Bulls Get What They Need

January 21, 2025

In our last note, we highlighted the importance of breadth for both bulls and bears in the market. The bulls needed to see an improvement from recent dodgy numbers, and that is exactly what played out.

However, breadth was not the only story of the week. The bulls received an added boost as the Dow Jones Transportation Average reversed higher. At the same time, we saw broader bullish performance as the Equal Weight S&P 500 outpaced its Cap Weight sibling. All in all, the bulls got exactly what they needed to keep the benefit of the doubt.

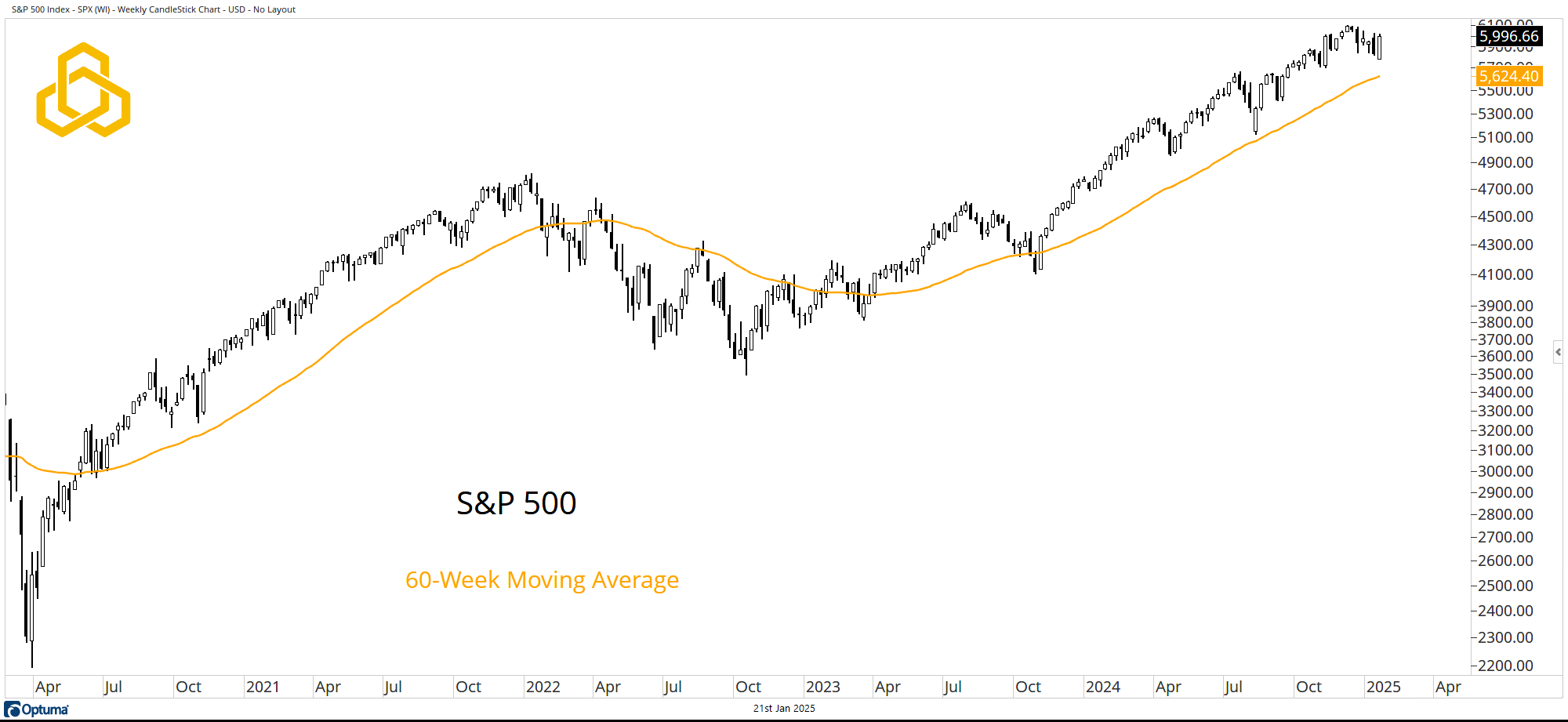

S&P 500

The S&P 500 closed the week above the rising 60-week moving average, though it has not really been at risk, despite choppy trading over the past two-plus months. Perhaps the most encouraging dynamic in trading last week is the fact that the opening print was the low of the week. Taken a step further, bulls can be encouraged by the fact that the close of the week was very much near the high of the range.

Source: Optuma

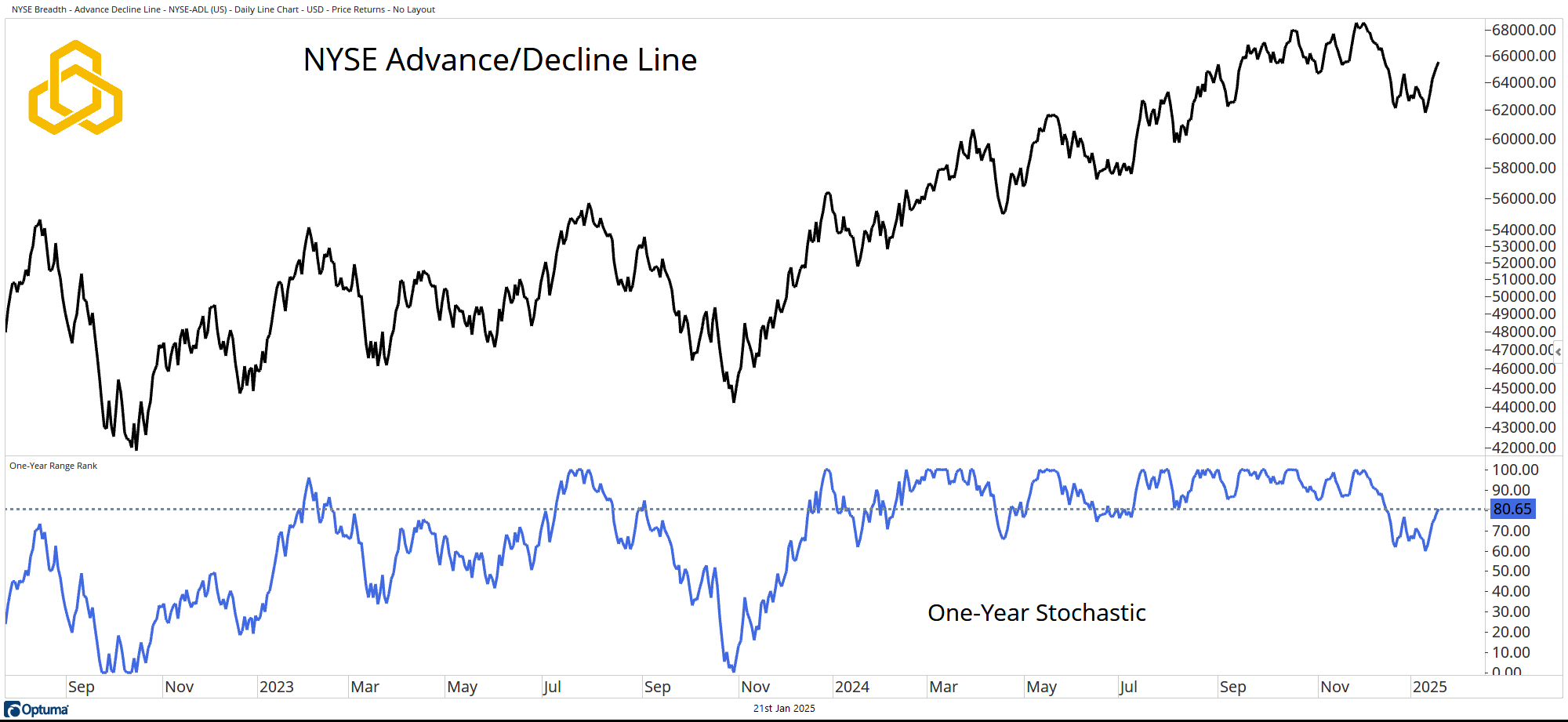

NYSE Advance/Decline Line

Entering the week, the biggest concern for the Advance/Decline Line was the fact that the one-year stochastic had broken decisively below the 80% mark. However, strong breadth over the course of last week’s trading brought the stochastic back to this key level.

The bullish case becomes stronger should the A/D Line take out recent highs.

Source: Optuma

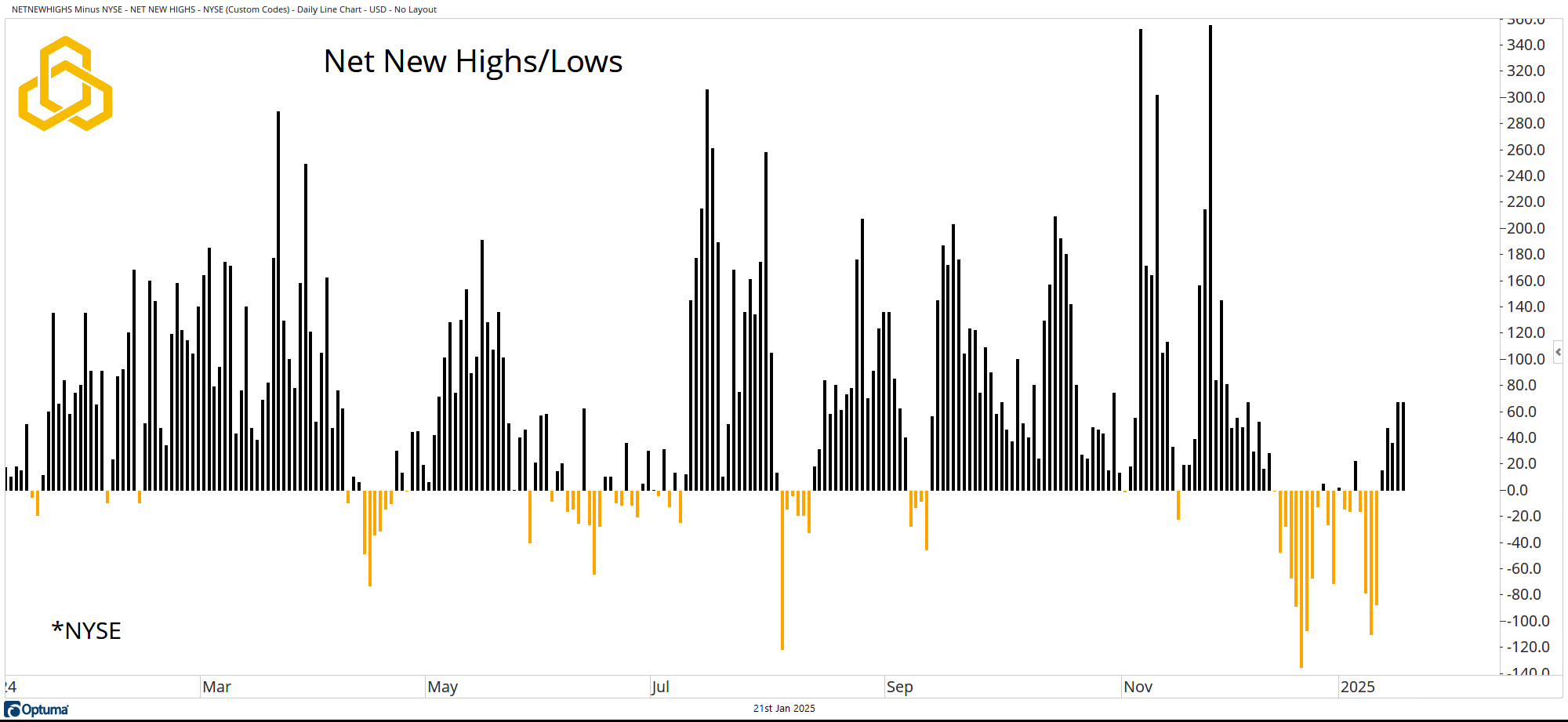

NYSE Net New Highs

In addition to seeing more stocks go up last week, we also saw a return of more stocks on the NYSE making new highs than making new lows. Net new highs were positive every day of the week.

Source: Optuma

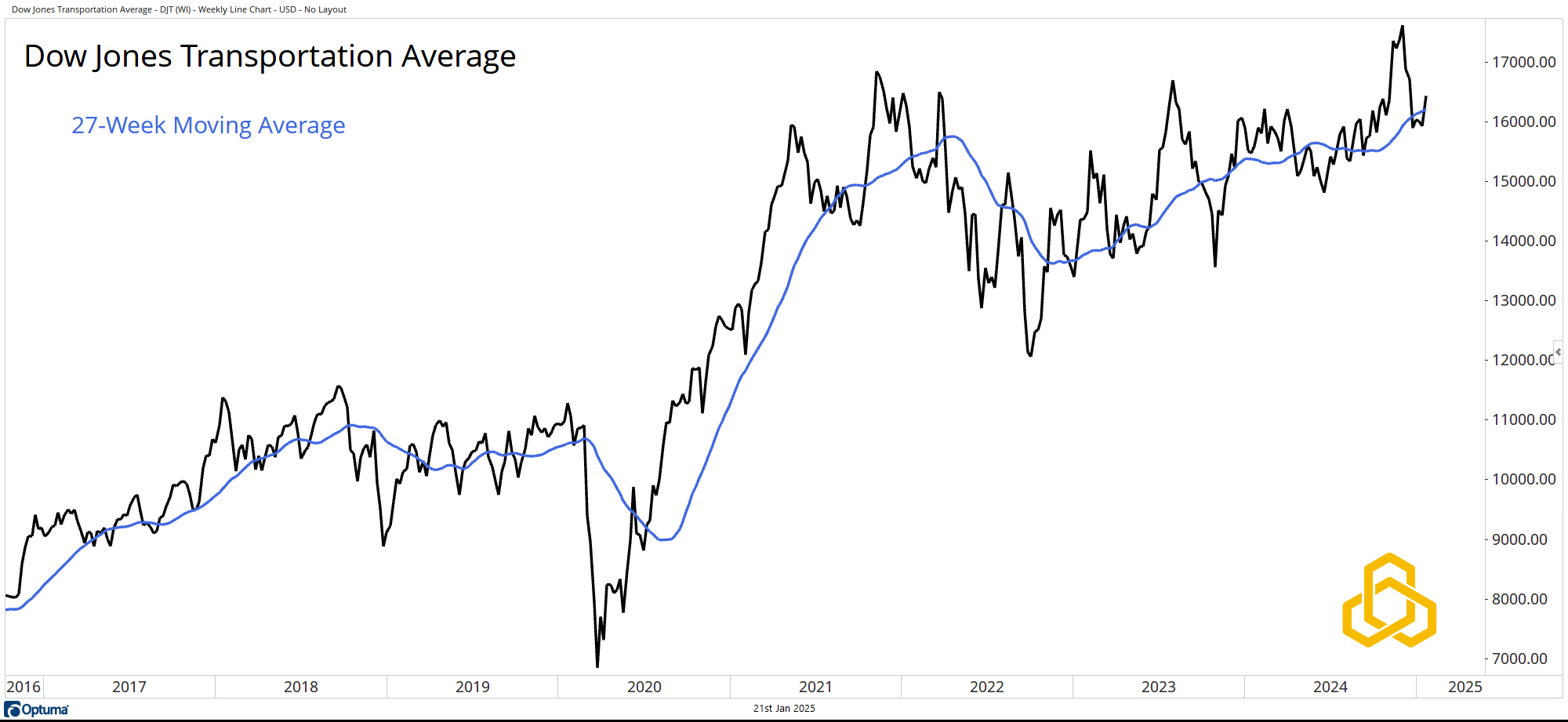

Dow Jones Transportation Average

Last week also saw an improvement in a key intermarket theme. The Dow Jones Transportation Average regained the rising 27-week moving average to remain in a bullish trend.

Source: Optuma

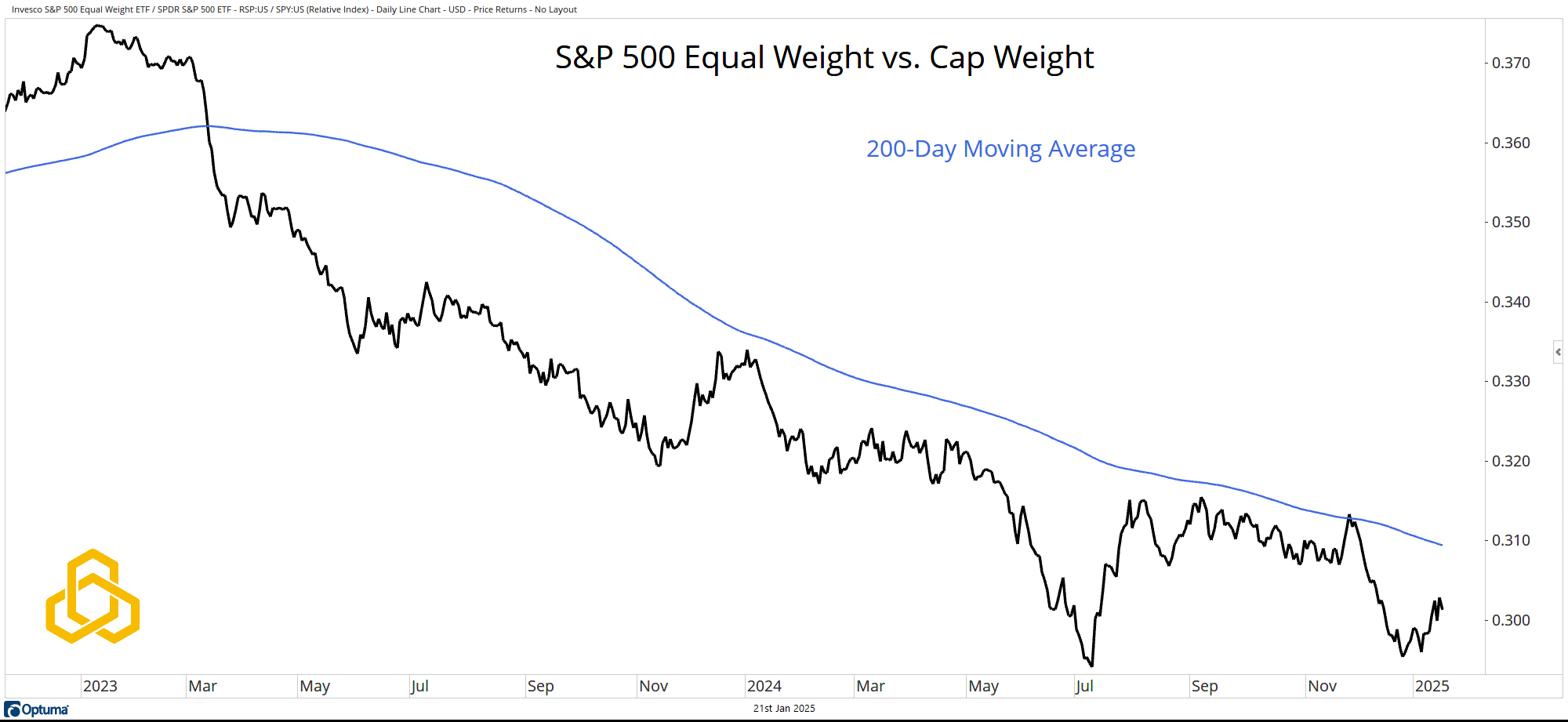

S&P 500 Equal Weight vs. Cap Weight

In a welcome reprieve within a strong bearish trend, the Equal Weight S&P 500 outpaced the Cap Weight index last week. Make no mistake, the market remains dominated by the largest stocks, but it is encouraging to see a rebound from the 2024 low.

Source: Optuma

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-385-20250121