Follow Prices, Not Fed Speakers

Last week saw volatility creep back into asset markets as Federal Reserve Governors made comments during their intermeeting speeches that seemed to fly in the face of what we were told by the Federal Reserve after their last meeting.

At that time, the Fed’s “dots” were still pointing to rate cuts in 2024. However, two different speakers told us that the door was open to no cuts this year. Personally, I do not think these speakers should be opining about the path of rates intra-meeting, especially when their message differs from what we were just told.

Even more especially if you are not a voting member this year…Mr. Kashkari, I am speaking to you.

But truthfully, no one should be surprised by what these speakers said; the market has been calling the rate cut bluff for the past few weeks. See our March 18th note where we highlight that inflation is still on our minds.

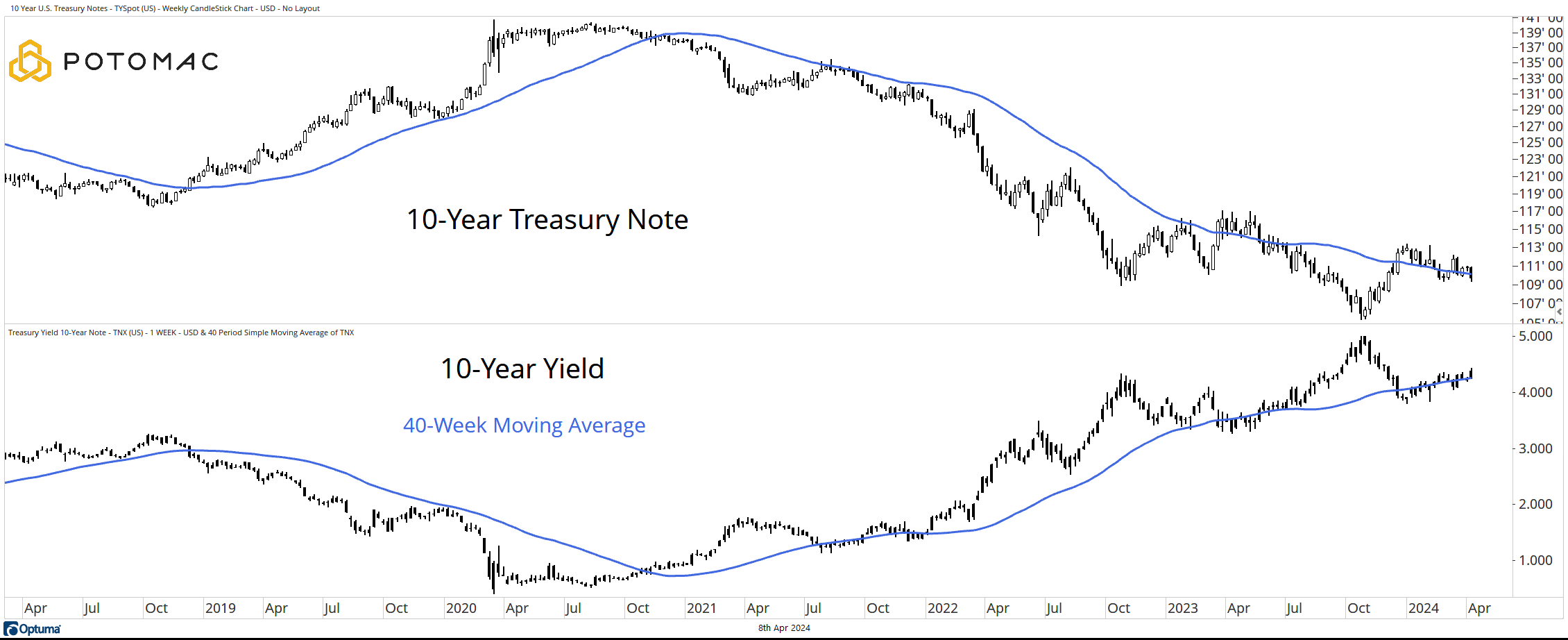

The 10-Year Note & Yield

The trend of the 10-Year Note price is still lower. The notes have been hovering around the 40-week moving average, but that average is declining. As one would expect, the trend of the 10-Year Yield is the opposite.

These two trends were in place well before last week’s comments.

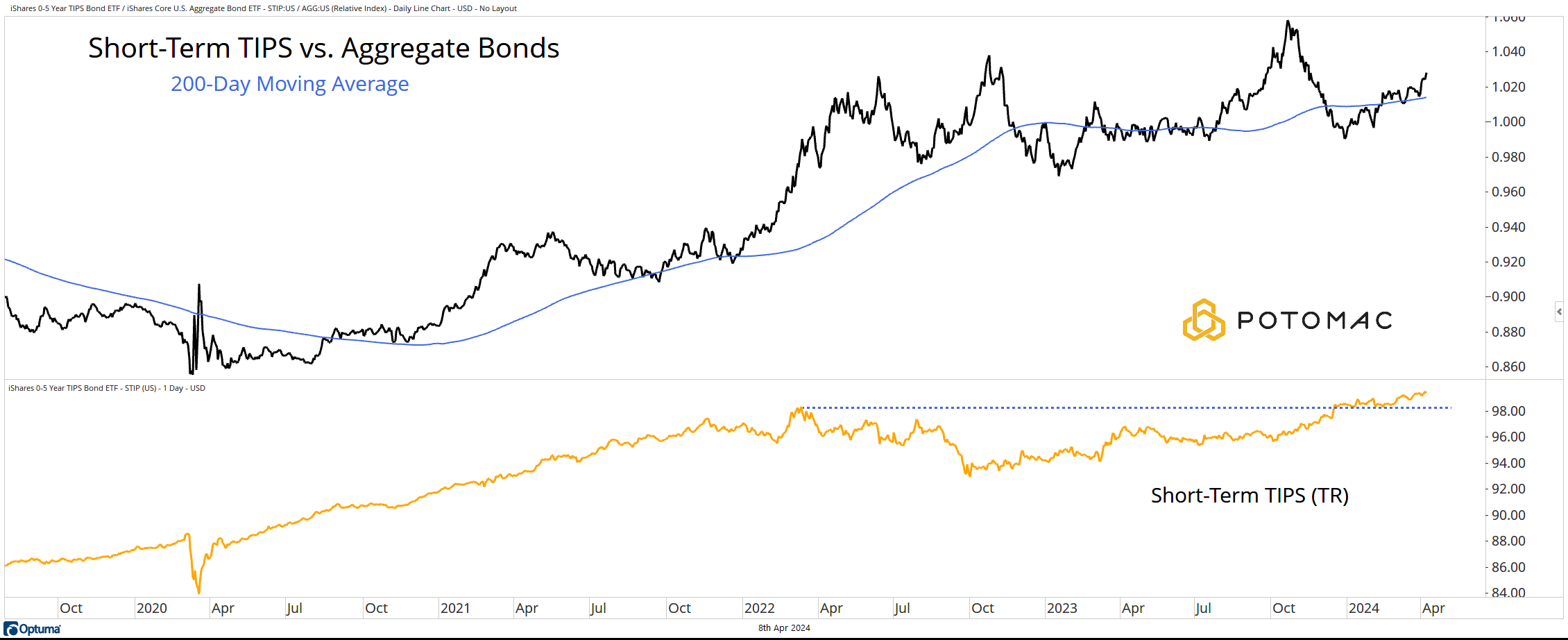

Short-Term TIPS vs. Aggregate Bonds

The total return ratio of short-term TIPS (STIP) relative to aggregate bonds (AGG) has been moving higher since the start of the year and has recently accelerated above the rising 200-day moving average. At the same time, STIP is trading at new highs on a total return basis.

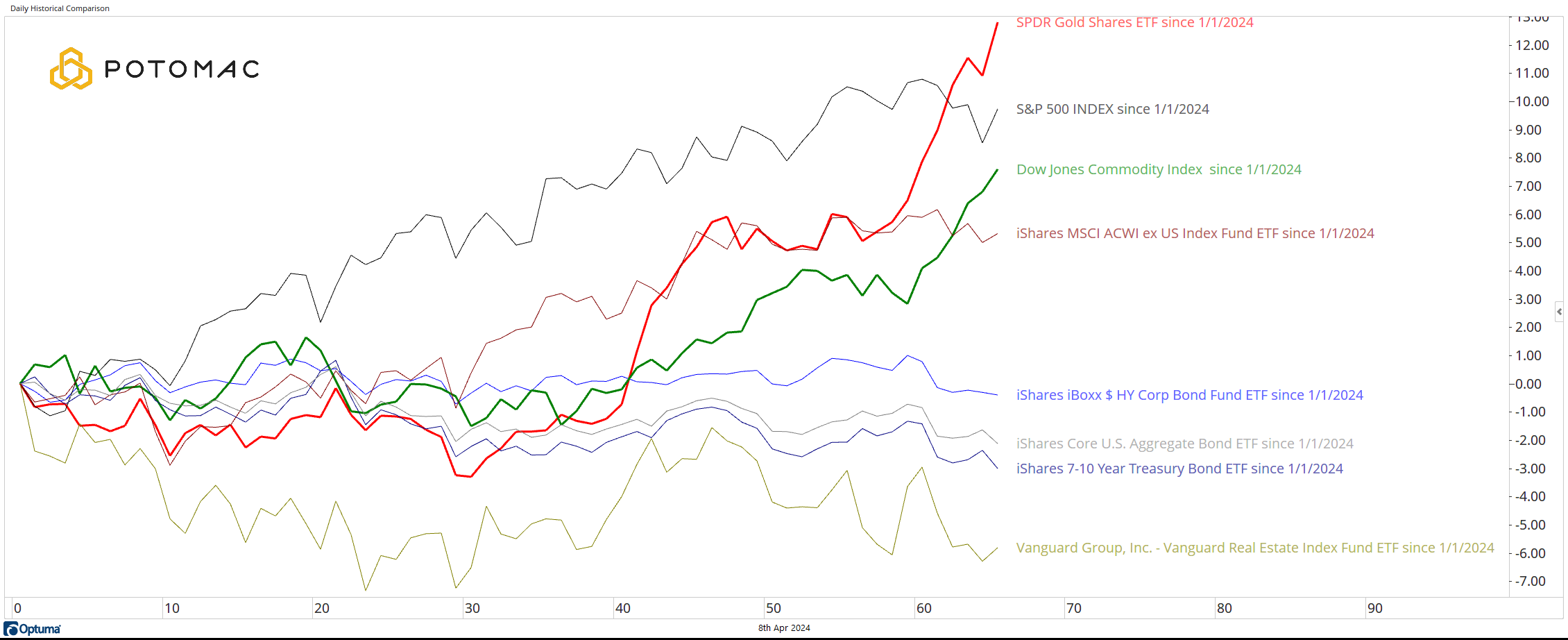

Asset Performance

Since the start of 2024, Gold has been the best-performing asset followed by the S&P 500. While gold has certainly received a lot of attention of late, we note that the Dow Jones Commodity Index is in the number three slot year to date. Fixed Income and Real Estate are lagging.

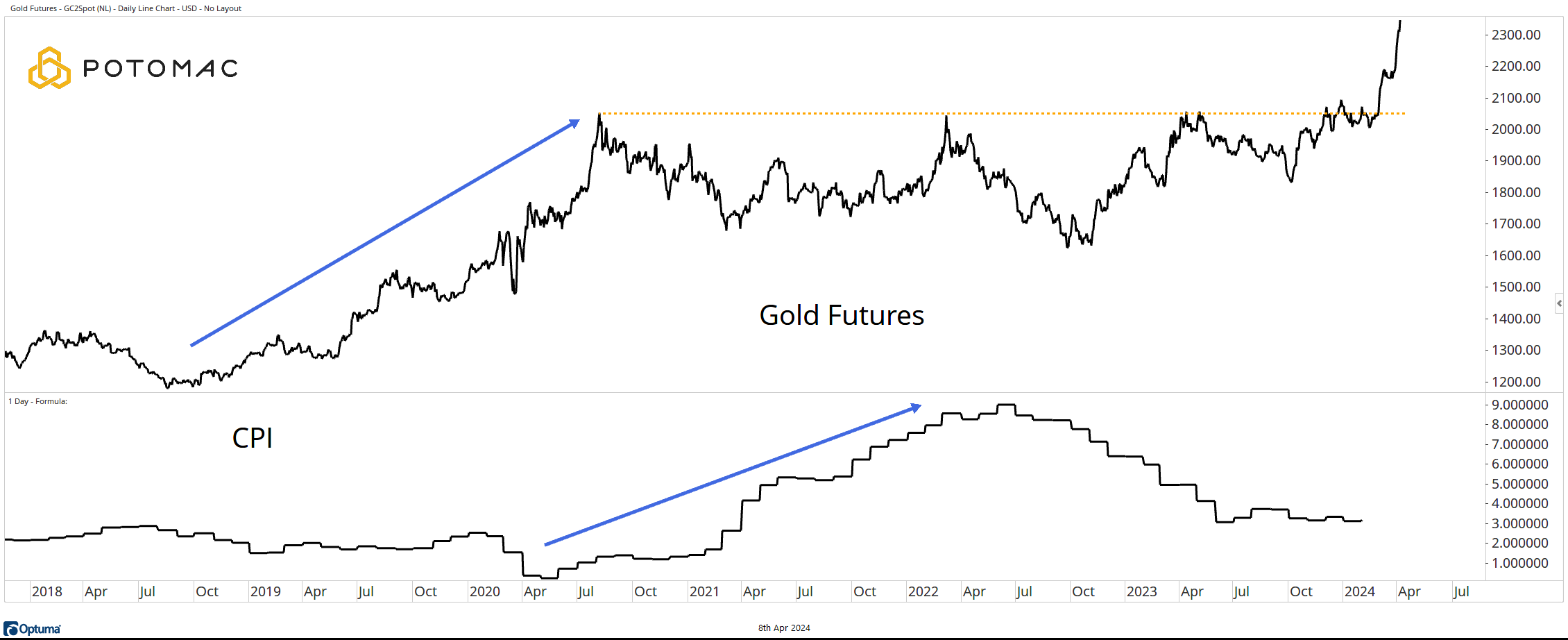

Gold

This chart is a repeat from our March 18th note. Then we highlighted that Gold tends to turn higher ahead of inflation (CPI). Today we note that Gold is accelerating to the upside after breaking to new highs.

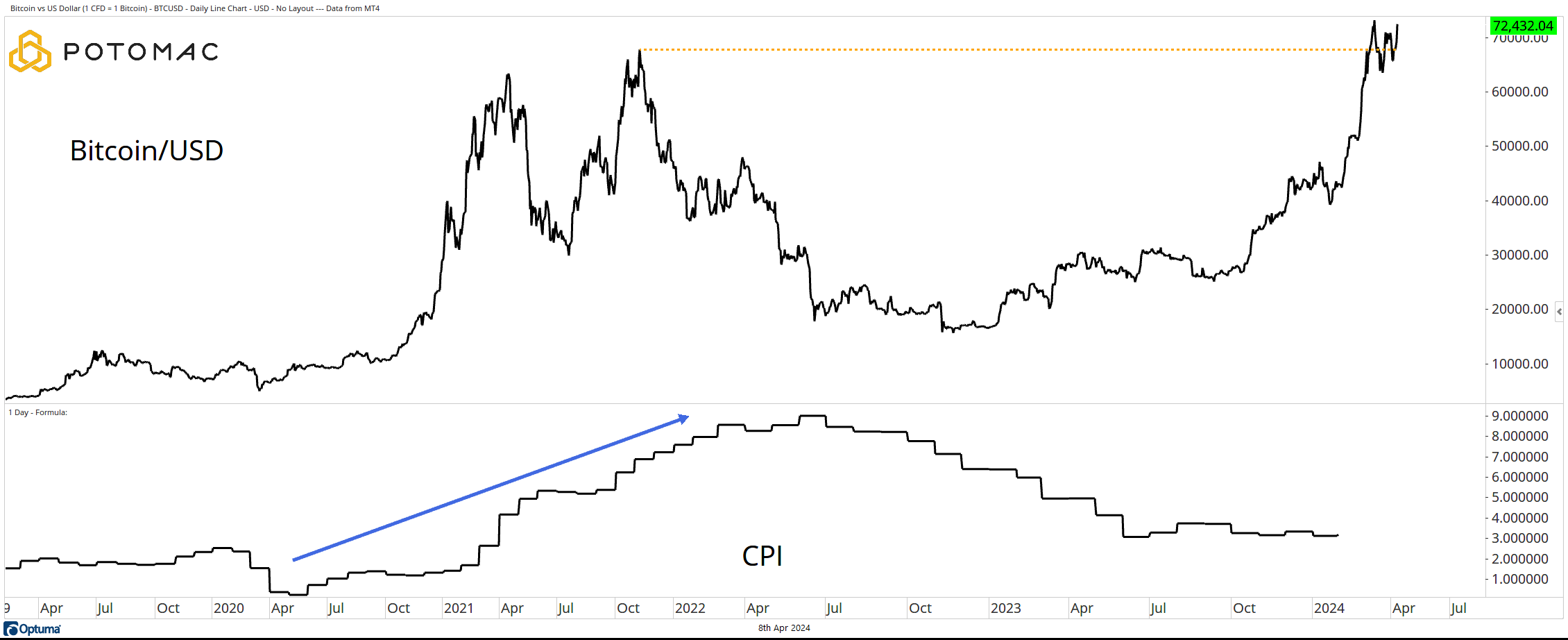

Bitcoin

The other chart making an encore appearance after a March 18th debut is Bitcoin. Is it “digital gold?” Perhaps.

My thesis here is simple, bitcoin is to Gen X and younger what gold was to Baby Boomers and older in strategic portfolios. If this is truly a hard asset, then the dynamics for bitcoin should be the same as for gold. In this case we mean an asset that rises in value as it discounts future inflation.

This is not to say that we have some unique read on the path of interest rates for the duration of 2024; we don’t. This is simply a reminder that the market does not appear to believe the prevailing narrative that inflation has been tamed.

Based on these trends, a rate cut would likely be a policy error.

*All Charts as of April 7, 2024, other than Bitcoin which is as of 7:30am on April 8, 2024. Past performance does not guarantee future results.

Potomac Fund Management ("Company") is an SEC-registered investment adviser. This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page. The company does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to the Company website or incorporated herein, and takes no responsibility for any of this information. The views of the Company are subject to change and the Company is under no obligation to notify you of any changes. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable or equal to any historical performance level.

PFM-316-20240408