A Big Week for Breadth

January 13, 2025

My weekend reading was full of views on market breadth. Some argue that the recent deterioration is a signal of an immediate correction for the broader averages. Others were making the case that breadth was still strong. Admittedly, it is hard for me to see the logic in the latter, but differing views are what make a market.

Our take is more nuanced. Yes, breadth has been weakening. However, there has not been enough of a deterioration to make the correction call. Also, we don’t make calls here. We’ll stick to the facts. No matter your view, this is a big week for breadth metrics as further weakness would not be a welcome sign for the bulls.

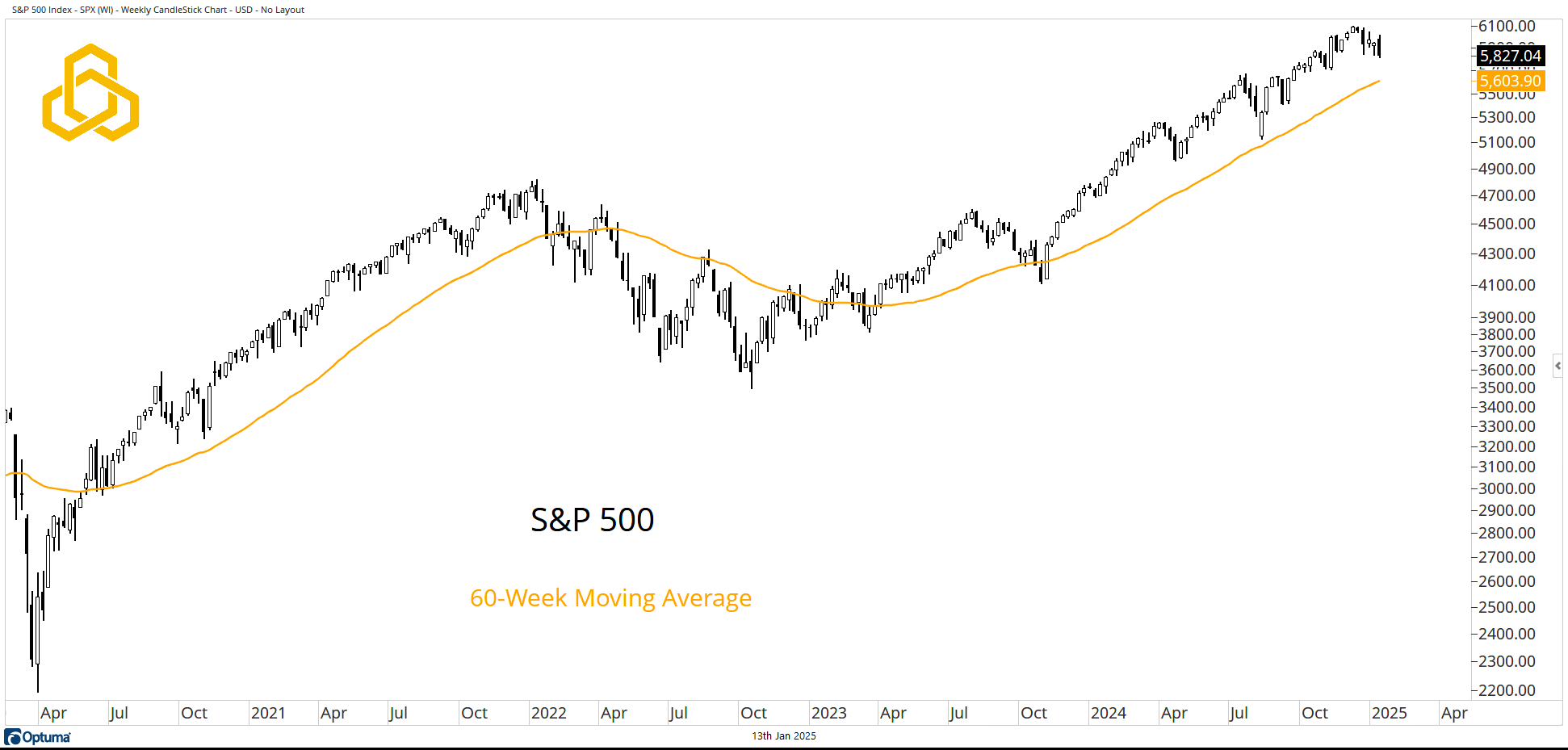

S&P 500

The S&P 500 moved lower last week, closing Friday near the trough of the week. The index remains above the rising 60-week moving average, keeping the long-term trend in the bullish camp. However, three of the past five weeks have been to the downside, creating some short-term angst in the minds of investors and traders.

Source: Optuma

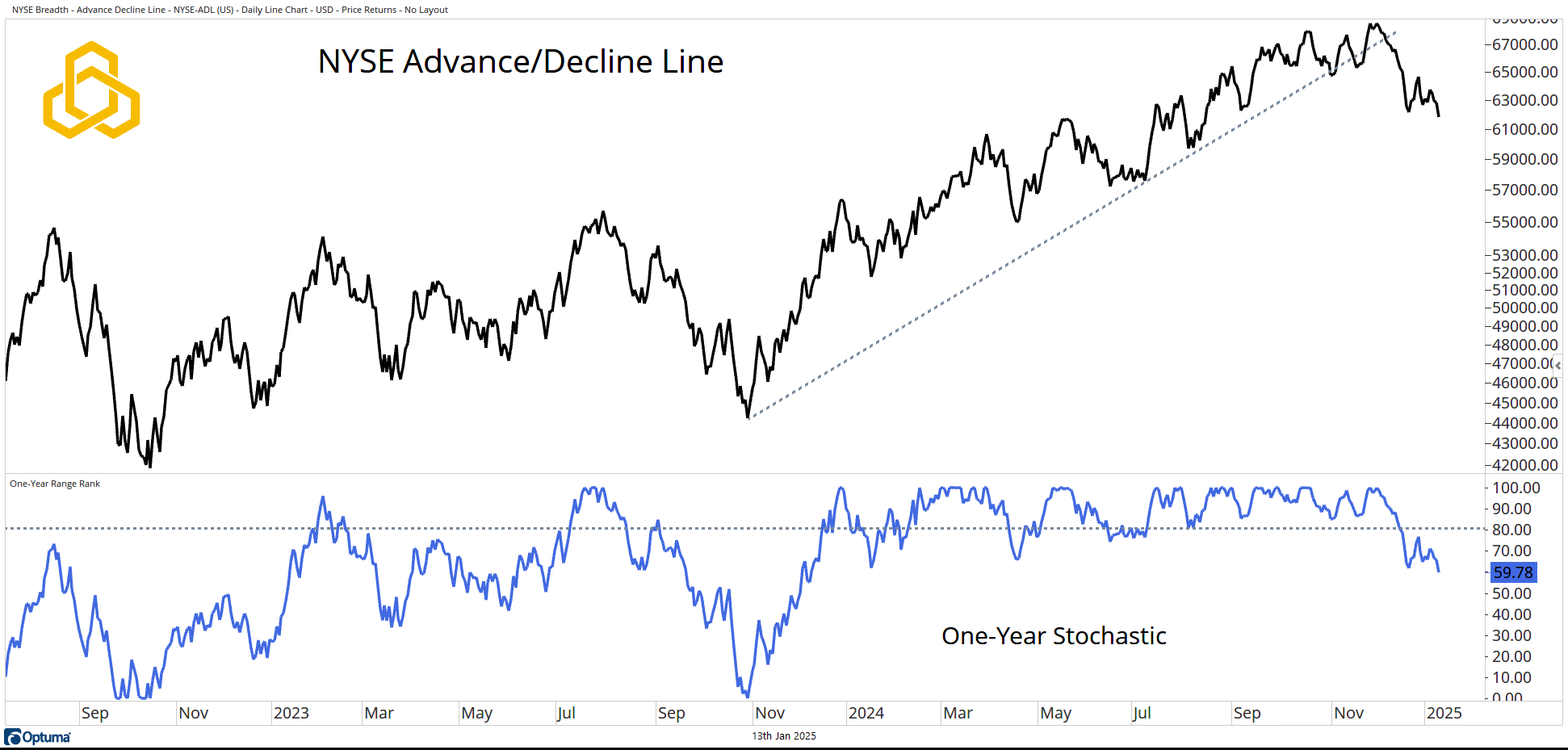

NYSE Advance/Decline Line

The cracks in the façade can be seen in the Advance/Decline Line on the NYSE. After spending 2024 in a clear uptrend with the one-year stochastic consistently above the 80% level, 2025 has begun with a breakdown.

A trendline drawn from the October 2023 low has been decidedly broken, and the one-year stochastic has moved to a one-year low.

Source: Optuma

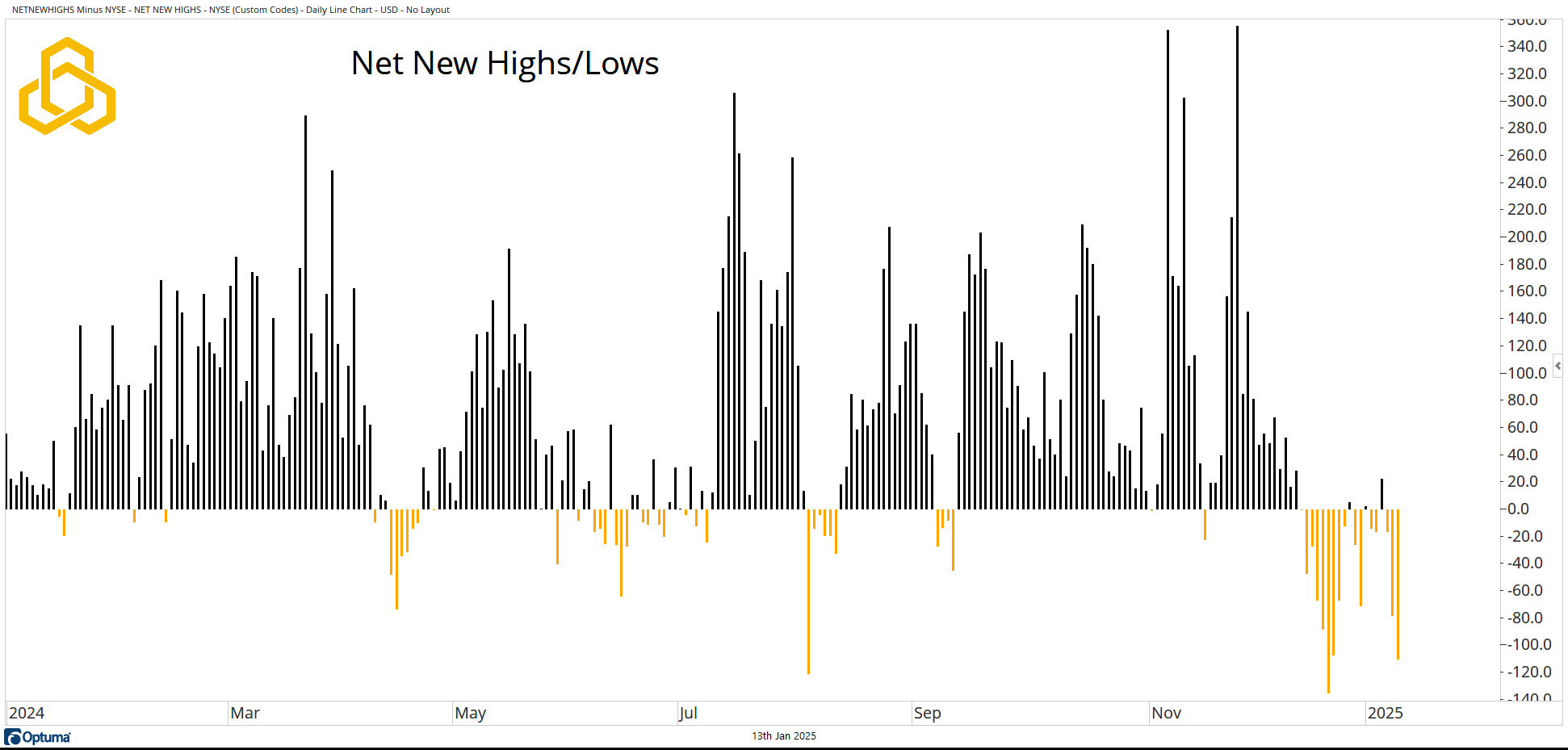

NYSE Net New 52-Week Highs/Lows

While recent weeks have seen more stocks going down than going up, we have also begun to see more stocks on the NYSE making new 52-week lows than those making new 52-week highs.

In 2024, we did not see sustained instances of more new lows than new highs. However, over the past few weeks, that has been the case. This is a trend that bulls will want to see quickly reversed.

Source: Optuma

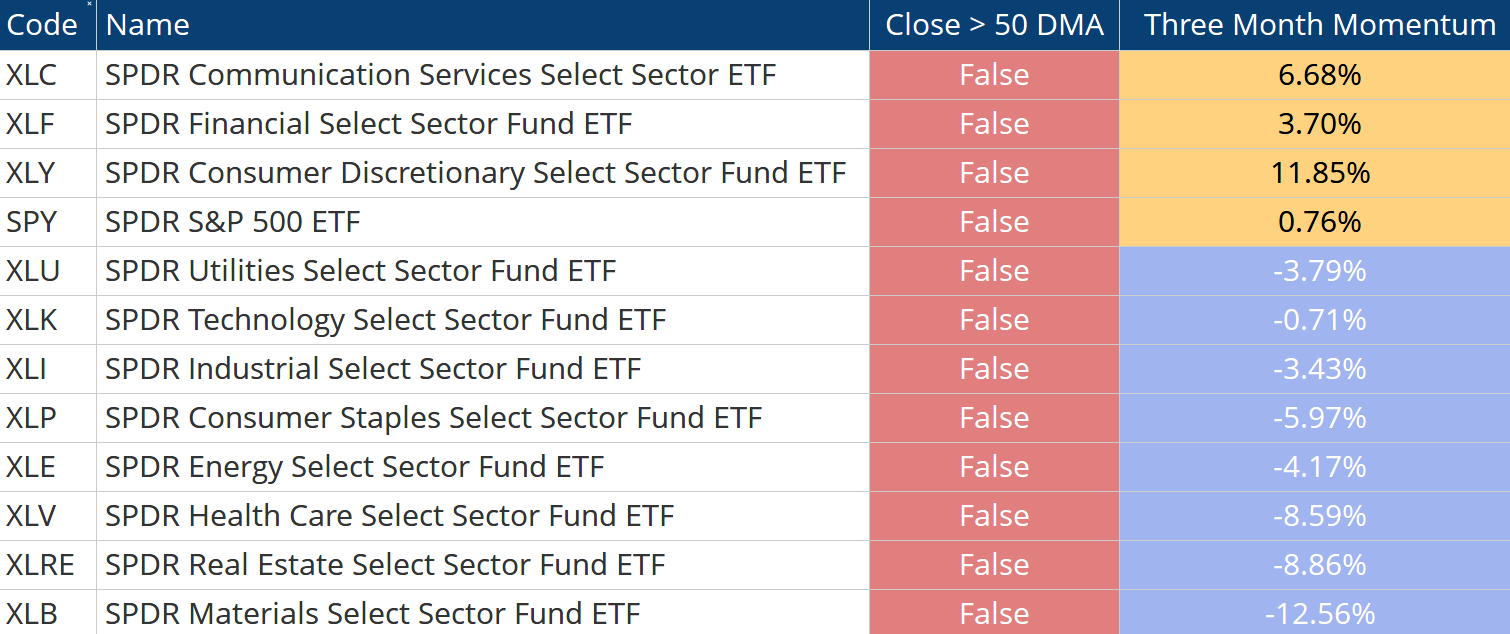

S&P 500 Sector Trends

The weakness at the individual stock level described above has had implications at a higher level. Moving from stocks to sectors, we can see that over the past three months, there have been only three sector ETFs with positive performance. At the same time, none of the sector funds are trading above their respective 50-day moving averages on a closing basis.

Source: Optuma

As we stated at the top of the note, this is a big week for breadth, as further weakness could have bearish implications for the larger equity trend.

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-383-20250113