Dare I Say It?

December 2, 2024

Risk asset markets in the U.S. are in confirmed uptrends for the most part. There is broad participation. Anyone making the “Mag 7” argument is either lying or completely detached from reality. Intermarket themes are beginning to confirm as well.

The title of this week’s note is a reference to something that we have been discussing internally for months. I hesitate to put it into print, but since we believe in probability over prediction—and therefore are not superstitious—I am going to go for it: Melt Up!*

S&P 500

That is a weekly closing high for the S&P 500. The index is in a confirmed uptrend above a steadily rising 60-week moving average.

Source: Optuma

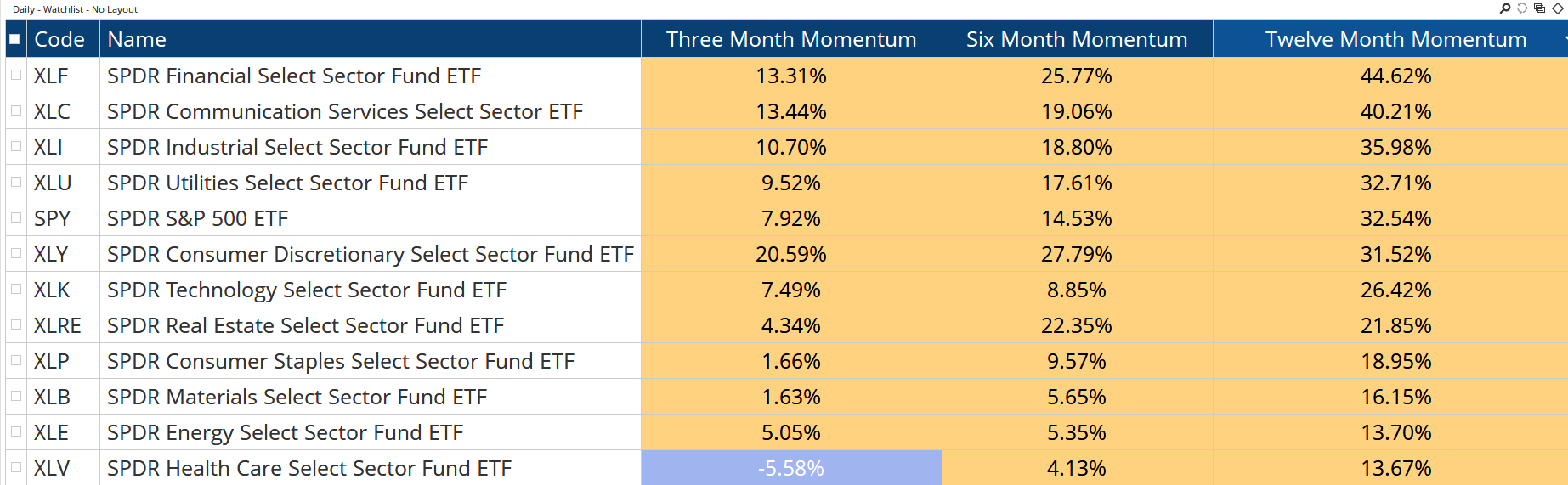

S&P 500 Sector Returns

Participation in the uptrend is broad. On the six- and twelve-month timeframes, all 11 sector ETFs are positive. The list below is sorted by twelve-month performance. Note that Technology is not at the front of the pack. Neither is Discretionary.

Source: Optuma

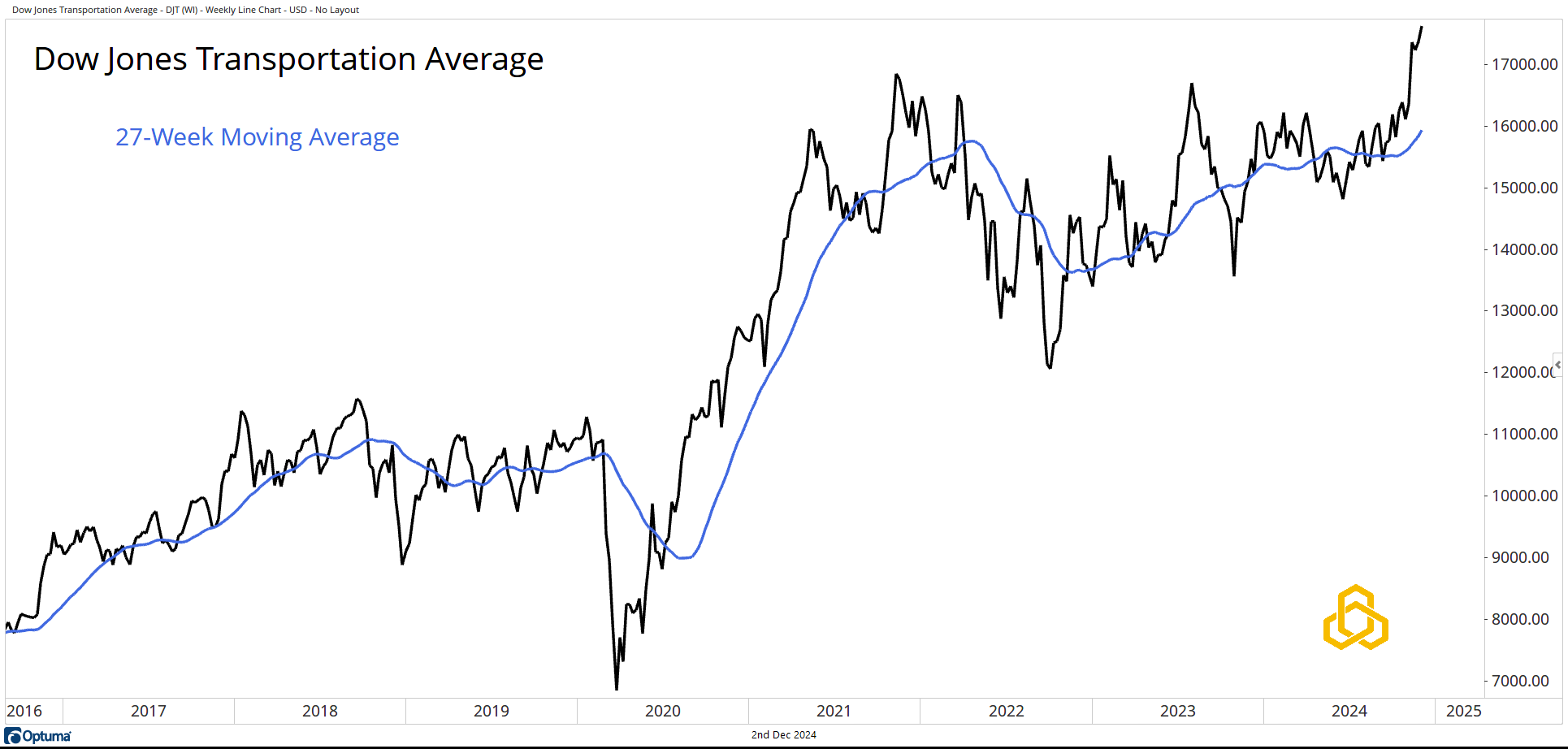

Dow Jones Transportation Average

After three years in a sloppy consolidation, the Dow Jones Transportation Average has broken to new highs above a now-rising 27-week moving average. For those of a certain vintage, you may recognize this as a take on Dow Theory, and it points to confirmation.

Source: Optuma

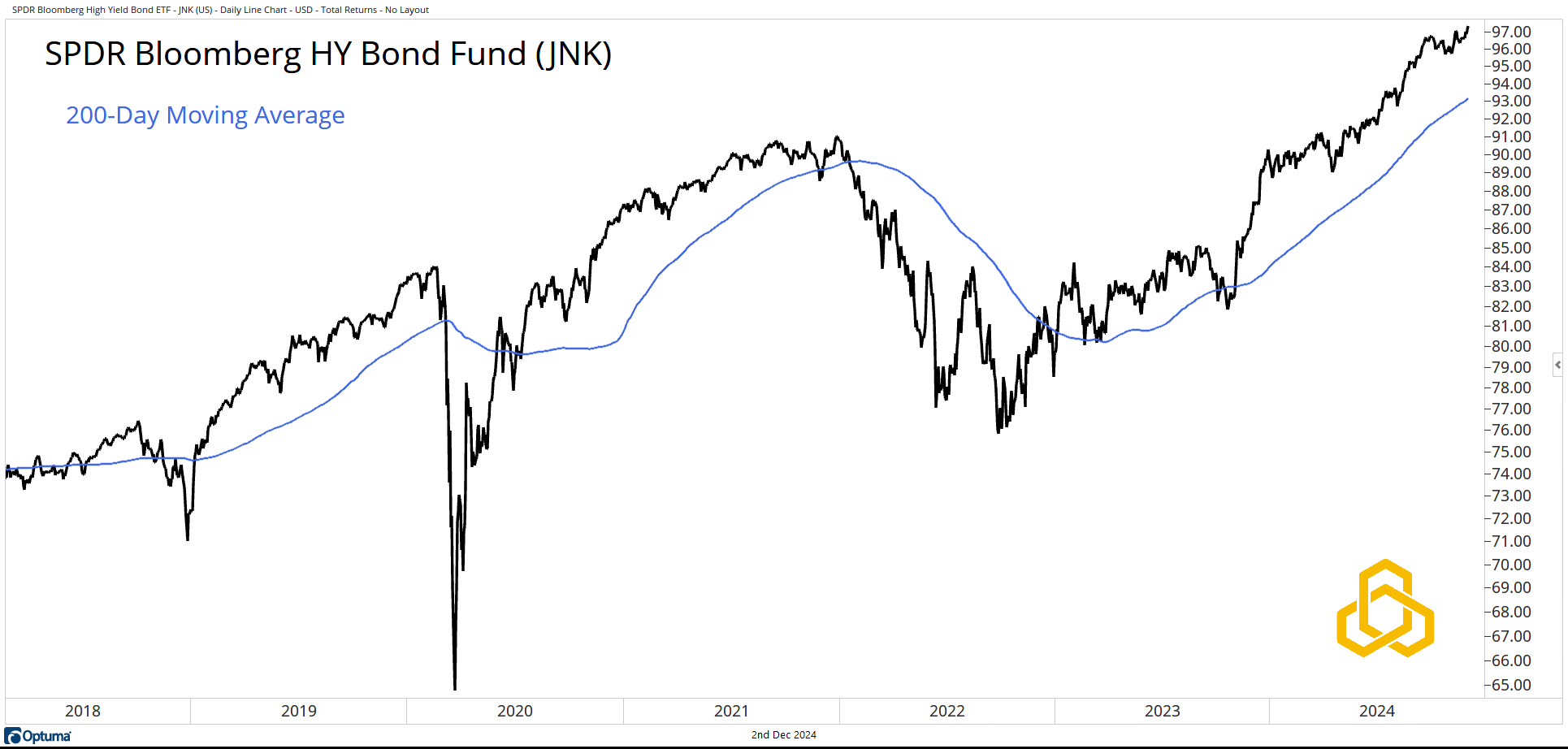

High Yield Bonds

The SPDR Bloomberg HY Bond Fund (JNK) closed the week at record levels on a total return basis, well above the rising 200-day moving average.

Source: Optuma

*Full credit to Manish Khatta for being the first on the team to call “melt up” in our internal conversations.

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-375-20241202