It’s Entitled to a Rest

January 19, 2024

The S&P 500 closed 2023 with a nine-week winning streak. It is entitled to take a rest, and that is just what it did during week one of the 2024 season. This pause coincides with the percentage of NYSE stocks trading above their respective 50-day moving averages reaching levels that have signaled exhaustion in the past. The new year begins with a continuation of the shift to a positive stock/bond correlation as both assets were strong in the final quarter of 2023.

S&P 500 Weekly

The S&P 500 pulled back in the first week of 2024, but it is hard to make the case that this is anything more than a pause within the prevailing bullish trend. A well-deserved pause, we might add, as the index had rallied for nine consecutive weeks to close 2023. The rising 60-week moving average highlights the longer-term bullish trend, and we can’t help but think that the January 2022 highs are still in play.

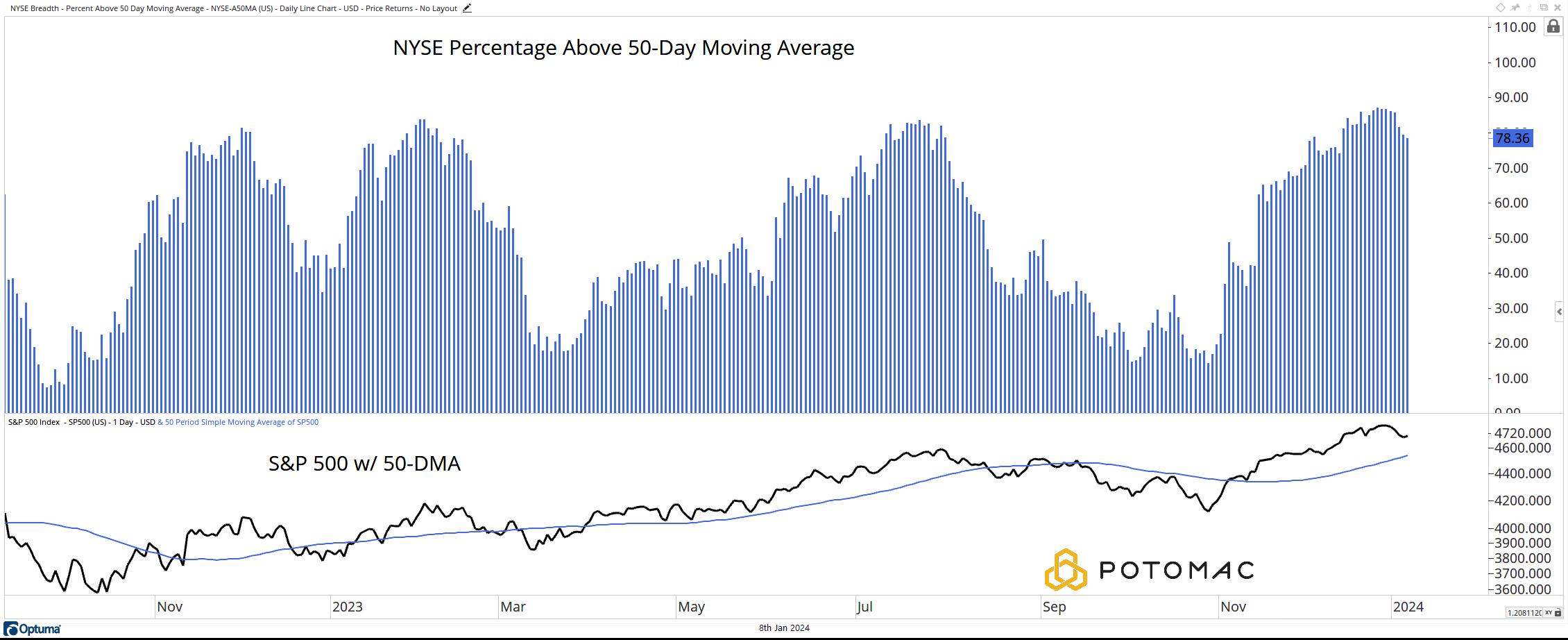

NYSE Stocks Above 50-Day Moving Average

Not only did the market rally for nine consecutive weeks before taking a breather, but the percentage of stocks on the NYSE above their respective 50-day moving averages reached nearly 90%. Readings above 80% for this metric have tended to signal short-term exhaustion for the S&P 500. In this case, however, the index is still above a rising 50-day moving average, keeping the short-term bullish trend in place.

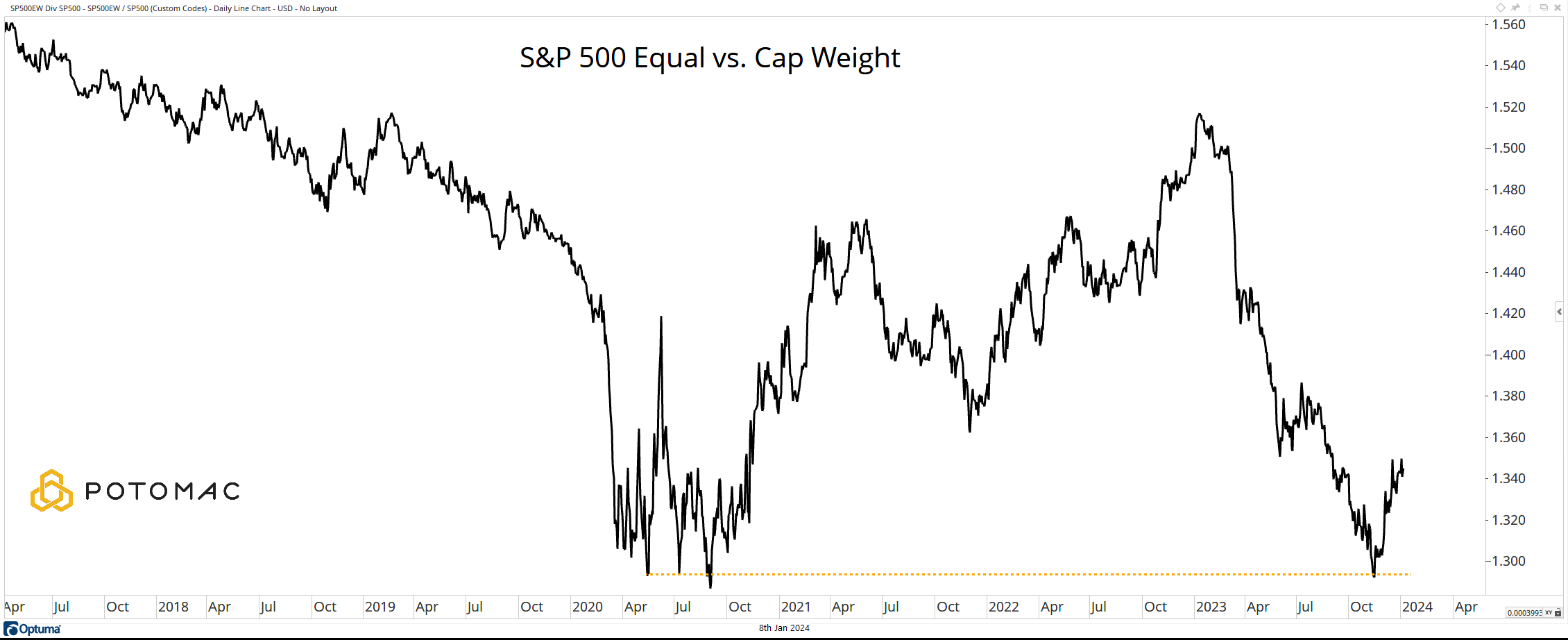

S&P 500 Equal Weight vs. S&P 500 Cap Weight

In the early days of 2024, the award for most consensus call goes to the “equal weight over cap weight” crowd. The uninformed were enamored with stories of the “Mag 7” for much of 2023 while forgetting that there is a difference between performance and participation. The simple fact of the matter is that there were a lot of stocks moving higher in 2023, the largest stocks just went up more. Now, many investors feel that 2024 is the year for the average stock. The equal weight version if the index has been performing well after holding a logical support level. The risk is that this trade will become crowded as investors reposition in January.

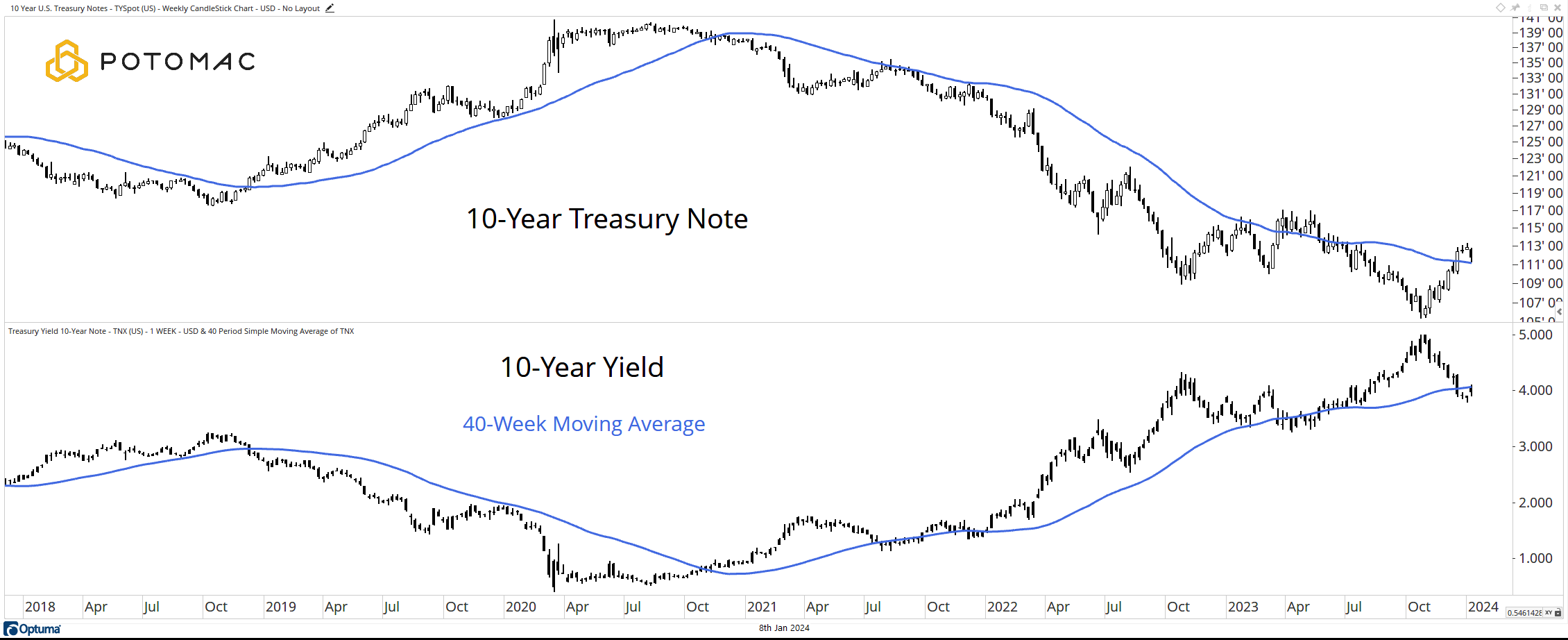

The 10-Year

Equities were not the only asset to put on the rally cap into the end of the year. The 10-Year Note (price) staged a sharp advance from the late October lows to regain the declining 40-week moving average which acted as support last week. The yield has moved lower, undercutting the rising 4-week moving average. Despite these moves in the final quarter, it is hard to say that the primary trends have changed.

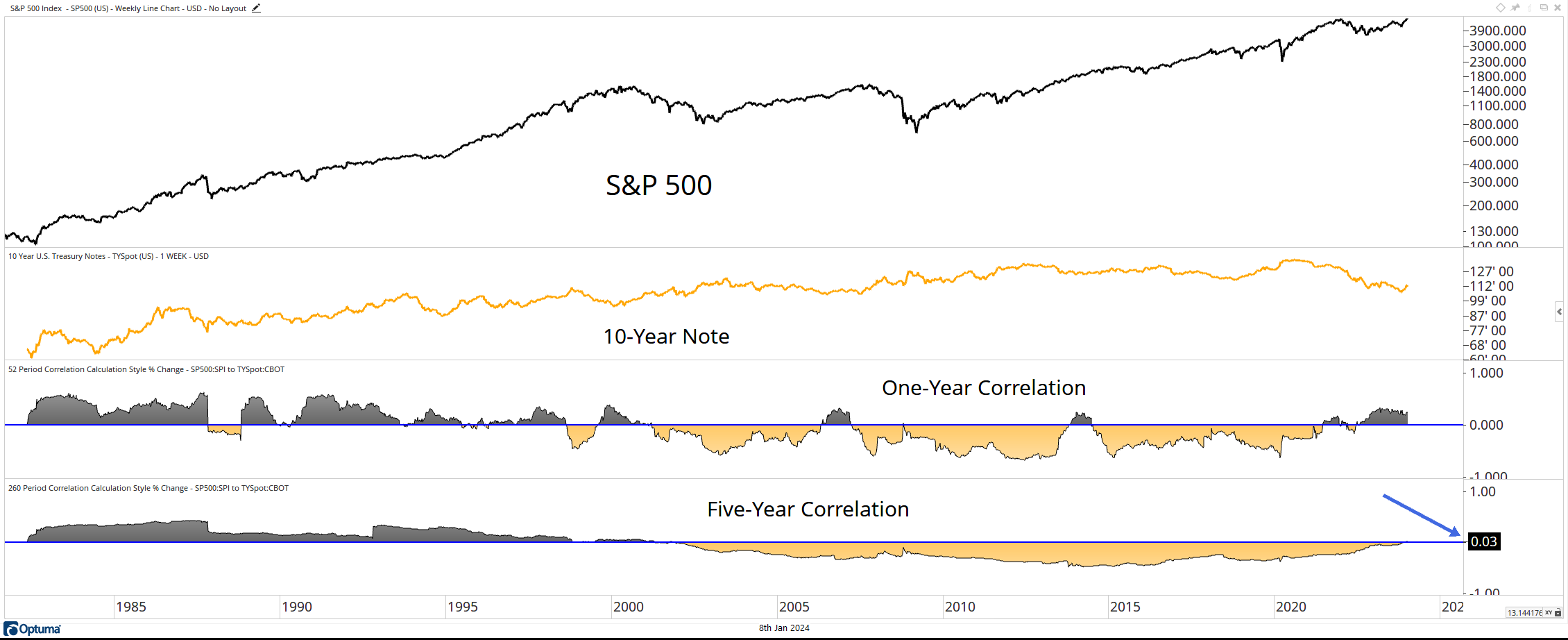

Stock/Bond Correlation

We close our first note of the year with a chart that should look familiar to our readers. We were one of the first on the street to point out the shift in stock/bond correlations back in the Spring of 2022. Now many others have come around to this view. With both assets moving higher during 4Q2023, the five-year correlation has turned positive for the first time since ~2002.

*All charts are from Optuma a/o the close of trading on 1/6/2024.

Potomac Fund Management ("Company") is an SEC-registered investment adviser. This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page. The company does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to the Company website or incorporated herein, and takes no responsibility for any of this information. The views of the Company are subject to change and the Company is under no obligation to notify you of any changes. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable or equal to any historical performance level.

PFM-301-20240108