Chop’t is Not Just for Salads

May 6, 2024

Chop’t was one of my favorite lunch spots when I worked in New York City. You walked in, picked what you wanted in a salad, and then at the very end, someone behind the counter would chop it all up in the bowl. Nice, fresh, and healthy. There was always a line out the door.

Now, Chop’t is all I can think about when I am looking at the market, and for those trying to act on every twist and turn, Chop’t is what they risk becoming; that will not be healthy for the portfolio.

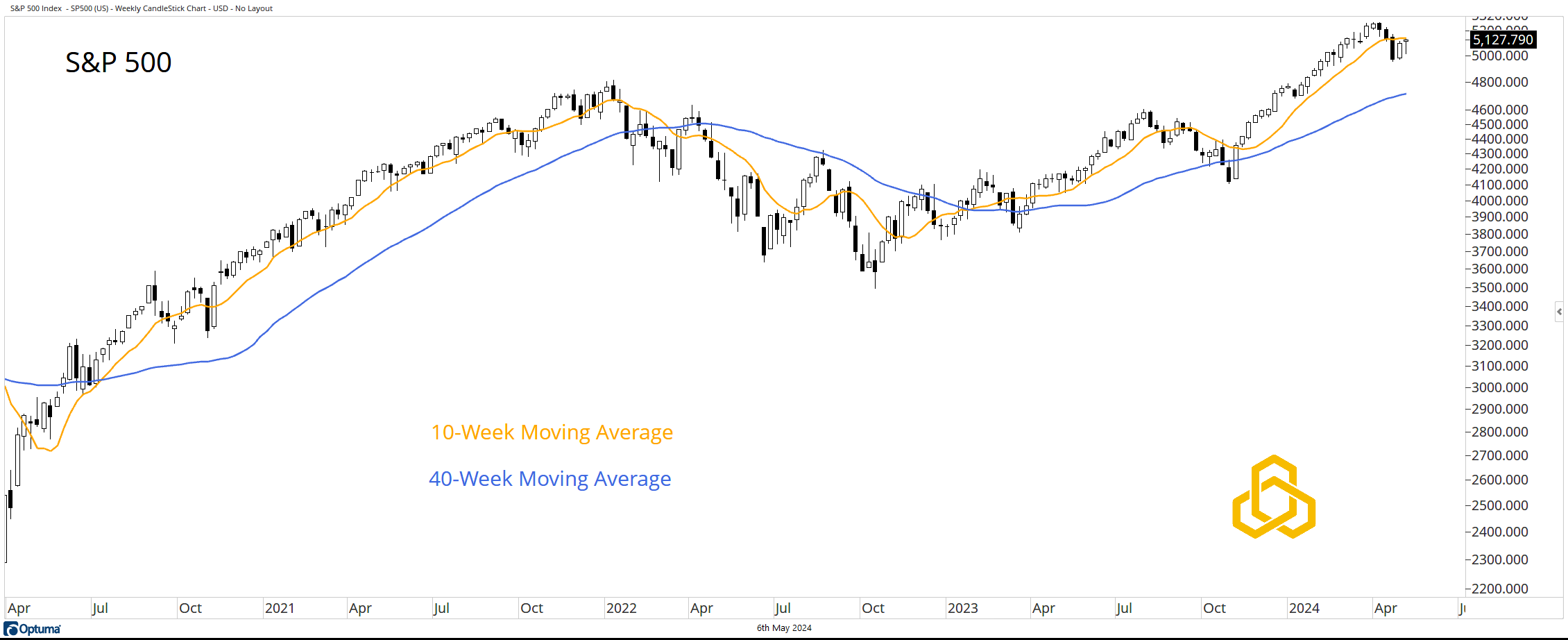

As we mentioned last week, the S&P 500 lies between the 10 and 40-week moving averages, with the former acting as resistance during the past week of trading. Despite advancing for the past two weeks, the index remains below the highs seen during the week ending April 19th.

Additionally, there has been little to no progress since the end of February. This is an environment for traders. Longer-term investors may be best served by recognizing that the primary trend is still higher and simply waiting for a more precise direction in the short term.

S&P 600

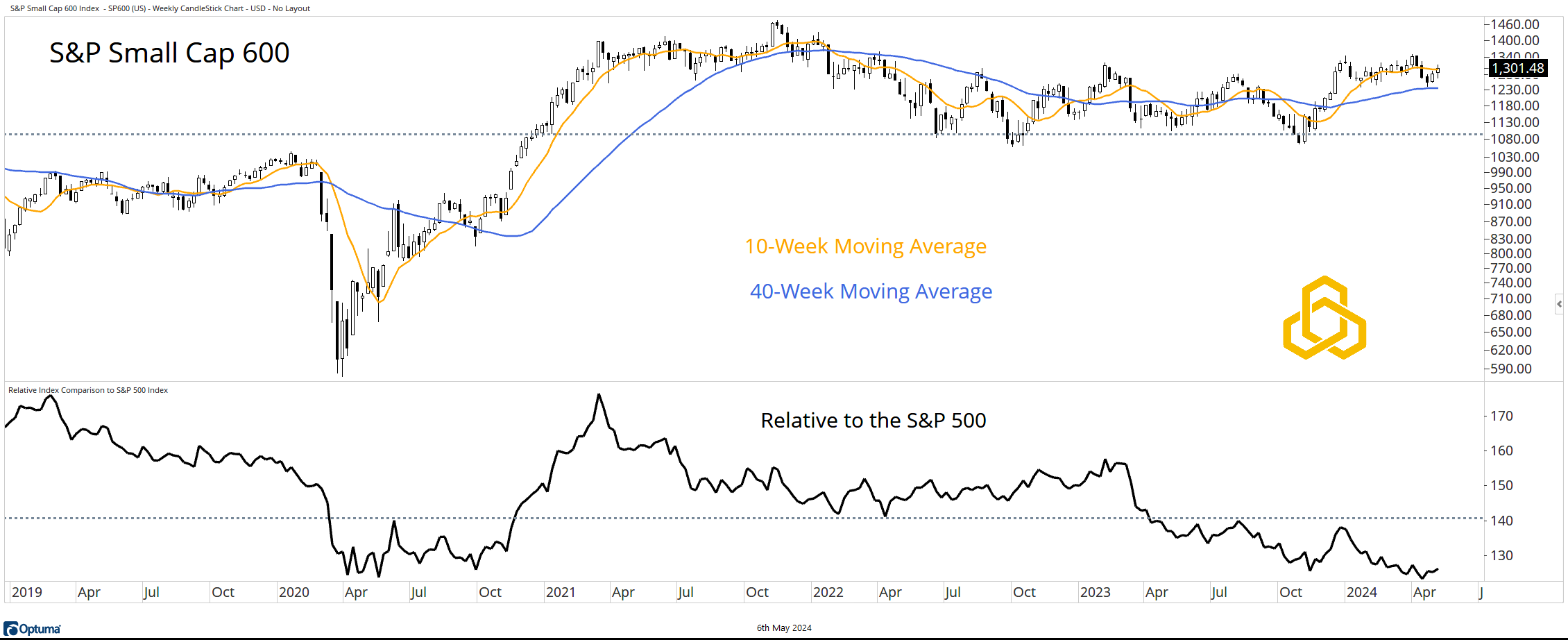

While the S&P 500 has been Chop’t for three months, the S&P Small Cap 600 has been in this state for over three years. There have been numerous instances of the 10-week moving averages crossing the 40-week moving average, confirming a sideways trend.

Despite not losing much ground during this time, the “smalls” have been a laggard relative to the “bigs,” providing another example of why having a static allocation to an asset or strategy can be harmful.

NASDAQ 100

The NASDAQ 100 is sporting a look similar to that of the S&P 500, trapped between the moving averages. It has not made much progress since early February. The relative trend is also beginning to fade from prior highs.

Aggregate Bonds

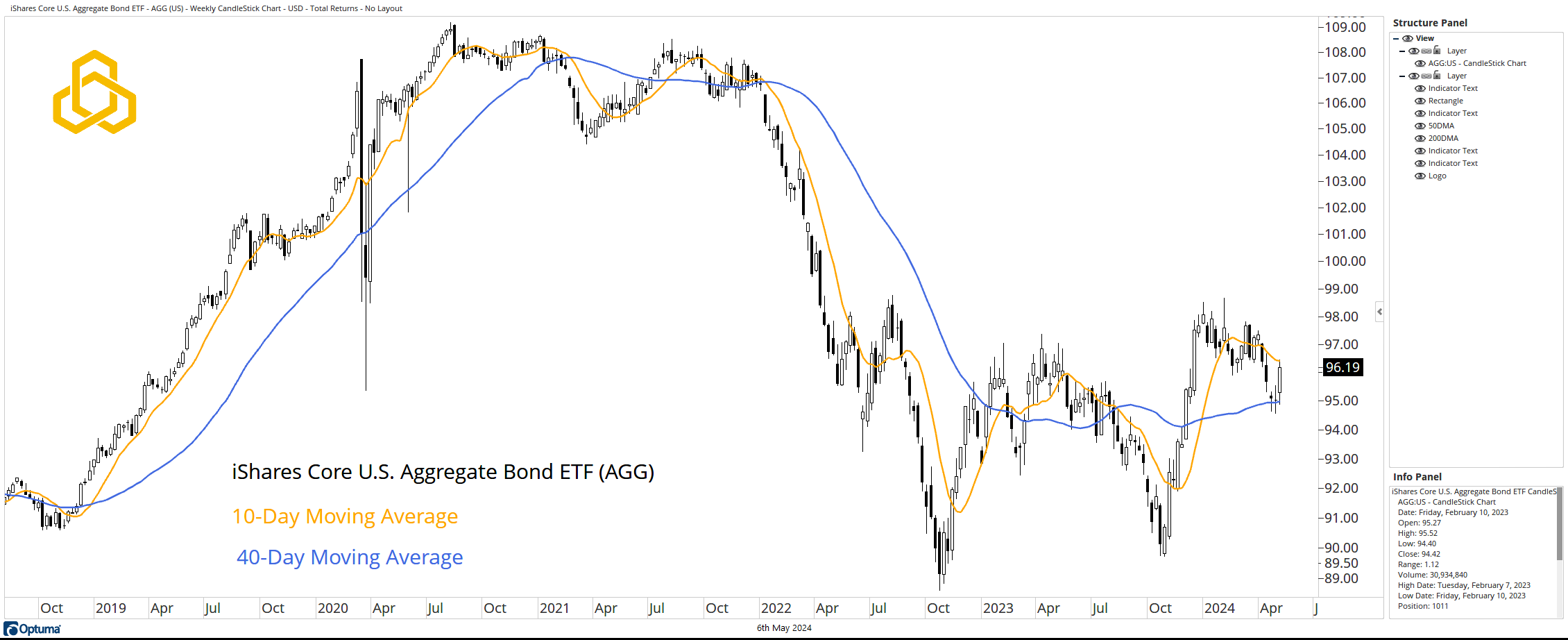

The iShares Core U.S. Aggregate Bond ETF (AGG) has been stuck in a consolidation range for two years. The fund is now trapped between a falling 10-week moving average and a flat 40-week moving average. Choppy and sloppy.

International Equities

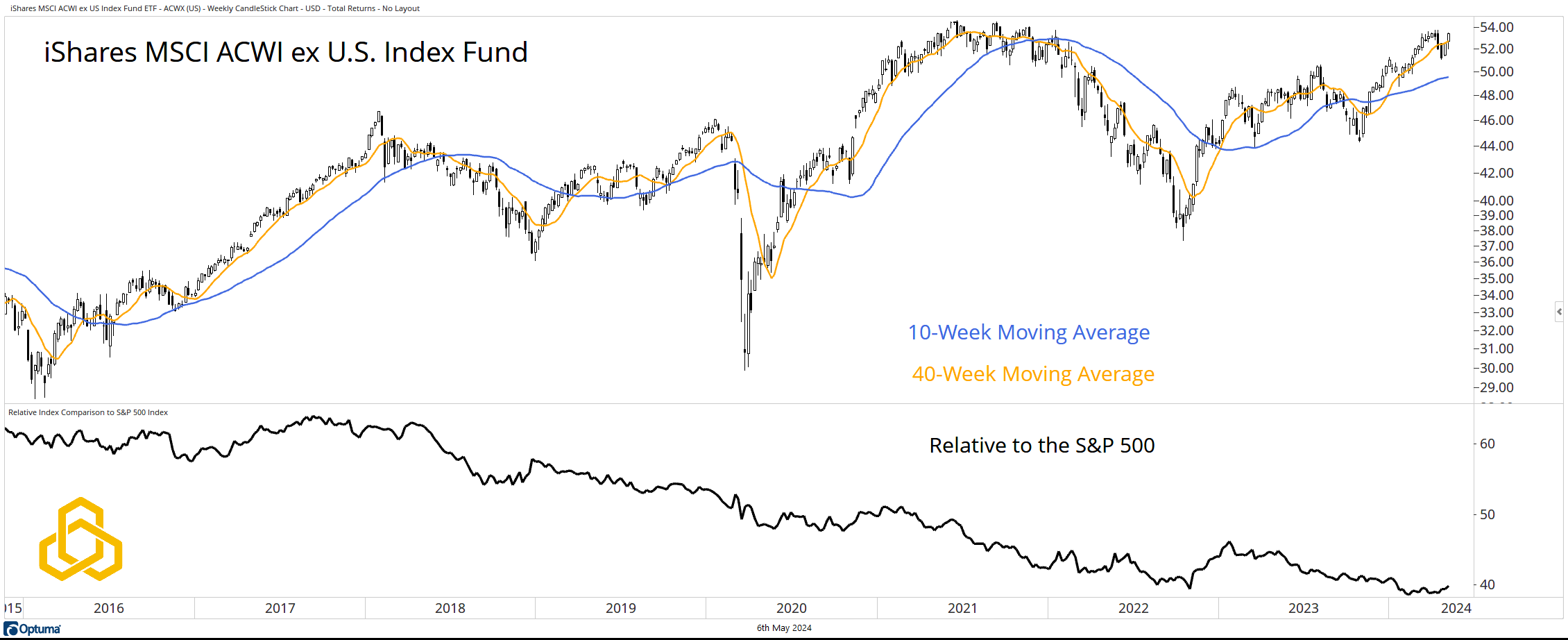

Not to be outdone by its peers in the U.S., the iShares MSCI ACWI ex-U.S. Index Fund (ACWX) trades above the 10 and 40-week moving averages and is on the verge of testing the 2021 highs. We can make the case that international “looks better” than the U.S. in the short term.

The relative trend leaves much to be desired despite a recent move higher. The benefit of the doubt remains in the U.S., but an open mind toward the rest of the world might not hurt.

*All charts from Optuma as of May 5, 2024. Past performance does not guarantee future results.

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-324-20240506