Bonds, U.S. Bonds

June 10, 2024

We are on the lookout for a durable bottom in bonds. There I said it.

I have not been a bond bull in a long time, and to be clear, I am not one right now. The momentum behind the decline in treasury prices has begun to slow, but at the same time, volatility in the space is waning.

Does this mean that they are poised to move higher in the near term? Not necessarily; it simply means that something is different now, and we want to have it on our radar.

Also, to be clear, this does not mean that our stance on stock/bond correlation has changed. If anything, the long-term correlation (five-year) has become more positive over the past few weeks.

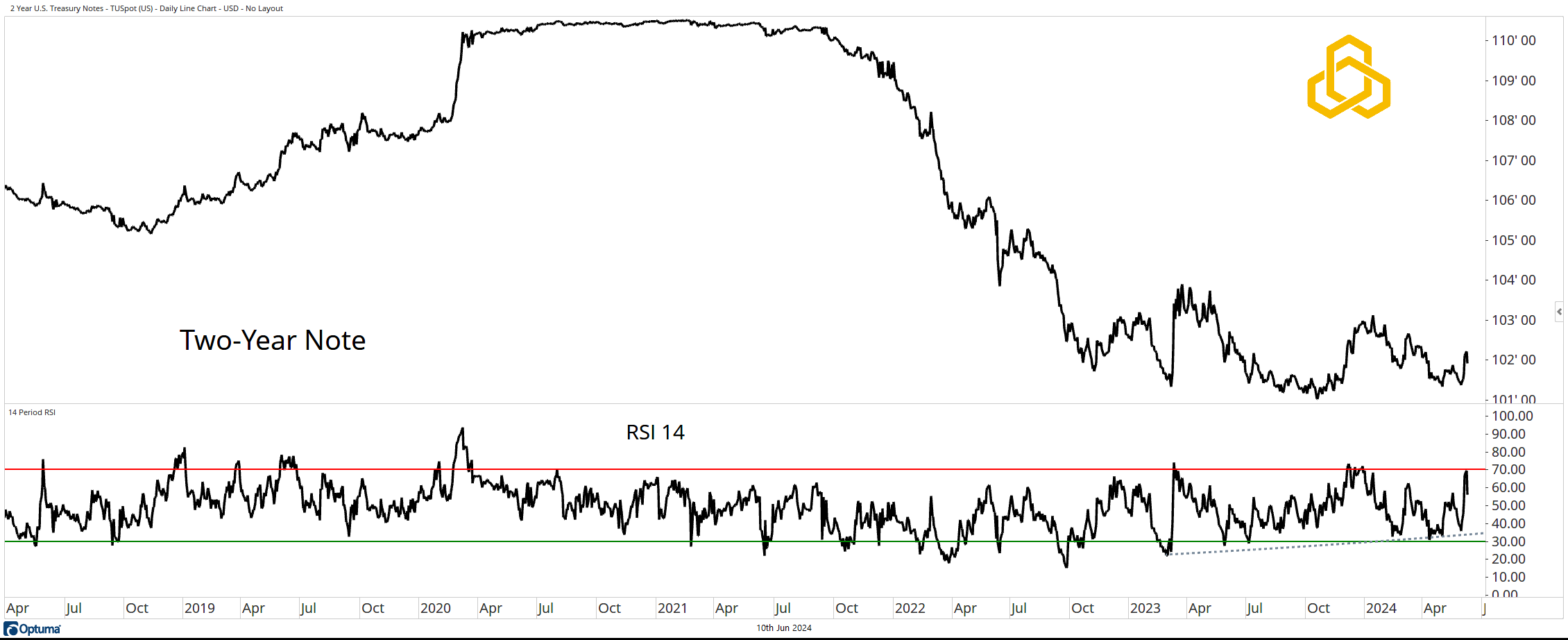

Two-Year Note

After a precipitous decline, the Two-Year Note has been in a consolidation between $101 and $104 for nearly two years. It has been almost one year since the 14-day RSI was able to register an oversold reading below 30. However, there have been multiple overbought readings above 70 since then.

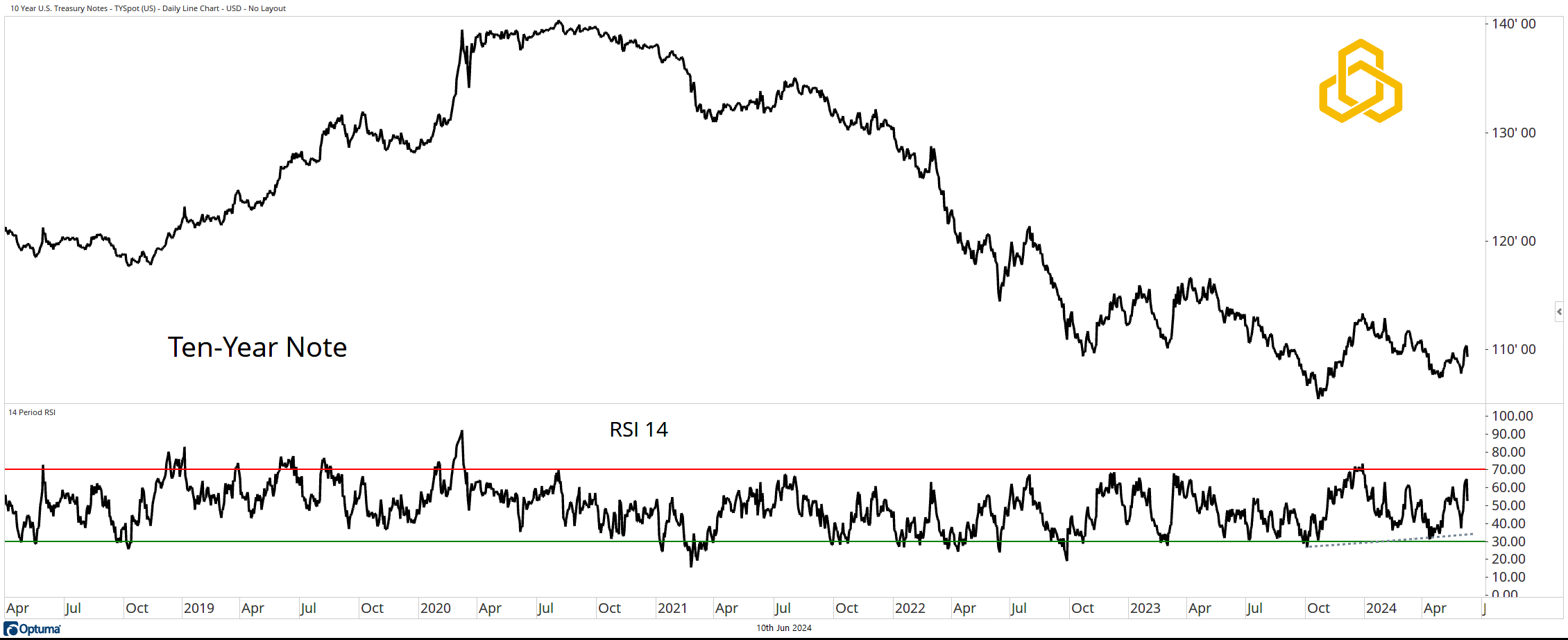

Ten-Year Note

The widely watched Ten-Year Note shows similar dynamics to the Two-Year. A sharp decline has been followed by consolidation (albeit one with a downside bias). The 14-day RSI has not been oversold since October 2023.

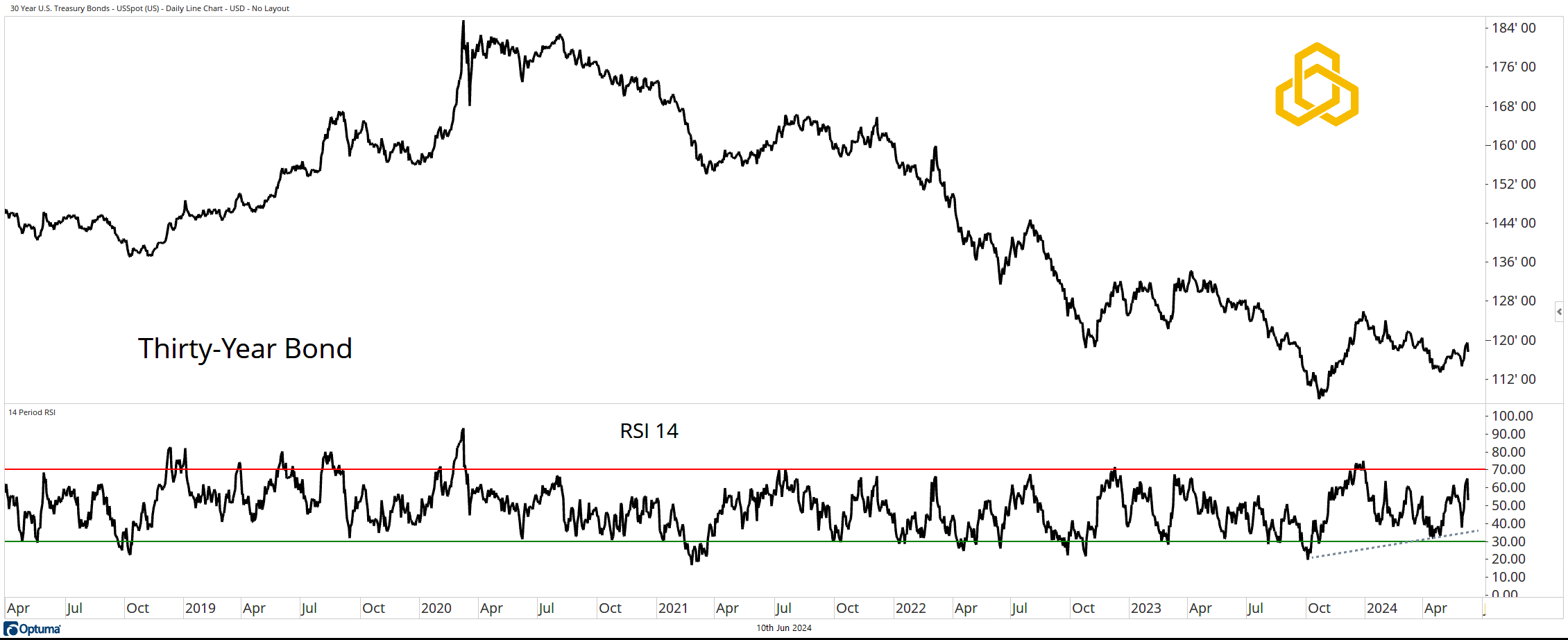

Thirty-Year Bond

Not to be outdone by its younger siblings, the Thirty-Year Bond also appears to be losing downside momentum. The 14-day RSI has been making higher lows since last becoming oversold in October 2023.

MOVE Index

The potential bottoming (stress potential) in U.S. Treasuries plays out as volatility in the space declines. The MOVE Index (think of it as the VIX for Treasuries) has been making lower highs and lower lows since peaking in March 2023.

*All charts from Optuma as of the close of trading on June 7, 2024. Past performance does not guarantee future results.

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-334-20240610