Do or Die Time?

March 10, 2025

After a third week of declines for the S&P 500, we can view this week as do or die for the bullish trend. We continue to view the market as “bent, not broken,” but we are open-minded enough to be concerned by what has been playing out.

Market returns require market exposure, and our job is to make sure manageable declines do not turn into catastrophic drawdowns. But we do this based on data, not headlines.

The biggest concerns center on the lack of confirmation from, and now breakdown in, the Dow Jones Transportation Average, combined with an increase in new lows on the New York Stock Exchange. Bulls need these metrics (and others) to improve this week.

It’s Do or Die Time!

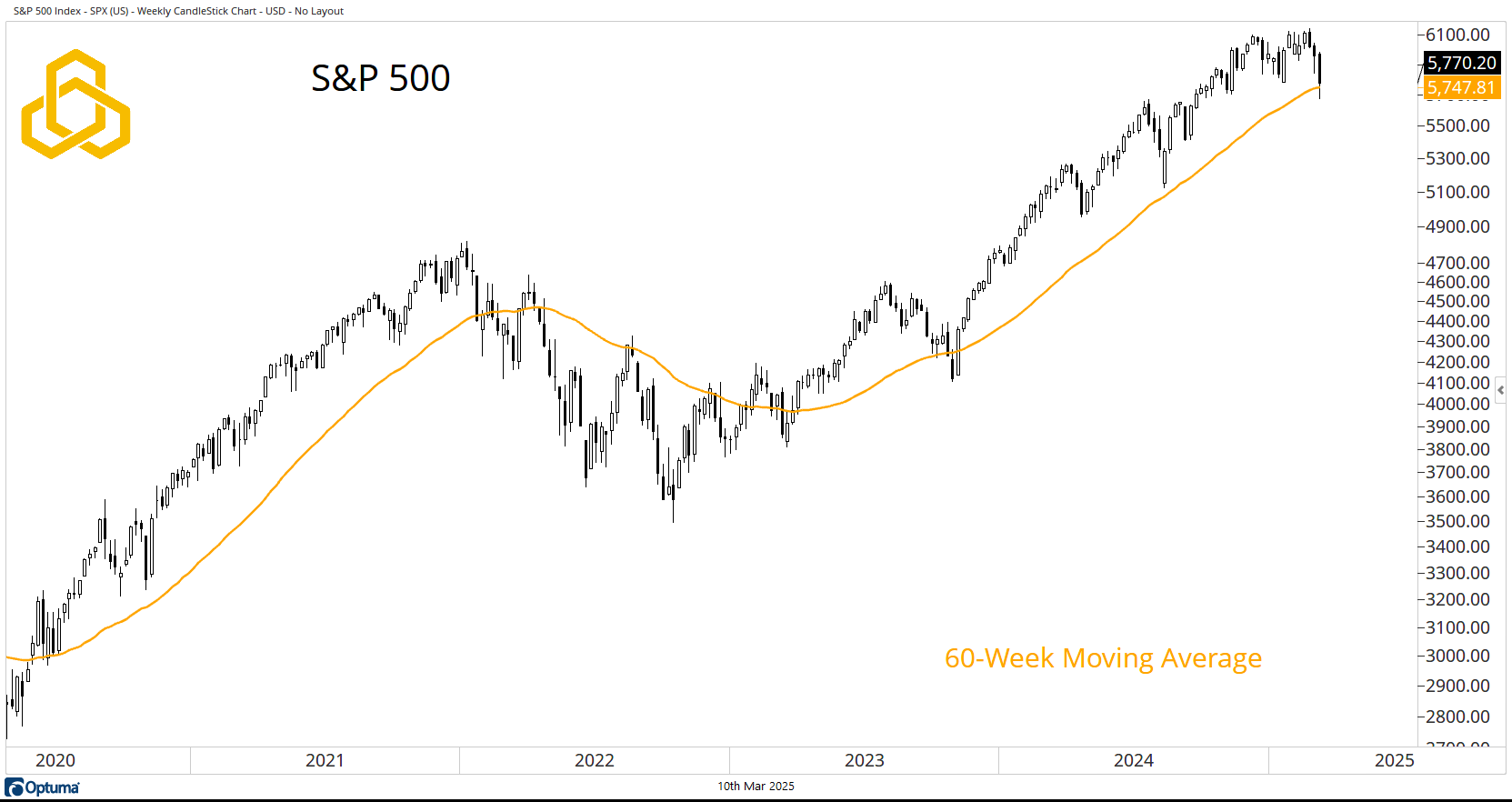

S&P 500

The S&P 500 traded below the 60-week moving average for the first time since November 2023 before rebounding to close the week slightly above this key measure of the long-term trend. For the second week in a row, a Friday rally has given the bulls hope by allowing the index to close off the lows. However, there needs to be follow-through, which has not been the case thus far.

Source: Optuma

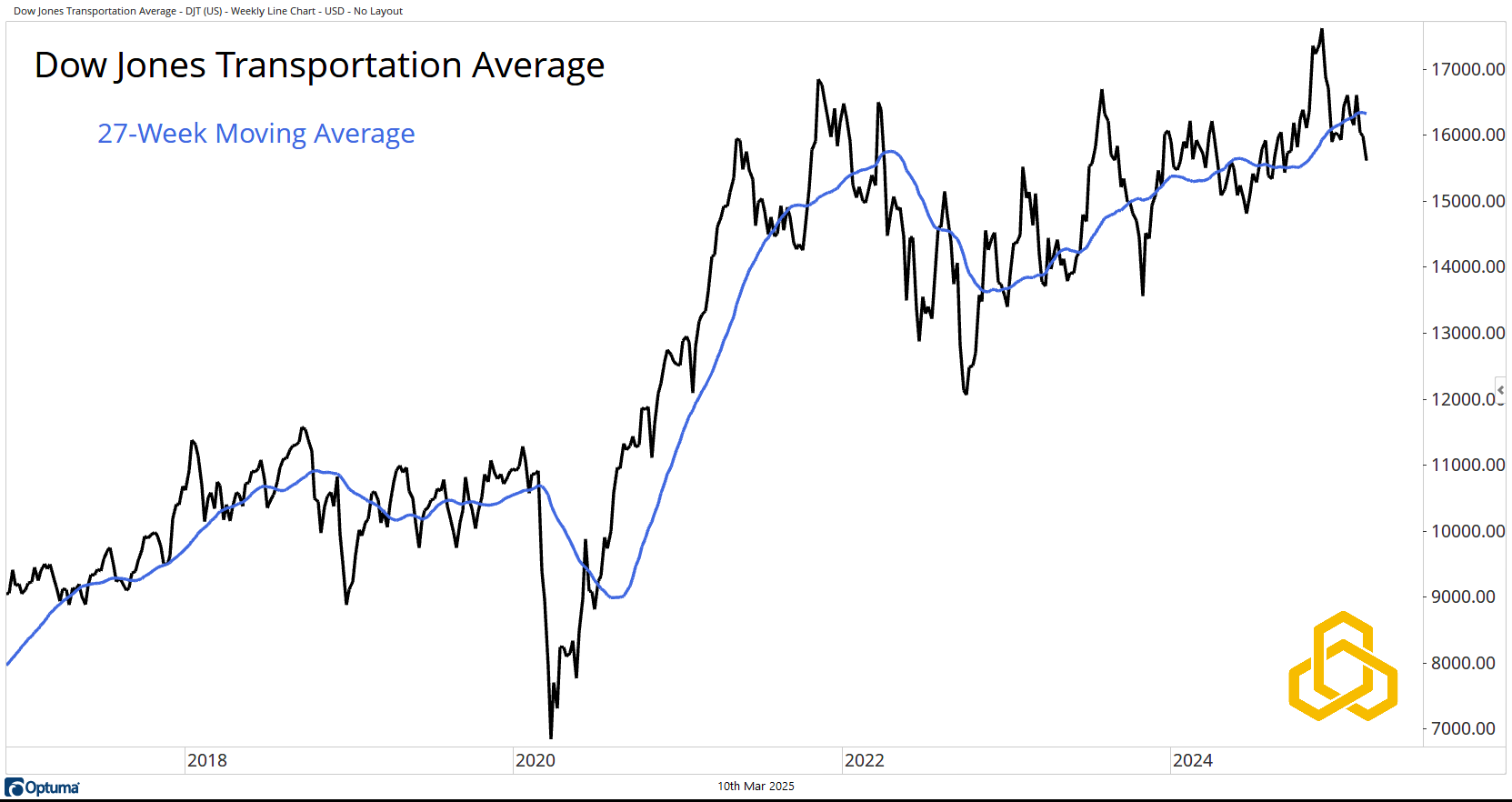

Dow Jones Transportation Average

The Transports remain a sore spot for equity bulls. The average failed to hold its break to new highs in November 2024 and has now fallen below the 27-week moving average. Recent weakness has led the moving average to begin to turn lower.

It is also worth noting that the Transports have made no progress for nearly four years.

Source: Optuma

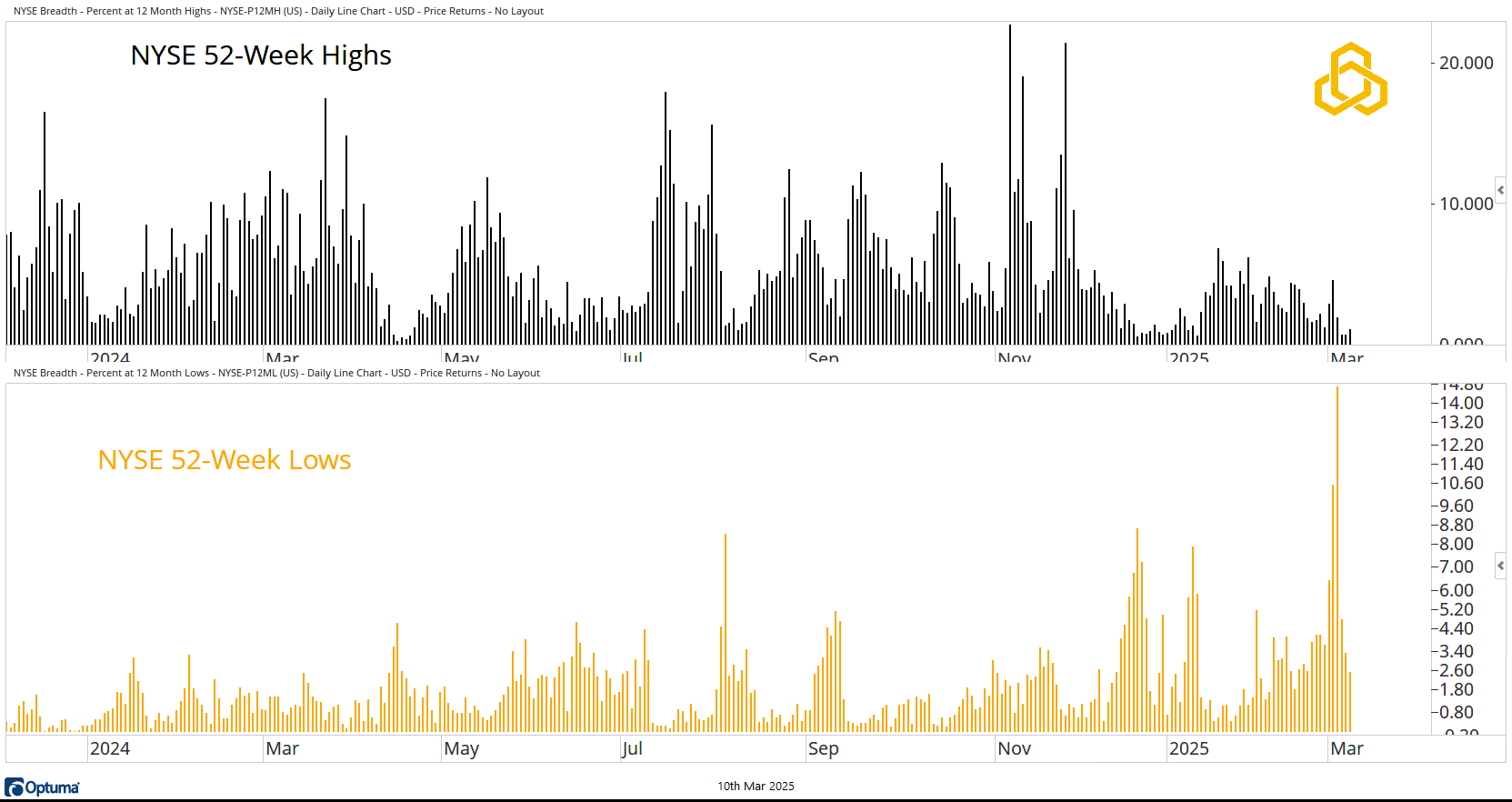

NYSE New Highs & New Lows

New Highs & New Lows In stark contrast to 2024, the new year has given us a character shift. We have seen a decline in the percentage of stocks on the NYSE making new highs. At the same time, the percentage of stocks making new lows has been moving higher.

A persistent increase in new lows is not synonymous with a healthy bull market for stocks.

Source: Optuma

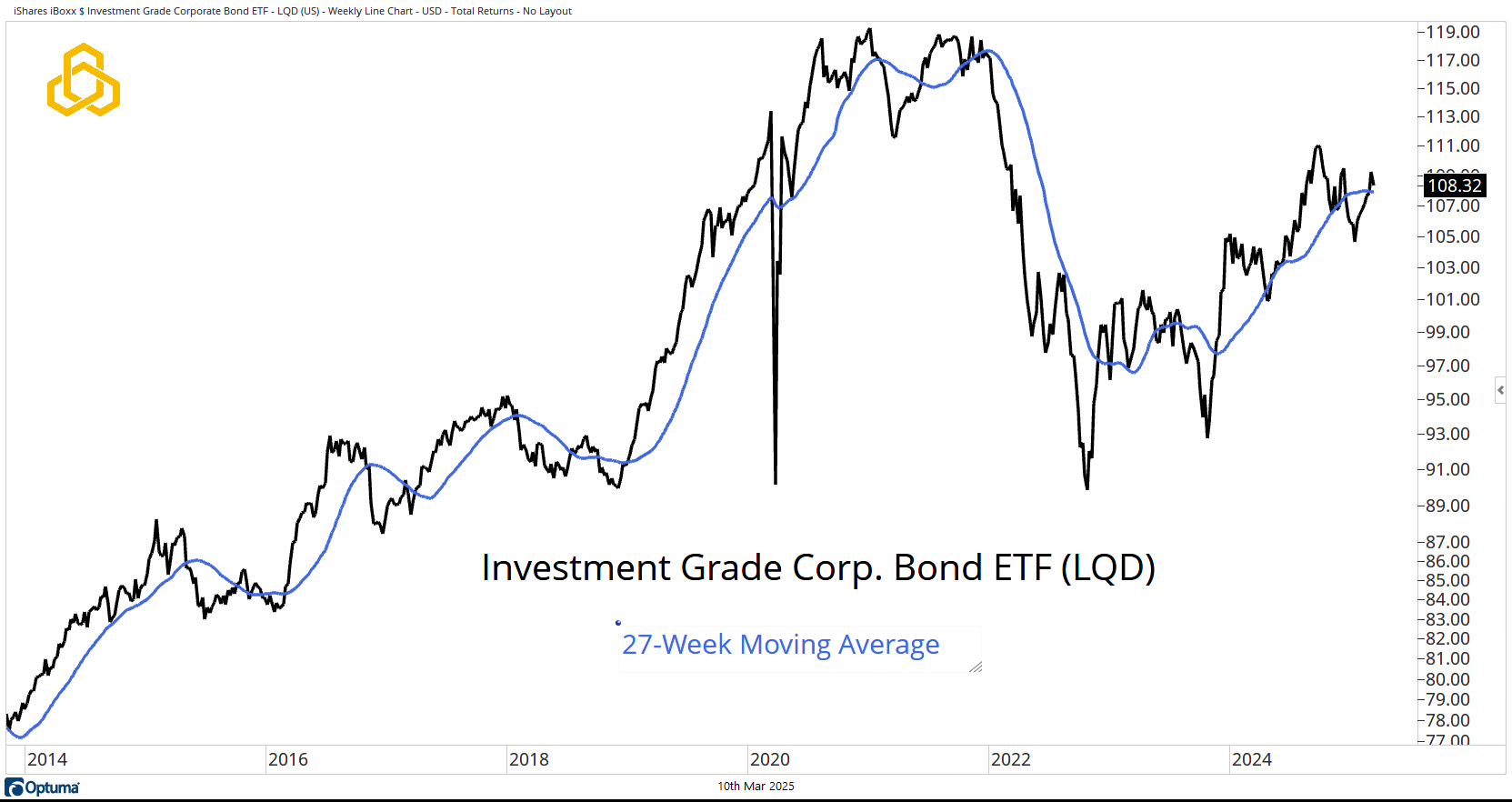

Investment Grade Bonds

Investment-grade corporate bonds have been stalling of late after failing to even approach new highs. The iShares iBoxx Investment Grade Corporate Bond ETF (LQD) has been wrestling with a 27-week moving average that has turned from rising to flat.

Source: Optuma

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-303-20250310