All Clear?

August 19, 2024

The speed of movements in the market, and in investor sentiment, is one of the biggest changes that I have seen over my career. It still amazes me how fast market watchers can go from “the world is ending, we need an emergency rate cut” to “things are fine, new highs are on the horizon.” First off, calling for a rate cut when the S&P 500 is ~10% off its highs and U.S. unemployment is 4.3% is downright laughable. Second, the people saying all is well are usually the people who are always saying “all is well” so I do not see the value-add in the comments.

The only opinion that matters is the opinion of the market, and today we look at bonds for their take. Any story that you or I want to make from them is simply narrative. The bond market appears to be signaling all clear, but we know that can change quickly.

The 10-Year

The 10-Year Treasury is the most watched product in the space. The BondBloxx Bloomberg 10-Year Target Duration U.S. Treasury ETF (XTEN) is trading near its highs (note that this is a newer product) and above the steadily rising 50-day moving average. Above current levels it is hard to argue for higher rates.

Source: Optuma

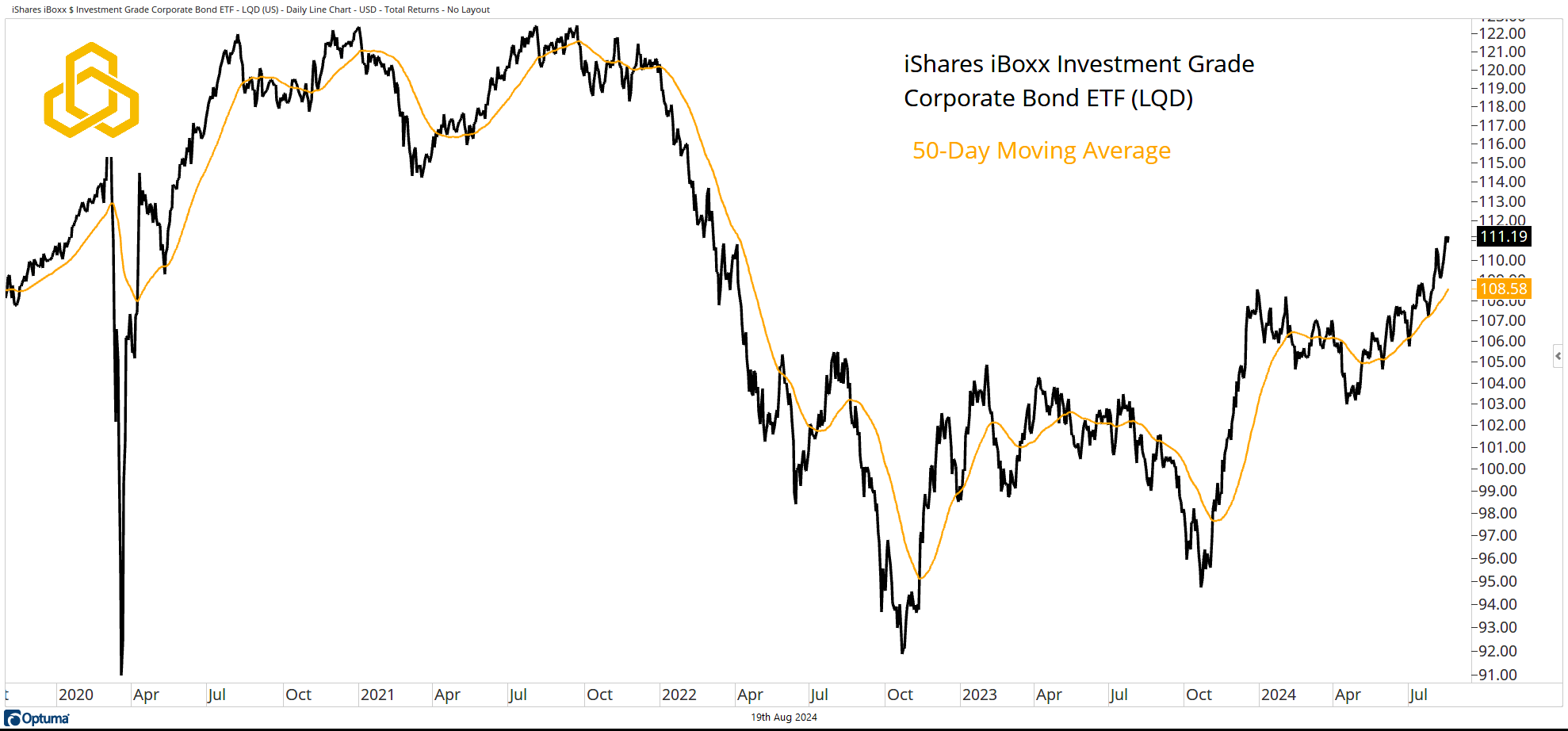

Investment Grade Corporate Bonds

The iShares iBoxx Investment Grade Corporate Bond ETF (LQD) has been making upside progress as it fights to claw back the disastrous 2022 losses. There is still a lot to do but the trend is bullish above the rising 50-day moving average.

Source: Optuma

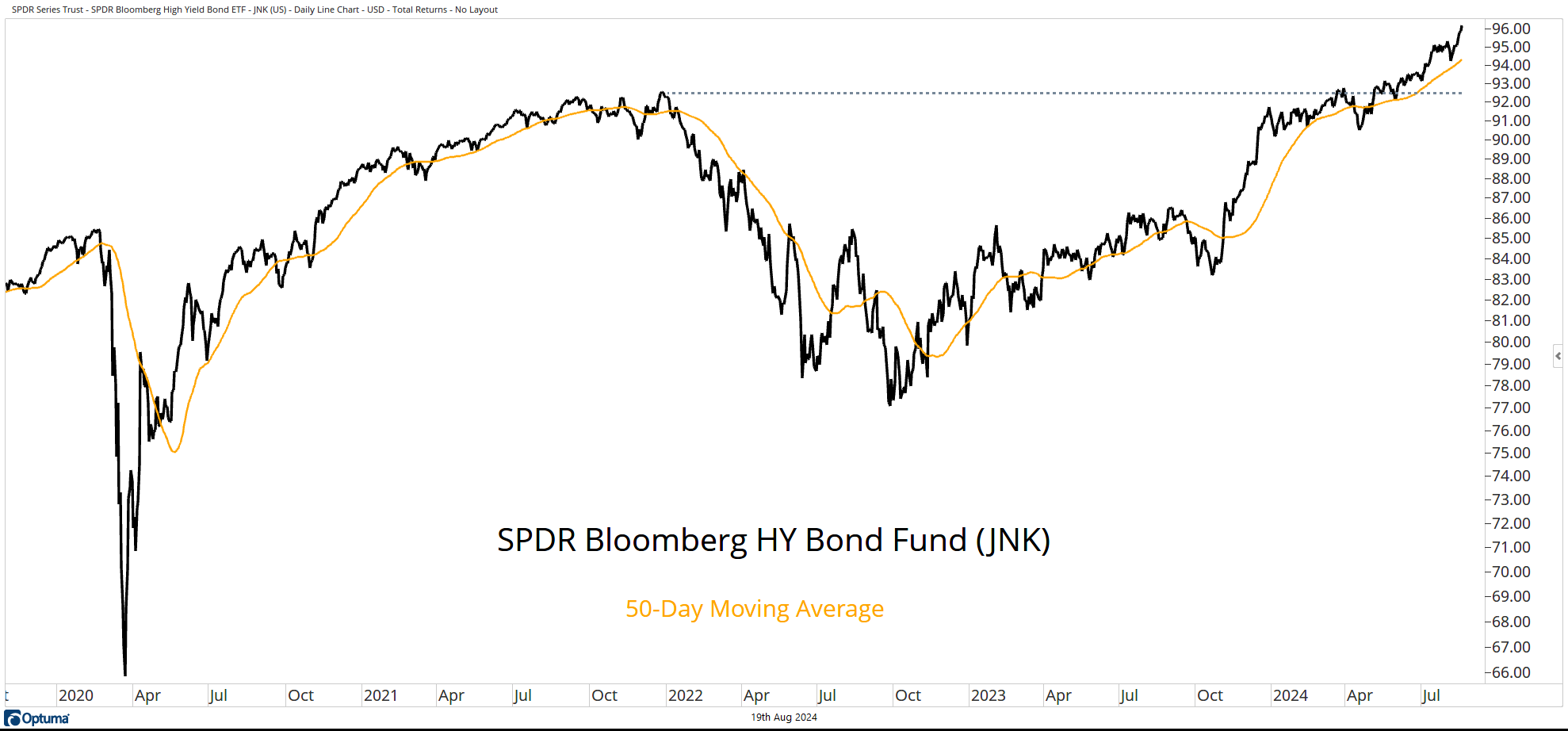

High Yield Bonds

The SPDR Bloomberg HY Bond Fund (JNK) is trading at record highs above the rising 50-day moving average. It is hard to make a case for rate cuts when the riskier parts of the market are trading at their highs and barely registered a blip during recent market volatility.

Source: Optuma

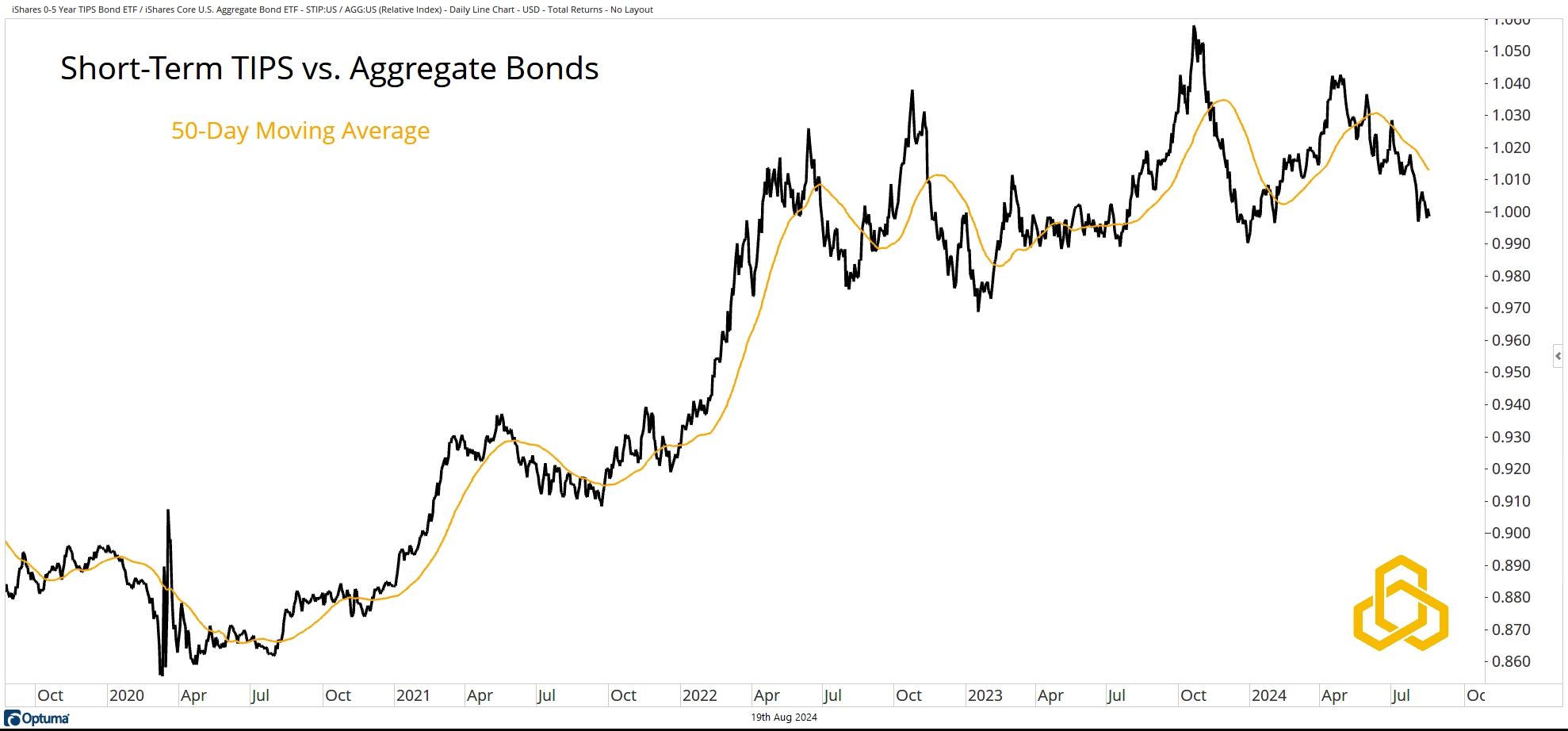

TIPS vs. Bonds

The relationship between Short-Term TIPS and Aggregate Bonds (STIP vs. AGG) points to expectations that inflation is no longer a concern. The ratio is well off the highs and trades below the declining 50-day moving average.

Source: Optuma

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-349-20240819