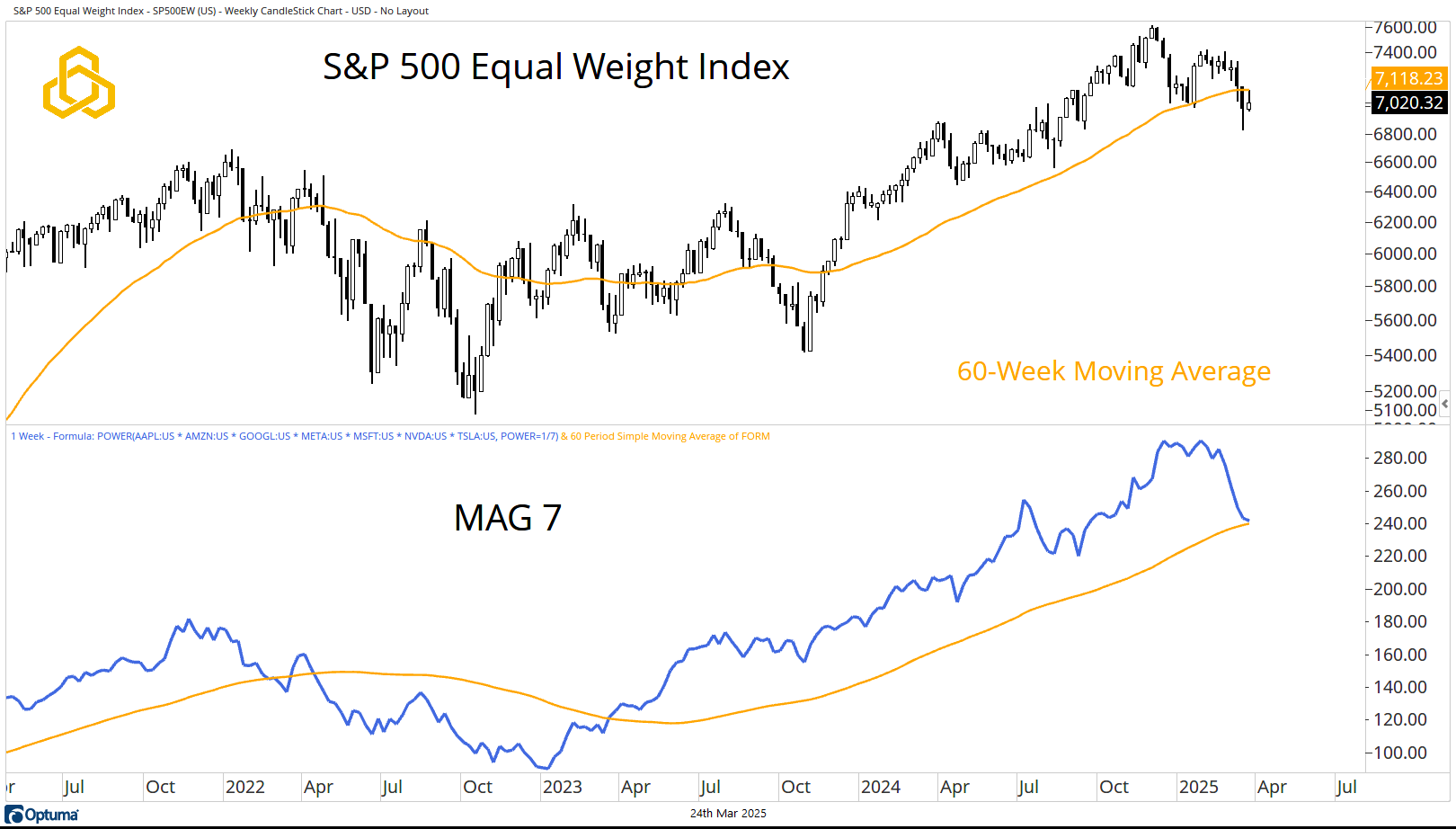

However, if we look at the Equal Weight S&P 500, we will see a similar trend playing out.

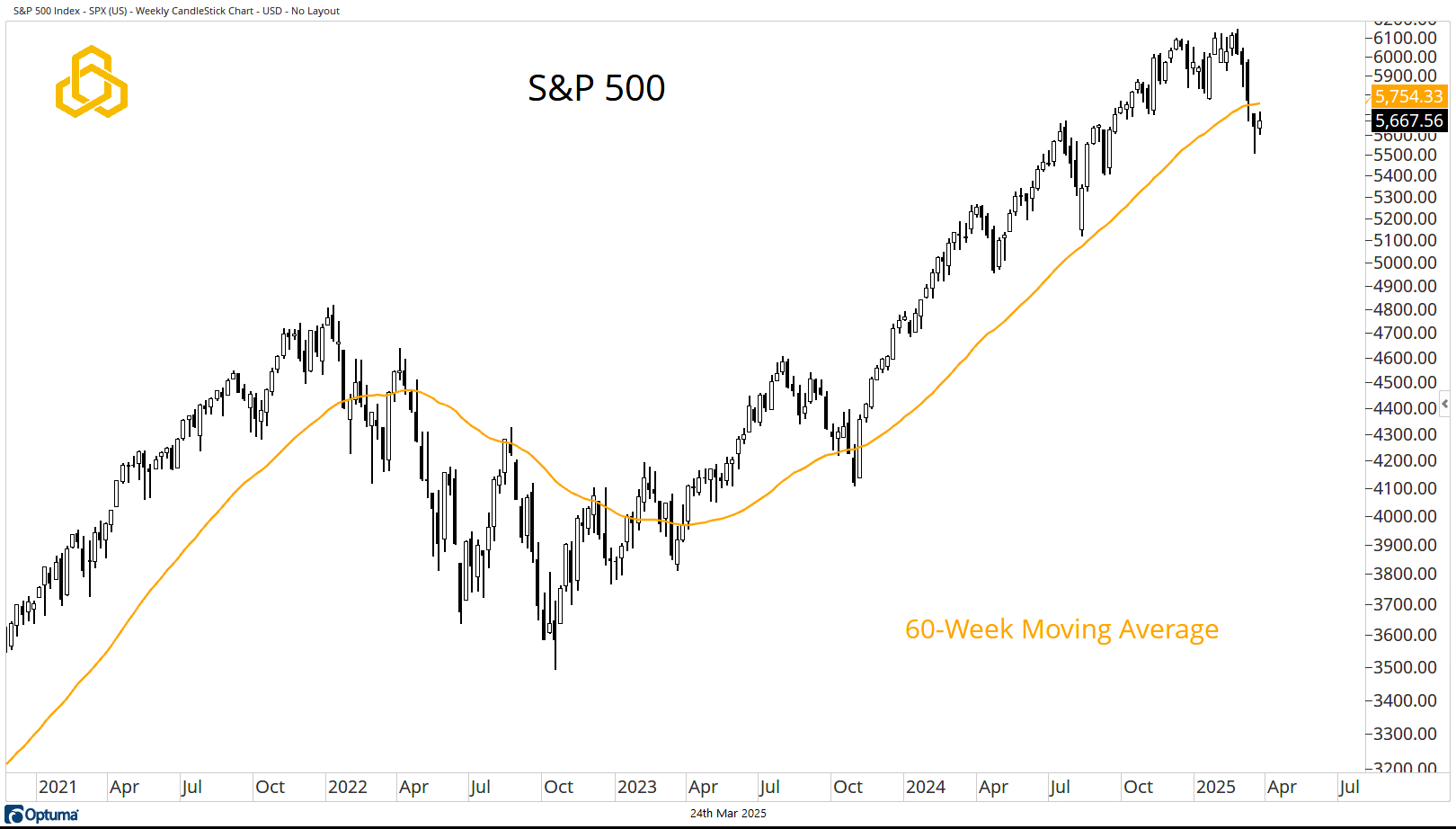

S&P 500

For the second consecutive week, the S&P 500 closed below the 60-week moving average. More importantly, perhaps, is the fact that the moving average is beginning to flatten. Essentially, the long-term trend is shifting from rising to flat. Bulls want to see this key measure of trend recaptured and begin to turn higher in short order.

Source: Optuma

S&P 500 Equal Weight Index

Many in the bullish camp have argued that there is not a major cause for concern here because it is only the MAG 7 that is pulling the market lower. Yes, the MAG 7 has been hit hard—no one is debating that. But, at the same time, the S&P 500 EW has a structure that is very similar to that of the S&P 500. It sits below the 60-week moving average, which is beginning to shift from rising to flat.

Meanwhile, Equal Weight MAG 7 is holding above the still-rising 60-week moving average.

Source: Optuma

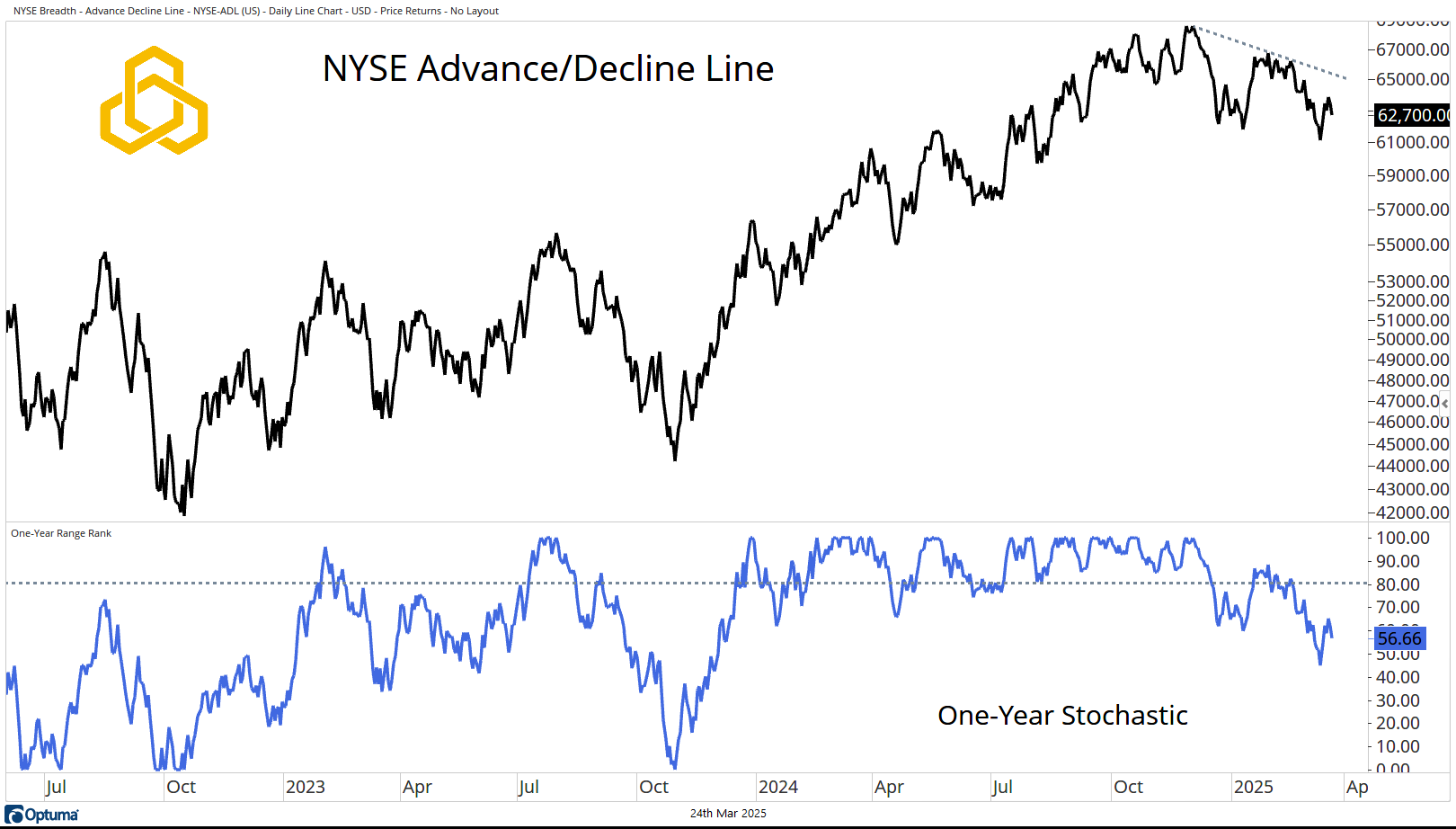

NYSE Advance/Decline Line

Despite a reprieve in the market last week, the NYSE Advance/Decline Line actually ticked lower on the week. At the same time, the one-year stochastic moved down as well. This metric now sits well below 80%.

Source: Optuma

The simple fact of the matter is that for U.S. investors investing domestically, breadth is weakening, confirming the recent move lower in equity prices.

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-307-20250324