Barbells are Not Just for the Gym

February 26, 2024

As the market, as defined by the S&P 500, moves higher on the back of high-profile names such as Nvidia, Corp (NVDA), and a handful of others, it may seem as if this is a raging bull market. It’s not.

It is a market where those with passive large capitalization index exposure are being rewarded. We are not trying to make the case that this is a bad thing, mind you. But passive flows are mindless and reward the largest stocks in that index. It is part of the game, and those who recognize that should be rewarded.

In fact, we often make the case that most investors should have a fair amount of exposure to passive index strategies. At the same time, we continue to believe that a better way to mitigate risk is not to blindly allocate to a “risk-off” asset but rather by having an allocation to something that is truly tactical that manages drawdown with low correlation.

We call it the barbell approach.

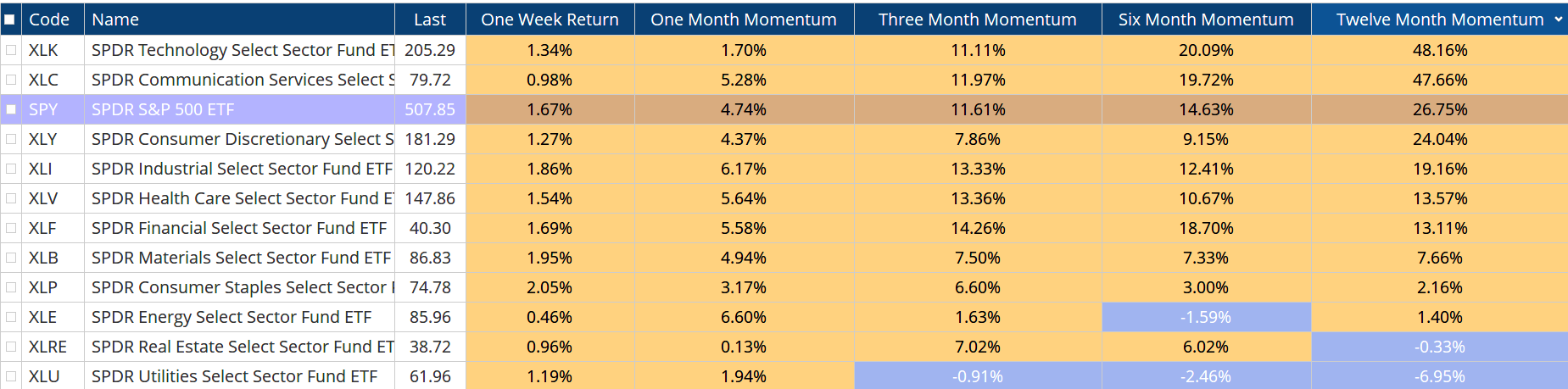

S&P 500 Sector Performance

Over the past 12 months, only two sectors are leading the S&P 500. They are Information Technology and Communication Services. It should not be a surprise to learn that these two sectors are the home of Apple, Alphabet, Nvidia, Microsoft, Meta, and a host of others.

Over the past six months, only three groups have outperformed the index. Over the past three months, four groups are outperforming, and over the past month, six groups are leading the index. The good news for investors is that the rally is broadening. However, over the past year, the best way to own the leaders has been to own the index.

The caution is that despite the outsized performance by Nvidia, Info Tech has been lagging over the past month. This is the largest sector in the index, if it rolls over, mindless passive allocations may not be rewarded.

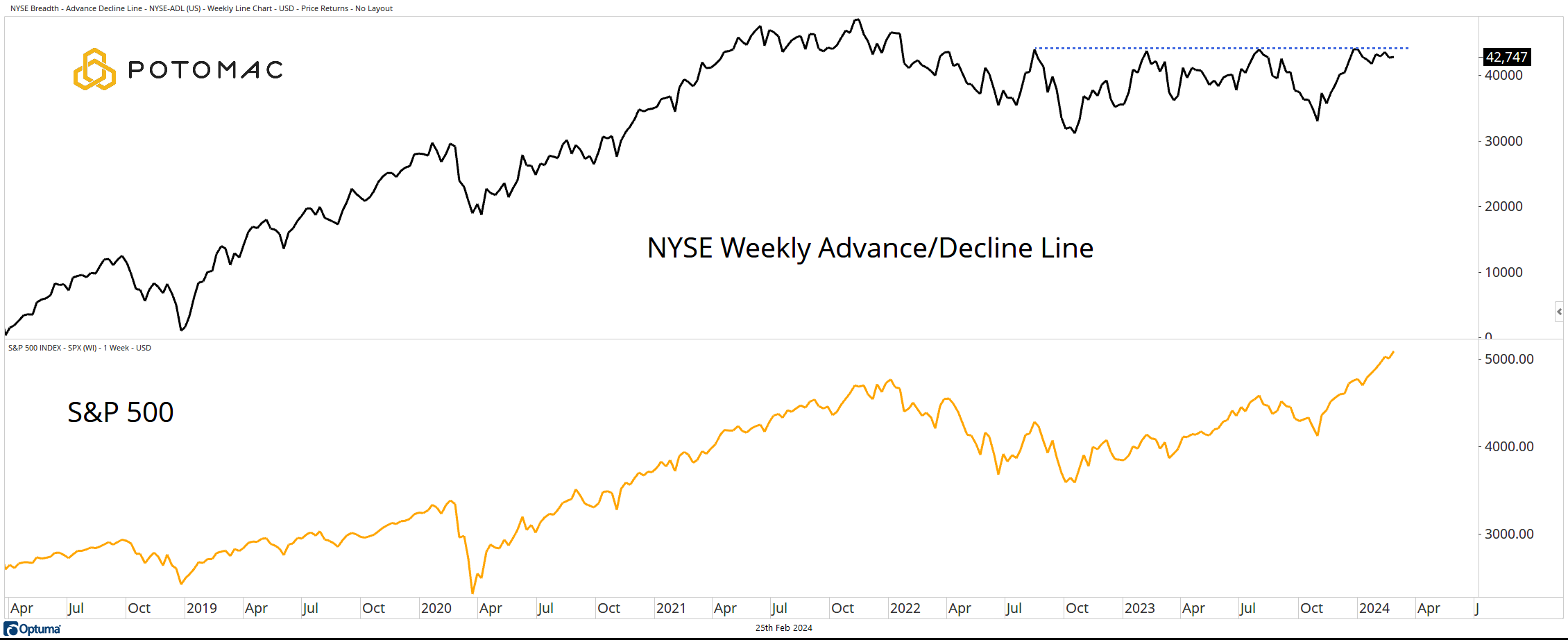

NYSE Advance / Decline Line

We note that the NYSE Advance / Decline Line refuses to add a level of confirmation to the rally in the S&P 500. Divergences alone are not a reason to run for the hills; they are not a catalyst.

However, they are a sign that the underlying health of the market is not great.

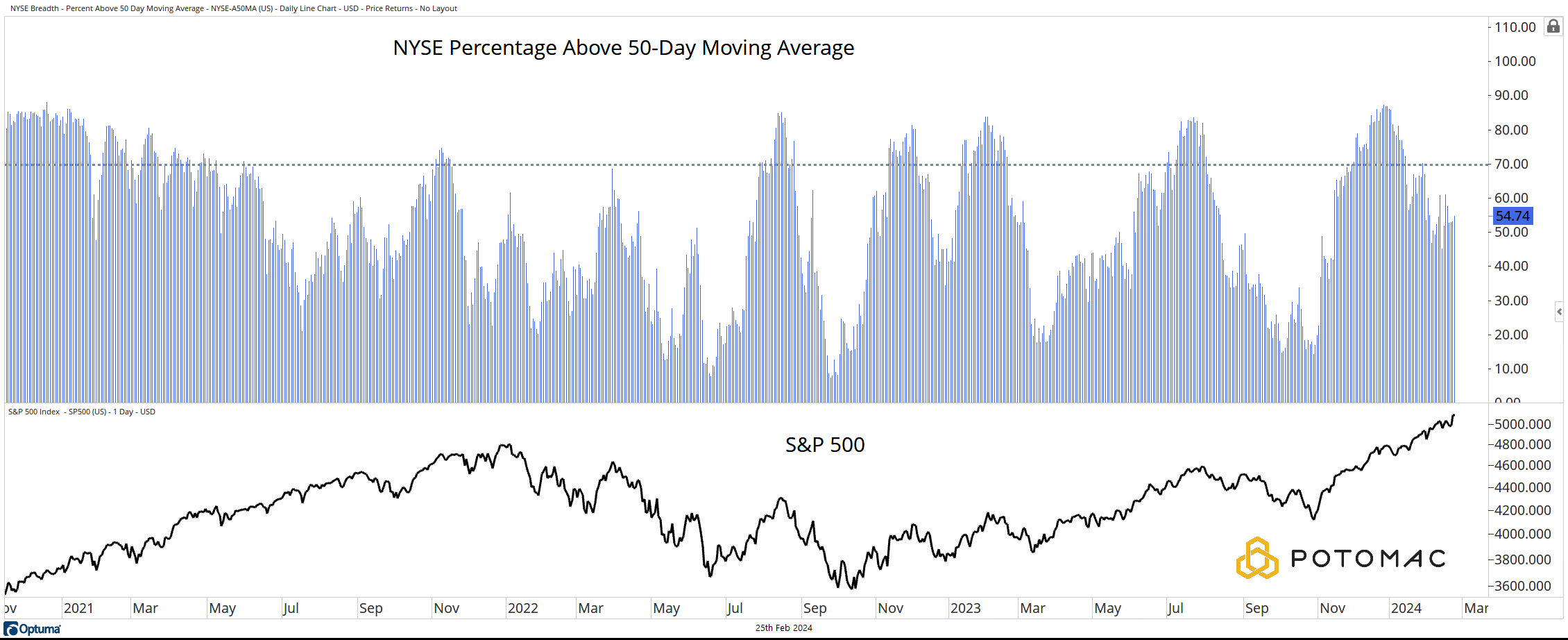

NYSE Percentage Above 50-Day Moving Average

When the S&P 500 was making new all-time highs throughout 2022, it was not uncommon to see the percentage of stocks on the NYSE above their respective 50-day moving averages in the 70s.

The current reading, with the S&P 500 at an all-time high, is 54.74%.

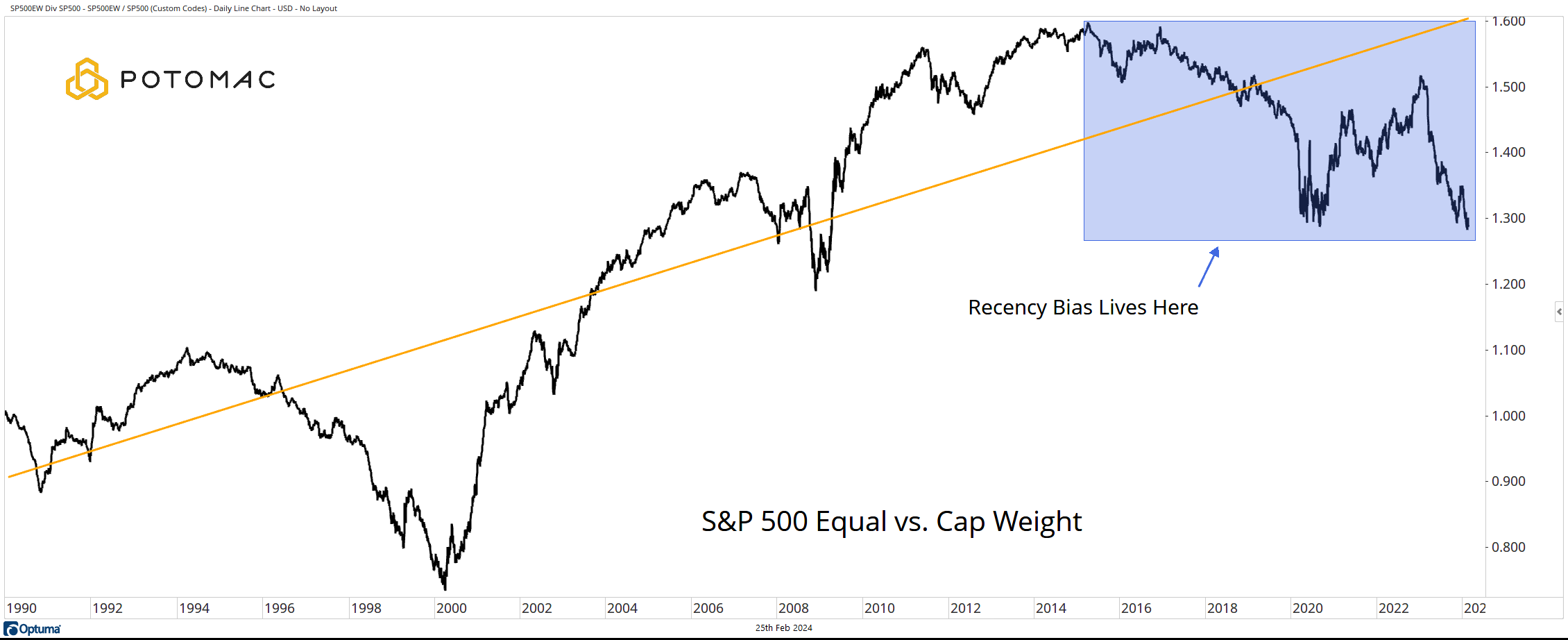

S&P 500 Equal Weight vs. Cap Weight

Recency bias will lead to believe otherwise, but over the long-term, the equal weight version of the S&P 500 outperforms the cap weight version. The upward-sloping linear regression line lays this out for all to see.

However, as more money blindly flows to passive index investing, the largest stocks garner the most capital.

Investors who only allocate to passive strategies are betting that this trend will continue when history shows us that the opposite is true. This is an area of ongoing research for the team.

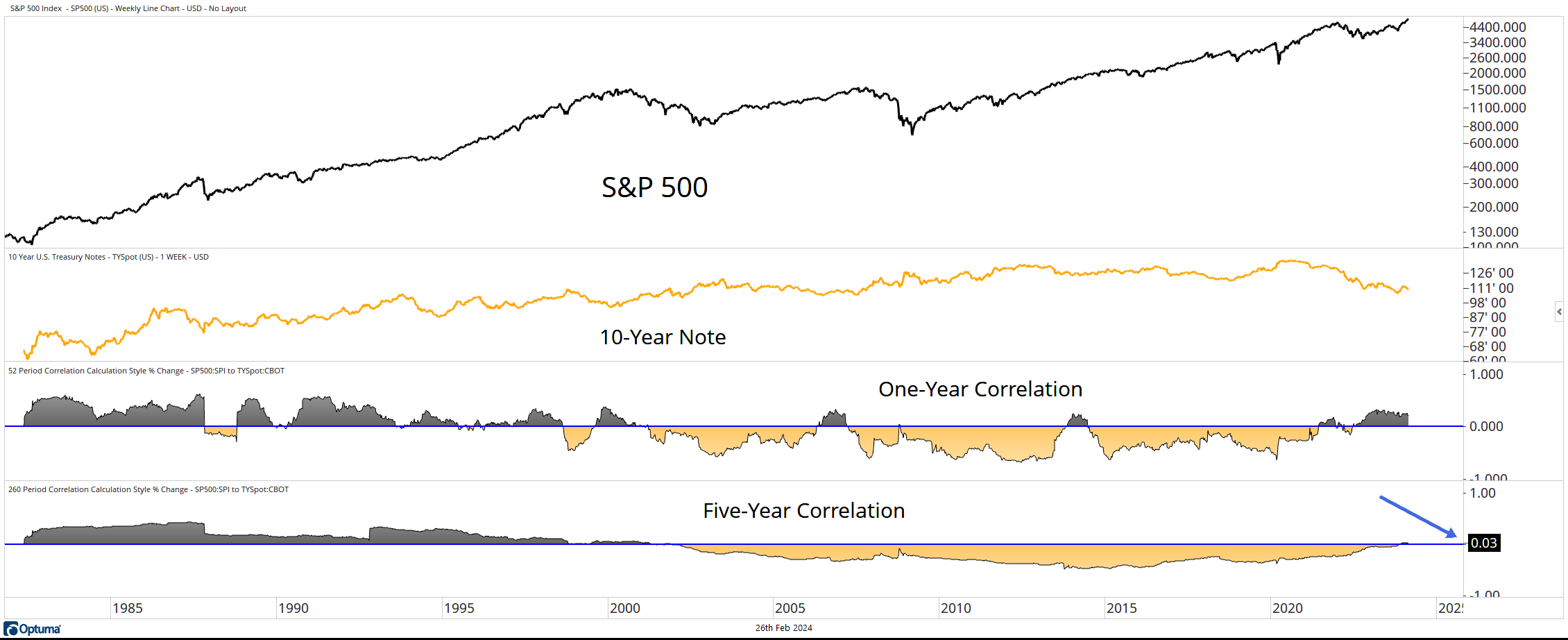

Stock-Bond Correlation Update

Thus far in 2024, stocks have moved higher while bonds have moved lower. The short-term divergence has not done anything to the correlations that we have been highlighting for nearly 2 years.

We do, however, think it is interesting that just as the rest of the market woke up to this fact, 2024 has started with a bit of a curve. This chart must be top-of-mind for allocators and solidifies our view on a barbell approach.

*All charts and data from Optuma as of the close of trading on 2/23/2024. Past performance does not guarantee future returns.

Potomac Fund Management ("Company") is an SEC-registered investment adviser. This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page. The company does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to the Company website or incorporated herein, and takes no responsibility for any of this information. The views of the Company are subject to change and the Company is under no obligation to notify you of any changes. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable or equal to any historical performance level.

PFM-308-20240226