Getting the Best of It

October 22, 2024

The title of this week’s note comes from a book by David Sklansky, best known for his work in the field of poker. More precisely, for his work in helping players understand the importance of knowing the odds and maximizing returns when those odds are in their favor.

Our approach to investment management works in much the same way. We do not follow the “got a hunch, bet a bunch” philosophy that many discretionary investors do. Instead, we try to recalculate the odds every day to determine whether they favor the market advancing or declining. As has been the case for a while now, the bulls are getting the best of it.

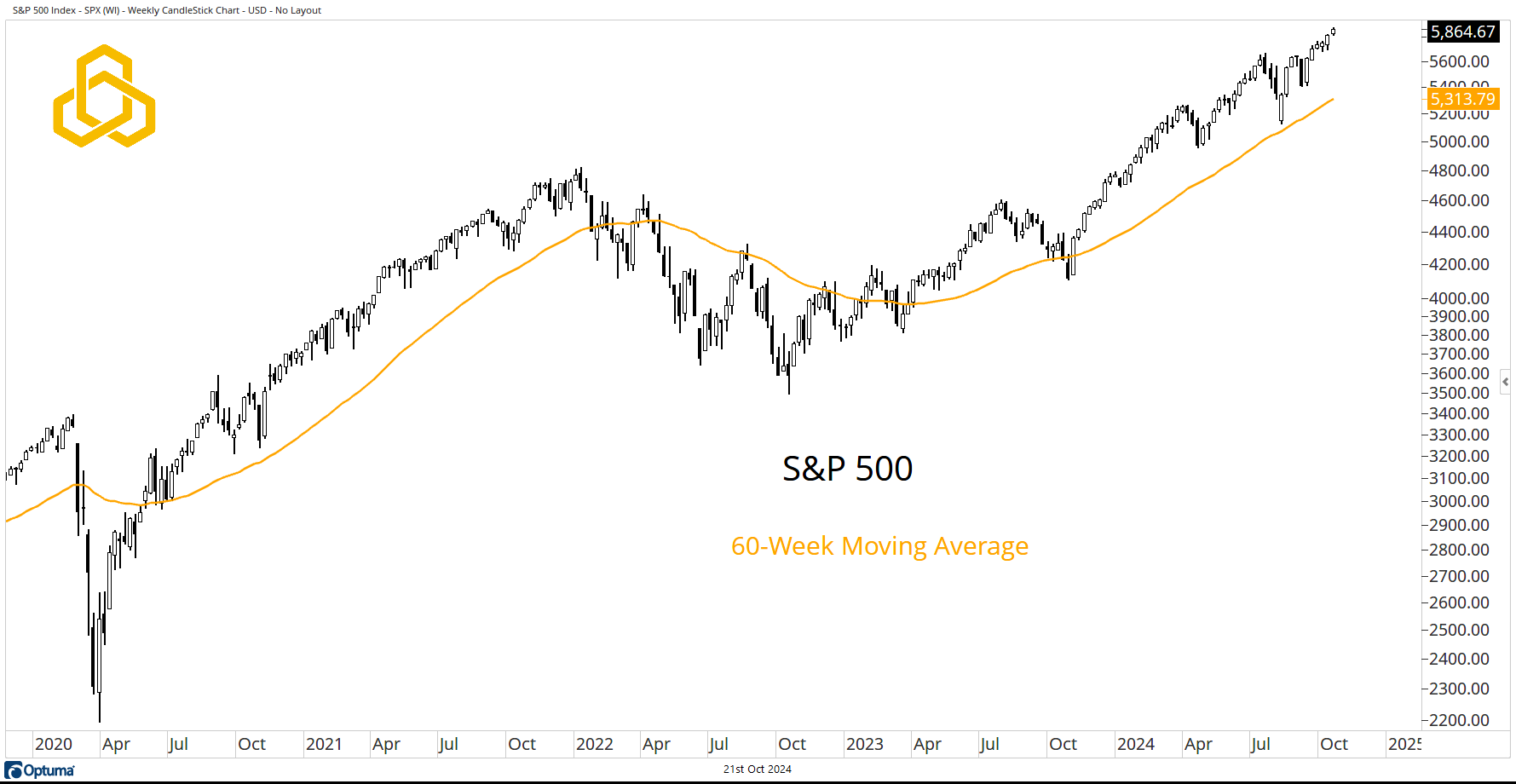

S&P 500

In the first lesson of Technical Analysis 101, we are told that charts moving from the lower left to the upper right are bullish. The S&P 500 continues to fit this description. The index has closed higher for six consecutive weeks, trending above a rising 60-week moving average.

A case could be made that the index is extended above the moving average, but those who have done the work (as we have) know that this is not a compelling bearish signal.

Source: Optuma

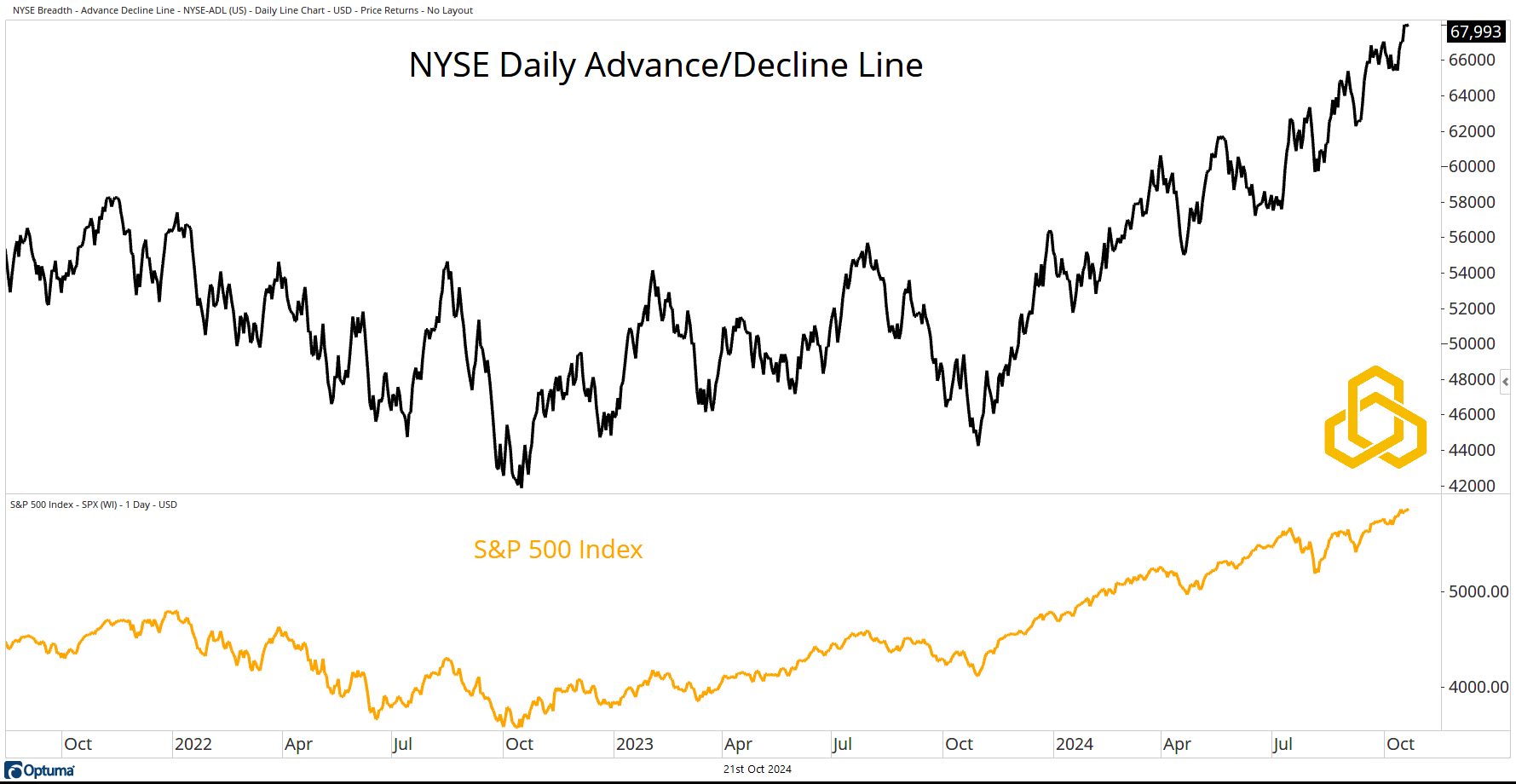

NYSE Advance/Decline Line

The NYSE Advance/Decline Line has also been trending upward, reaching record levels. This key measure of market breadth indicates that, in a healthy bull market, more stocks should be rising than falling. That seems to be the case here. Technically, this is known as confirmation, and we have it.

Source: Optuma

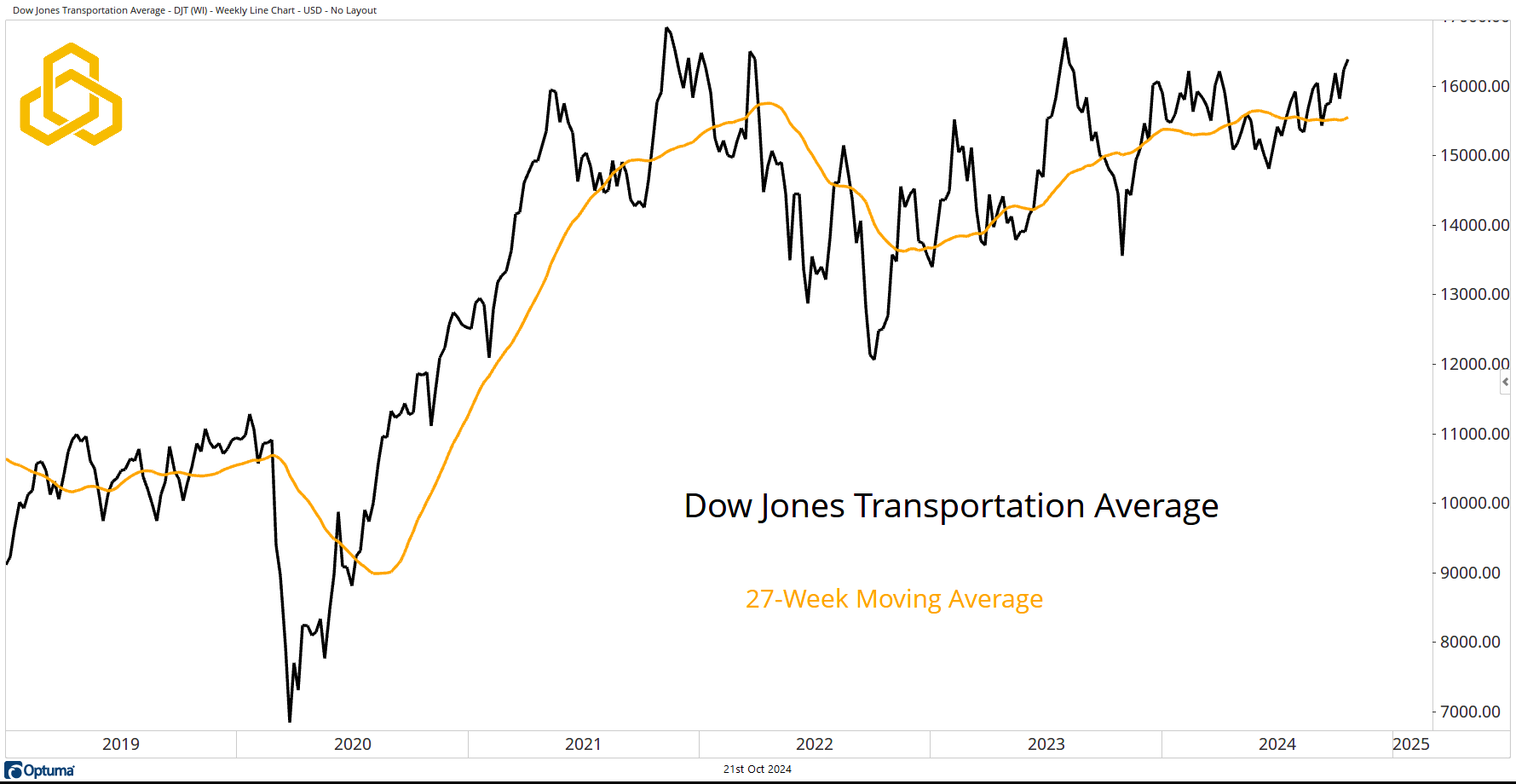

Dow Jones Transportation Average

The Dow Jones Transportation Average has been the one weak spot in the market, providing a glimmer of hope for the bears. However, the average is now in a bullish position, above the 27-week moving average and threatening new highs. A breakout to the upside from the three-year consolidation would further tilt the odds in favor of the bullish trend in equities.

Source: Optuma

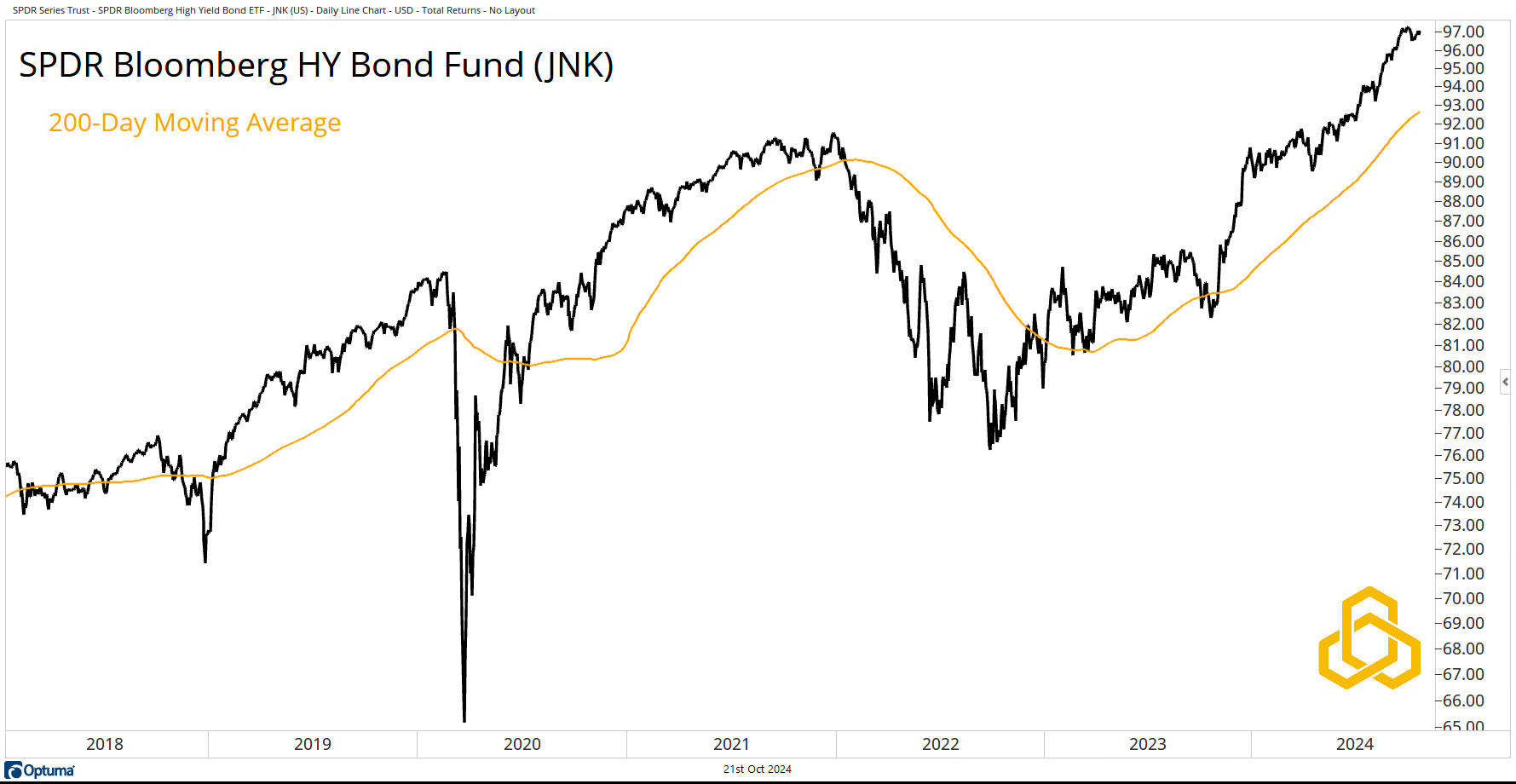

High Yield Bonds

The SPDR Bloomberg High Yield Bond Fund (JNK) is trading near record levels on a total return basis, above a steadily rising 200-day moving average. It is hard to make a bearish case when the “riskiest” credits are trading at record highs.

Source: Optuma

Is the stock market guaranteed to move higher from here? Absolutely not.

However, the odds do point in that direction. Until that changes, the bulls are getting the best of it.

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-364-20241021