It’s Not All Tech All the Time

February 10, 2025

This past weekend was less eventful than the previous three as it relates to “things that investors are worried about,” and as I went through my weekly process to prepare for this writing, it struck me that there was not much new to add to what we have been saying.

That gave me a chance to pick up on something more interesting. Investors spend a lot of time focused on Technology stocks. This makes sense, as the group is the largest sector weight in the S&P 500. However, it is interesting to note that the group has not been overly exciting for more than half a year. At the same time, the “most important” part of the Technology sector has been dead money for nearly a year. Yet, the S&P 500 remains in a steady uptrend.

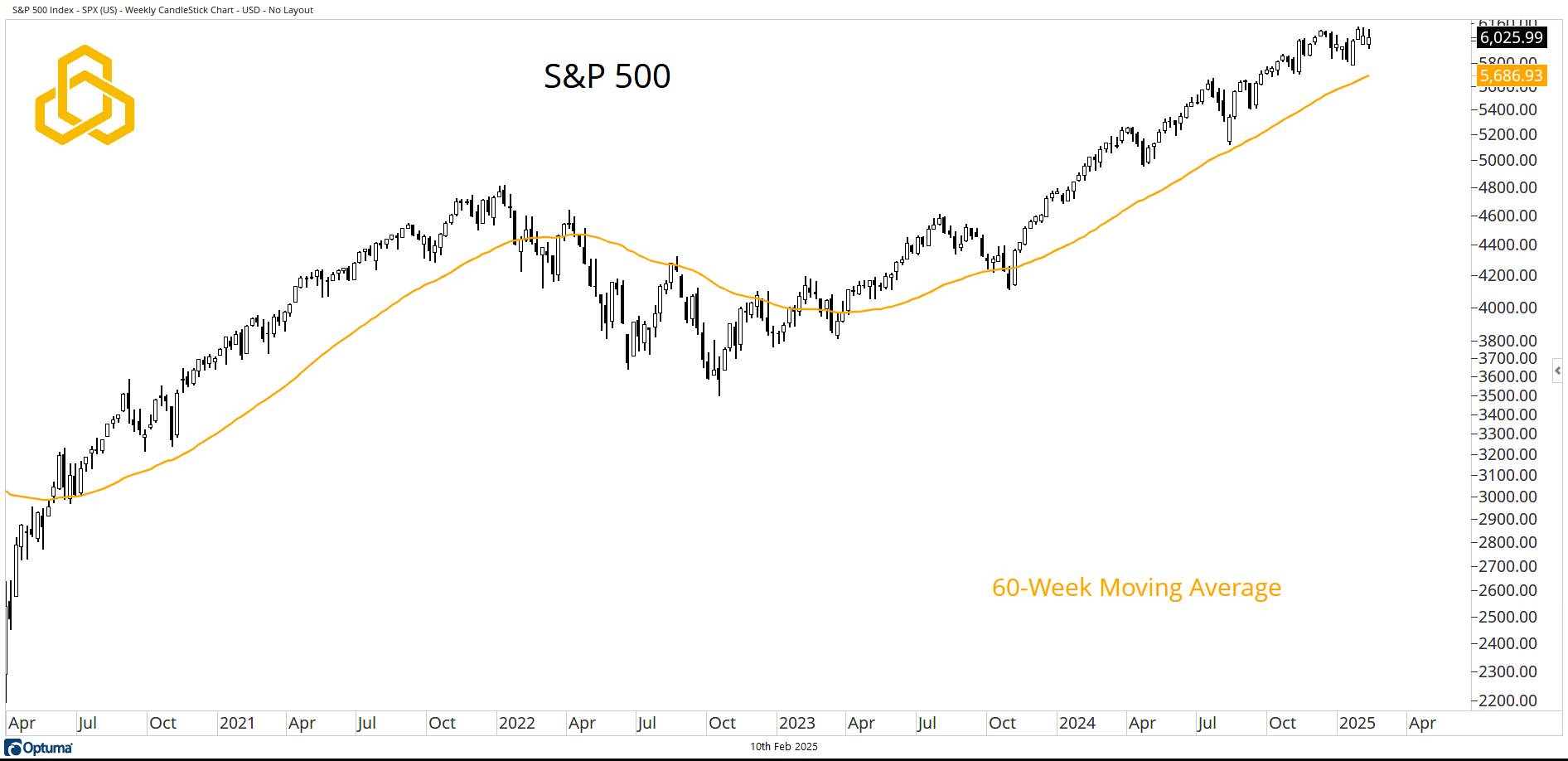

S&P 500The S&P 500 did close lower for a second consecutive week, but it is hard to make a compelling bear case here. Only two weeks ago, the index closed at a record level, and it remains well above a steadily rising 60-week moving average.

Source: Optuma

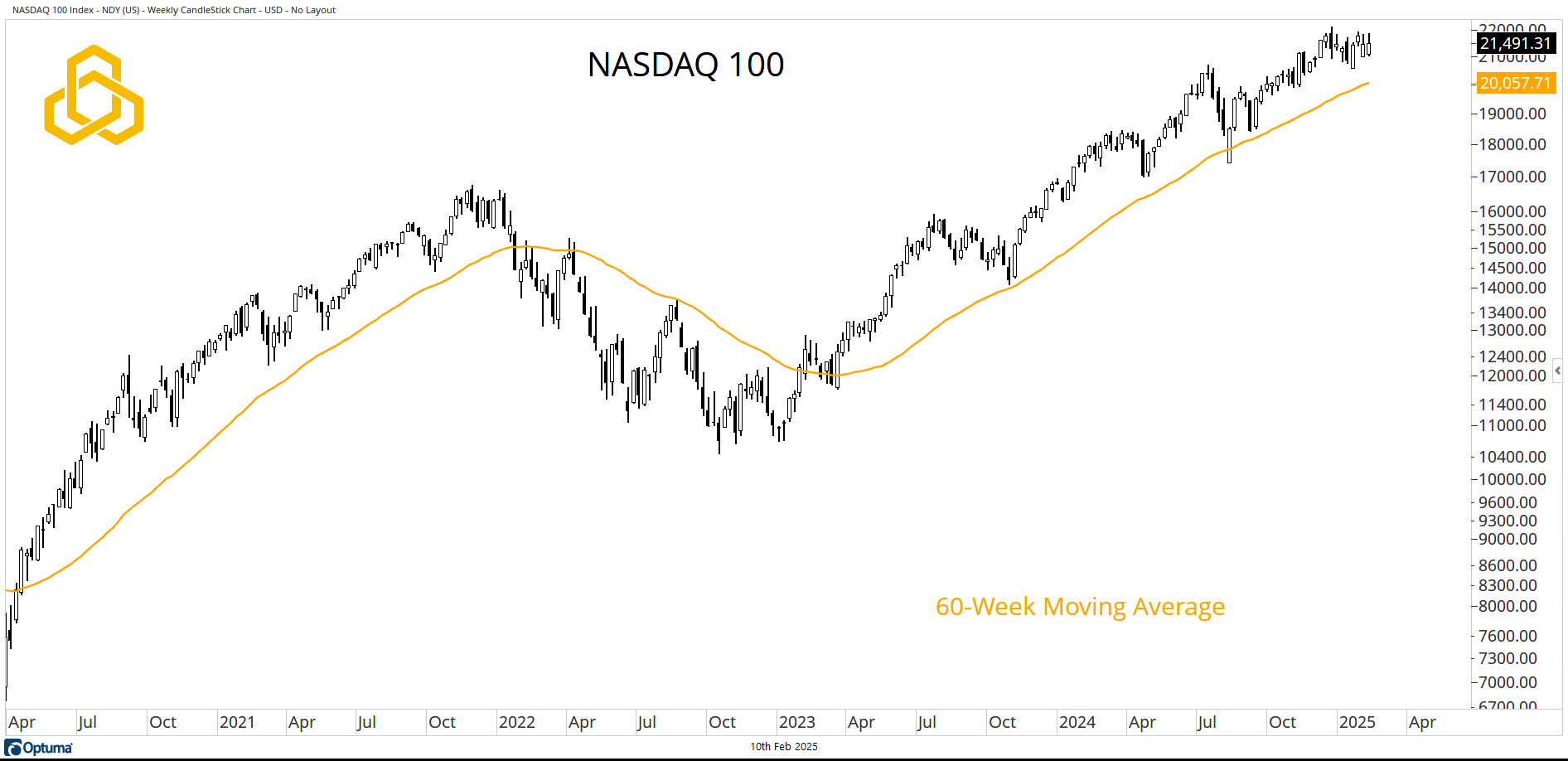

NASDAQ 100The NASDAQ 100 also remains in a bullish trend, above a rising 60-week moving average. Yes, the weekly closing high here was back on December 13th, but it is still hard to see the bear case right here, right now.

Source: Optuma

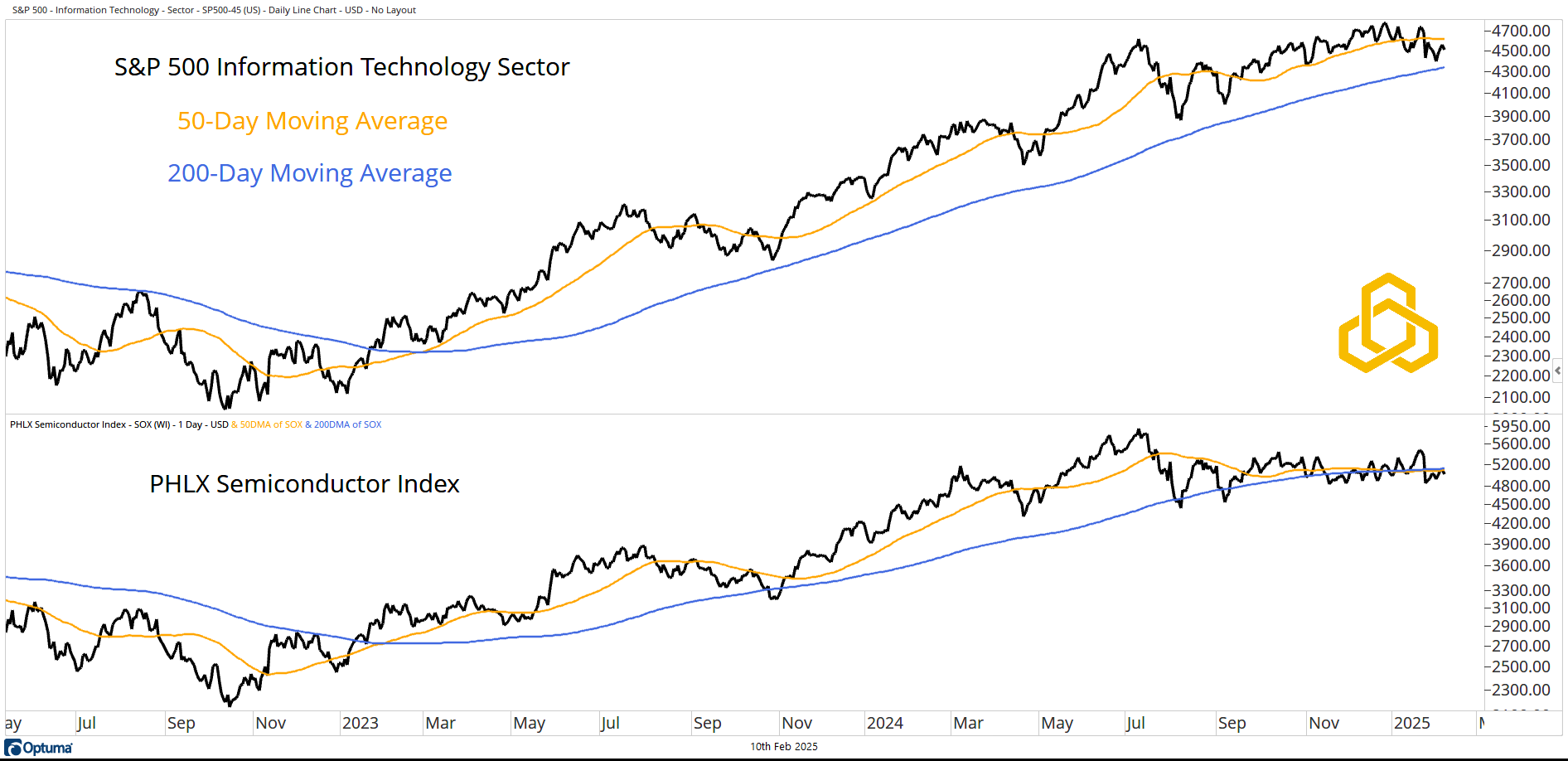

Technology & SemiconductorsAs we mentioned above, the Technology sector is the largest weight in the S&P 500. The second-largest group, Financials, is a distant second. Within the Technology sector, Semiconductors are vitally important.

Interestingly, the bullish trends for the S&P 500 and the NASDAQ 100 are playing out while Technology has made no progress since June 2024 and is trapped between its 50- and 200-day moving averages. At the same time, Semiconductors have been sideways since March 2024 and trade below their moving averages.

Source: Optuma

Why do you care? If the broader averages can maintain healthy uptrends while these key parts of the market merely tread water, it is likely that there is strength elsewhere.

Simply put, the market is not being driven by a small number of stocks.

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-389-20250210